BlackRock acquires Preqin for £2.55bn - What Does it Mean for Private Markets Data & Analytics?

TL;DR - Expect to see more Private Markets Data & Analytics M&A as the trend towards Private Markets liquidity and transparency continues

If you haven’t already subscribed, join 521 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

On Sunday night UK time the Financial Times broke the news:

BlackRock has agreed to buy Preqin, a UK private markets data group, for £2.55bn in cash, as the world’s largest money manager presses harder into alternative assets and makes its first foray into financial information provision, said people briefed about the matter.

The $10.5tn asset manager beat S&P Global and Bloomberg to acquire Preqin in the latest of a series of deals for specialised data providers.

There’s no two ways about it - this was a mind-blowing deal.

We knew it was coming - that Preqin was for sale had been leaked in the FT a few weeks previously. But the announcement still felt surprising. It was a lot to take in at once.

Your thought process might have gone something like this…

The FT piece a few weeks ago talked about a £1bn valuation - but the actual price was £2.55bn. That’s 13x forward revenue. Thirteen times?! Revenue?! Forward revenue?!

There must have been a hell of a lot of competitive tension in the process. Who else was bidding to get the valuation that high?

And BlackRock as the successful bidders? It makes sense - they have deep pockets and sell into the same market - but what was their full rationale for getting into Data & Analytics?

How sore must the other Data & Analytics players looking to build out a leading Private Markets data play be feeling?

What does this mean for Private Markets data in general?

And Mark O’Hare, the owner? How much of the business does he and his family actually own? What on earth are they going to do with all that money?

Unlike AlphaSense’s acquisition of Tegus a few weeks ago, this deal has already attracted a lot of commentary, so you will all have read a fair amount on this topic already.

But we’ll try to cut through the noise and provide some useful analysis and thoughts for you to build on.

The valuation

As pointed out by the FT in its Lex column analysis of the deal, thirteen times forward revenue is actually not all that outlandish in Data & Analytics.

S&P Global and Moody’s have enterprise values of $154bn and $82bn respectively. Each trades at about 12 times forward revenue, respectively.

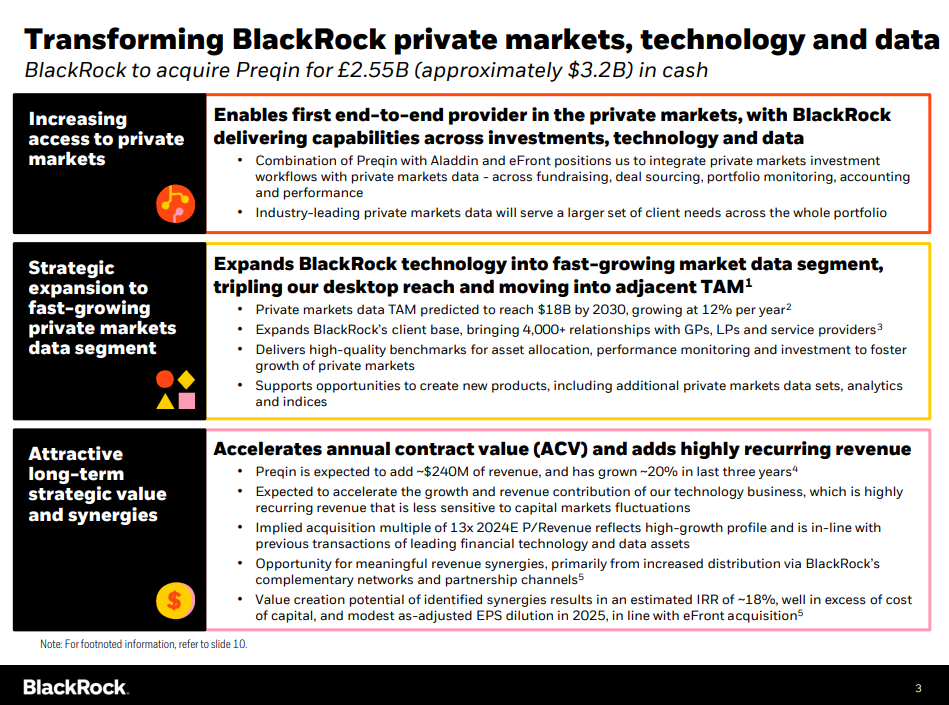

The investor presentation that BlackRock provided to accompany the announcement webcast yesterday also points this out:

It also highlights that BlackRock are forecasting an 18% IRR from the transaction. The footnote does not help to make sense of this - there is no timescale given, for example.

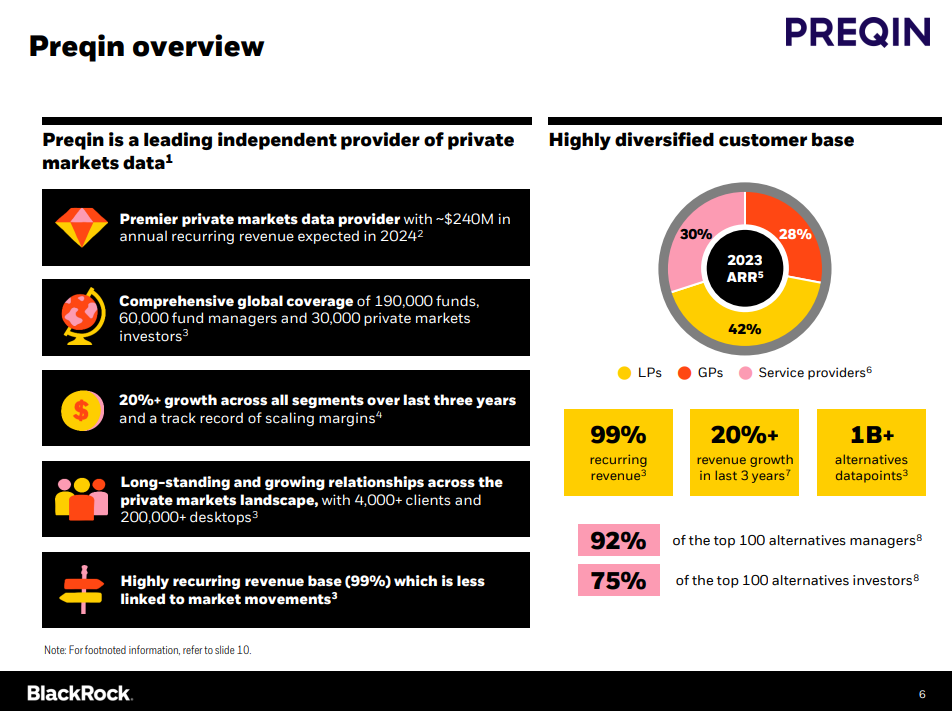

The deck also provides no more real detail on Preqin’s financials (no EBITDA, no renewal rates, etc), but it does highlight some of the drivers behind their financial success:

99% recurring revenue

20% CAGR last 3 years

Diversified customer base

Some of the analysts on the BlackRock investor call yesterday tried to push but they got no more clarity around numbers. The BlackRock management team focused on parroting their messaging around how this would be a long-term net positive acquisition for the business.

BlackRock - welcome to the Data & Analytics world

The last time we saw a non-Data & Analytics Financial Services player make a huge Data & Analytics acquisition was when LSEG acquired Refinitiv from Thomson Reuters in May 2020 for $27bn.

The BlackRock/Preqin transaction brought that deal to mind. At the time, LSEG CEO David Schwimmer remarked:

It is a rare and compelling opportunity to combine two world-class businesses and create a global financial infrastructure leader.

LSEG were executing on a game plan to create a higher value business by transitioning towards Data & Analytics.

Given that BlackRock trades at 6x forward revenues, it’s clear that a similar strategy is at play here.

Unlike LSEG in 2020, however, BlackRock already has a technology play alongside its Asset Management business. (Although it’s still subscale by comparison.)

BlackRock’sAladdin platform is the largest investment management platform in the market, handling $21.6 TRILLION in assets in 2020.

And in May 2019, BlackRock acquired eFront, a similar platform to Aladdin but for alternative investments.

So the opportunity as BlackRock see it is to plug Preqin into this tech infrastructure:

Through the Aladdin platform, BlackRock provides technology solutions to over 1,000 clients. The combination of Preqin with eFront, Aladdin’s private markets solution, brings together the data, research, and investment process for fund managers and investors across fundraising, deal sourcing, portfolio management, accounting, and performance.

Why? For all the classic reasons Strategic buyers acquire Data & Analytics businesses, including to:

Sell more Software and Data & Analytics to their existing clients;

Access new clients in Alternative Assets (on which subject more shortly);

Improve renewal rates;

Push through price increases.

This is why BlackRock believes that the deal makes sense in the long term, even if in the short-term it will be dilutive (they are funding the acquisition by raising $3bn of debt).

Sudhir Nair, Global Head of Aladdin is excited by the opportunity:

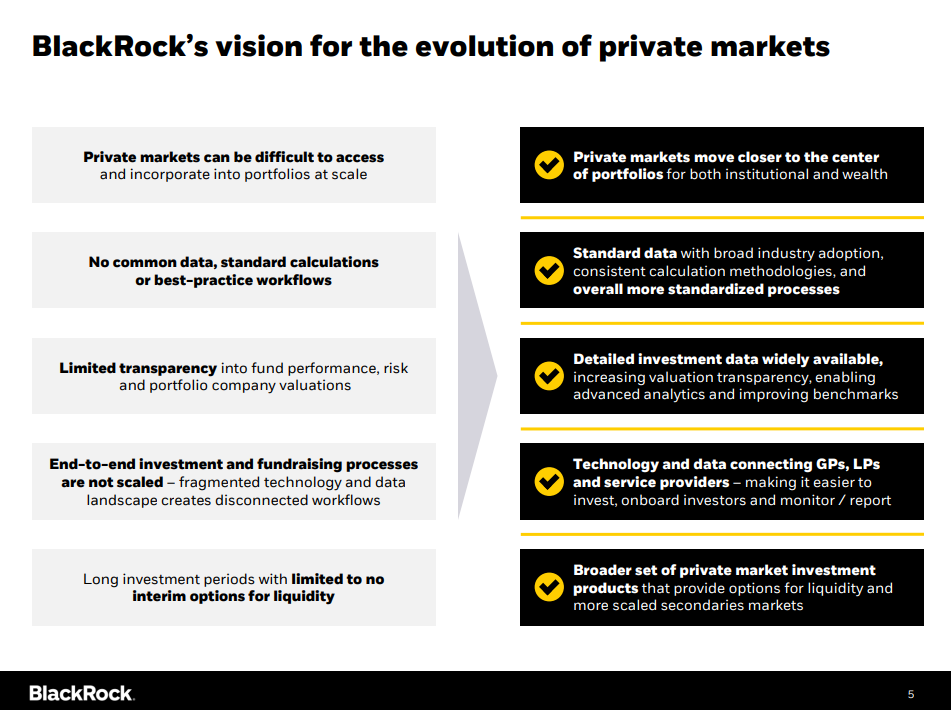

Together with Preqin, we can make private markets investing easier and more accessible while building a better-connected platform for investors and fund managers. This presents a substantial opportunity for Aladdin to bridge the transparency gap between public and private markets through data and analytics.

He and BlackRock understand the value of Data & Analytics:

If you listen to Larry [Fink] and the others, a lot of Blackrock was built on this thesis that managing client portfolios and client money is really all about information processing. Effective information processing and turning data into information is all about having the right technology.

Private Markets Data - the race is on!

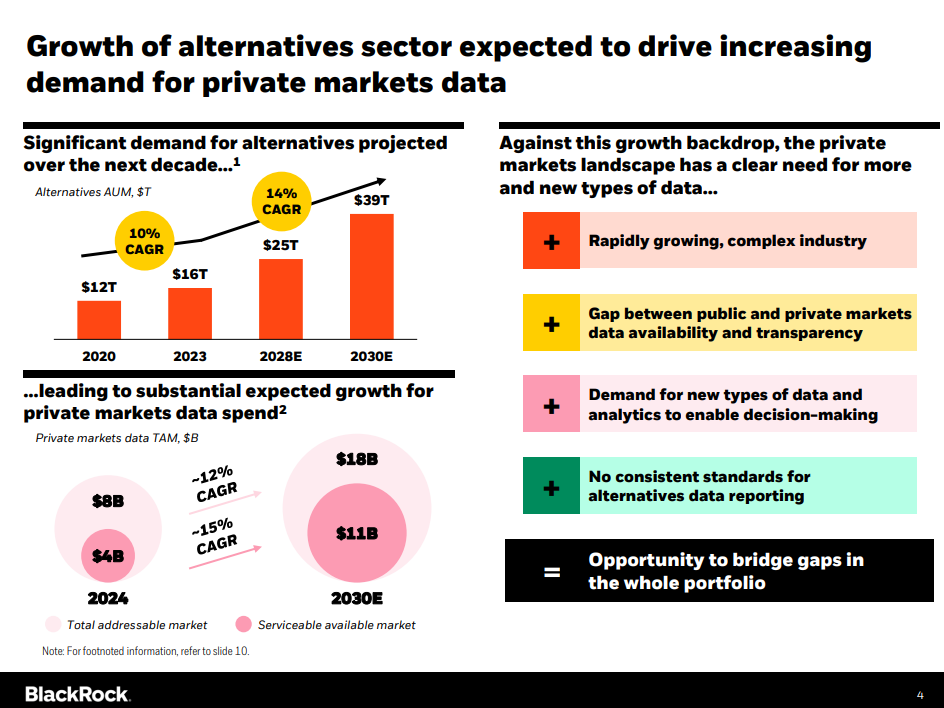

On the announcement call yesterday BlackRock CEO Larry Fink clearly laid out the opportunity:

This acquisition is about driving evolution and growth in the private markets. by measuring them, understanding their drives of performance and making them more investible.

Think about how data, benchmarks and risk analytics transformed public markets… They made investment performance and drivers of returns much more transparent.

Our aim is to do all of that in the far less mature Data & Analytics and Index business for all the Private Markets.

We talked a little about Private Markets back in May when we looked at Secondary Market Data & Analytics provider ApeVue:

We don’t intend to do a full breakdown here of how Private Markets have grown in the last twenty years while Public Markets have declined. If you want to dig into this topic in depth we highly recommend Michael Sidgmore’s

newsletter.But if we take a step back and look at the overall trend, and squint a bit, it seems probable that Private and Public Markets are actually likely to converge at some future point.

Another way of saying this is that introducing liquidity and transparency into Private Markets actually serves to make them function more like Public Markets. If this trend continues then everything becomes investible.

In a Fortune interview last year, Sudhir Nair, Global Head of Aladdin, gave a glimpse into how BlackRock see this trend playing out:

I would say probably the biggest area of focus, when we think about the future, is the portfolio of the future. We believe it will be very different from the portfolio of today—much more personalized, much more customized, much more holistic. It will blend active and passive, public and private, it will have elements that are tax aware and tax efficient, it will manage and maintain individual sustainability preferences, it will have all sorts of aspects and characteristics that, quite frankly, will put a lot of strain and challenge on much of the existing infrastructure and ecosystem. So when we think about our strategy, and what’s next, it’s all about preparing BlackRock and our clients to be able to build, manage, and distribute that portfolio of the future at scale.

This is the trend that BlackRock and all the other Financial Data & Analytics providers are focused on. The race to service the Private Markets is on!

Who are the losing bidders and what will they do next?

We know from the Financial Times article that both Bloomberg and S&P Global both lost out.

Bloomberg is not a surprise. They are notoriously conservative and have made relatively few acquisitions.

S&P Global missing out is more of a surprise. Adding Preqin data to Capital IQ would have certainly provided an upgrade to their dataset.

One wonders whether the change of leadership announced last week may have played into some indecision on their part about whether to bid what was necessary to win the deal.

Who else might have bid? We can speculate…

LSEG seem an obvious party to have had a look at Preqin. Acquiring the asset would have been a great addition to LSEG Workspace (AFKA Refinitiv), and would have served to differentiate them from Bloomberg in their conversations with customers.

We suspect that Nasdaq will also be sorely disappointed not to have acquired Preqin. It’s clear from the Nasdaq Private Markets section on their website that they are gearing up for a big push into data to complement their existing Secondary Market trading platform.

What will these companies do now?

We can expect that the other data providers in and around Private Markets will be attractive acquisition opportunities. For example:

Mergermarket (ION Group);

Pitchbook (Morningstar);

You can be sure we will be keeping a close eye on the sector.

What will the O’Hares do with the money?

You can rely on the intrusive British media to provide us with the answer.

According to The Daily Telegraph:

Mr and Mrs O’Hare own 80pc of the business through their family holding company Valhalla Ventures, triggering a major payday once the deal completes.

The £2bn windfall puts them in the top 100 richest people in Britain.

The O’Hare’s investment vehicle already has an investment in Data & Analytics provider Net Zero Insights. And Mark O’Hare had also set up a Data & Analytics business (Citywatch) prior to Preqin.

It’s very hard to step away from Data & Analytics once it’s in your blood. One would hope that Mark O’Hare (and the 300 Preqin employees sharing the remaining £500m) will form a Preqin mafia and encourage the growth of a whole raft of new Data & Analytics businesses.