HG Insights - California Dreamin’

TL;DR - HG Insights has an incredibly powerful dataset of Technology Company Data & Analytics. Plus Scott Adelson’s rise to the top job at Houlihan Lokey

Welcome to the 18 new subscribers who have joined us in the three days since our last post! If you haven’t subscribed, join 252 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Sometimes everything conspires to point in a certain direction. This week the world has been pointing me towards Santa Barbara, California.

My fascination with Investment Group of Santa Barbara continues (no website, but here’s an interview with their founder, Reece Duca), fuelled by my reading of 7 Powers, inspired by IGSB’s guidance to the management of Tegus. (I wrote a piece on Tegus and AlphaSense a few weeks ago.)

I spoke this week with Jason Saltzman, Director of Growth at Santa Barbara-based Live Data Technologies, who enjoyed my post on Revelio Labs. Two fascinating People Data companies in a fast-growing and innovative Data & Analytics sub-sector.

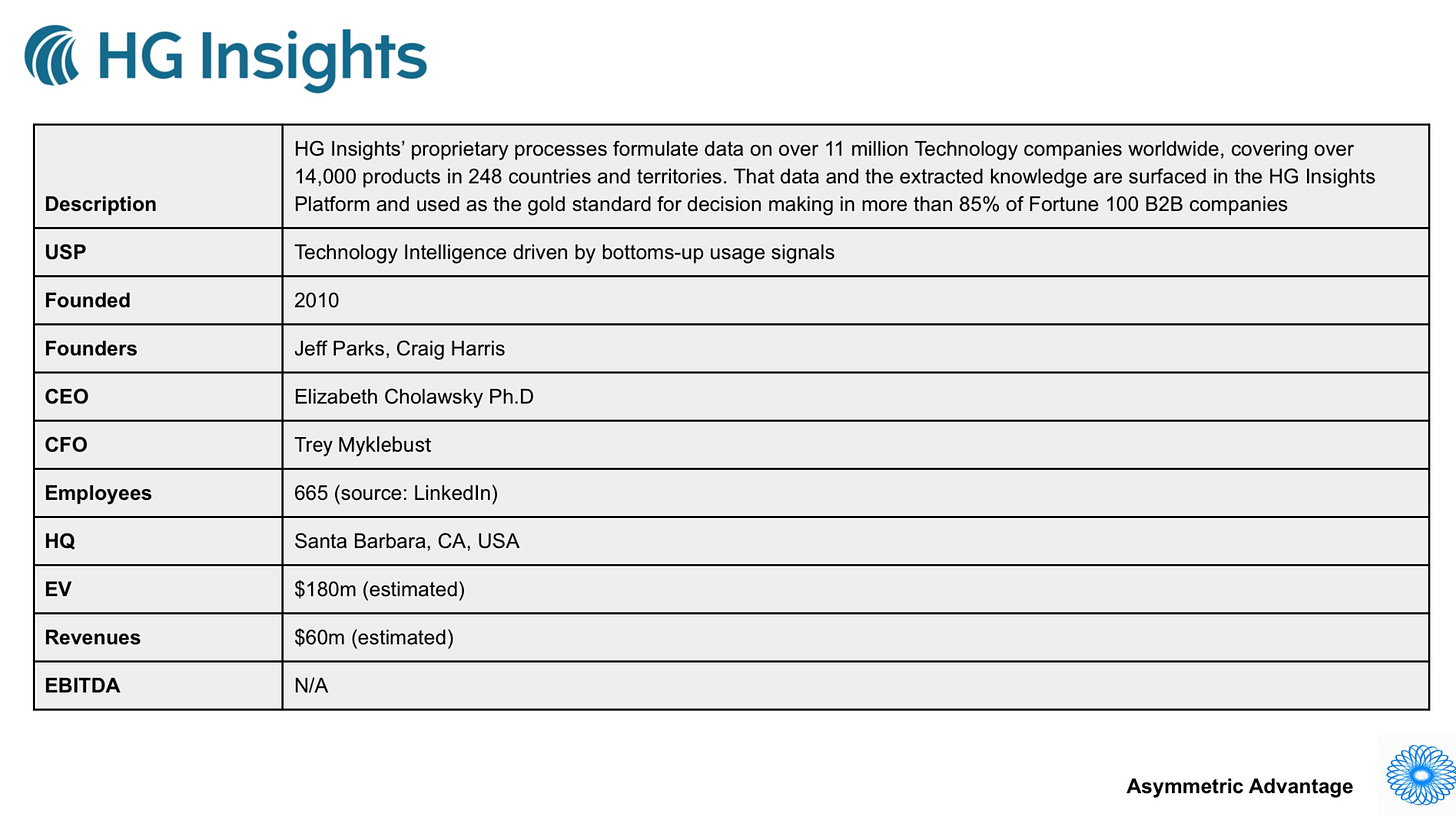

And for today’s post the company I decided to profile also happens to be based in Santa Barbara: HG Insights.

Having spent some time near Santa Barbara (including a memorable surfing experience in the Pacific Ocean) a couple of years ago I can totally understand why these three intelligent groups of people would want to live there - it’s a beautiful part of the world.

Before I begin, a digression (but also with a SoCal feel)

Last week, my old boss, Scott Adelson, was announced as the new CEO of $6.5bn market cap LA-HQed investment bank Houlihan Lokey.

This event has really gone unremarked on in the media, a fact that has surprised me. In my opinion, this is a real positive for HL, and more attention should have been paid by the financial journalists of the world.

Scott has been Global Co-Head of Corporate Finance at HL since 2003, and in that time he has grown it from nearly zero revenues to a >$1bn revenue business.

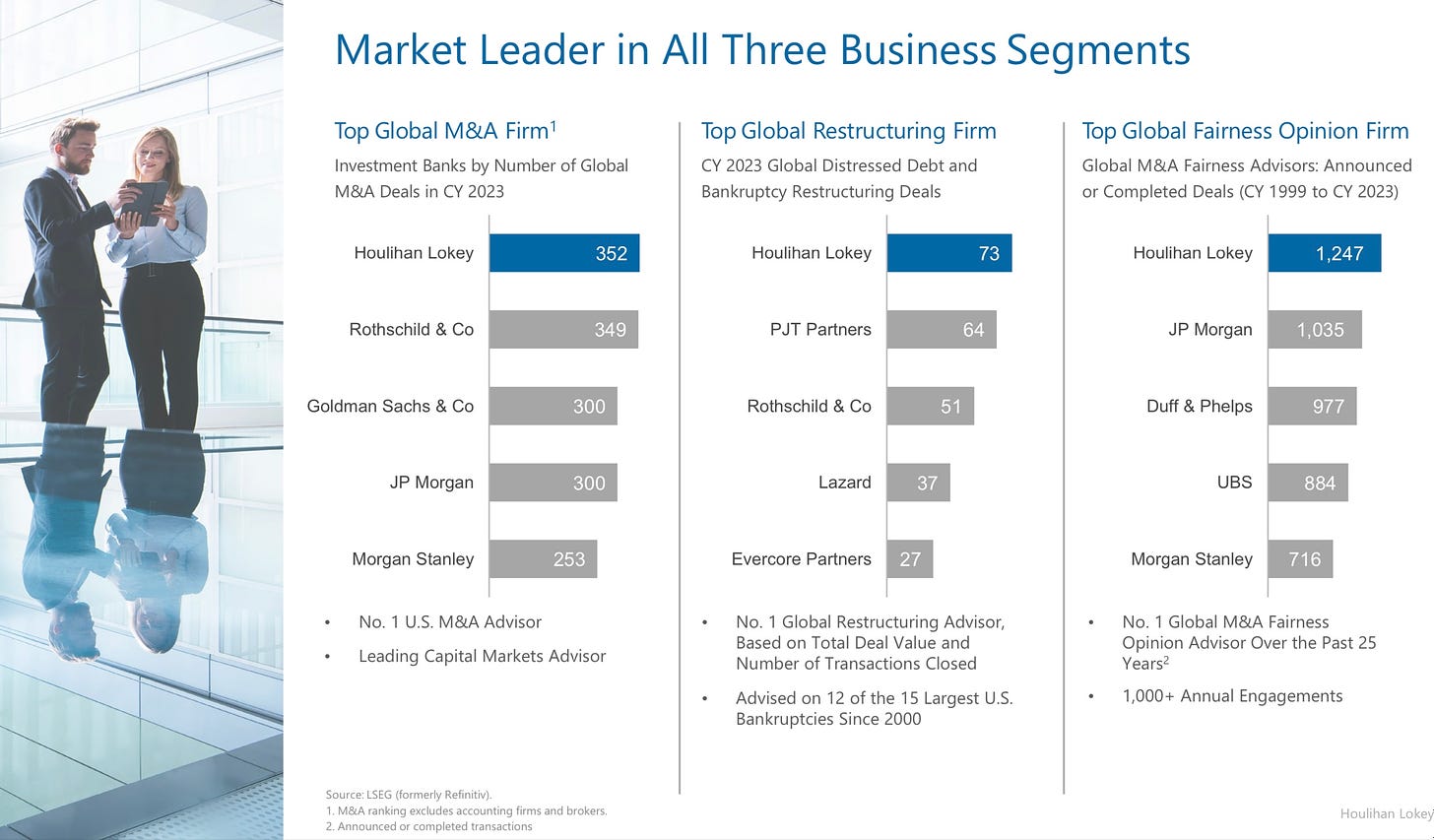

(Slides from HL’s February 2024 Investor Presentation.)

Excluding accounting firms and business brokers, HL advises on more M&A deals than any other company.

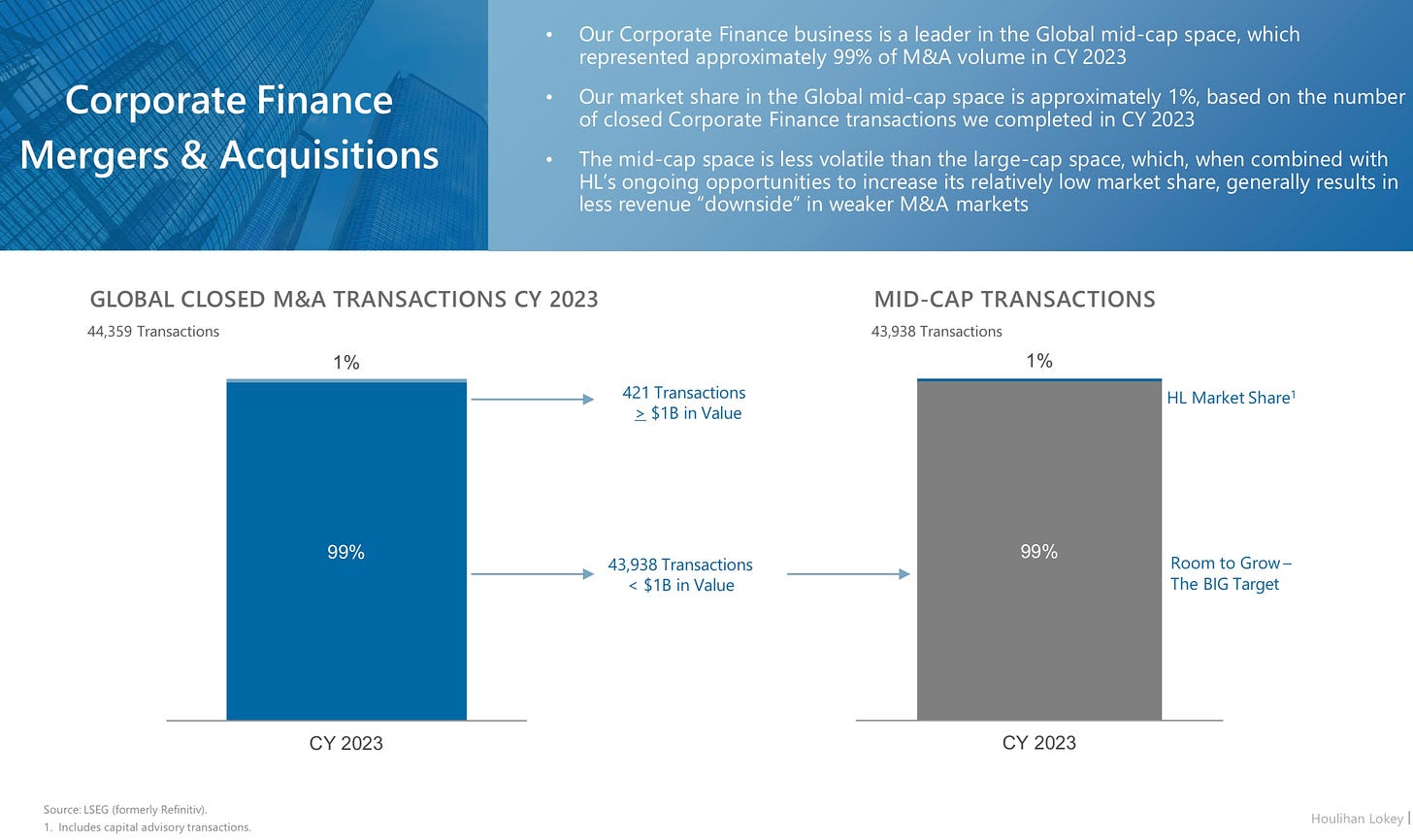

And there is still plenty of room to grow:

I spent five years working directly for Scott from 2018 to 2023 helping to grow the Corporate Finance division. I know Scott well enough to be certain that he will bring all of his strategic insight, intellect, hard work, and people skills to bear running the whole of HL, including, for the first time, oversight of the Restructuring and Valuations divisions.

I would particularly emphasise the focus that Scott places around building logical, common-sense, data-driven systems and processes to generate revenue growth as a reason for my confidence that he will lead Houlihan Lokey to even bigger and better things.

The media have missed a trick here. IYKYK. Scott will make the whole of HL hum.

I wish him all the best in his new role.

HG Insights - *not* just another marketing data company

When I mentioned to a few people that I was going to write about HG Insights (not to be confused with software investor Hg Capital), I got a lukewarm response.

“Aren’t they just another marketing data company like ZoomInfo?”

And at first glance, it would seem so.

According to their press release when Riverwood Capital Partners invested in January 2021:

HG Insights’ proprietary processes formulate data on over 11 million companies worldwide, covering over 14,000 products in 248 countries and territories. That data and the extracted knowledge are surfaced in the HG Insights Platform and used as the gold standard for decision making in more than 85% of Fortune 100 B2B companies.

But look a little closer and something interesting is happening at HG.

The press release continues:

A relentless focus on curating the world’s most comprehensive and accurate technographic information, including technology installation, IT budgets, and contract information, and on surfacing insights through the HG Platform, has powered HG Insights’ rapid organic growth.

Michael Levy of sales intelligence consultancy GZ Consulting summed up what is going on at HG well in an analysis in February 2021:

HG Insights continues its evolution from a technographics licensor to a full-service direct source of technology market intelligence.

In other words, they are not providing generic Company Data & Analytics for Marketing purposes. They focus on providing proprietary, metadata-rich Technology Intelligence.

Technology Intelligence - The Holy Grail (AKA the origin story)

In her HG Vision 2022 presentation on YouTube, HG Insights CEO, Elizabeth Cholawsky, explains the meaning of HG:

HG stands for holy grail, because the founders of the company went out and asked their potential customers “what’s your holy grail of marketing and sales data?”

And it came back that, yes they want to know exactly the buyer, when they’re buying it and their contact details… but the technology profiles we offer of the companies is a critical piece, and this became the holy grail.

What distinguished HG from Technology Intelligence firms like Gartner or IDC, was that they take a bottoms-up approach to analysing the market.

Elizabeth Cholawsky again:

Before HG, Harte Hanks were getting data on companies and technology by picking up the phone and smiling and dialling. And the founders of HG decided that there has to be a better way than that - it’s not scalable and it’s also not accurate. And they got together to work out how to mine from freeform documents the kind of content we have today.

Now we’re the leader in the market. We’ve grown over 6x in employees and revenues in previous five years.

Our vision is to be the number one authority in technology intelligence.

So how do they gather the data?

I’m sure this is the number one question that every prospective customer asks them in the course of their sign-up journey. And I imagine that the answers they get are as opaque as the information online.

From a lot of digging and stitching together of research, it would seem that the data comes from broadly four sources:

Data partners - third-party data sources provide some of the table stakes generic information about businesses (location etc);

Document - according to Elizabeth Cholawsky, HG Data review 20 million documents per month. Exactly what these documents are is not clear;

Web-crawling;

Internet traffic.

The second data source was the foundation of HG’s business. But this has been augmented by sources 3 and 4 through two acquisitions.

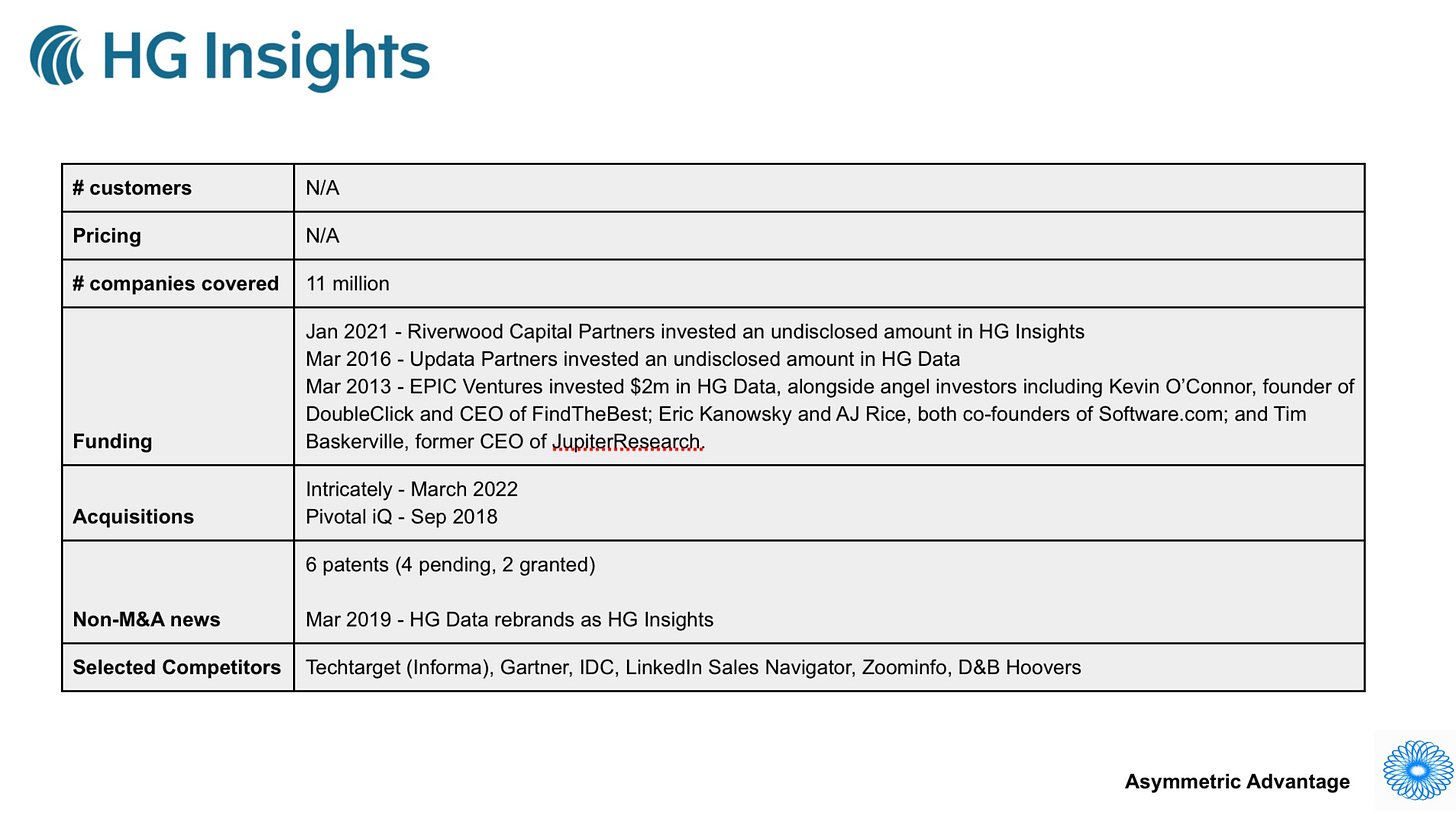

Pivotal iQ acquisition - September 2018

Web-crawled data was added through the acquisition of London-based Pivotal iQ.

Here’s sales intelligence consultant Michael Levy again:

Like HG Data, Pivotal iQ employs web crawling and natural language processing to build its dataset. Coverage spans 186 countries representing over 90% of the global ICT spend. The database is matched to D&B WorldBase, providing account and location level views across corporate hierarchies. The firm claims to cover installed technology for all global firms with $50M in revenue and global publics with $25M.

Pivotal iQ intelligence covers 600,000 companies, 8,500 vendors, 10 million supply-side announcements, and 40,000 contracts. Data is updated daily.

The Pivotal iQ InstalledView service details hardware and software installations at the account level. SpendView provides market and country-level analytics and competitor take-out campaigns across 21 spending categories and 22 sectors. SpendView includes a visualization engine for competitive and account analyses. The BuyerView service provides enterprise IT and purchasing departments with intelligence around which vendors are being deployed and which companies are managing outsourced projects within their peer group.

Elizabeth Cholawsky gave more detail on the value added by Pivotal iQ in her Vision 2022 speech:

Pivotal iQ actually created a very accurate model to figure out IT budgets at different levels - global, regional, down to pro-forma budgets for different companies.

So in terms of use cases we went from account information to IT spend information. IT spend information gives you the information to do total addressable market, your observable market. You can slice and dice by spend and by technology and by technology categories. So that market research data for prospecting, planning, product planning, identfication of new M&A opportunities all falls under this banner of IT spend information.

Intricately acquisition - March 2022

The acquisition of Intricately provided a third data type. Cholowsky again:

There was another company out there called Intricately that was looking at cloud dynamics in a very different way. That was through a global sensor network that monitored internet traffic worldwide and could tell near real time what applications were growing, what applications were declining, where companies were really starting to progress and change from a cloud laggard to a cloud leader. Intricately was so interesting that the companies decided to join forces.

Together this combined data set is extremely rich. If you watch HG’s product demos on YouTube, you can see the extent of the data at the user’s disposal.

If you are a Data & Analytics business owner, take note. The richer your dataset, the more valuable it is to your users. There is a network effect at play here.

So what next for HG Insights?

Firstly, they will continue to grow their core market of data for sales and marketing into software companies. As Elizabeth Cholowsky says:

Every customer has two or three feeds of intent data. But the problem wasn’t the quantity of data, it was the usability of data. We could put the context around the intent signals - they are in a buying mode, they are in a research mode, they are in a replacement mode, there is a competitive takeout opportunity. And we can know that because we have all of the trending information in the technologies that we have got and we have got the intent signals, and we have got the categories that we can slice and dice.

This is pretty compelling from a sales perspective IMO.

But I can also see many use cases for their data, above and beyond pure Sales data. It’s the best dataset on the technology sector that I have come across. If I was in the business of looking for sources of Alpha, either for investing in public or private companies, I would subscribe to HG Insights for sure.

Bonus Reading and Listening

Amusing and insightful interview with Scott Smyth, founder of Pivotal iQ, on what it takes to found a Data & Analytics business

The best podcast interview with Elizabeth Cholawsky, in which she describes how HG Insights eat their own dog food, and use their data in their own processes, is this one:

Fascinating podcast interview with a HG Insights Sales Development Representative, in which he describes best practice for an SDR. As an experience salesperson myself, I really enjoyed this:

Other interesting reading from the last few days:

Fascinating profile in Bloomberg of John Seo’s hedge fund Fermat Capital Management, their success in the Cat bond market, and the overall market for weather-related catastrophe insurance.