Jua - AI Weather Data & Analytics [company analysis]

TL;DR - AI-driven precision weather forecasting generates material value for energy trading

Welcome to the 12 new subscribers who have joined us since our last post! If you haven’t subscribed, join 286 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Last week I met up with a couple of friends working at Artificial Intelligence companies. One at Github/OpenAI, the other working to productise an innovative AI technology (currently in stealth mode, as the saying goes).

I’ve shied away from talking about AI since starting this newsletter. There’s so much nonsense written about it, and I didn’t want to be another noisy but unclear voice unless I had something specific to say.

But, even if we are still only in the foothills of what can be done, AI is clearly eventually going to revolutionise Data & Analytics. So of course I am keeping a close eye on how it is being deployed across the sector.

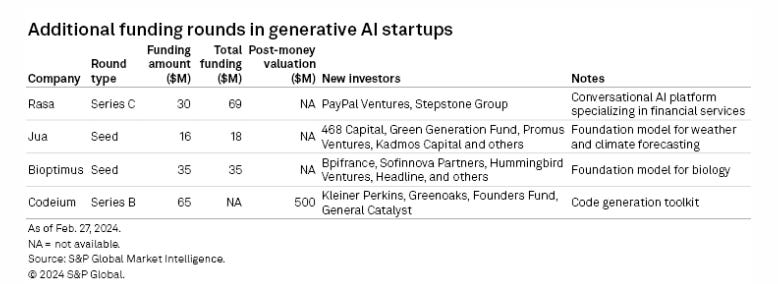

So, when I came across this Generative AI Digest from 451 Research/S&P Global Market Intelligence, my attention was caught by one detail in a table halfway through the roundup of news.

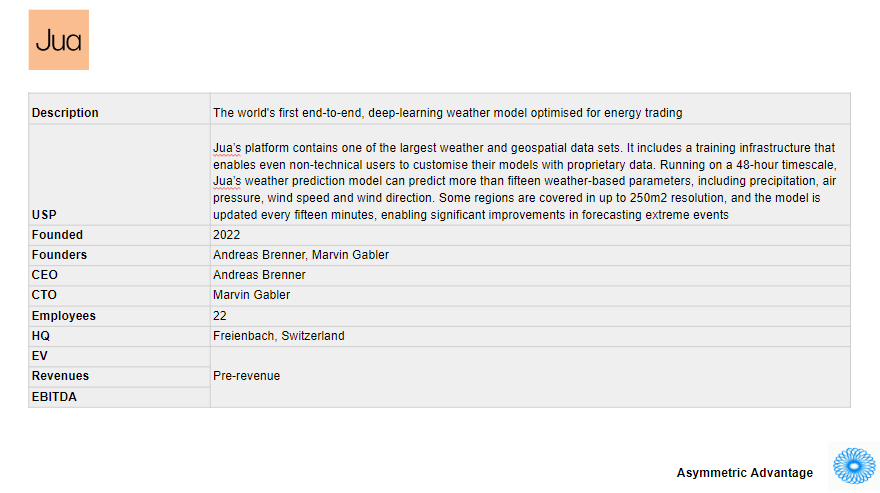

Jua - a “foundation model for weather and climate forecasting”.

And when I looked at their website and discovered that they offer “AI for weather-dependent energy trading: trade energy with high-accuracy weather predictions”, I wanted to dig in.

So here we go.

Weather ’tis nobler in the mind…

Weather was the fourth most-searched-for term in Google last year (no surprise to see so much p*** in the top 10!):

Consumers’ need for weather information is limited to triviality like whether we need to take sunglasses or a raincoat when we leave the house, or whether we should go to the beach this weekend.

However, for businesses, having granular and highly accurate weather data is of critical importance to their decision-making and ability to make money. The much over-used example here is making sure have enough ice cream stocked in your supermarkets if there’s going to be a heatwave. But it goes much further than that.

Just think about the impact of weather on the global insurance industry.

(I flagged this fascinating profile in Bloomberg of John Seo’s hedge fund Fermat Capital Management two weeks ago. It discusses Fermat’s success in the Cat bond market, and the overall market for weather-related catastrophe insurance.)

Weather Data & Analytics

Over the years, I’ve tracked the progress of TBG AG-backed DTN and MeteoGroup closely, as the two businesses passed through the hands of a variety of owners, finally merging in 2019 to create a B2B Weather Data & Analytics behemoth.

DTN focuses on providing industry-specific Weather Data & Analytics solutions across Agriculture, Aviation, Marine & Offshore, Mining, Refined Fuels, Sports & Safety, Shipping, Transportation, Utilities & Renewable Energy.

While DTN has been growing, there has been an absolute flowering of weather Data & Analytics businesses, and particularly so in the last 5 years. As with Carbon Credit Rating Agencies in my last post, this is another space whose growth has been enabled by the explosion of Earth Observation satellite constellations and the commensurate democratisation of satellite imaging.

Asymmetric Advantage’s growing database of Data & Analytics companies currently contains 30+ Weather Data & Analytics businesses, and we’ve barely scratched the surface.

So what’s different about Jua?

Two things stick out:

Their focus on using LLMs;

Their focus on creating products for energy trading.

Jua’s use of AI for weather forecasting

Jua aren’t alone here:

Google Deepmind announced their “GraphCast: AI model for faster and more accurate global weather forecasting” in November 2023;

Huawei published a research paper in Nature in 2023 outlining their own “artificial-intelligence-based method for accurate, medium-range global weather forecasting”;

NVIDIA announced their Earth Climate Digital Twin two weeks ago in March 2024 to “allow virtually any user to create AI-powered emulations to speed delivery of interactive, high-resolution simulations”.

But while these folks are providing free models for users to build on top of, Jua:

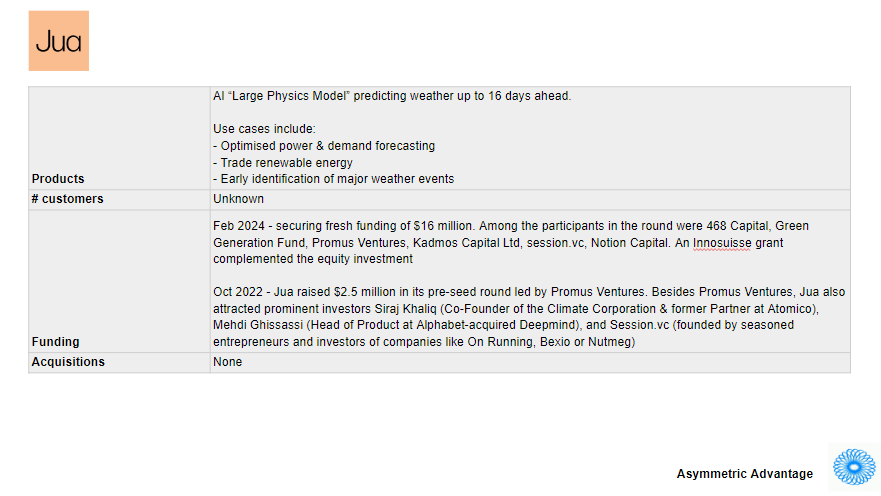

Have a far more powerful solution - investor 468 Capital explained in their press release for Jua’s recent funding round that:

Unlike existing models trained to apply to specific industrial verticals and narrow problems, such as weather predictors using a ring-fenced set of data, Jua’s platform is a true foundation and agnostic model for the natural world, able to make sense of data and phenomena it has never seen before to understand events, reveal deep insights and make accurate predictions. It is also the largest AI model in environmentally focused computing – 20 times larger than GraphCast by Google and significantly more powerful than FourCastNet by Nvidia and Pangu Weather by Huawei.

Jua are an AI-led Weather Data & Analytics business with a productised solution. And they are currently one of a very select few of such AI-led Weather Data & Analytics businesses.

Jua’s focus on Energy Trading

At their February 2024 fundraising, Jua announced their pivot away from industry-agnostic weather data to providing solutions for the Energy Trading market.

Targeting the energy industry, Jua plans to launch the solution in the next weeks.

Weather events, adverse or mild, impact electricity generation, demand, and transmission. Accurate weather forecasts are required to help different players in the energy sector to anticipate peaks in electricity demand, manage energy production, and plan for outages. In the renewable energy industry, precise weather data and forecasting are essential for optimising operations, mitigating risks, and ensuring efficient energy production.

Using tens of millions of data points to provide precise forecasts, Jua developed the first end-to-end deep learning model, a “Large Physics Model” for nature, that can predict the weather accurately, precisely, and quickly than traditional solutions. The AI weather forecasting model offers unprecedented speed in predicting weather changes, allowing users, particularly in the energy sector, to develop global, high-frequency and high-accuracy weather models within days.

With its first appearance in the startup scene in 2022, Jua aimed to provide a weather prediction model, but it has gone beyond this concept and expanded it in size and scope to become a true foundation physics model for the natural world. The first tests have already been conducted.

“We have done some validation on extreme events, such as hurricanes and cyclones showing promising performance,” said Andreas Brenner, co-founder and CEO of Jua. “We are currently fully focused on the energy industry, where extreme events are an important driver of energy stability, profit and loss. We have therefore made it a priority to outperform legacy prediction models on such events,” he added.

In a recent interview with Sales Playbook, CEO Andreas Brenner explained the value of their data to traders:

Our customers are trading huge sums.

Daily events where weather can impact the performance of a single trader in the hundreds of thousands [of dollars], but if you are talking about the very large events you are talking about millions in a few days in performance, just because you are predicting weather more accurately for that event.

Where do Jua go from here?

If Jua can really move the needle and produce alpha-generating data, their content will be in high demand from traders at hedge funds, energy firms and investment banks.

And beyond trading data, Jua is attempting to sell into utility companies to help them forecast the need for installed capacity.

CEO Andreas Brenner also makes the case in his interview with Sales Playbook that the data can be used to drive investment in building additional capacity, particularly for renewables:

If you can predict more accurately what the weather will be like, there’s a better investment case for renewables. We can do something positive for the energy transition.

And beyond the Energy sector, 468 Capital suggests that:

In the future [Jua] will help businesses in sectors such as energy management, insurance, chemicals, agriculture and air travel, and could help governments and civil society organisations tackle challenges from civil planning and food distribution to public service delivery.

Jua are definitely one to watch.

I’ve found the following links interesting in the last few days:

Financial Services

Michael Sidgmore of

has published a great analysis of the Private Markets sector, full of useful data from a variety of sources:

Data & Analytics

The indefatigable Matt Ober (thank you for all of your help and encouragement, Matt!) of The Rollup and Initial Data Offering (both must-subscribe (free!) Data & Analytics-focused content services if you haven’t already done so) has published two great reads in the last week:

Give-to-get data models - “What is Give to Get? It’s a dataset where you have to contribute data or information to get back data. You have to participate. You may get raw data back, analytics, a composite number or some sort of derivative. In the end these datasets get better and better as there are more contributors.”

Building a moat - “Building a moat is hard. Figuring out what that moat is, is the first step. I continue to believe one of the best moats you can build is a unique, proprietary dataset.”

- has written a great piece on how data providers can communicate with their target audience most effectively:

- , founder of web-scraped data marketplace Data Boutique, has published an insightful article on what he has learned from 10 years of selling web-scraped data. In a nutshell - selling web-scraped data is hard!

- ’s latest post includes a fascinating analysis of Roper Technologies’ business model and M&A activity, quoted from Scuttle Blurb:

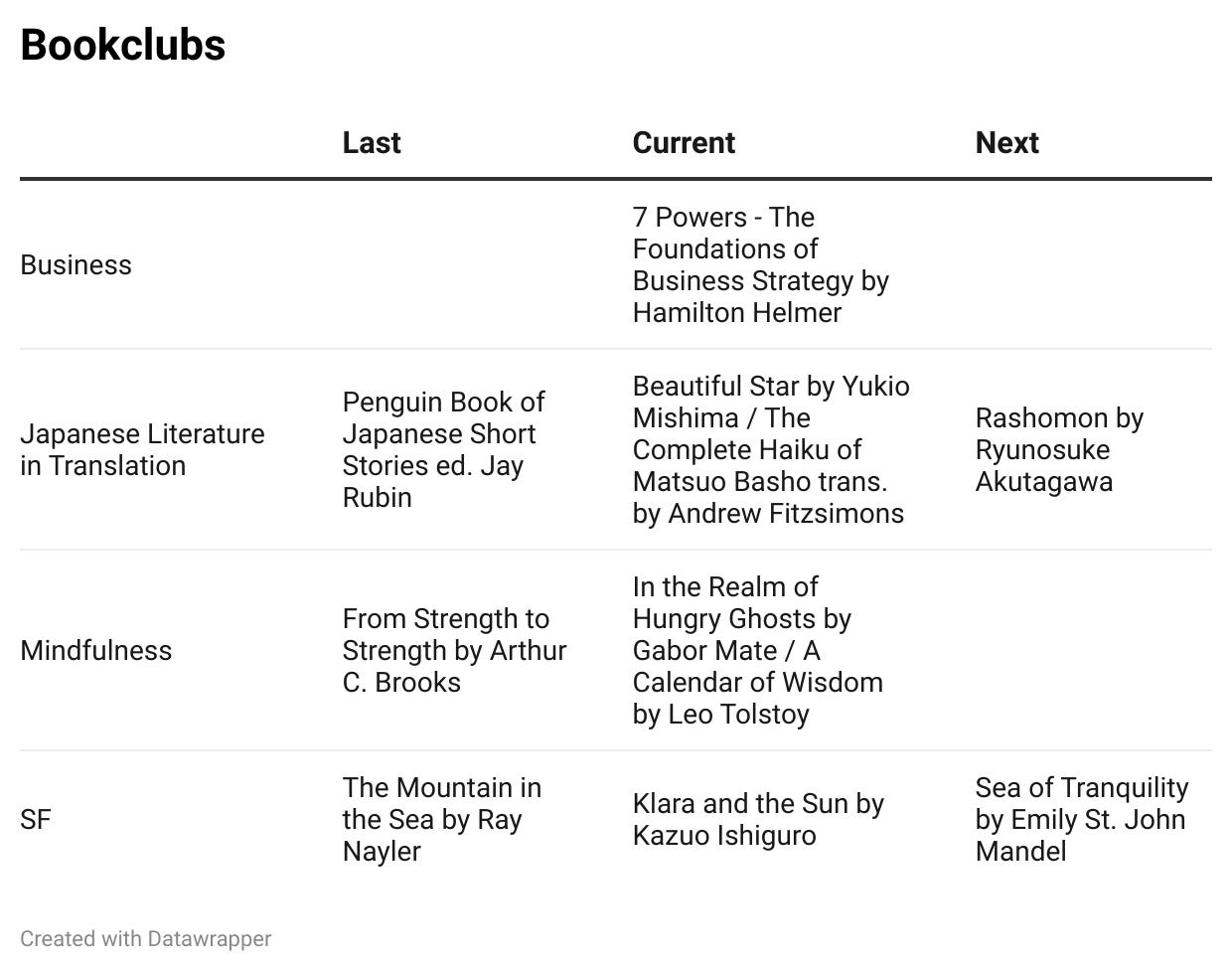

Bookclubs

I noted that the table of books did not display correctly last time I wrote about this. Apologies!

I’m running a few bookclubs this year as a way to push me to read and finish more books. I’ve started two more clubs in the past month - one for Mindfulness and one for Japanese Literature in Translation. See the list of clubs and books below. If you would like to join me in reading any of these, please drop me a line. The rules for all the clubs are the same:

One book every two months;

Choice rotates between bookclub members.

Hey, thanks for the link, Alex! Cheers 💚 🥃

Hi Alex and thanks for the mention