Is Dataminr's $4.1bn 2021 valuation delaying a potential IPO and will the strategic measures they have now put in place get them back on track?

TL;DR - Hybrid Media Monitoring and Critical Event Data & Analytics Provider looks to accelerate growth through AI, Sales and a focus on Cyber Security

If you haven’t already subscribed, join 509 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Dataminr was the third-most popular choice in the survey we ran at the end of April, asking what Data & Analytics companies you would like to see analysed.

We profiled the number two choice, Toggle AI, two weeks ago, and, as promised, our feature on the number one choice, Amberdata, is coming soon!

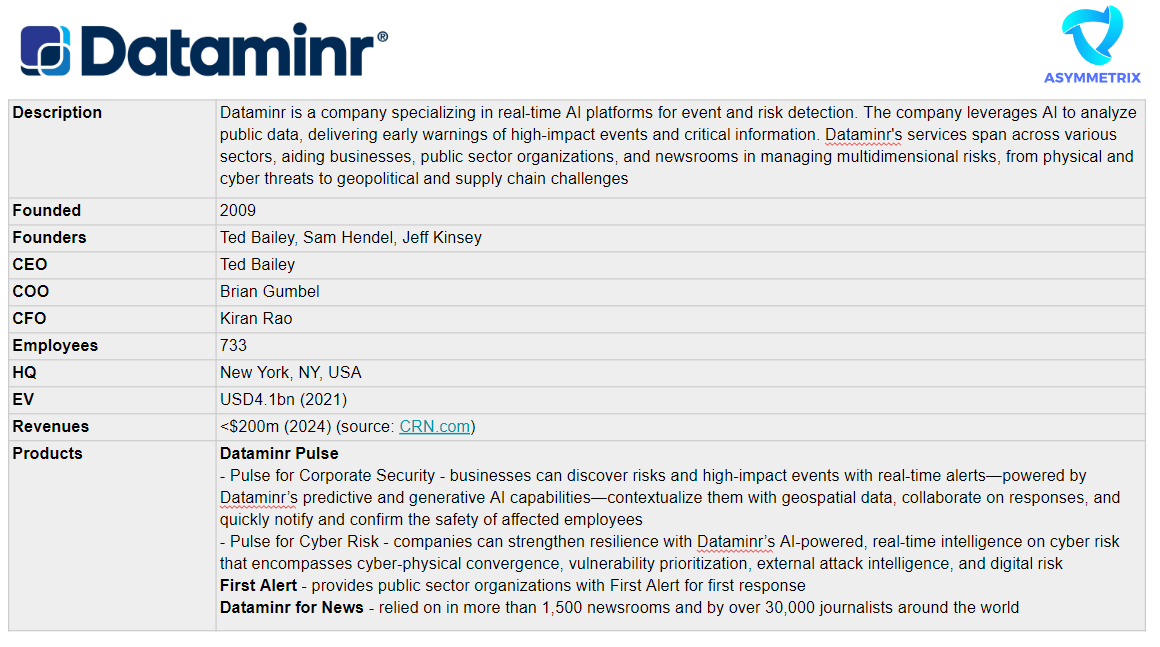

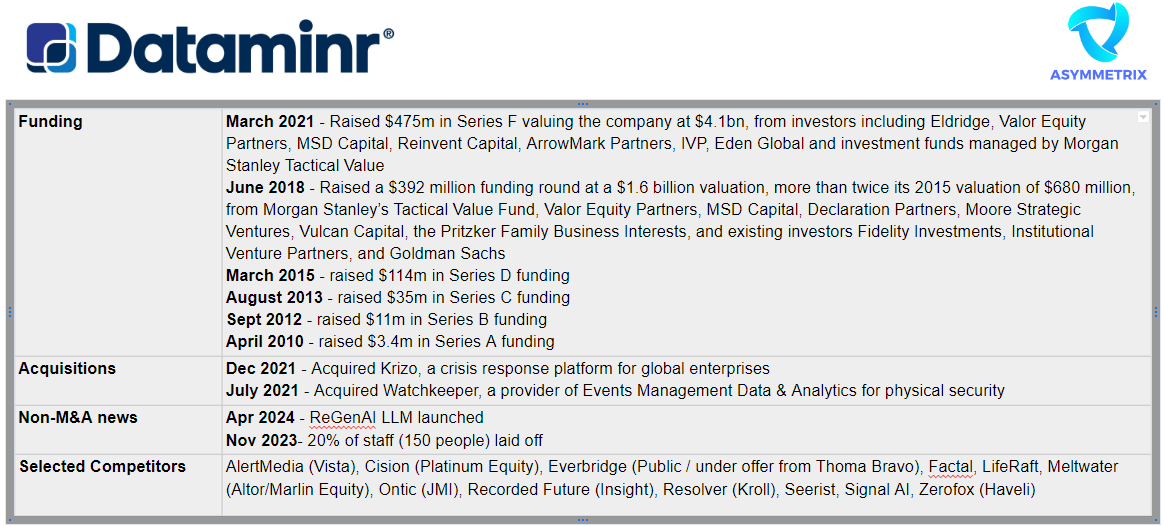

Dataminr has been on our radar for a long time, but it was the two eyebrow-raising valuations at its 2018 and 2021 fundraisings - $1.6bn and $4.1bn respectively - that made us really stand up and take notice.

Since inception, Dataminr has raised more than $1bn to build out what is a hybrid of Media Monitoring Data & Analytics, and Critical Event Monitoring Data & Analytics.

So what is going on here that is special?

How is Dataminr different from:

a Media Monitoring stalwart like Cision, or its newer rival, Meltwater?

the myriad of Critical Event Monitoring Data & Analytics providers on the market?

And, will the business ever reach a financial position where it makes sense to IPO?

Origin Story

In the words of founder Ted Bailey:

My Dataminr journey started more than a decade ago. When I was in college, I studied the history of real-time information technologies. I was fascinated by how technologies like the printing press, telegram, radio, and television changed society when they were adopted broadly. These technologies caused fundamental shifts in the way people learned about events occurring across the world in real time.

In 2001, tragedy struck when a jet flew into the side of the World Trade Center and the horrific events of 9/11 began to unfold before our eyes. Despite the advances in real-time information technologies over the centuries, real-time information gaps prevented the people in the towers from having an accurate understanding of what had just happened. There was no technology that delivered the critical information people needed to know in order to evacuate the buildings to save their lives.

I founded Dataminr in 2009 to create that technology — the world’s first real-time information discovery platform that could detect critical breaking information from real-time public data. At the time, one-to-many public platforms like YouTube and Twitter on which people broadcast what they see, hear, and experience in the world were starting to gain adoption across society. Yet, the public digital data landscape was still very much in its infancy.

Since 2009, there has been an explosion of public digital data that is unparalleled in human history, with millions of digital platforms and IoT sensors creating billions of real-time data units every minute. When an unexpected event first takes place, that fact the event took place is immediately recorded in digital data — in rich formats spanning text, images, video, sound, and IoT sensor data. I couldn’t have imagined back in 2009 just how dramatically this universe of public data would expand in just over a decade.

What does Dataminr do?

As Ted Bailey says above, Dataminr was originally developed as a solution for companies and first responders to react to critical events as quickly as possible.

But it quickly found that there was a ready market for journalists to get access to the data in order to create breaking news.

As a consequence, the business now has three main customer types:

Large multinationals

Public sector first responders

News media / journalists

And Dataminr has developed three main products to serve these users:

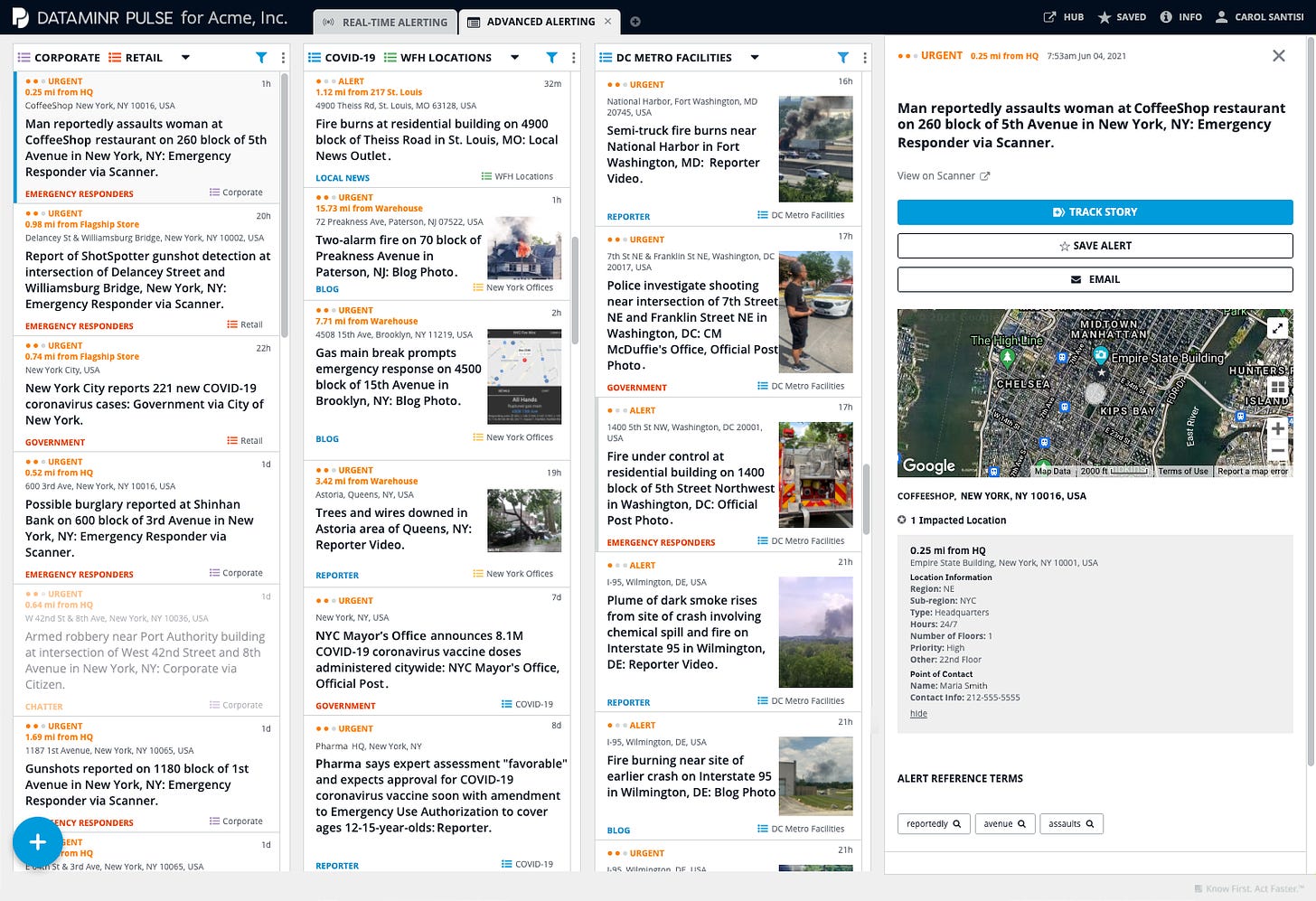

Dataminr Pulse - discover risks and high-impact events with real-time alerts;

First Alert - provides public sector organizations with First Alert for first response;

Dataminr for News - relied on in more than 1,500 newsrooms and by over 30,000 journalists around the world.

Dataminr and AI

Dataminr aggregates large volumes of publicly available data, sifts through it and serves up trending information.

It has always leant heavily on its tech credentials, asserting that the insights generated were driven by its proprietary algorithms. They were claiming to be AI before the current wave of obsession.

As ever with AI businesses, it’s always difficult to know from the outside which claims are true, and which are overstated. Certainly, the product provides the service it claims - Dataminr’s systems have provided early warning signals for both the COVID pandemic and the January 6 United States Capitol attack.

But how much of this was purely tech-driven, without human intervention, is unclear.

An October 2020 article by The Intercept, mainly alleging unfair use of Dataminr data for profiling during the George Floyd protests, claims that, at that time, Dataminr used humans to perform much of the monitoring of the data:

Although Dataminr has touted itself as an “AI” firm, two company sources told The Intercept this overstated matters, and that most of the actual monitoring at the company was done by humans scrolling, endlessly, through streams of tweets.

“They kept saying ‘the algorithm’ was doing everything,” said a Dataminr source, but “it was actually mostly humans.”

Improving its AI creds since then has understandably been a critically important focus for Dataminr.

In the current, AI-obsessed environment, to be a Data & Analytics business collecting massive amounts of data without using AI properly is deleterious to your profitability, scalability and investability.

So it’s not surprising that in November 2023 Dataminr took the decision to rationalise their workforce and refocus on burnishing their AI credentials.

According to a Techcrunch article, on November 28th, Dataminr:

[laid] off about 20% of staff… or around 150 people. It cites the impact of the economic environment, operational efficiencies, and “the recent rapid advancements of our AI platform,” according to a memo from founder and CEO Ted Bailey, shared with us by a source.

The company will be looking to further progress its AI platform and products — specifically with the launch of a new AI platform in Q1 that will combine predictive AI with generative AI — but even with the investment that those will require, as a result of the moves it’s making today, “Dataminr will have multiple years of cash runway and a near-term path to profitability,” he continued. (That potentially also implies that it’s setting itself up for a scenario in which it won’t be raising more outside funding.)

Dataminr’s current position

And, lo, it came to pass. In mid-April this year, Dataminr announced:

Today, Dataminr, one of the world’s leading AI companies, is launching ReGenAI (Regenerative AI), a new form of generative AI that automatically regenerates textual descriptions as events unfold.

Using predictive AI to analyze and synthesize key developments detected in more than one million public data sources, ReGenAI distills multidimensional events into concise event briefs that dynamically update. Customers can gain rapid understanding of an evolving event through a constantly updated, AI-powered live event brief, enabling corporations and governments to determine the impacts on their organization and respond more effectively.

And Dataminr are going to need this technology to give them a push forward. That 2021 $4.1bn valuation feels like some pretty big boots to fill currently.

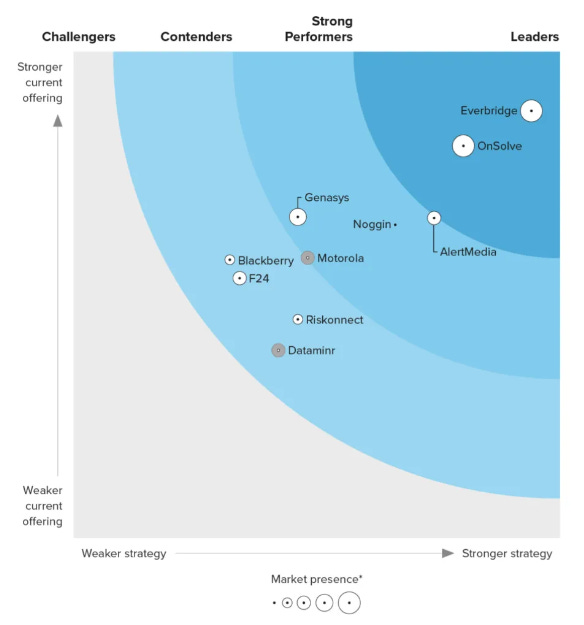

According to a recent Forrester report, Dataminr is at the weaker end of the spectrum in the Critical Event Management space.

(The Forrester Wave: Critical Event Management Platforms, Q4 2023)

So what are they going to do about it?

A week after the ReGenAI announcement, Dataminr issued another press release that, on the surface, appears mundane, announcing the arrival of a new COO, Brian Gumbel.

But when you combine it with an interview he gave to CRN.com, and dig into the competitive landscape, the Dataminr “turnaround” strategy becomes clear.

Focusing on Cybersecurity is a priority

Brian Gumbel has been hired from Armis, a high growth Cybersecurity Data & Analytics provider backed by big hitters like Georgian, Insight Partners and Capital G.

Cybersecurity is a space with massive growth potential for Dataminr. Brian Gumbel lays out the opportunity as follows:

Within cyber we see four main areas in which we are going to cover.

First is around digital risk intelligence — those are areas such as data breach alerts, preventing phishing campaigns, domain name and account impersonations, leaked credentials, fraud detection, those types of activities.

The next pillar is third-party risk intelligence. And what you'll find there is our ability to prevent ransomware attacks on critical partners and customers, prevent data leaks and leaked credentials sold by threat actors, online impersonation and DDoS and website defacement, just to name a few.

Next, you've got vulnerability intelligence. And this is a space that has not been modernized in years. One of the things that we're going to be focusing on here is emerging and trending vulnerabilities, and ongoing exploitations, vulnerability disclosures and research. And also just making sure that servers and also industrial control systems are not exposed.

The last pillar is around cyber-physical intelligence. We'll be able to look at physical threats to IT and OT infrastructures — looking at things like natural disasters, disruption and outages, warding off cyber warfare and other things that are happening within supply chain disruptions, etc.

(For more on Cybersecurity Data & Analytics, check out the piece we wrote on Security Scorecard in April this year.)

There’s an urgent desire to increase sales

Gumbel has been brought in specifically to grow their Sales & Marketing function:

At Dataminr, Gumbel’s responsibilities will include heading its go-to-market operations, sales and partnerships while also overseeing customer success and marketing.

This hire sends a strategic signal to the business and the market: we need to bring more money in the door.

And why?

Gumbel lets slip that the business is “approaching $200m in revenue”, meaning that the $4.1bn valuation of 2021 will be hard to get to currently. Putting the pedal to the metal on revenue generation is of critical importance because…

The oft-mentioned Dataminr IPO is still on the management team’s minds

An IPO of Dataminr was mentioned back in March 2021 when Dataminr raised $475m at a $4.1bn valuation.

Ted Bailey, the founder and CEO, said in an interview that it will be using the money to continue growing its business in existing areas: adding more corporate customers, expanding in international sales and expanding its AI platform as it gears up for an IPO, most likely in 2023.

In the end, 2023 was an annus horribilis for the Tech industry, with reduced valuations and downrounds everywhere, little market appetite for tech IPOs, a difficult funding environment, and layoffs abounding.

But Mr Gumbel’s interview makes clear that

in terms of its revenue, growth and market opportunity, “the company is right in that sweet spot” for a future IPO, Gumbel said.

Dataminr seem to agree - they link to the article on their website including the headline: “Dataminr Hires New President Brian Gumbel From Armis To Drive Channel, IPO Push”.

No pressure, Brian!

What next for Dataminr?

There’s an expression which seems to be almost global in nature: you can’t sail more than one boat at a time.

In Dataminr’s case, they are actually sailing three boats simultaneously:

Corporate Security (including Cyber);

First Alert for public sector first responders;

Dataminr for news organisations.

Might they consider divesting one or more of these? Which area do they want to be best at? Brian Gumbel’s appointment suggests a focus on the first is of topmost importance.

Rationalising their focus would be a hard decision for the management team to take, particularly if maximising topline performance is the number one priority. But being more focused may help them to grow in one specific area, and potentially make them more attractive to investors. Selling off their solution for journalists would also potentially be good multiple arbitrage, and make them look less like Cision, Meltwater or Signal AI.

It’s possible, of course, that Dataminr may be taken out before it can IPO. Or, indeed, taken private after it does so. Thoma Bravo are currently in the process of doing exactly this to Critical Event Management and national public warning solutions software, Data & Analytics provider Everbridge, and Haveli Investments completed the take private of Zerofox only a month ago.

It seems like Dataminr have made good progress in the last 12 months towards achieving their goals. It will be fun to watch how they get on next.

And why?

Gumbel lets slip that the business is “approaching $200m in revenue”, meaning that the $4.1m valuation of 2021 will be hard to get to currently. Putting the pedal to the metal on revenue generation is of critical importance because…

4.1bn?