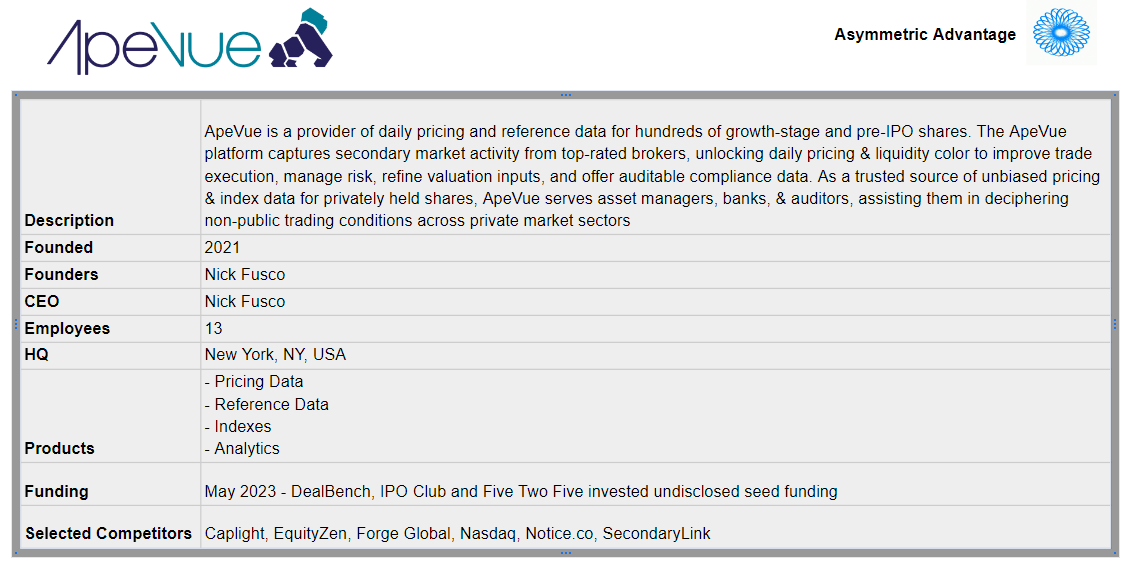

ApeVue - Financial Data & Analytics for Private Growth and pre-IPO companies

TL;DR - If only there was a secondary market in ApeVue's own stock - then we would know how much it's worth!

If you haven’t already subscribed, join 376 members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

It’s been a while since I wrote about a small company. The last time I featured Weather Data & Analytics provider Jua.

This is because you, my dear readers, have told me with your page views: write about larger companies. But when I dug into Secondary Markets Data & Analytics provider ApeVue I knew I had to go against this guidance - it’s such an interesting business. I hope you’ll agree.

Valuing a public company is easy. You go to your data source of choice (including many free options) and check out the market cap.

But what about the 99.999% of companies that are private? How do you value them if you don’t have access to proprietary information?

Traditionally the answer has been:

Make a best guess using alternative data like employee numbers, likely growth, and multiples achieved in the space previously;

Use the valuation from a prior funding round (if it was disclosed).

But what if there was another way?

The advent of secondary markets for private company stock provides a vision of an alternative.

(The “Ape” in ApeVue actually stands for “A Private Equity”. Nothing to do with monkeys sadly. But it makes for a good picture.)

ApeVue’s Origin Story

ApeVue founder Nick Fusco spent 12.5 years at Markit and IHS Markit, focused on Fixed Income and Index products. He then worked as CRO at Semantic Evolution, a provider of AI-powered unstructured data services for the financial services industry (acquired in 2023 by Fimatix).

He jumped ship in 2021 to set up ApeVue.

Musing briefly on the secondary market

In an “overhead in a Goldman Sachs elevator” moment back in 2009, while working in corporate finance in the UK, I remember hearing an UHNWI discussing buying shares in then unlisted Facebook. At the time, doing this type of trade was pretty much unheard of in the UK. You could buy into a private company during a funding round but outside that there was pretty much no liquidity.

How was this trade able to happen? I thought.

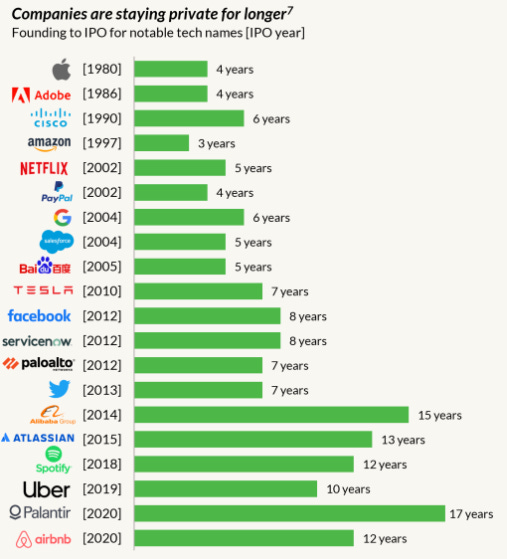

What I was witnessing were the birthpains of this “new” (I use the quotation marks because, of course, nothing is new in finance) market in private stock. Facebook had been private for too long at that point, and employees were desperate to get some liquidity. Trading venues like SharesPost and SecondMarket sprung up to cater to them.

Once the genie was out of the bottle, there was no turning back. Indeed, the continued growth of financial sponsors and their game of “pass the parcel” of assets from one to another has meant that many private company shareholders find themselves in need of a means to cash in their shares. Palantir, anyone?

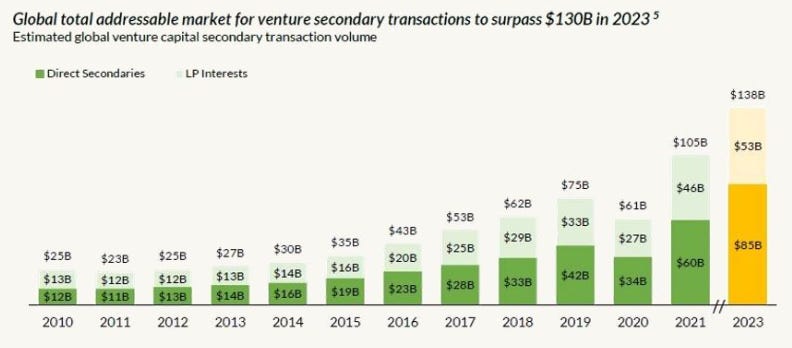

(Source: Industry Ventures)

At the start of this year I asked someone “with grey hair” whose opinion I value highly, how a deflation of the private equity bubble might play out. Where would the opportunities for value investors be, if PE and VC were forced sellers?

Right now, it appears that the answer might be: private secondary transactions.

This article from the FT in January highlights the opportunity:

Investment firms are raising billions of dollars to buy stakes in venture capital-backed technology start-ups, as a long drought in acquisitions and initial public offerings forces early investors to offload their stock at discounts.

The start-up secondary market, where investors and employees buy and sell tens of billions of dollars’ worth of shares in privately held companies, is becoming an increasingly important trading venue, in the absence of traditional ways of cashing out and given a slowdown in start-up funding.

Venture secondaries buyers are primed for a busy year as start-up employees look for a way to sell their stock and investors look to return capital to their own backers or reallocate it elsewhere.

Secondary market specialist Lexington Partners last week announced a new $23bn fund to buy up stakes from “large-scale investors”. Lexington had originally aimed to raise $15bn, but upped its target on the back of high demand, and said it was “in the early stages of a generational secondary buying opportunity” that could last years.

The fund will predominantly buy shares from private equity funds but also expects to invest as much as $5bn into venture capital secondaries, said a spokesperson.

“We are seeing crazy amounts of [limited partner investors] that are distressed and need to lighten their venture load,” said the head of a $2bn venture capital firm.

Whether valuations are up or down, and although the market stalled briefly in Q3 2023, the broad trend for secondary transactions is heading only in one direction.

There has been a commensurate explosion of venues for trading private stock. Here are just a handful of them:

Some of these venues sell their data to traders. Some don’t. But there is data there if you are prepared to stitch it together.

Enter ApeVue, stage left.

Many asset managers cannot buy private stocks due to the lack of price transparency between financial disclosures or funding rounds which creates hurdles for net asset value calculations, risk reporting and other governance requirements.

As funding rounds are infrequent, Fusco explained that ApeVue collects pricing data from transactional brokers who are active in institutional-sized deals in the pre-IPO share market.

“They are providing prices from actual transactions rather than estimates,” Fusco added. “We think that is the truest reflection of where willing buyers and sellers are mutually agreeing on prices so the quality is high.”

(Source: MarketsMedia)

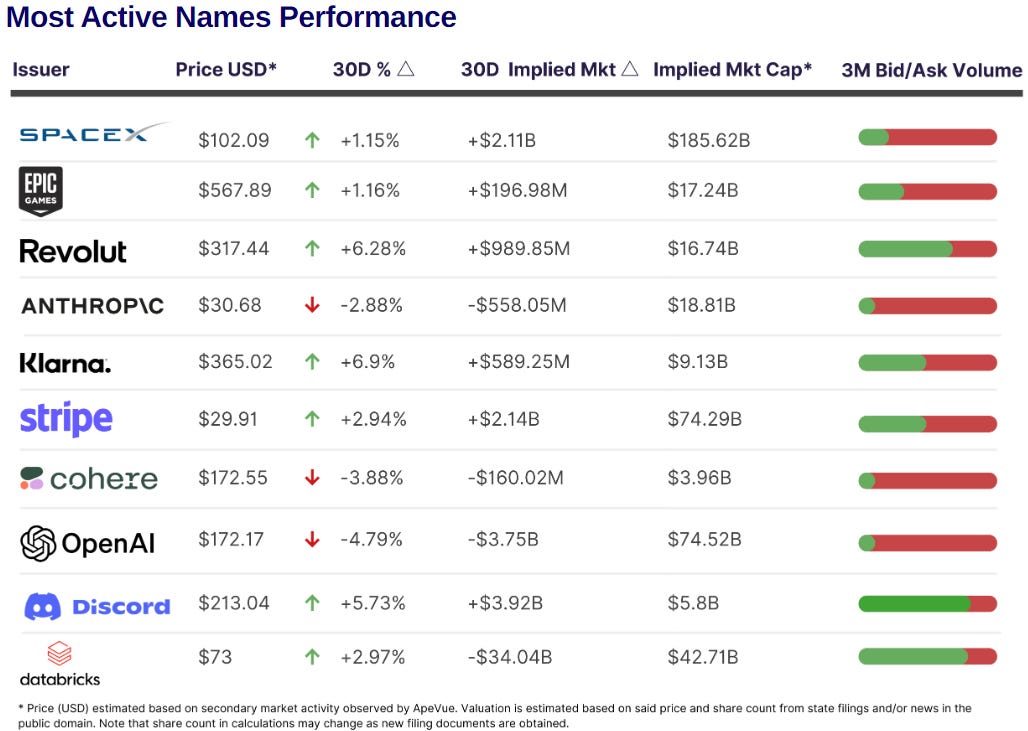

Here, for example, is ApeVue’s data on the most liquid private companies across these platforms:

Now that’s what I call transparency! No more looking at old funding rounds or guessing where the valuation should be based on AltData or market dynamics. Here’s real mark-to-market pricing for private companies.

It’s not clear how deep their data goes currently. Do they have data on all stocks in all venues? My guess is no. But this is certainly possible.

What they do have, however, is extremely valuable to a wide range of market participants.

I know many Investment Banking analysts whose lives would be made easier by having access to ApeVue’s valuation data.

What next for ApeVue?

I anticipate that ApeVue will be raising money imminently in order to expand their dataset. In order to be truly valuable they need to have deep data. All the data from all the venues. And this costs money to obtain and stitch together.

What’s the hurry?

Well, to continue the simian metaphors, there’s an 800-pound gorilla in the wings waiting to grab market share.

Nasdaq Private Market acquired VC Experts’ private company data products last year in order to create the basis of a 15,000 company private markets dataset.

The landing page is ready…

Now it may be that other exchanges may not want to give their competitor their data, and would rather give it to a neutral party like ApeVue, and the market can always cope with multiple participants. But getting to scale quickly would be a good idea…

Bonus listening

I recommend listening to this interview with ApeVue CEO Nick Fusco on the Fat Pitch Podcast. Interesting on the secondary market in general and ApeVue in particular.