Analysis of 13 Data & Analytics M&A and Fundraising Transactions, an IPO, and a changing of the guard at S&P Global - June 25-July 4, 2024

TL;DR - So much activity going on at S&P Global, Qloo, Everbridge, Acturis, RavenPack, Wilmington, Similarweb, Solera, idealista, Duetto, Clay, Fetcherr, Climate X, LiveEO and Prewave

If you haven’t already subscribed, join 542 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

There were so many transactions during this period that this post will not fit in the email!

If you find that your email client has cut off the post, please go through and read the full post online.

If you were the banker or investor on any of these deals, and would like to discuss the sector, drop me a line!

First of all, some non-M&A news.

June 27 - S&P Global announced that its Board of Directors has unanimously elected Martina L. Cheung, S&P Global's current President of S&P Global Ratings, to succeed Douglas L. Peterson as the Company's President and Chief Executive Officer, effective November 1, 2024.

This is pretty momentous news in the world of Data & Analytics.

Doug Peterson has been CEO of S&P Global since July 2013. During his tenure, S&P has, amongst other things:

Grown revenues from $4.875bn to $12.497bn;

Rebranded the business as S&P Global from McGraw Hill Financial;

Acquired IHS Markit, SNL Financial, CRISIL and Kensho;

Divested McGraw Hill Construction and JD Power.

That’s some pretty big shoes to fill. We wish both Doug Peterson and Martina Cheung the best going forwards.

July 2 - Qloo, a trendspotting Data & Analytics provider, has secured $25m in Series C funding. The round was led by AI Ventures, with participation from AXA Venture Partners, Eldridge, and Moderne Ventures.

Trendspotting, helping brands to predict consumer behaviour, is a valuable space.

Ascential sold consumer trend forecaster WGSN to Apax in January this year for £700m (although this was less than Ascential had originally wanted for the business). WGSN founder Mark Worth (the W in WGSN) saw so much value in trendspotting that he started competitor Stylus immediately after selling WGSN to EMAP (which became Ascential).

Qloo’s dataset enables users to ask granular questions which are reminiscent of the Amazon recommendation algorithm: “what movie genres are people in SoHo who like H&M most likely to watch?”

We’ll keep an eye on which way the business trends in future.

July 2 - Thoma Bravo, a leading software investment firm, announced the completion of its acquisition of Everbridge, Inc., a provider of critical event management and national public warning solutions, in an all-cash transaction valued at approximately $1.8 billion.

We touched briefly on Everbridge last week when we analysed Dataminr:

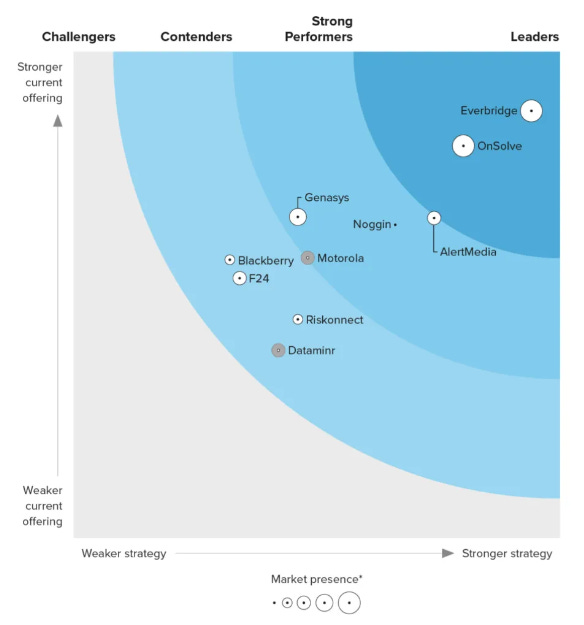

Everbridge, which IPOed back in 2016, proudly display their leading position at the top right of The Forrester Wave: Critical Event Management Platforms on the home page of their website.

So Thoma Bravo have bought themselves the leader in Critical Event Management. Everbridge has been growing steadily and revenues in 2023 were $448m - Thoma Bravo are paying roughly 4x revenues. But, according to their most recent 10K, Everbridge made an operating loss in each of the last three years, and the public markets are not a good place to be right now for loss-making tech businesses.

Thoma Bravo should provide a good home for Everbridge to continue to grow away from the spotlight of the public markets and, at some point, reach profitability.

Qatalyst advised Everbridge, and Raymond James advised Thoma Bravo.

July 2 - Acturis, a supplier of insurance software, and Astorg, a European private equity firm, announced that they have signed an agreement for Astorg to acquire a further stake in Acturis. Astorg will now own approximately 52% of the capital of Acturis. Alongside Acturis management and colleagues, the co-founders, Theo Duchen and David McDonald, will remain significant shareholders with a sizable minority stake, and continue to partner closely with Astorg to support existing clients and drive the company’s international growth.

Astorg’s increased investment gives them a majority shareholding in Acturis. Will this mean they have more of a say in the decision-making? Will Astorg, led here by Principal Benoit Ficheur, opt to break up the group, as they have done with Delinian? Or invest in inorganic growth?

Deutsche Bank advised Astorg, and Jefferies advised Acturis.

July 1 - GP Bullhound has led a $20m investment in RavenPack, a data analytics pioneer for financial services. This investment aims to accelerate the development and launch of RavenPack’s new AI platform, Bigdata.com, enhancing decision-making for leading financial professionals.

A follow-on investment by hybrid-corporate finance advisor/VC/PE firm (merchant bank, anyone?) GP Bullhound for RavenPack as it looks to reach critical mass. Per Roman at GP Bullhound led the deal.

RavenPack provides Google-like search capabilities from unstructured data to drive investment decisions. Sounds very much like AlphaSense. That’s pretty tough competition!

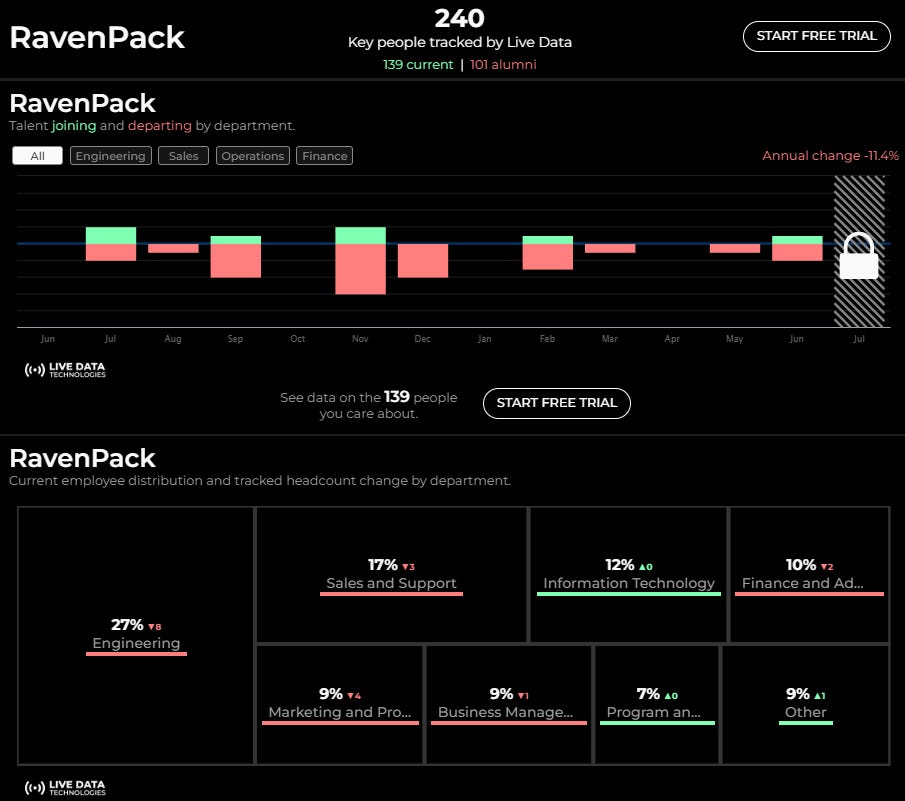

According to Live Data Technologies it has been a tough 12 months to be at RavenPack - headcount has reduced 11% in that period.

July 1 - Wilmington Healthcare Ltd. (including HSJ & Interactive Medica SL) has recently been acquired by Inspirit Capital from Wilmington plc. Home to the Health Service Journal (HSJ), Wilmington Healthcare is also a leading provider of data, information, events and advisory solutions across the NHS, pharmaceuticals, med-tech and life sciences sectors. The group is being rebranded under the recognised HSJ name and will comprise of four divisions: HSJ Market Intelligence, HSJ Advisory, HSJ Events and HSJ.co.uk.

Inspirit Capital is mopping up unloved B2B data and software assets from listed players like Wilmington, Wiley, Capita and Lloyds Register. A familiar strategy but you don’t often see a small investor do this many deals so quickly.

Those with long memories may remember Ascential selling Health Service Journal to Wilmington for £19m back in 2017, during its first round of disposals of “heritage brands”.

This time the asset traded for £26.3m.

Inspirit were advised by Richard Fetterman and Joe Barnett at Arrowpoint Advisory.

July 1 - Similarweb announced its acquisition of 42matters, an app intelligence provider headquartered in Zurich, Switzerland. The acquisition marks a significant step in expanding Similarweb’s data capabilities in the rapidly growing app analytics market, which is expected to reach $15.7 billion by 2028, with a CAGR of 20.2% (source).

There has been a fair amount of excitement about this deal in the world of AltData. Similarweb mainly provides web traffic ranking data about different website. 42matters is a natural fit here, providing focused Data & Analytics on mobile and connected TV app traffic.

Similarweb provide more deal rationale on their blog, including the nugget that:

42matters has been a vital partner in our App Intelligence offering for 2 years, providing essential data that has helped app creators and owners gain a competitive edge.

June 28 - Solera Corp., a provider of SaaS solutions to the vehicle lifecycle ecosystem, announced that it has publicly filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission (“SEC”) relating to a proposed initial public offering of shares of its common stock.

Vista Equity Partners are seeking a valuation of $10-13bn at IPO for Solera, which they took private for $6.5bn back in September 2015.

In the interim they have made a series of bolt-on acquisitions, including:

Feb 2022 - Spireon, a device-independent telematics and connected vehicle intelligence company, from Greenbriar Equity Fund;

July 2021 - ENData Pty Ltd, a data-driven property repairs and contents replacement solutions software provider;

June 2021 - eDriving, a digital driver risk management partner for commercial fleets;

May 2021 - Omnitracs, a fleet management platform, and DealerSocket, a SaaS provider to the automotive industry;

Mar 2018 - RedCap Technologies LLC, a mobility and logistics platform that enables vehicle and customer movements in and around dealerships;

Jan 2017 - Autodata, a provider of technical information and knowledge solutions for the automotive service, maintenance and repair industry.

Solera had been mooted to combine with a SPAC back in March 2021, but this did not ultimately materialise.

A veritable feeding frenzy for investment bankers is taking place around the IPO:

Goldman Sachs & Co. LLC, Morgan Stanley & Co. LLC, BofA Securities and Jefferies are acting as lead book-running managers for the proposed offering. Citigroup and RBC Capital Markets will be book-running managers, and Baird, BMO Capital Markets, Piper Sandler, Rothschild & Co, Stifel, William Blair, Wolfe | Nomura Alliance, KKR, Macquarie Capital and Needham & Company will act as co-managers for the proposed offering.

June 28 - EQT sold its majority stake in idealista, a real estate platform in Spain, Italy, and Portugal, valuing the business at EUR 2.9 billion. Cinven has signed an agreement to acquire a 70% stake in the Company. EQT originally acquired idealista in 2020 in a deal that valued the firm at EUR 1.3 billion and will retain an 18% share in the Company following the transaction.

Pretty cut and dried. The Ibero-Italian equivalent to Zoopla or Zillow has changed hands from one PE firm to another. Morgan Stanley advised EQT and Michael McDonagh at Liberty CF advised the management team. JP Morgan advised Cinven.

June 27 - Duetto, a provider of revenue management software for the hospitality industry, announced that it has been acquired by GrowthCurve Capital from affiliates of Warburg Pincus and other shareholders. Terms of the transaction were not disclosed.

Duetto integrates third-party data with hotels’ proprietary data to enable them to maximise their revenues. Lighthouse, who have featured twice in our M&A analyses this year, are a data integration partner.

Jefferies LLC served as lead financial advisor and William Blair served as a co-advisor to Duetto. Congratulations to my ex-colleague Chris Gough at Houlihan Lokey, who served as exclusive financial advisor to GrowthCurve.

June 27 - Clay, a provider of data for go-to-market teams, raised $62m at a $500m valuation.

Clay has raised a $46M Series B at a $500M valuation from Meritech Capital with participation from Sequoia, First Round, Box Group, Boldstart, and some of the world’s top sales and marketing leaders to power growth for tech’s biggest names like Anthropic, Intercom, Notion and 2500+ others. This is in addition to our previously unannounced $13.5M Series A, led by Sequoia, $2.5M seed led by First Round, and pre-seed from Box Group

After a slow start, Clay has been growing like a weed, providing a single view of data for go-to-market workers like Sales Development Reps.

Founder Kareem Amin recently gave a particularly candid interview to investor First Round in which he outlined the ups and downs of founding a Data & Analytics business. He highlights a lack of focus as a core issue in finding Product-Market Fit. Their expanding client list is proof that they have certainly found it now!

June 26 - Fetcherr, a startup providing an AI-powered pricing and inventory control engine to airlines, has attracted $90 million in Series B funding led by Battery Ventures, with existing investors also participating.

As we can see from other recent transactions and investments in and around the space (Lighthouse, Duetto, etc), Travel is a hot space for Data & Analytics investment.

Any information that can enable travel industry businesses like airlines or hotels to improve their (often razor-thin) margins is high value, must have data.

It seems likely that Fetcherr will be an appetising acquisition target for a larger player at some point in the near future.

June 26 - Climate risk intelligence company Climate X has raised $18m in Series A from GV (Google Ventures), Pale blue dot, CommerzVentures, A/O, Blue Wire Capital, PT1, Unconventional Ventures and Western Technology Investment (WTI).

Predicting the impact of weather for insurers is big business. The annual Caribbean hurricane season is the biggest driver of risks or losses in the reinsurance market. If the big one ever strikes Miami it will make the GFC look like a storm in a teacup.

UK-headquartered Climate X offers proprietary financial insights into the likely impact of climate risks on physical asset valuations, from residential and commercial properties to road, rail and power infrastructure.

This is super high value Data & Analytics. At some point someone will pay a lot of money to acquire Climate X. We may need to profile them in the not too distant future - please message us if you would like to read a deeper analysis.

For bonus reading on the topic of catastrophe insurance, take a look at this fascinating profile in Bloomberg of John Seo’s hedge fund Fermat Capital Management earlier this year. It discusses Fermat’s success in the Cat bond market, and the overall market for weather-related catastrophe insurance.

June 25 - LiveEO – which uses AI to transform raw satellite data into insights to help companies manage their climate risks and resilience – has raised €25 million in a Series B funding round led by NordicNinja and DeepTech & Climate Fonds (DTCF).

We have posted before about the Cambrian explosion of data providers driven by access imaging from to the ever-increasing number of Low Earth Orbit satellites.

LiveEO is another provider leveraging this satellite data, this time to provide Data & Analtytics for operators of infrastructure like power grids, rail networks and pipelines. LiveEO provides them with insights into how vegetation, third-parties and weather events is interfering with their smooth running.

Consolidation in this market is expected - most likely driven by a sponsor with a roll-up play.

For a look at other companies using LEO satellite data, have a read of these two articles:

June 25 - Prewave raises €63m Series B led by Hedosophia to leverage AI to help businesses manage unprecedented supply chain challenges and deliver the world’s first supply chain superintelligence platform.

A pretty ambitious claim for what is essentially a media monitoring company!

Prewave collects unstructured data on (currently) 1,271,510 suppliers and alerts subscriber to any potential risks, including weather-related disruption, cyber, geopolitical and ESG.

We will follow Prewave as they put this large amount of cash to work.

Dataminr will most likely be keeping a close eye on Prewave’s progress.

![Jua - AI Weather Data & Analytics [company analysis]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc17b1df2-3403-449a-8626-660f32780b20_1280x847.jpeg)