$500m Rare Earths & Batteries Data & Analytics company - digging into Benchmark Mineral Intelligence

TL;DR - A high-growth Data & Analytics company likely to change hands in the next few years

If you haven’t already subscribed, join 310 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

One final ask. After two months and 14 posts about Data & Analytics, I’d love to know more about you and your reading habits to help inform what I write about next. Please complete the following one-minute survey. Thanks!

I spend a good amount of time each week reading transcripts of Board Calls and Investor Presentations from 40+ public Data & Analytics companies.

One constant theme is their desire to invest in building data businesses focused on the Energy Transition.

They are not doing this out of the goodness of their hearts (whatever they may say to the contrary). They are doing it because it is makes sound business sense.

Examples:

MSCI acquired Trove Research, a Carbon Market Data & Analytics provider, in October 2023;

ICE participated in Carbon Credit Rating Agency BeZero’s funding round in November 2022 (see my recent analysis of the four players in the Carbon Credit Ratings space);

Lance Uggla, former CEO of IHS Markit, became CEO of General Atlantic’s BeyondNetZero fund in 2022 (listen to this podcast for more detail);

S&P Global launched S&P Global Sustainable1, their ESG division, in April 2021.

So it’s no surprise to see that Private Equity firms are actively making investments in Energy Transition platforms.

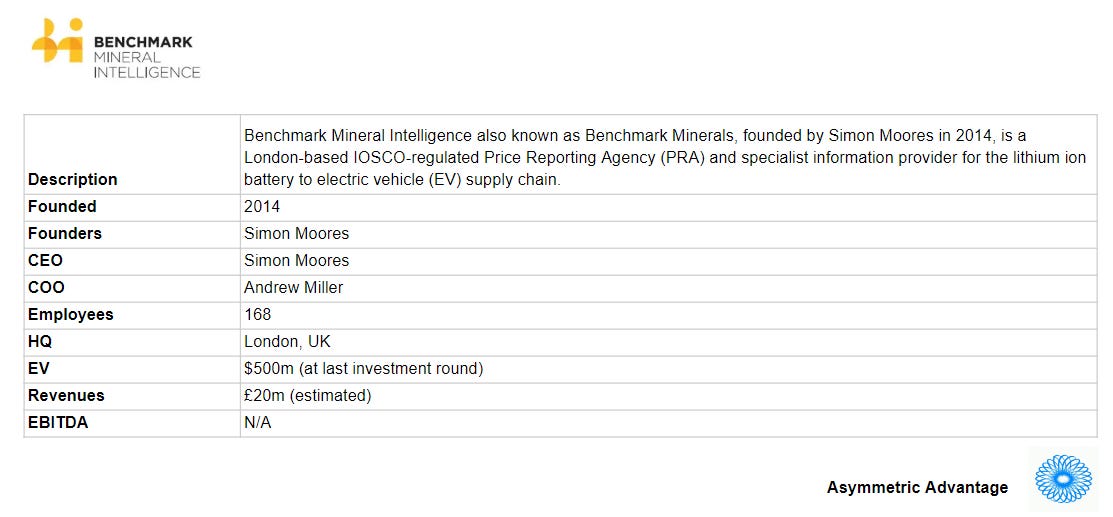

Benchmark Mineral Intelligence is a perfect example of the trends in the Energy Transition Data & Analytics sector.

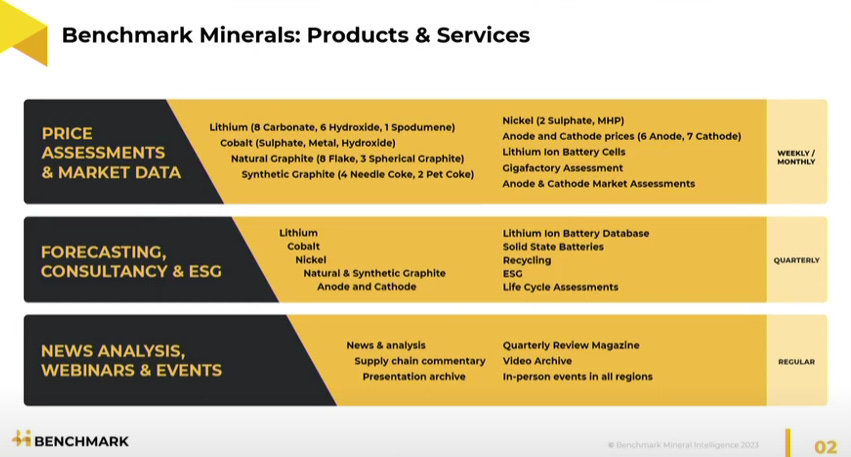

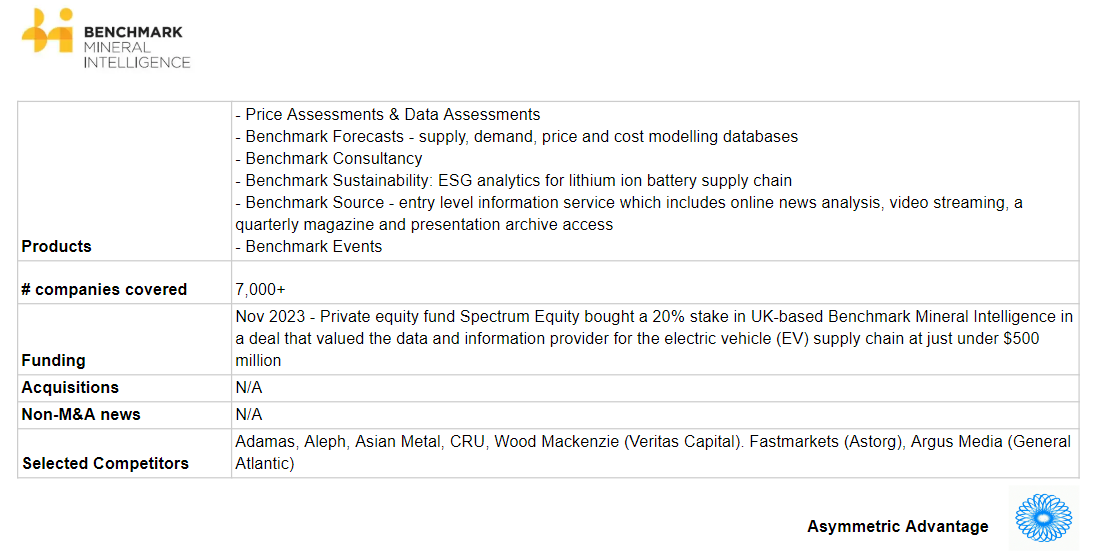

Benchmark enables the energy transition through a world class, independent offering of lithium and critical minerals prices, battery and EV supply chain data forecast subscriptions, advisory services, and industry-specific events.

Benchmark’s clients are major decision makers across critical minerals, battery materials, lithium ion batteries and automotive OEMs.

We have been tracking Benchmark Mineral Intelligence since launch in 2014. Data on Rare Earths, especially lithium, was always going to be valuable as the EV market took off, and so it has proven.

So it was unsurprising to see Spectrum Equity buy up a 20% stake in Benchmark in November 2023 for $100m, valuing the business at $500m. $0 to $500m EV in 9 years from pure organic growth is pretty good going!

Competition to acquire the stake was fierce - Reuters reported in June 2023 that Hg Capital and Bowmark Capital were also involved in the process, and it appears from the report that the valuation was driven up considerably. Given the current relative weakness of the pound against the dollar, UK PE firms often struggle to compete at auction against their US counterparts, so for a hot property like Benchmark it’s no surprise to see a US PE firm win out.

Spectrum have a long history of investing in Data & Analytics businesses, including:

Business Monitor International (sold to Fitch);

EagleView Technologies (sold to Vista Equity);

Lighthouse (current investment);

RapidRatings (current investment);

RiskMetrics (sold to MSCI);

World-Check (sold to Thomson Reuters).

Spectrum should prove great stewards of the business over the next few years before the inevitable exit to either a strategic or another PE firm.

Financial performance

Financial information available about Benchmark is limited. But their most recent filing (FY22) on UK’s Companies House suggest that revenues doubled that year, likely taking the business across c.£5m ARR.

This correlates with Benchmark’s own assertion in their press release announcing the investment that:

The company has seen over 500% sales growth over the past three years as it built out its customer base, product portfolio and global footprint.

If the FY22 growth is extrapolated forwards, revenues were likely c.£10m+ ARR in 2023, and could be c.£20m in 2024. This might seem punchy at first glance, but at a $500m valuation these numbers actually seem low!

Whatever the exact financial information, it’s clear that Benchmark is a high-growth Data & Analytics business.

Price Reporting Agencies

One of Benchmark’s growth drivers is their status as a Price Reporting Agency (PRA).

A quick word on PRAs for the uninitiated.

Price Reporting Agencies (PRAs) are Data & Analytics providers who report prices transacted in physical and some derivative commodity markets, giving an informed assessment of price levels at distinct points in time. A wide variety of market participants rely on PRA price reports, such as producers, refiners, traders and taxation authorities.

Price Benchmarks, curated by PRAs, hold strategic power in the world of raw material markets. These benchmarks provide a standardized and objective measure of current market prices, enabling industry players to make decisions based on reliable information.

This information is the absolute epitome of must-have information, often written into contracts between third parties. Consequently PRA subscriptions are extremely sticky, driving high renewal rates even in the face of significant price increases.

A few examples of PRAs (large and small):

Platts (S&P Global Commodity Insights) - what don’t they cover!

Argus Media - publishes more than 40,000 energy and commodity prices;

Fastmarkets - cross-commodity price reporting agency (PRA) in the agriculture, forest products, metals and mining, and new generation energy markets;

General Index - covers various commodities such as LPG, crude oil, refined products, marine fuels and energy transition;

Mintec - agri-food-focused PRA;

Quantum Commodity Intelligence - daily market prices for oil, biofuel, carbon credit and ammonia.

Benchmark have created a great niche for themselves:

Benchmark is the world’s only Price Reporting Agency (PRA) audited to the highest Type 2 IOSCO standard across the suite of raw material prices it publishes.

Benchmark sets reference and benchmark prices for lithium and other key battery raw materials and chemicals, including graphite, anode, nickel, cobalt, cathode, PCAM, black mass (battery recycling) and battery cells.

According to Reuters:

[Benchmark] lost out to rival Fastmarkets in 2019 to provide reference pricing for the London Metal Exchange's lithium contract, [but] Benchmark has wasted little time since mapping out aggressive growth targets and attracting key industry players.

What next for Benchmark?

Beyond organic growth from the sectors they are already active in, according to their announcement in November, Benchmark:

Recently expanded into rare earth elements for the permanent magnet supply chain

Seeks to add coverage of new supply chains critical to the energy transition.

I would also expect them to consider moving into other adjacencies. Electric Vehicles seems likely, which could potentially lead on to supply chain data overall.

Spectrum are likely to back bolt-on acquisitions too. For portfolio Data & Analytics company Lighthouse they recently supported the acquisition of Stardekk, a provider of channel management and distribution software for the hospitality industry.

But it seems likely from looking at Spectrum’s previous holdings of Data & Analytics assets that they will not own Benchmark for too long.

I would expect to see Spectrum to sell their stake within a relatively short time horizon.

Who would be likely to acquire Benchmark next?

There would be no shortage of PE interest, seeking to build a bigger platform. Perhaps Astorg, the owners of Fastmarkets, might look to put the two businesses together. Or it could be rolled into General Atlantic-backed Argus Media, or Veritas Capital’s Wood Mackenzie.

And of course, there is the 800-pound gorilla in the room, Platts, who are underweight in this area, and have that stated commitment to the Energy Transition that we mentioned at the start of this article.

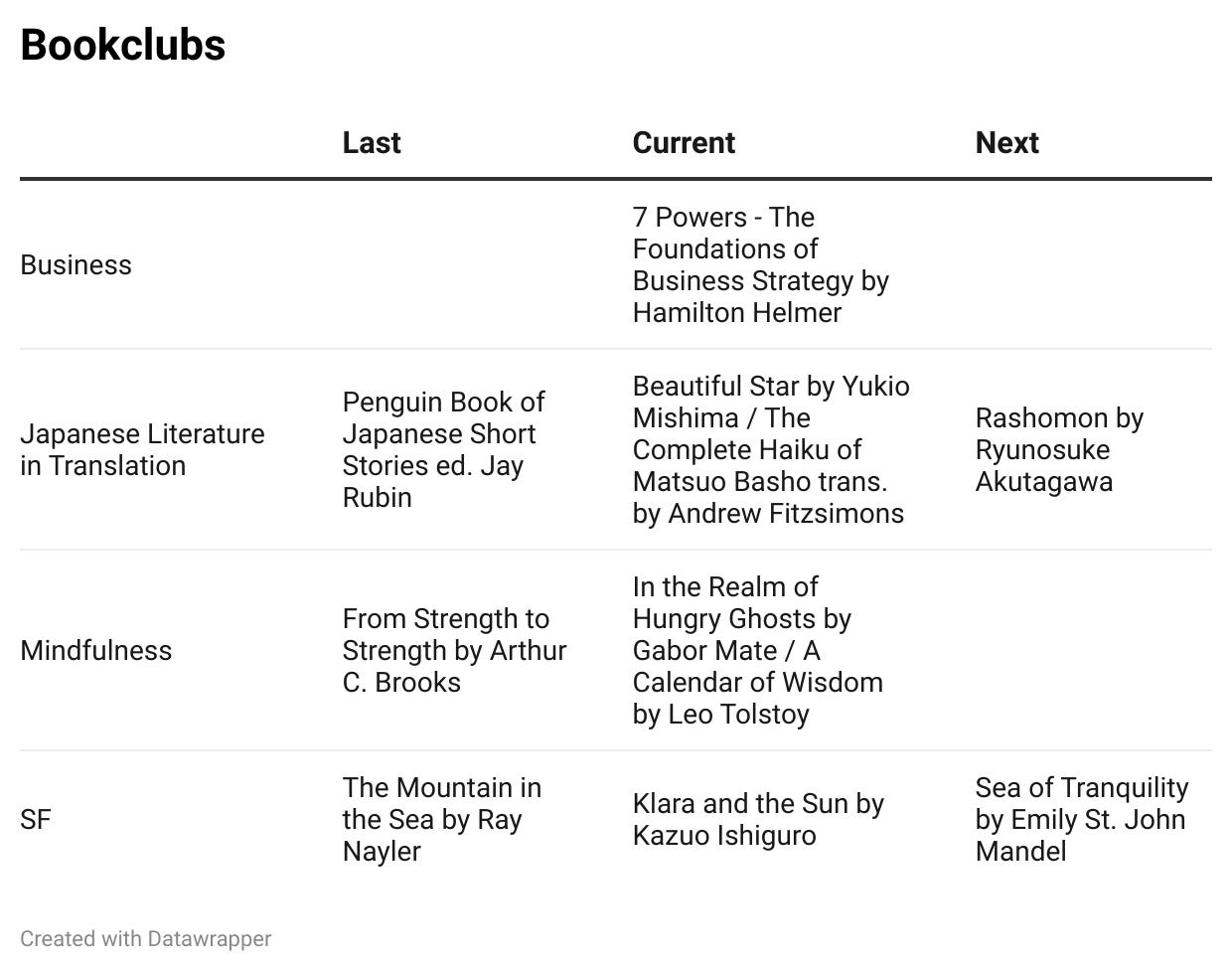

No further reading today. But a quick ‘thank you’ to the one person who contacted me to sign up to my Science Fiction book club. You know who you are and I’m looking forward to discussing Sea of Tranquility with you soon.

If you would like to join me in reading any of the below books, please drop me a line.

The rules for all the clubs are the same:

One book every two months;

Choice rotates between book club members.