Carbon Credit Rating Agencies

TL;DR - High-value generators of transparency data for the fast-growing Voluntary Carbon Market

Welcome to the 6 new subscribers who have joined us since our last post! If you haven’t subscribed, join 274 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

This is the first in a series of articles about Energy & Commodities Data & Analytics, one of the most valuable sub-sectors of Data & Analytics.

I plan to spend some more time in the coming months providing analysis on this space.

Having said this, at the end I will also comment on a transaction in the Healthcare & Life Sciences Data & Analytics sector, (the acquisition of MotionHall by Clarivate) so expect to see plenty of content on other sectors as well.

“It can be extremely difficult to understand if “a ton is a ton” without really specialized knowledge.”

- Donna Lee, founder of Calyx Global, interviewed by CleanTechnica

This issue lies at the heart of the race currently going on to become the ratings agency of choice for the Voluntary Carbon Market (VCM).

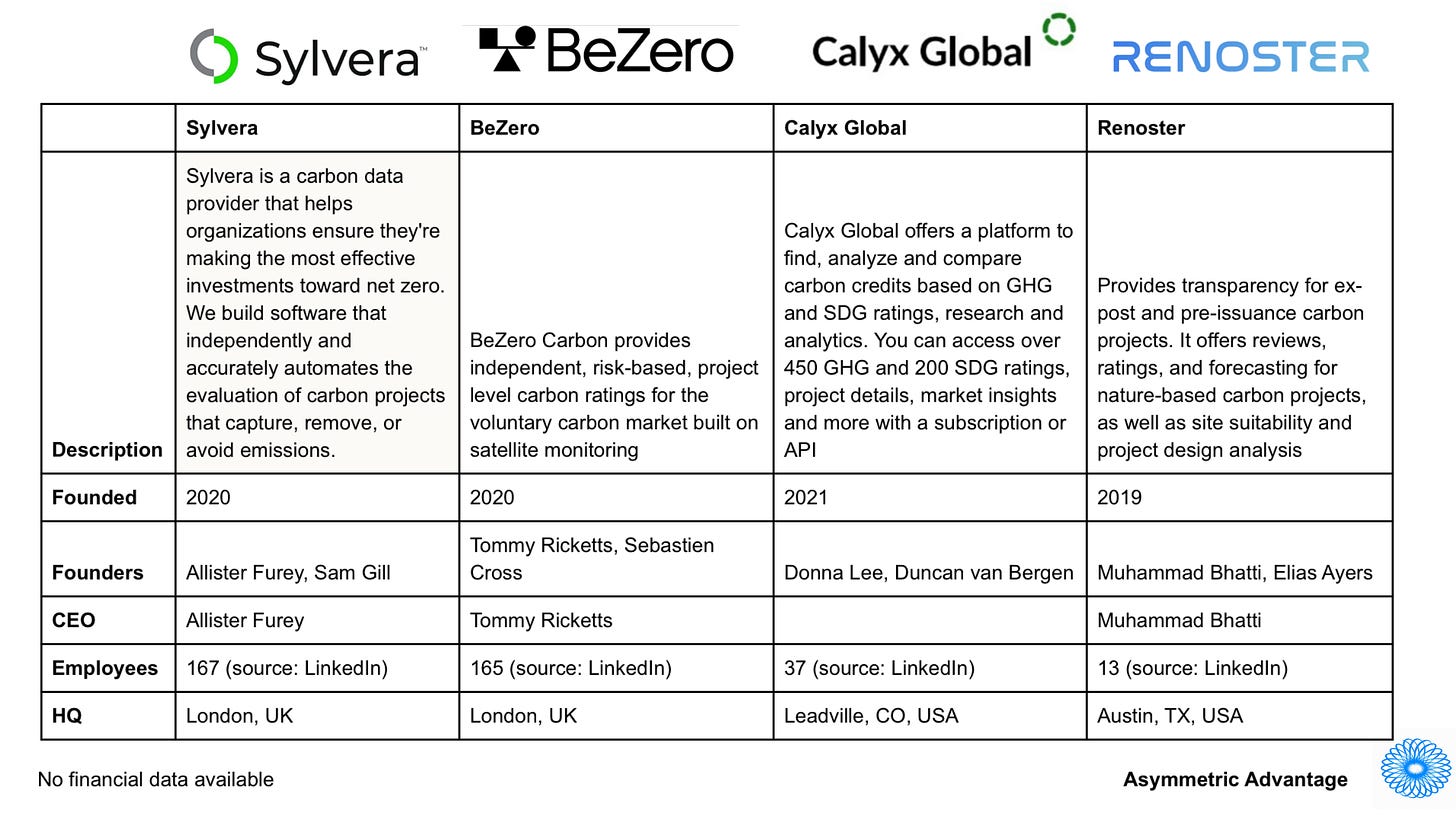

Four Carbon Credit Rating Agencies (CCRAs) were founded between 2019 and 2022: BeZero, Renoster, Calyx Global and Sylvera.

All of them have essentially the same mission. In the words of Sylvera:

A [carbon] credit rating assesses the likelihood that the credits issued by a carbon project have delivered on their claims of avoiding (meaning reducing) or removing of one metric ton of carbon dioxide (tCO2), or other greenhouse gasses (GHGs), measured in CO2 equivalent (tCO2e).

(As an aside, the businesses all of the CCRAs has been made possible by the explosion of satellite constellations providing access to high quality imaging at a reasonable cost. Evidence here of how new technologies drive the development of innovative Data & Analytics businesses.)

Why is this important?

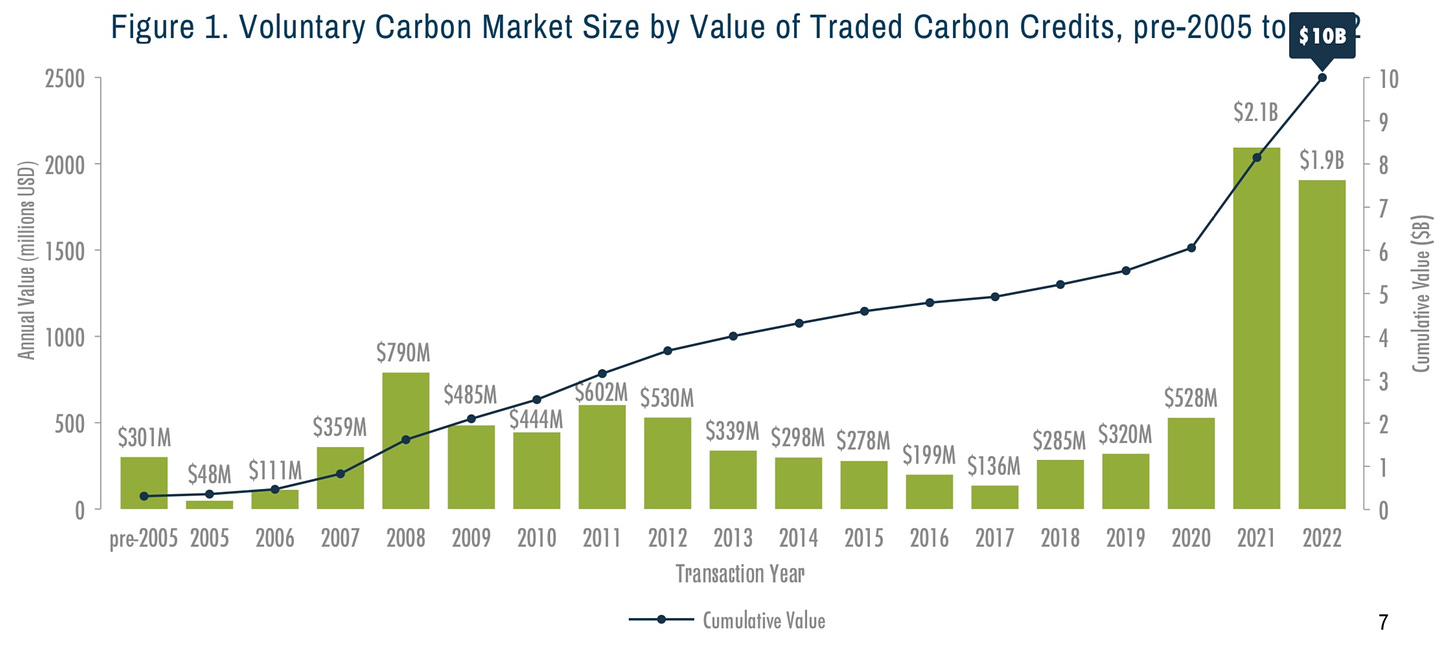

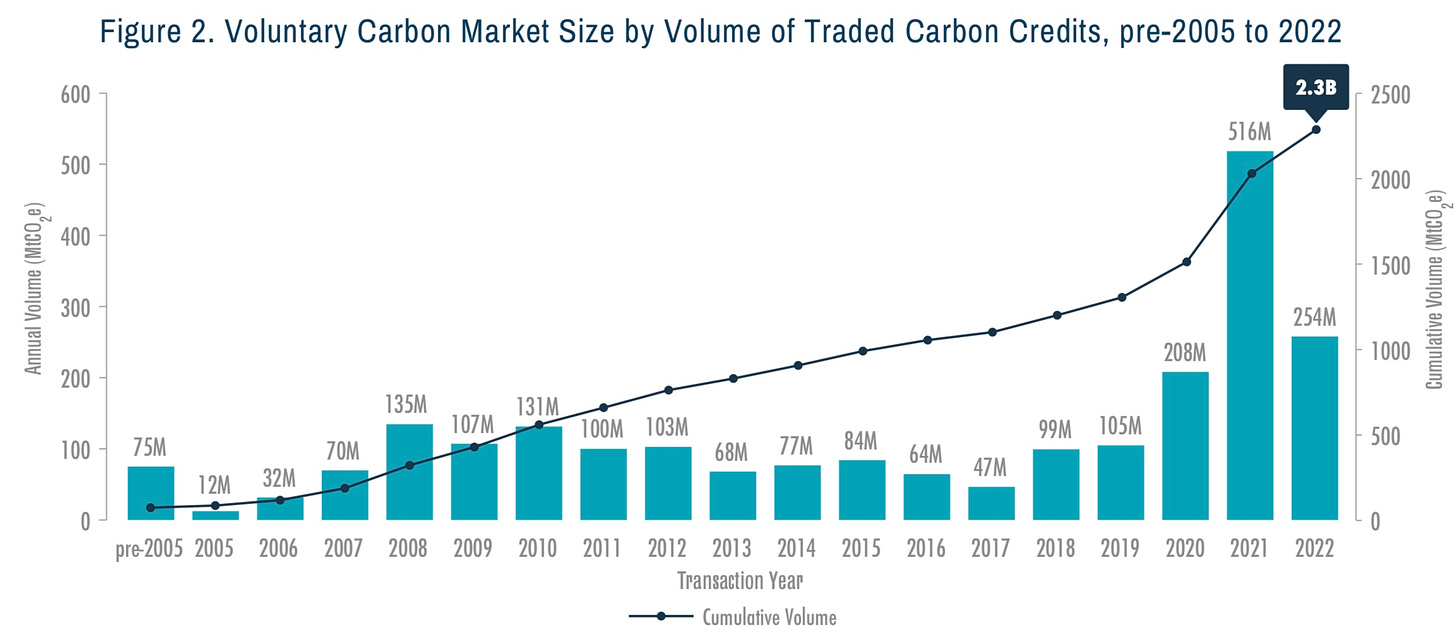

Carbon Credit Rating Agencies have effectively appointed themselves to police the carbon markets. And while regulation to enforce emissions policies and carbon trading is mired in geopolitics, the Voluntary Carbon Market (VCM) has grown massively, driven in part by consumer appetite to purchase goods and services from companies with sustainable credentials, and is currently valued at around $2bn.

Indeed McKinsey estimates that the VCM will reach $50bn by 2030. That’s growth that makes you sit up and take notice!

As the market has matured there has been greater demand from all participants for accountability to show that carbon offset projects have been effective.

Carbon offset projects have not been effective historically.

An article on Sylvera and the carbon offset market in the Financial Times quotes research from UC Berkeley that:

So-called Redd+ projects — which focus on reducing emissions from deforestation and forest degradation in developing countries — suffer from widespread over-crediting, which “creates a race to the bottom that is hard to emerge from. Buyers seek the lowest-cost credits that are often the most over-credited.”

“We can’t count on the offset market to be fixed or be trustworthy. There has been significant over-crediting” - Barbara Haya, UC Berkeley.

Sylvera has yet to find a project that it considers good enough for its highest AAA rating.

In order for accountability and transparency to be achieved, granular data is essential.

This is evident in the divergence in value between different types of carbon offset projects:

Newer vs older vintages;

Nature-based solutions vs industrial projects;

Projects with more than one co-benefit certification vs projects with one or none.

The more valuable of each pair have better data available about them - they are more transparent - it is clearer whether “a ton is a ton”. Therefore they are more investible.

According to Ecosystem Marketplace:

Newer credits are attracting higher prices, indicating that buyers are seeking newer vintages with more robust recent methodologies, or are paying more for credits that align with their current emissions years as much as possible. The premium for carbon credits with a more recent vintage, representing more recent emissions reductions activities, was 57% above older credits.

CORSIA-eligible project credits gained market value, driven by a 126% increase in price. This notable growth of CORSIA in the VCM in 2022 indicates a growing relationship between compliance markets and the VCM.

Carbon Credit Rating Agencies effectively bestow value on projects by providing that transparency. This makes them highly valuable Data & Analytics businesses just like the Big Three Credit Rating Agencies: S&P Global Ratings, Fitch and Moody’s, who effectively run a monopoly on the global ratings market.

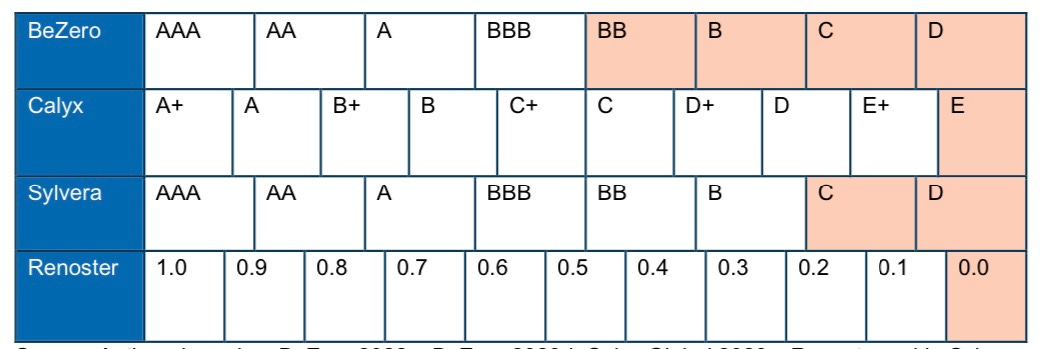

Like their non-Carbon-focused namesakes, CCRAs rate projects on a sliding scale:

(source: Carbon Marketwatch: Assessing and Comparing Carbon Credit Rating Agencies).

As you can see, Renoster’s ratings are somewhat different from the others in that they provide an “is a ton a ton?” scale. But they are all broadly comparable.

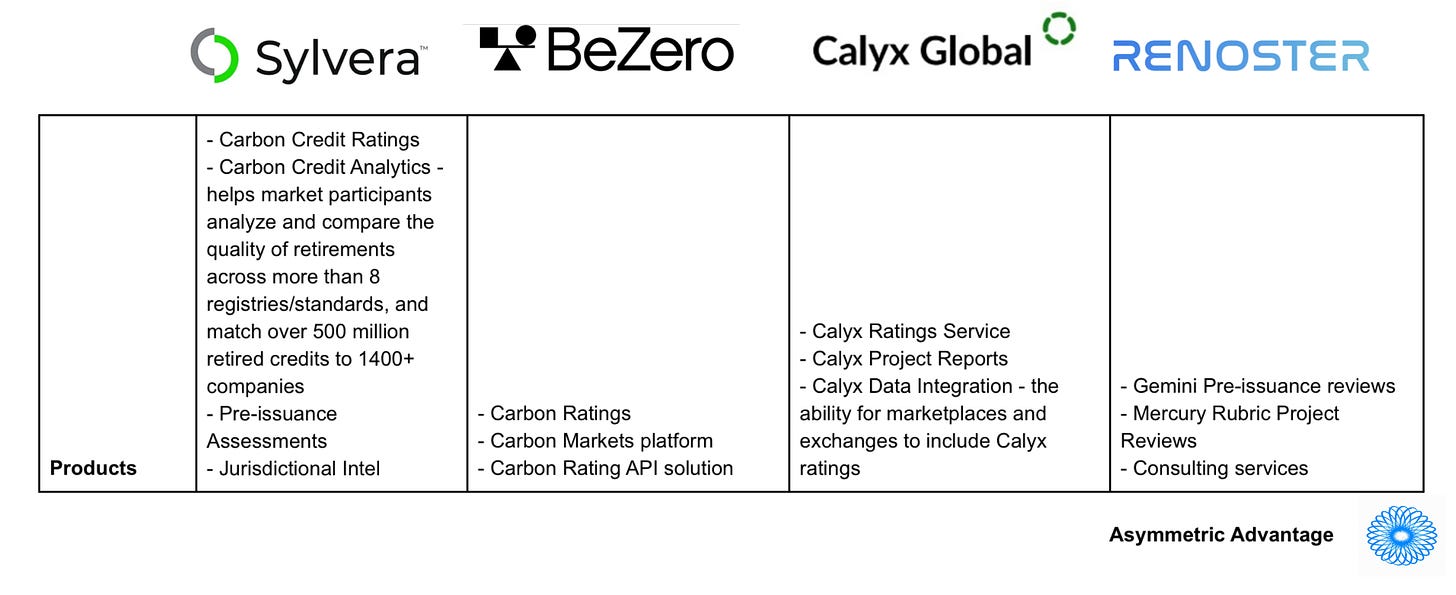

Their products are all broadly similar too: individual carbon offset projects are rated and access to data is available via a subscription. They also provide data integration solutions.

So what’s the difference between them?

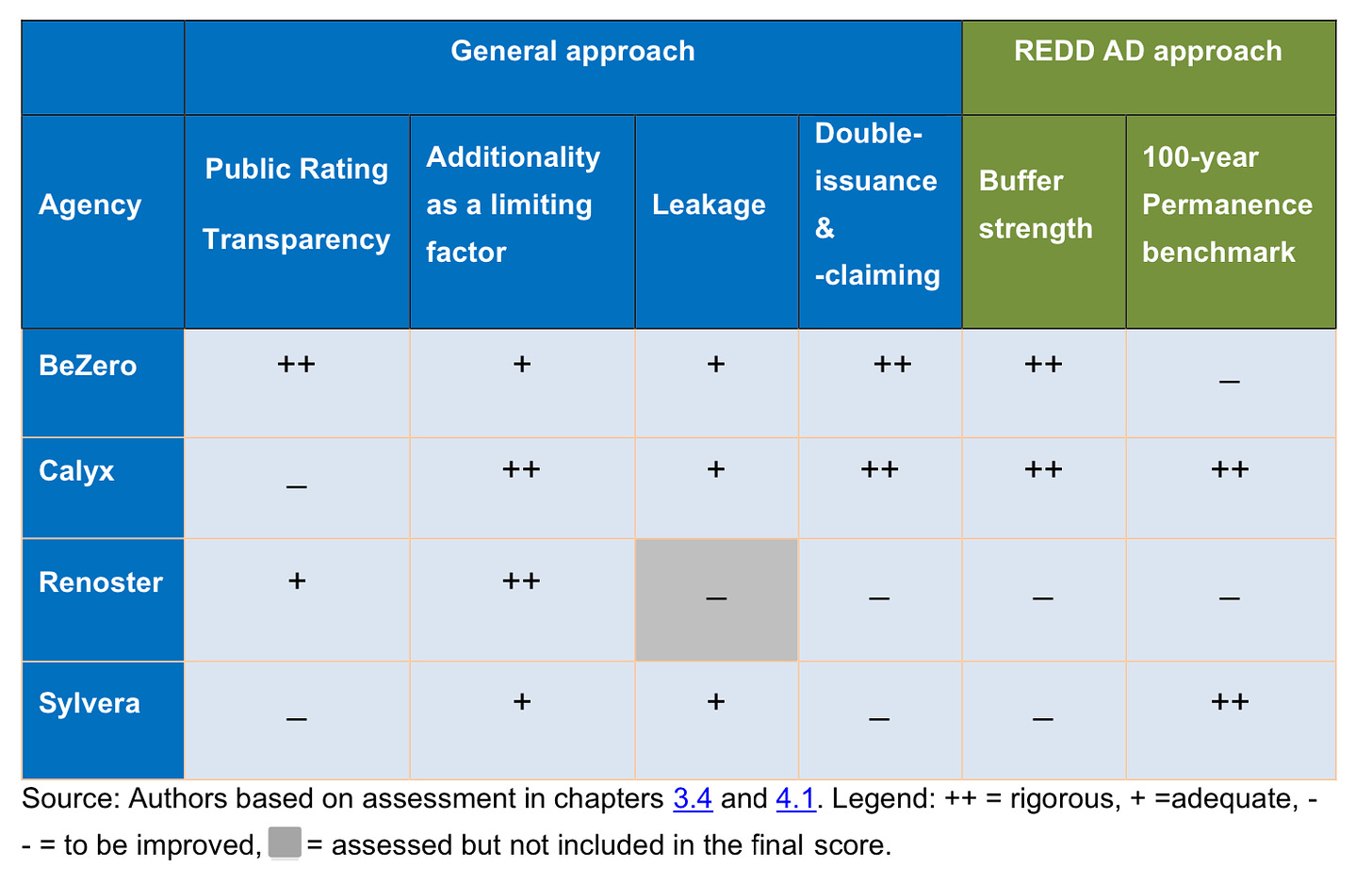

The report from Carbon Marketwatch referenced above focuses on the rigour of their reporting in its differentiation, placing BeZero and Calyx at the top of the scale:

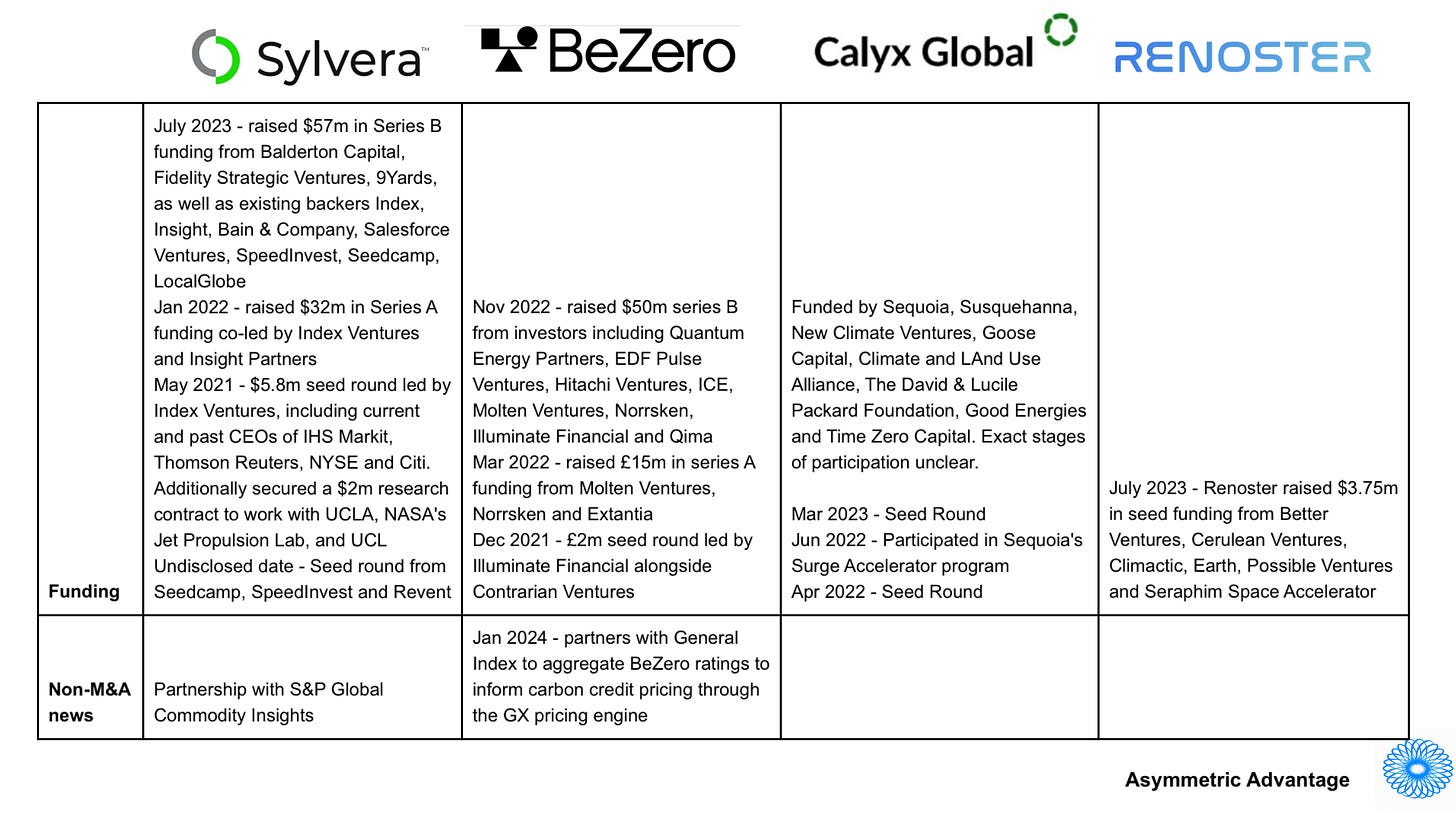

However, in the world of Data & Analytics, it’s often a race to scale that is most important, and in that respect the leaders are Sylvera and BeZero, who have raised exponentially more money and have far more employees than Calyx and Renoster.

What next for the Carbon Credit Rating Agencies?

But the race is not over yet. If I were a PE investor I would be circling Calyx and Renoster looking to fund them to become serious competitors in a market with high growth potential and potential monopoly characteristics.

And in the meantime, until the four companies reach scale and the competitive moat becomes unassailable, the existence of affordable data from satellite providers means that we may well see new market entrants attracted by these dynamics.

And how does the future look beyond this?

The acquisition of Trove Research by MSCI in October 2023 points the way.

And the large Data & Analytics strategics (including the CRAs) have their eyes on the CCRAs already:

Sylvera has a partnership with S&P Global, who recently launched a separate division focused on Sustainability: S&P Global Sustainable1;

ICE are early-stage investors in BeZero.

Expect to see growth, further fragmentation, and consolidation in the years to come.

M&A Transaction Hot Take

Clarivate Plc, has announced an agreement to acquire the substantial majority of assets of MotionHall, “a provider of biotech and pharma partnering market evaluations, detailed company profiles, competitive landscapes detailed by M&A specifics, deal comps and more.”

Founded in 2015 by Rachael Craig, MotionHall only has 11 employees listed on LinkedIn, so the price paid will not be material and should remain undisclosed. This tuck-in acquisition will fit in Clarivate’s Life Sciences & Healthcare division.

According to Clarivate, “the acquisition of the full intellectual property, clients and team from MotionHall enables acceleration of multiple roadmaps, including targeted enhancements to Clarivate Cortellis, market assessments, as well as a new Business Development & Licensing Enterprise Workbench”.

It’s a good fit for Clarivate, but would have worked equally well in the newly formed Hg and Warburg Pincus-backed Norstella behemoth, GlobalData’s Healthcare division (recently the subject of a substantial stake acquisition by Inflexion, valuing the business at £1.1bn, and potentially leading, I would expect, ultimately to a full spin-out in due course), or ION Group’s Mergermarket business.

Other reading I have found interesting in the last few days:

In the FT, one of my favourite writers, Simon Kuper, outlines the impact on society of populations consuming less and less mainstream news, in his article No News is Bad News.

I’ve become somewhat obsessed with WaniKani, the kanji memorisation system which promises to finally get me further along towards my dream of joyo kanji fluency.