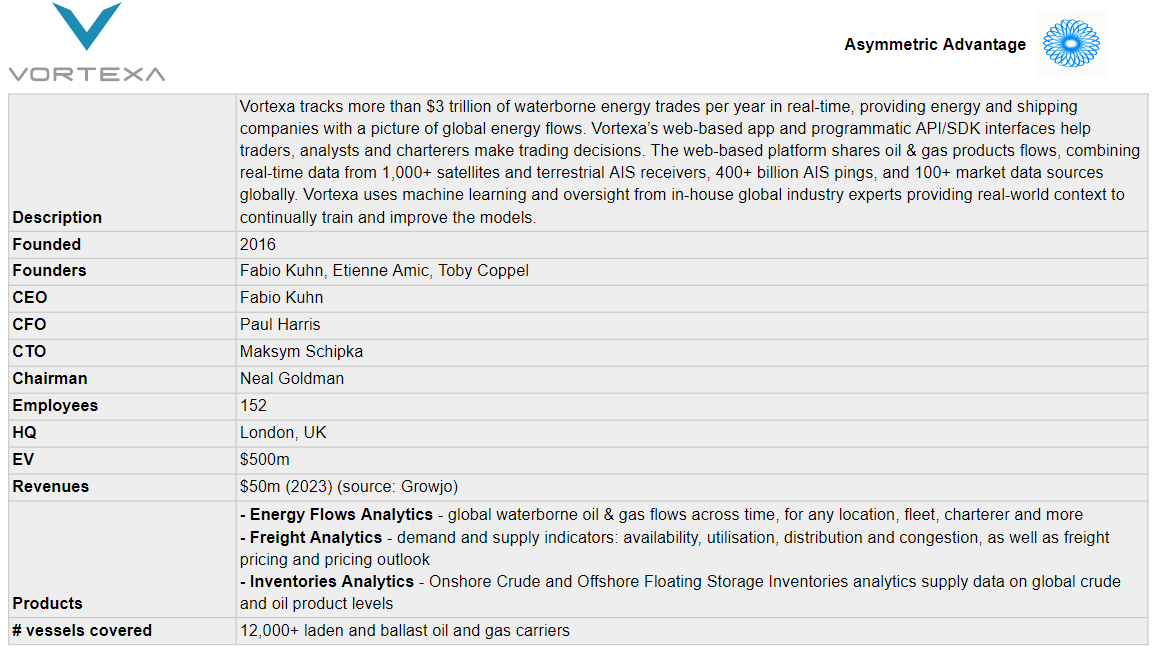

Vortexa - $500m EV Energy & Commodities Data & Analytics provider

TL;DR - Vortexa data generates alpha for energy and commodities traders through real-time vessel and cargo tracking

If you haven’t already subscribed, join 412 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Vortexa’s Origin Story

In an interview with The World of Oil Derivatives podcast in 2021, Vortexa founder Fabio Kuhn told how, while working as Head of Trading Technology and Analytics at BP, he had the realisation that:

One day we will know what is inside every single tanker, even the small tankers carrying products. We will know which product [they are carrying] in real time and when it’s going to arrive somewhere and how much is in the ship. At the time it seemed like science fiction.

When Kuhn arrived in energy trading, after working for NASA at Moffett Field, he found an archaic industry that was just starting to embrace data.

At the time the pace of trade, the pace of understanding, the pace of information to trade was shocking. Some of the trades went on for days, as opposed to milliseconds or seconds. That’s what really opened my eyes to, wow, this is an industry yet to be transformed.

Much of the third-party data that was available when Kuhn started to work in oil and gas trading was in the form of monthly reports. He saw an opportunity to build a product more like the data that hedge funds and other traders had in-house, using the information from their own proprietary trades. He also drew inspiration from altdata sources like Genscape (now part of Wood Mackenzie).

In 2016 he took the plunge and formed Vortexa.

What does Vortexa do?

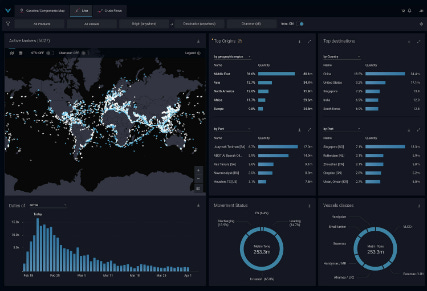

In a nutshell, Vortexa uses data from the explosion of low earth orbit satellite constellations and ship-tracking technology along with machine learning and AI to predict and map the movements of tankers in the $7 trillion a year energy trading market.

Vortexa makes the data available via API for integration into clients systems, or they can access the information via a GUI.

And what can you do with this data?

Over to Fabio Kuhn again

A Vortexa user can say, well, hang on, I’ve seen these ships move over, physically seen them move over, so I can tell you [how accurate] that [U.S. Energy Information Administration] announcement is going to [be]. So you can actually sell instead of buy when everyone else is buying.

As the data and the tech and the transparency of the market evolves, you start being able to look further and further into the future, with a greater and greater level of confidence. You could already start seeing the ships that will be going into and out of the US and be able to anticipate what will be a couple of weeks ahead. And a lot of the other patterns are going further and further into the future as you start to understand freight better, as you start understanding the forward view on loading ports across the world.

Vortexa’s current position

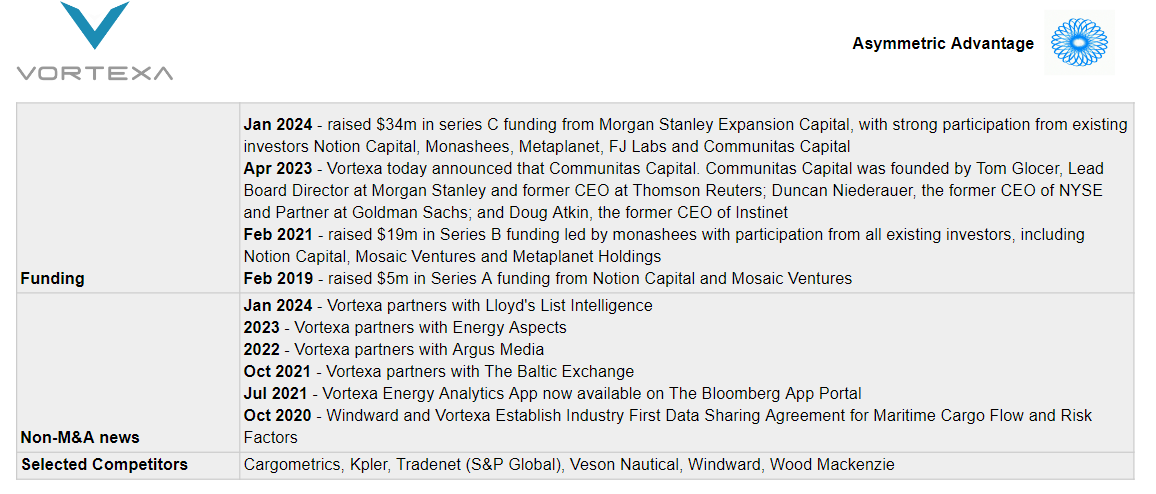

Vortexa have funded their growth through multiple fundraisings. In January this year they raised $34m from Morgan Stanley Expansion Capital and their existing investor base.

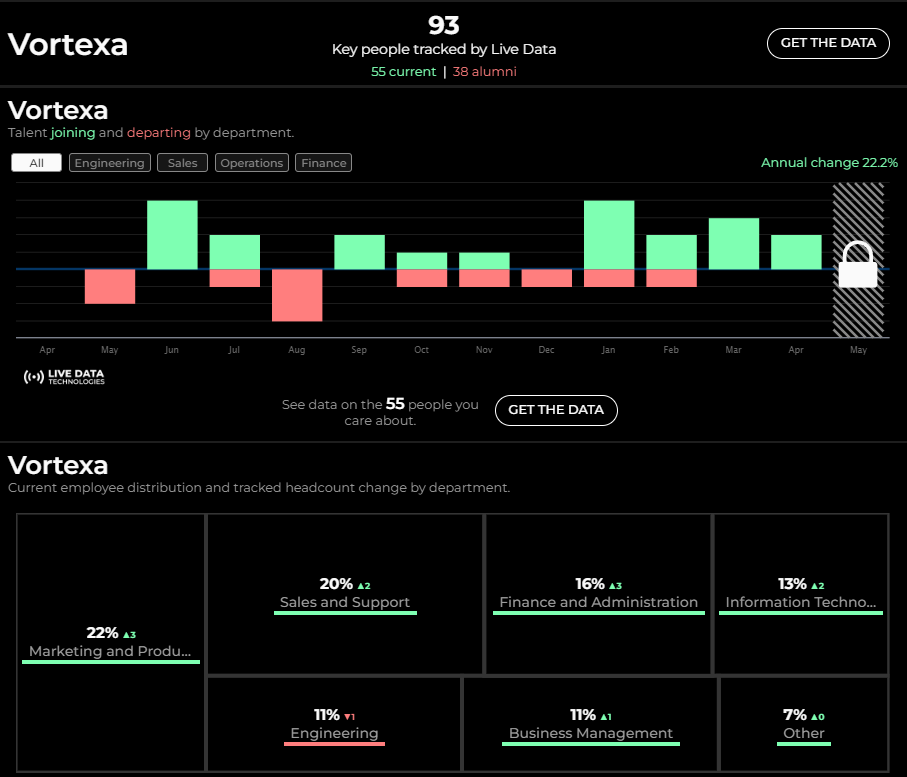

Vortexa have been spending the money on data, software and processing power, and, notably, people.

According to Live Data Technologies, in the last 12 months Vortexa’s headcount has grown 22%, bucking the general trend in Tech for declining staff numbers.

The growth in Sales and Marketing is particularly noteworthy, suggesting a drive to grow topline revenues is in progress.

Also noteworthy is the number of partnerships with other data providers they have agreed. It’s generally the case in Data & Analytics that the more data points you are able to provide, and the more interlinked they are, the more valuable your product is.

What next for Vortexa?

That pile of cash raised this year may well be burning a hole in the Vortexa management team’s pockets.

It’s unusual for a Data & Analytics business to get to this point and not make any acquisitions. Their competitors are certainly very active.

Who might they buy? Well, data partnerships are often an interesting guide to what might be a good fit. In this case, Summit Partners-owned Energy Aspects would be a good combination.

Argus Media, on the other hand, would be an obvious trade acquirer, as would Wood Mackenzie and S&P Global.

And the large Data & Analytics Private Equity investors such as larger competitor Kpler’s owners Insight Partners and Five Arrows, or Spectrum Equity (owners of Benchmark Mineral Intelligence, who we profiled in April), are doubtless circling.

Other interesting content from the past week:

This post by

is absolutely on point. Fabulous analysis of what makes data (and by inference Data & Analytics businesses) valuable:

It’s been a week of interesting announcements of AI and Altdata innovation by large Data & Analytics providers:

Bloomberg announced that they would be making their Bloomberg Second Measure (BSM) credit card transaction data set available alongside their traditional enterprise content;

ZoomInfo announced the release of their ZoomInfo Copilot applying AI to ZoomInfo’s B2B data to predict salespeople’s pipeline, get AI-guided recommendations about who to contact, when to engage, and what to say;

Thomson Reuters announced their CoCounsel Microsoft Copilot AI integration. The video is well worth a watch. This is what the future looks like for every knowledge worker. That includes you, bankers and investors!