AlphaSense acquires Tegus - what does it mean for Expert Networks and Data & Analytics?

TL;DR - A seismic moment likely to drive further consolidation in Expert Networks and Data & Analytics

If you haven’t already subscribed, join 448 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

The announcement of the acquisition of Tegus by AlphaSense yesterday felt like one of those M&A moments that happen only every so often and shake the world around you.

If you’ve been an active participant in a business sector for many years then you’ll know what I mean. A deal is announced, usually one of scale, and you know that from now on things will be different.

For those of you in the Data & Analytics space, do you remember where you were when you heard that:

IHS and Markit were joining forces?

S&P Global was buying Markit?

The Thomson Corporation was acquiring Reuters?

LSE had agreed to acquire Refinitiv?

Reed Elsevier was changing its name to RELX?

Okay, so the last one was a joke, but the others all felt hugely significant at the time.

The combination of AlphaSense and Tegus is smaller in scale, but punches similarly for me.

Perhaps this deal resonates because the work I did earlier this year analysing AlphaSense and Tegus was personally transformational.

Looking into the two businesses significantly expanded my understanding of both Expert Networks and AltData.

In addition, drilling into Tegus, and the impact of Investment Group of Santa Barbara (IGSB) and Hamilton Helmer’s 7 Powers on Tegus’s decision-making, pushed forward my knowledge of business strategy.

(If you haven’t read 7 Powers, I would advise you to do so. It’s an immensely powerful, if also incredibly challenging, read.)

The analysis I published on AlphaSense and Tegus is also, by a long way, the most read piece I have written to date, which speaks to people’s interest in the two companies.

And so, a day after the deal was announced, the question that comes to my mind is:

Why has so little analysis of the deal been written so far?

The best insight I’ve seen to date is Max Friberg of Inex One’s immediate hot-take.

There has been nothing written so far in the mainstream business media. Nothing in the Wall Street Journal and nothing in the Financial Times. The industry newsletters are just rehashing the press release.

So, for what it’s worth, here are my thoughts.

The deal provides significant additional scale for AlphaSense ahead of its impending IPO

The combined business is now worth $4bn, with combined revenues north of $300m.

There is a real sense that Jack Kokko and AlphaSense are a force to be reckoned with in the Data & Analytics world. When you add the Elnick Brothers and Bob Casey (and the rest of the IGSB brains trust) then AlphaSense have some serious intellectual firepower to bring to bear.

Momentum is building around AlphaSense that could lead it to become a challenger to the large Data & Analytics providers such as S&P Global, Bloomberg and LSEG in due course.

The deal adds significant proprietary data to AlphaSense’s knowledge graph

As we’ve seen recently with the arms race for AI companies to acquire training data, proprietary data sets are extremely valuable.

Tegus has proprietary data on thousands of private companies, with a particular focus on in the PE and VC landscape.

This additional data will make AlphaSense’s product a more attractive subscription proposition for non-public company focused investors, advisors and consultants.

Expect to see AlphaSense leverage this additional data to drive up subscription numbers and push through price increases.

What other assets will AlphaSense be considering acquiring?

With both firms having previously made tuck-in acquisitions to add databases of information and analytics tools to their solutions, we can expect that they will not be shy of doing so again in future.

Advanced investment analytics tools like Toggle AI, which we looked at last week, would be easy deals to do (particularly now that both Toggle AI and AlphaSense share an investor in Softbank).

And datasets of information like Vinesh Jha’s Estimize would also be interesting.

But, now that they have got a taste for larger deals, would they consider buying a business like currently depressed valuation Company Data & Analytics provider ZoomInfo? ZoomInfo CEO Henry Schuck is on the board of Tegus, so there is a connectiuon there. Perhaps this is a stretch, given ZoomInfo’s Sales & Marketing slant, but we wouldn’t be surprised to see a transformational deal of this order in due course.

What does the significant reduction in valuation for Tegus mean for Expert Network valuations overall?

The acquisition values Tegus at $930m, versus the $3bn valuation achieved in their last raise in November 2021.

This will be of particular interest to other Expert Networks, and their associated bankers and investors, currently examining their exit options.

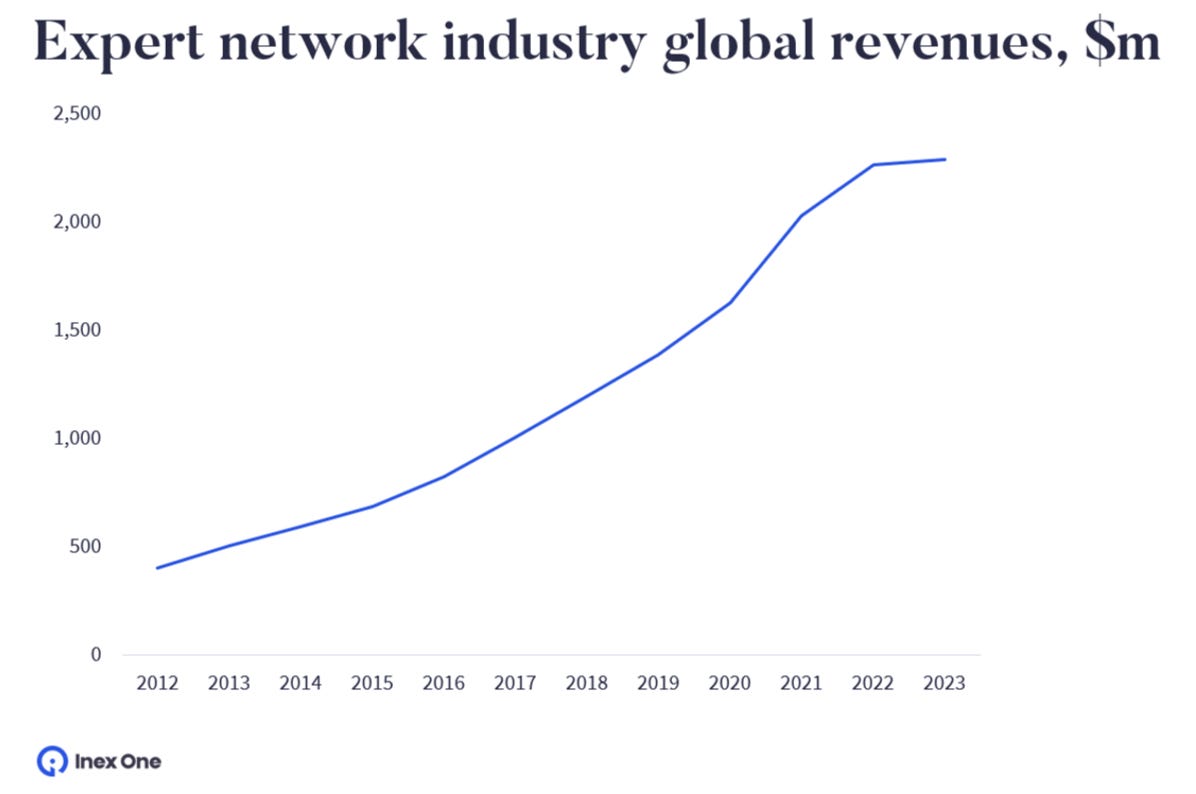

Will the valuation multiple in this deal have a negative impact on valuations beyond the overall slowdown seen in the Expert Network space in the past year?

(thanks to Max Friberg once again!)

Of course Tegus’s 2021 valuation was also achieved at the top of the tech market and before the general global economic slowdown kicked in. Not every Expert Network raised money at the same time and will be in the same position as Tegus.

Perhaps, conversely, the growth of AlphaSense, and the thesis behind its acquisition of Tegus, will make Expert Networks, particularly those with transcript libraries, a more attractive takeover target for other Data & Analytics providers concerned by the threat of AlphaSense, and serve to drive up valuations in competitive processes?

How will the large Financial Data & Analytics providers respond to the impending threat of AlphaSense?

So, will the likes of S&P Global, Bloomberg, LSEG and Factset be considering acquiring other Expert Networks, particularly those with transcript libraries?

If we consult Inex One’s database, Expert Networks which stand out as potentially attractive targets if you subscribe to this theory include AlphaSights, Third Bridge, Dialectica, Guidepoint, In Practise and Arbolus…

… and then there is GLG. Surely the most obvious Expert Network take-out target of all.

These large Data & Analytics firms have not previously shown any appetite to acquire Expert Networks. Indeed, back in 2009, S&P divested Vista Research to Guidepoint for $10-13m, booking a $14m loss on an asset they had bought only three years previously. Institutional memories tend to be long-lasting.

Perhaps the giants of Data & Analytics will be frantically trying to acquire AlphaSense itself? Before it reaches a scale when this becomes too hard, and they (particularly FactSet) become take-out targets themselves.

From what we know about Jack Kokko, however, it seems unlikely that a trade sale will be happening any time soon. The course towards an AlphaSense IPO and further growth is set and it would be a real surprise to see any deviation from this.

But, then again, these seismic moments do have a tendency to happen just when you’re least expecting it.

It would seem that the other expert networks need to broaden their offerings.