Analysing AlphaSense and Tegus

TL;DR - two fast-growth hybrid Data & Analytics / Expert Network businesses with inspirational leaders are disrupting the market

Welcome to the 14 new subscribers who have joined us since last week! If you haven’t subscribed, join 164 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues you think may be interested. Thank you!

I first wrote about AlphaSense and Tegus at the end of January, after Matt Ober (author of The Rollup newsletter) brought them to my attention in an Alternative Data Podcast interview with Mark Fleming-Williams.

In that post I was dismissive of the two companies, casting them as mere aggregators of third-party data. As I dug deeper into the Company Data & Analytics sector in my next post, it became clear to me that there was more to the two businesses than initially met the eye, and that they may well represent the future of the sector - hybrid Data & Analytics / Expert Networks. And by my last newsletter, it had become clear that they were worthy of deeper analysis. I asked you in a poll if you would be interested in reading an analysis of AlphaSense and Tegus, and 100% of the 8% (!) of you who responded said yes. Quite what the remaining 92% thought, I don’t know, but I felt committed enough to do the work. So here we go!

AlphaSense and Tegus are similar in many ways.

They serve the same main client base: Financial Services.

They have both effectively converged on providing Company Data & Analytics, Industry Research and Expert Network services;

They have similar Enterprise Values ($2.5bn at last raise for AlphaSense, and $3bn for Tegus);

They both see an opportunity to dislodge the incumbents, and grow huge businesses in enormous sectors;

Both have mighty impressive, still-incumbent founding leadership teams. I suspect we will be talking about Jack Kokko at AlphaSense and the Elnick brothers at Tegus for many years to come.

But they are also quite different.

Origin Stories

When it comes to superhero movies, I’m probably going to make myself unpopular here by saying that I’m in Martin Scorsese’s camp. Black Panther and the Miles Morales’ Spiderman aside, I’ve avoided pretty much all the Marvel and DC movies. But I do know that the Origin Story plays a large part in every superhero story.

After many hours of reading and listening to articles and podcasts about, interviews with, and analyses of AlphaSense and Tegus, I think the two companies can be boiled down to their essence from their origin stories.

The AlphaSense origin story

In a podcast interview with RJ Lumba’s Growth Investor podcast, AlphaSense Co-founder Jack Kokko says about his time as an M&A Analyst at Morgan Stanley at the start of his career:

It was so manual to find the information [you needed] using the legacy solutions and tools [available]. Morgan Stanley gave us the best sets of tools that money could buy, but it was still very basic. You couldn’t search across these vast volumes of documents [in one go]. You’d have to CTRL+F search one document at a time in PDFs, one keyword at a time. Shockingly this still goes on today.

But we are trying hard to change that and upgrade that research process and what we decided with my cofounder was that there’s a big problem and the traditional solutions and providers aren’t really trying to solve this. You had Google and others solving this for all of us in a magnificent way as consumers. Searching across vast volumes of information on the internet, but nobody was doing this for business information, for all the thousands of sources of proprietary information that you really have to subscribe to, and go log in to portals one at a time, and figure out where to get started, before you could start looking for what you needed.

So we decided that, although this was going to be really hard, but it was going to be possible to bring this all together and then bring AI, Machine Learning and NLP to take all these thousands of sources, millions of documents and billions of datapoints and understand it based on algorithms to read textual documents so that we could build a really smart search engine, that searches, like a B2B Google, across all these information sources and then gives you just the information you need, precisely, quickly, reliably, so that you can do your job lightyears better than the way it was being done before.

In a nutshell, Jack Kokko and his co-founder, Raj Neervannan, decided back in 2008 at Wharton Business School that they would build a better mousetrap for bankers (and other users) than the financial research providers were providing. One more akin to the experience of using Google.

Keep this in mind whenever you look at the AlphaSense journey and strategy and you won’t go far wrong.

The Tegus Origin Story

In September 2022, Tegus took $20m of investment from Positive Sum, Patrick O’Shaughnessy’s investment vehicle. Something about this moment put Tegus co-founder Michael Elnick in a reflective mood, and he published a post on the Tegus blog which shines a spotlight on the drivers behind the business. I quote a long extract below, which I think is worth reading in detail. But if it’s too much then just skip to my summary right after.

As is often the case with founders, Tom & I were ambitious, eager, and wanted to tackle as much as possible as fast as possible. We saw new opportunities at every turn. The IGSB [Investment Group of Santa Barbara] team urged us to slow down and to nail the product early on. If we didn’t nail the product, nothing else would matter. We took their advice to heart, and spent every available minute with a narrow set of potential customers. We worked to deeply understand the pain points of these investors, discussed their research processes, and identified specific opportunities to build an offering that they couldn’t live without.

And as we began building our initial offerings, we stayed very focused - applying an incredible amount of pressure behind very few initiatives. It is easy to talk about focus - but it is hard to commit to it. It required saying no to countless opportunities to expand to new end markets, new customer segments, and new geographies.

In a world where the mantra is often “grow at all costs”, who has time to spend hours each day with customers? And why would we limit our opportunities, especially as I think about fundraising for my next round? But this concentration and focus has paid dividends.

When we entered the market in 2017, we had strong counter positioning with a disruptive price point and a service model that was uniquely opposed to what GLG, Guidepoint, ThirdBridge, and the traditional expert networks were offering (a great lesson that the more profitable the incumbent, the stronger power of counter positioning. As Jeff Bezos says, “your margin is my opportunity”).

Counter Positioning allowed us to quickly gain traction. We recognize that we cannot rest on our laurels and must constantly be searching to develop new sources of power (i.e. Scale Economies as our library of content grows).

We believe that capital allocation is one of the most important parts of our job. Since day one we have focused on generating positive cash flows and on running the business efficiently. As a high growth startup it was unfashionable to focus on free cash flow in 2019-2021, but we were undeterred.

Running the business efficiently allows us to control our own destiny. It has allowed us to raise significantly less capital than almost any peers at our stage and scale. We have deployed our capital in unique ways. A couple of years ago, we used excess capital to buy back shares from early investors. Over the course of the last twelve months, we have acquired three businesses, including BamSEC and Canalyst. And we continue to look for new opportunities to allocate our capital in service of our customers.

In summary:

The two Elnick brothers took investment from one of the canniest (and most secretive) tech investors of the last 50 years - Reece Duca - who guided them to:

Be obsessed with finding product market fit;

Focus on free cash flow, not raising money;

Differentiate your business from your competion.

As an alumnus of LA-based Houlihan Lokey, I can see the value that the Elnicks have got out of thinking about financial services from a Californian, not a New York perspective. Looking somewhat from the outside in gives you an alternative take.

The key information in Michael Elnick’s post is hidden in his oblique reference to “strong counter positioning with a disruptive price point and a service model that was uniquely opposed to what the traditional expert networks were offering.”

of the Not Boring newsletter (acknowledging his debt to the research of Byrne Hobart in The Diff) provides us with the explanation of what this alternative product is in his deep dive into Tegus:Tegus leverages its scale to build an uncatchable library of user-generated content (UGC).

When you think of UGC, you typically think of teens sharing videos on TikTok, creators dropping in-your-face content on YouTube, or influencers posting thirst traps on Instagram…

Now, instead of aspiring influencers, imagine that you could get the best investors in the world to create content for you and pay you to do it in exchange for access to all of the other investors’ content.

That’s essentially what Tegus does. In exchange for those low per-call rates, Tegus investors and experts opt-in to sharing a transcript of their call with the entire member base, with a lag. Every call with an expert on a particular company adds to the corpus of information available to all Tegus clients about that company.

In a nutshell: Expert Networks converged with Data & Analytics.

To my faithful readers I say: is this not what we have been discussing for the last few newsletters?

No time like the present

So where have they got to now?

As with any private company, the data about the businesses is quite opaque, and we end up reading the tea leaves to figure out two businesses’ positions - particularly when it comes to financials. What I wouldn’t give for a few expert calls/access to a transcript library to get some proprietary data (but then I wouldn’t be able to share it with you here, so I guess it’s academic.)

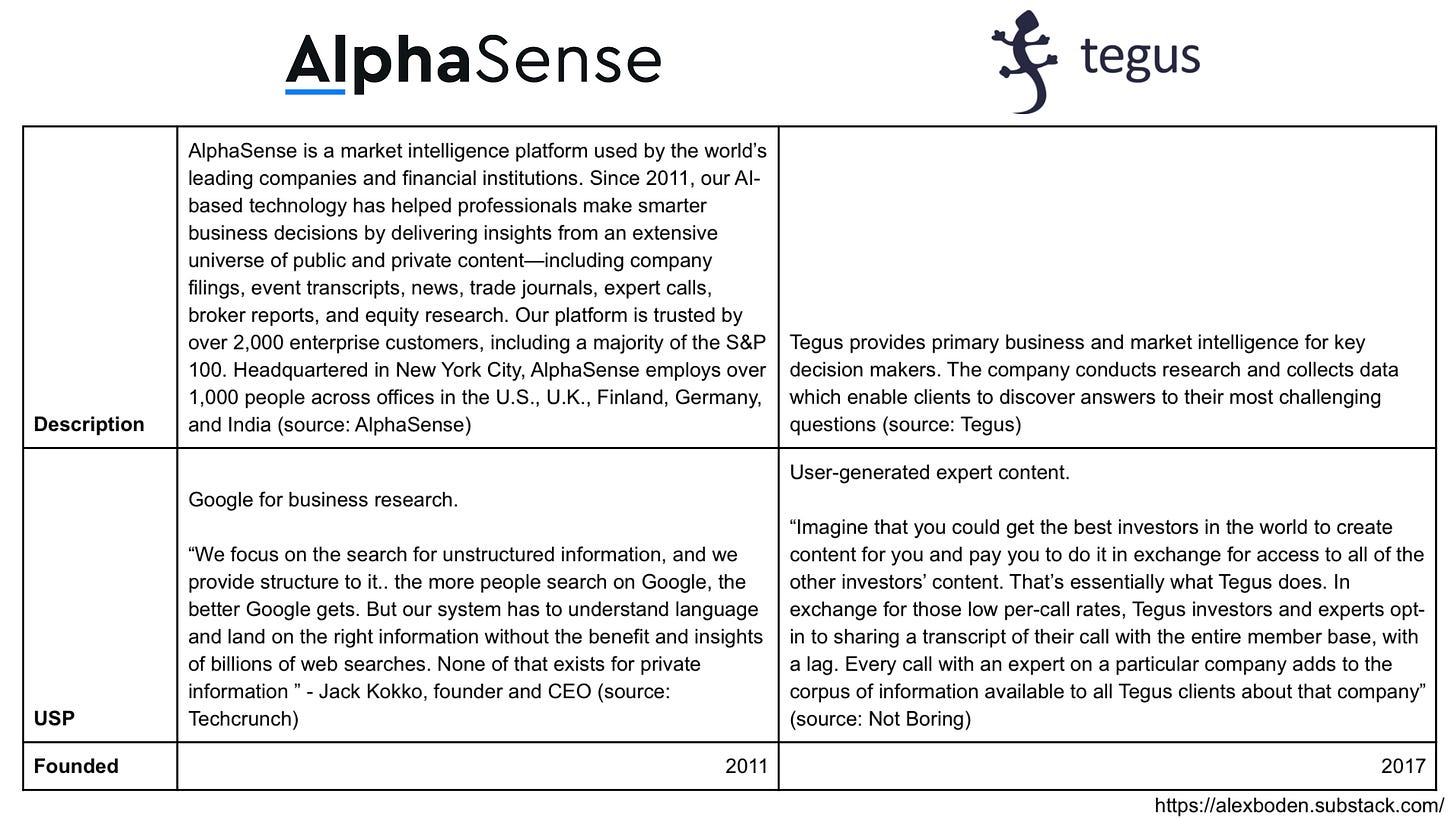

Here’s some basic information about the two firms:

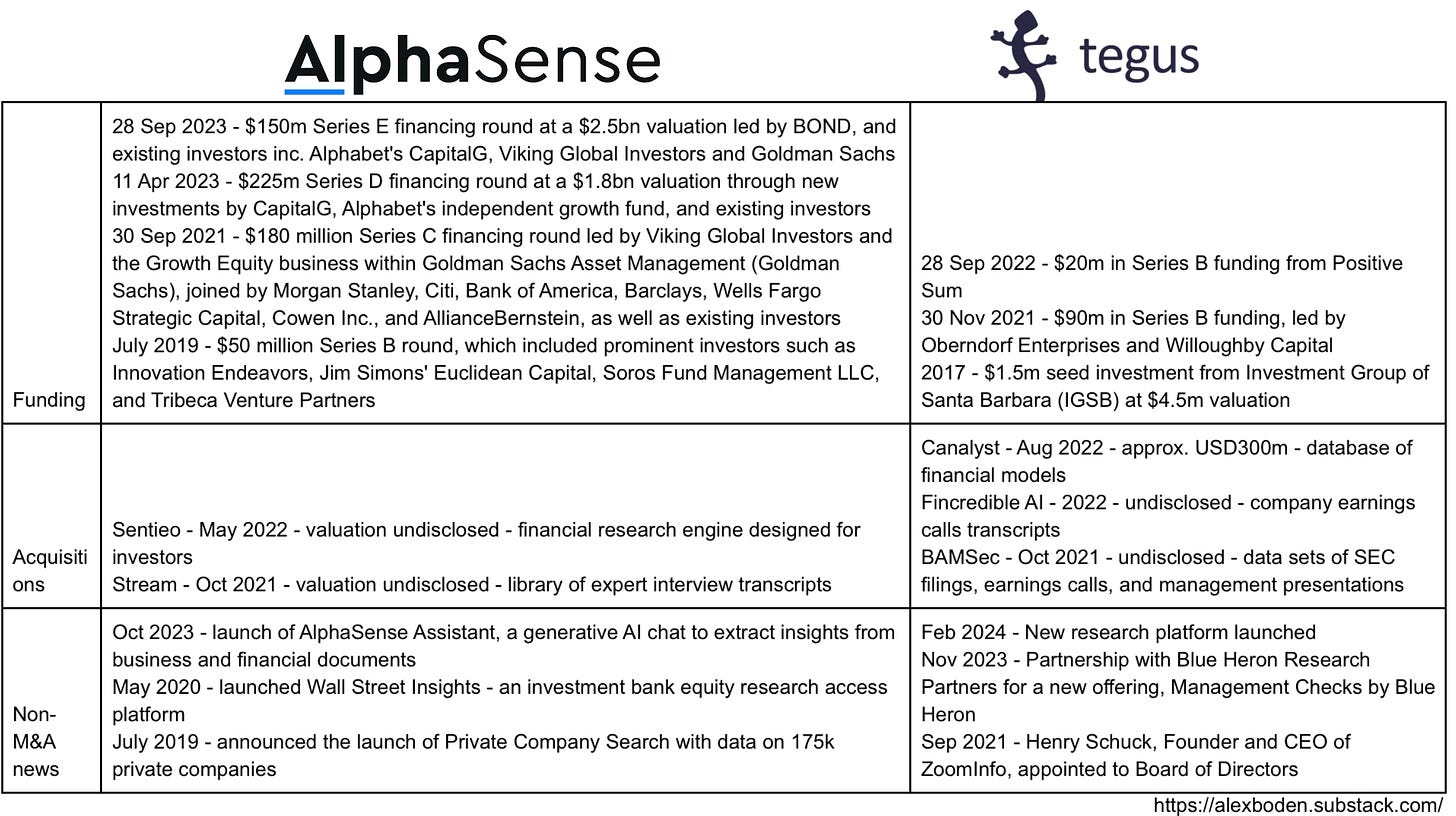

And here’s some info on their fundraising, acquisitions and other relevant news.

Unsurprisingly from a firm that has made a virtue of being cashflow positive from the start, Tegus have raised a relatively small amount of money, mainly, it appears from investors who can have a semi-mentoring impact on the management team.

AlphaSense meanwhile have raised north of $600m and appear to be following the traditional “go-big-or-go-home” Silicon Valley playbook. Having said that, they too have raised money from some strategically sensible sources, including a number of Investment Banks, whose Equity Research they have been keen to plug into their platform, and whose users they want to become adherents of the product.

While AlphaSense’s distribution of Equity Research from the largest investment banks is definitely a differentiator, as I said at the start of this post, the two businesses share many similarities:

Both provide Expert Network services and transcript libraries - AlphaSense have acquired their way there through their 2021 acquisition of Stream;

Both provide tools to help financial analysts to gather information about public and private companies quickly (aka Financial or Company Data & Analytics);

Both are making acquisitions to fill in the gaps - serving to make each company more like the other.

And this similarity, and the acquisitions, are now starting to cause the two tectonic plates to collide.

If you have access to Fitch’s Pacer, the court documents provide a fascinating insight into the business models, software, data and strategies of the two companies.

AlphaSense clearly feel strongly that Tegus are moving onto their turf. AlphaSense’s marketing material also suggests a preoccupation with what Tegus is doing.

Meanwhile AlphaSense are also positioning themselves as an Expert Network, conveniently ignoring Tegus in their description of the market.

What happens next?

I’m afraid I don’t agree with CB Insights’ prediction that Tegus will be acquired by GLG. Given the current trajectories of the two businesses. I think it’s far more likely that at some point Tegus outgrows GLG. Take a look at the S1 for GLG from the IPO that they pulled in 2022 and draw your own conclusions.

Both Tegus and AlphaSense look like the future to me.

Traditional Company / Financial Data & Analytics providers like FactSet, S&P’s CapitalIQ, Bloomberg, Moody’s and Dun & Bradstreet must be thinking hard about the threat posed by both of them. And Expert Networks like GLG, AlphaSights, Guidepoint, ThirdBridge and VISASQ/Coleman Research can already by seen to be thinking about how to move towards providing similar services.

I expect both firms to keep on growing - eating into spend from Financial Services and Strategics on Data & Analytics and Expert Networks. How big will they get? Only time will tell. Personally, I hope they IPO at some point so we can learn more about their inner workings.

Thanks for reading and do pass this on to anyone else you think may be interested.

Bonus reading:

Pinpoint Research’s profile of AlphaSense provides some great analysis. It’s in Korean so I’ve linked to it here via a Google translation;

Interview with Jack Kokko on the Morgan Stanley alumni website

The mysterious Kevin G published a fascinating interview with Reece Duca, founder of Investment Group of Santa Barbara, the notoriously taciturn tech investor behind Tegus, on his

newsletter;For those of you who would like a starting point to understand the Expert Network industry, Max Friberg of InexOne has made a great primer;

InexOne have also made a useful profile of Tegus.

When I wasn’t reading about AlphaSense and Tegus, or finishing Klara and the Sun, I found the following links interesting this week:

Fascinating piece on Nicholas Saunders, the man who took British cuisine and produce out of the post-WWII doldrums

Interesting thought piece by Nomad Data on Data Marketplaces

These two in-depth newsletter posts are thought-provoking about how we can deal with the consequences of the impact of the digital world on our lives:

this has been a fascinating read! there is a bigger story here..