Revelio Labs - “the universal HR database”

TL;DR - People data can provide alpha-generating AltData on companies

Welcome to the 33 new subscribers who have joined us since our last post! If you haven’t subscribed, join 197 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues you think may be interested. Thank you!

If you made it to the end of my last, mammoth post (on AlphaSense and Tegus), you may well, like me, be hoping that the next one will be shorter. Your wish is about to be granted.

Today’s post is the first in a series of shorter posts looking at individual Data & Analytics companies. To compensate for the shorter length, I am planning to publish the newsletter twice a week, including a variety of different formats, one of which will be individual company analyses.

I’ve spent the last month poring through the Data & Analytics industry, rebuilding from scratch my database of companies. The dataset is now running to four figures and is growing exponentially. There is no shortage of interesting Data & Analytics companies out there.

Sometimes, though, I look at a company and just know there is something special about it. I had that feeling when I looked at Revelio Labs.

Having now thoroughly researched Revelio Labs, I know I am somewhat late to the party. Indeed, Mark Fleming Williams interviewed the founder, Ben Zweig, back in January 2021.

and Eagle Alpha, unsurprisingly, picked up on them even earlier, back in January 2020:

But at least HBS only got around to interviewing them a few months ago:

(The interviews all cover much the same ground, BTW. If you only listen to one, I would listen to Mark Fleming-Williams’ Alternative Data podcast.)

There are also a lot of interviews on YouTube, which are similar in content.

These two YouTube videos are somewhat different from the podcast interviews:

I like this one because you get a sense of the origins of the business:

And this one is fun because you get to see Ben Zweig present on a big stage!

In a nutshell, what I find exciting about Revelio Labs is:

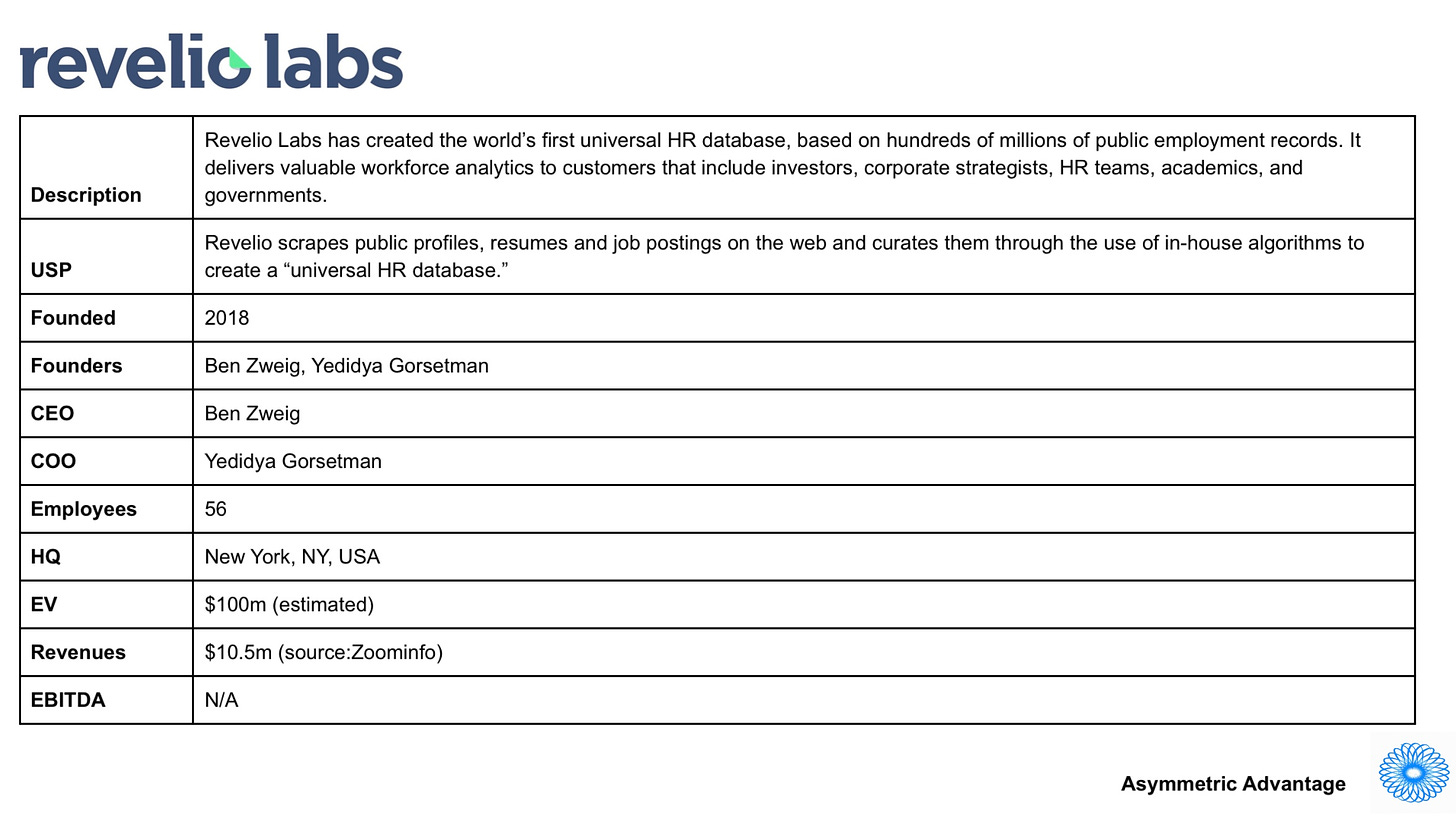

Although it positions itself as an HR Data & Analytics provider, it is really a Company Data & Analytics provider. It has data on the employees of 4.5m companies globally: employee numbers/growth/attrition, job types, seniority, compensation. Using this data you can understand the dynamics of any business in detail.

What are we talking about here? AltData. Data that gives you an edge in understanding a company. No wonder then, that Eagle Alpha picked up on it early. Ben Zweig talks in the podcasts about hedge funds being the early adopters of the product. Again, no surprise there.

Also no surprise that one of Ben’s jobs before founding Revelio was as a quant at a hedge fund. He’s also an academic with a PhD in Labour Market Economics, who still teaches at NYU Stern.

I guess what I also liked about this idea is what I often find intriguing about brilliant businesses: it’s a simple idea well executed.

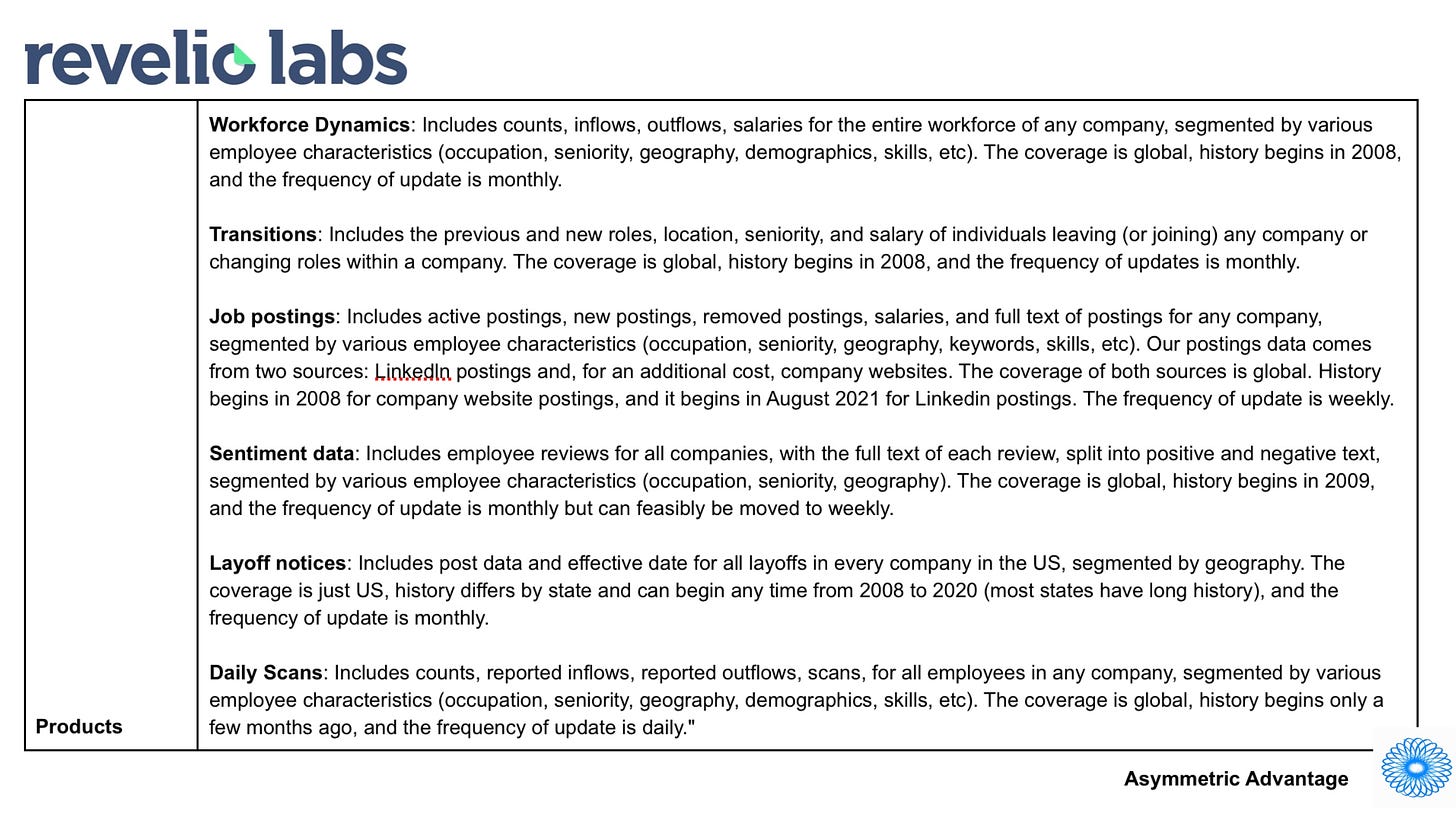

LinkedIn data, Glassdoor data, U.S. Department of Labor data - it is all sitting out there waiting to be aggregated, taxonomised, compared and analysed.

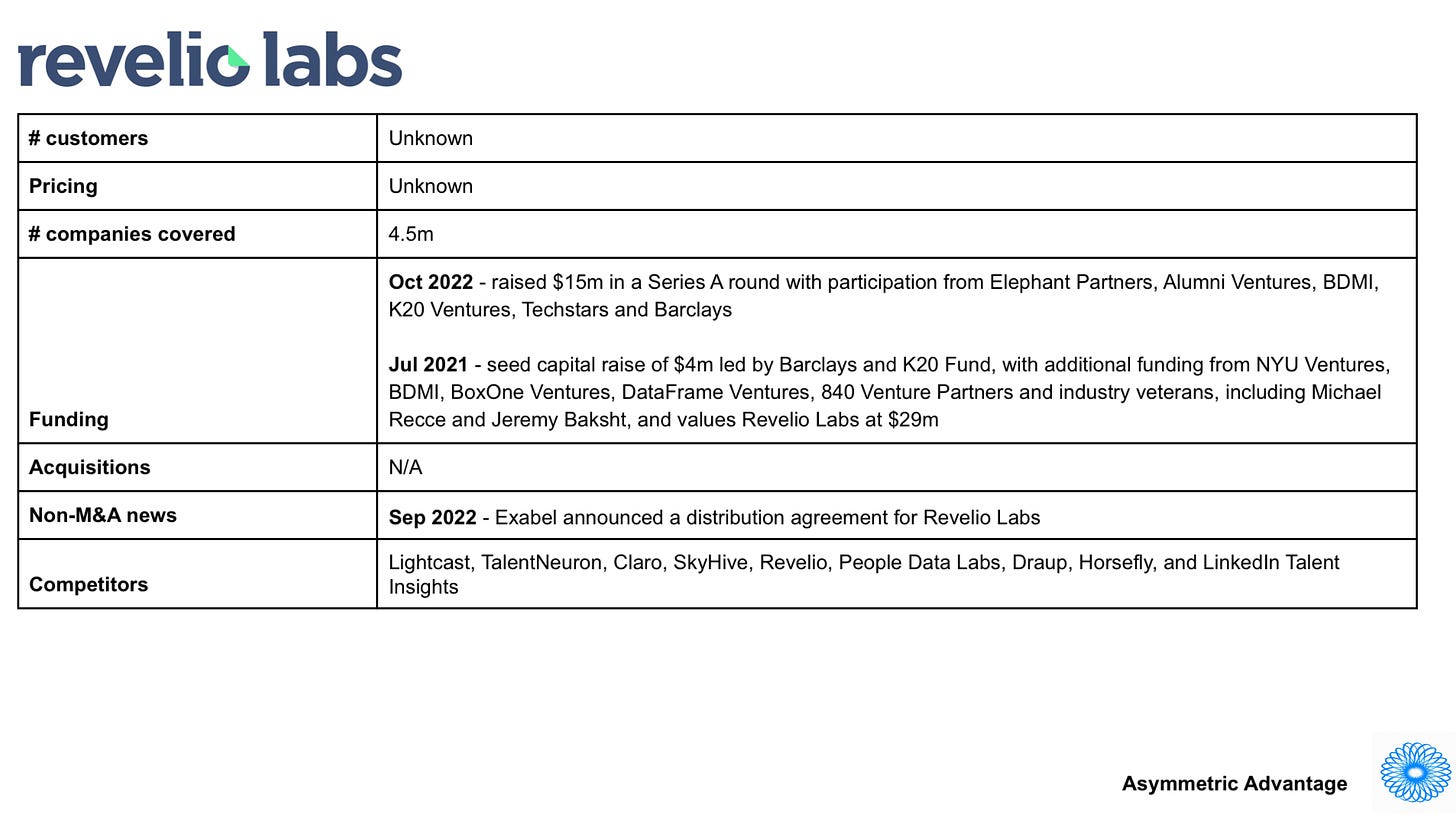

That said, the downside here is that the publicly available nature of the data means that the barrier to entry is low, and they are not alone in doing this. A good number of other start-ups are also providing Talent Intelligence and People Data & Analytics, including Draup, SkyHive, Horsefly, Lightcast, TalentNeuron, People Data Labs, Claro and LinkedIn themselves, in their LinkedIn Talent Insights business.

So the key is going to be in how the data is plumbed together, how good the taxonomy is, and how useful and user-friendly the analytics tools are. Revelio appear to be doing very creative, skilful and useful product development here. You only have to quickly skim the Revelio blog to see this. Here are a few recent topics they have covered, to give you a flavour:

We Found Love in a Corporate Place. Which employees are crazy in love with their jobs?

A Tale of Two Cultures - In One Company. It was the best for managers, it was the worst for juniors

These articles are all written by their staff economists using Revelio Labs data. They are packed full of insightful and useful data.

Yes, that’s right. They have staff economists. I love this as a point of differentiation.

They also have 20+ software engineers, focused on web scraping data, piping it in, creating the infrastructure and delivering it.

And a data science team enriching the data, working on the taxonomy and data matching.

And a dashboard team focused on creating a great user experience.

I would be very surprised if Revelio weren’t currently being circled by both Private Equity investors and strategics from the HCM software and Data & Analytics spaces. When their next liquidity event happens I will be sure to let you know!

Other things I have found interesting since my last post:

Books & Book Clubs

I have started three book clubs this year - one at home, one for Science Fiction and one for Business Books. If you are interested in joining either the SF or Business Books clubs please let me know.

After seeing the influence it had on the management of Tegus (see my last newsletter) and having become somewhat obsessed with Investment Group of Santa Barbara, our Business Book Club started reading 7 Powers: The Foundations of Business Strategy last week. If you are also interested in reading this and discussing it afterwards, please drop me a line

Our SF book club is just finishing reading Klara and the Sun, and we are going to move on to Sea of Tranquility next.

I am also considering starting a bookclub for Japanese Literature - please let me know if you would like to join me. I’m currently reading:

Business-related content

Financial services veteran and entrepreneur Stuart Fotheringham wrote this interesting dissection of Pod Shops, AKA multi-strats.

I enjoyed Abdullah Al-Rezwan’s analysis of AppFolio, another Reece Duca-backed business. “Mr. Duca alone owns almost one-fifth of the shares outstanding and ~40% of voting power at AppFolio.”

Speedwell Research have been looking hard at Mark Leonard’s Constellation Software, and have put out both a podcast and a research piece. Mark Leonard is a fascinating investor to get to grips with. Consume in your preferred format:

The J.P. Morgan Making Sense podcast has an interesting interview with the head of investing at Fulcrum, in which he discusses how having an accurate picture of what is happening now (“Nowcasting”) is both critical and possible for the first time using AltData, providing a proper platform for forecasting:

Great read! You’re right on the lack of defensibility from using public data. I used to lead strategy at Adzuna, a large global job aggregator, and we launched a data analytics product by combining our proprietary data with the same public data sources that the others use. There’s lots of interesting verticals with different use cases depending on the nature of data available - hedge funds, corporates, higher ed, national and local govt, think tanks and economic consultancies.