Analysis of 6 Data & Analytics M&A and Fundraising Deals - June 4-17, 2024

TL;DR - A few large keynote deals in what has been a relatively quiet Data & Analytics M&A landscape

If you haven’t already subscribed, join 493 (so close to 500!) smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

June 17 - Karnov Group announced that Greenoaks Capital Partners and Long Path Partners’ offer to acquire Karnov had only been accepted by shareholders representing 26.2 per cent of all shares in Karnov Group by the end of the extended acceptance period, and that BidCo has decided to withdraw the offer.

Just as we were beginning to think of this as a done deal, it is off.

Scandinavian Legal, Tax and Accounting Data & Analytics provider Karnov can go back to its knitting (see the acquisition of Schultz below) and Greenoaks and Long Path can settle into their roles as supportive minority shareholders.

Karnov Group is pleased that Greenoaks and Long Path are committed to Karnov Group and welcomes their expertise and support, especially regarding AI specific resources from Greenoaks.

However, one suspects that this story has a few more twists in store down the line if management, shareholders and potential investors can reach alignment.

June 12 - Gorilla announced the close of their €23M Series B round, led by global venture capital firm Headline, with support from existing investors Beringea and the Flemish investment company PMV.

Innovative power pricing Data & Analytics provider Gorilla is worthy of attention. Products that enable customers to price effectively are high value, particularly in complex markets with thin margins.

June 12 - Karnov Group AB entered into a business carve out agreement to acquire the legal information business of J.H. Schultz Information A/S for a cash consideration of up to SEK 478 million (USD46m).

For many years, Schultz LIS has successfully delivered online legal information solutions to Danish municipalities, while also addressing the law firm segment. Karnov Group acquires the IP rights, including customer contracts and content from Schultz LIS, which will be transferred to Karnov Denmark. The acquisition has great strategic value as it supports Karnov’s development of best-in-class generative AI solutions. Moreover, the acquisition provides Karnov Group new customers on the Danish municipality market.

A straightforward tuck-in acquisition for Karnov.

June 11 - AlphaSense, the leading market intelligence and search platform, announced an agreement to acquire Tegus, a leading provider of expert research, unique private company content, and financial data and workflow tools.

This transaction will bring Tegus' breadth of private company data to AlphaSense's platform, further delivering on the companies' shared mission to empower business and financial professionals to make smarter decisions through AI-driven market intelligence.

As part of this deal, AlphaSense has raised $650 million in funding, co-led by Viking Global Investors and BDT & MSD Partners, and joined by new investors, J.P. Morgan Growth Equity Partners, SoftBank Vision Fund 2, Blue Owl, Alkeon Capital, as well as existing investors Alphabet's CapitalG and Goldman Sachs Alternatives. This raise brings AlphaSense's valuation to $4 billion.

We discussed this in length last week here:

and previously analysed the two businesses here:

Thank you for all of your support and feedback. We were overwhelmed by the interest in last week’s article. Why the mainstream business media has overlooked this deal is unfathomable.

We will be keeping a hawk-like eye out for news of AlphaSense’s impending IPO.

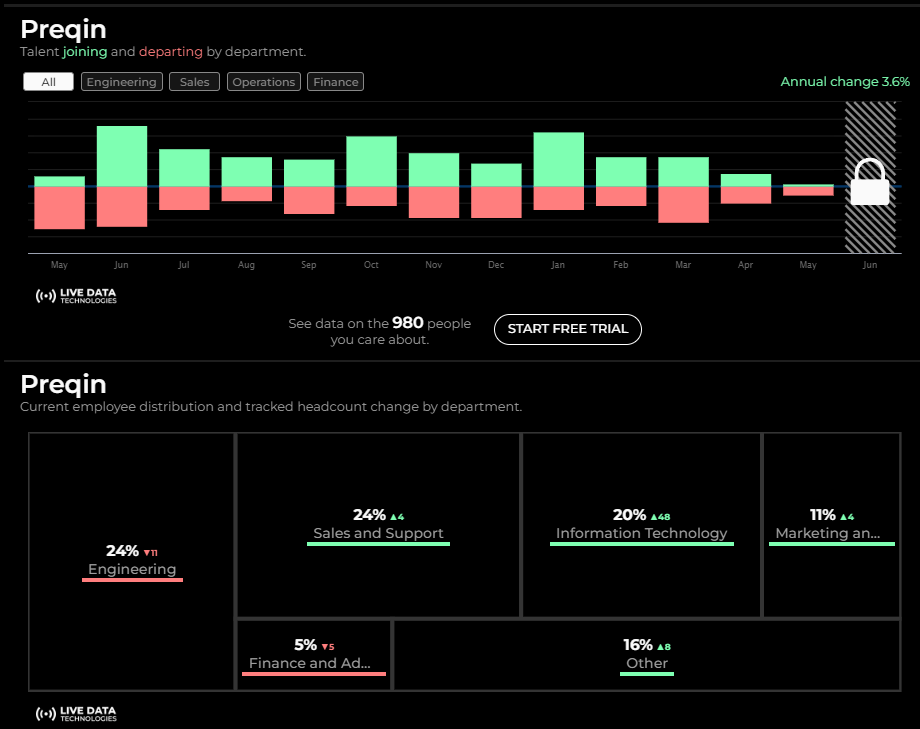

June 5 - According to the Financial Times, Preqin, a provider of Private Markets Data & Analytics, is exploring a sale that could value the company at more than £1bn.

Preqin has long been the jewel in the Alternative Assets Data & Analytics crown.

Founded by Mark O’Hare in 2003, the company now has 980 employees globally, with revenues of £122m in 2022, and has continued to grow during the difficult economic environment, fuelled by investor appetite for the Private Markets.

According to the article:

Goldman Sachs was advising the business, which it was marketing to interested parties, the people added. Preqin was predominantly interested in doing a deal with a larger rival or so-called strategic buyer and wanted to avoid being sold to a private equity group, they added.

Among those that have been looking at buying Preqin were US financial data giant S&P Global and US asset management group BlackRock, some of the people said. Other data companies could jump into the mix of a sale process that is still in the early phase.

This suggests that Preqin are well aware of the difference in valuation that they will be able to achieve if they sell to a strategic rather than a PE firm, and that they have probably already received some indicative offers from large players in the market.

In a separate article, the FT digs into Preqin’s valuation:

Its revenues have grown by a compound annual 24 per cent in the three years to 2022. That makes its £1bn price tag — 7.5 times 2022 turnover [£122m] — look broadly reasonable. MSCI valued Burgiss at 10 times previous year revenues, thinks Russell Quelch at Redburn, while Morningstar bought credit-focused LCD at 11.6 times.

For more thoughts on Private Markets Data & Analytics, read our previous post from May on ApeVue:

The FT has been scathing for years now about Private Markets, and appears to be waiting eagerly for the bubble to burst. They see the shareholders of Preqin putting the business up for sale as yet more evidence that we are at the top of the market.

Perhaps they are right that there is a reckoning to come in the short term, but we are still in the early years of Private Markets, and (barring massive amounts of regulation) it seems probable that there is a lot further to go in the long term.

June 4 - Green Street, a provider of commercial real estate intelligence and analytics in the U.S. and Europe, has acquired Locatus – the Netherlands-based provider of data and analytics for the retail sector in the Benelux region.

TA Associates acquired a majority stake in Green Street in July 2022 from Welsh, Carson, Anderson & Stowe (who retained a minority stake), and are currently fattening the turkey for Thanksgiving.

Locatus is Green Street’s fourth acquisition since 2020, and it follows the late 2023 acquisition of Local Data Company (LDC) – UK industry-leading retail location data provider.

Expect more acquisitions as GreenStreet is grown to compete more effectively with large Commercial Real Estate Data & Analytics providers such as CoStar.

Links to interesting content consumed recently:

Fascinating interview between Fred Corkett, Co-Founder and Managing Director of expert network Dialectica, and Ihar Valodzin, Founder of investor CRM ListAlpha:

International cricket minnows the USA knocked cricket superpower Pakistan out of the T20 World Cup last week. How? It’s all about the positive impact of immigration: