$700m EV Aerial Imaging Data & Analytics provider - Thoma Bravo's Nearmap

TL;DR - In the face of increasing competition from satellite-driven Data & Analytics providers, Nearmap provides high value data for P&C insurance

If you haven’t already subscribed, join 323 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

One final ask. After three months and 15 posts about Data & Analytics, I’d love to know more about you and your reading habits to help inform what I write about next. Please complete the following one-minute survey. Thanks!

Data & Analytics - Recent M&A Hot Takes

April 9th - Rimes, Provider of EDM (enterprise data management)-as-a-Service and investment platform solutions to the global investment community, has been acquired by Five Arrows, the alternative assets arm of Rothschild & Co, from EQT.

Five Arrows have history of acquiring fintech businesses serving Trading - they sold Pirum to Bowmark back in 2019, for example - so it’s not a surprise to see them buy this industry stalwart. EQT held the asset for 4 years, bolting on one acquisition in that time. The process kicked off in October last year and the valuation at that time was reportedly $2.1bn.

April 5th - Credit data firm Experian has agreed to buy Illion, one of the leading consumer and commercial credit bureaus in Australia and New Zealand, for up to AUD820m (£427.2m).

This deal has felt like an inevitability for a long time. Experian has been hoovering up regional credit bureaux for over a decade. The price seems very reasonable for this sector given that reported EBITDA was AUD65m.

April 2nd - Descartes Labs, a leading provider of geospatial analytics and artificial intelligence solutions, acquired all of the operating assets of Geosite, a SaaS provider of geospatial intelligence to property and casualty insurance companies.

Antarctica Capital are building an interesting portfolio of Data & Analytics businesses. After investing in Descartes Labs in August 2022 it’s not a surprise to see them back this bolt-on acquisition which brings them into the P&C insurance market (of which more in the rest of this post!)

I’ve recently profiled several Data & Analytics businesses powered by imaging:

All harness the democratisation of Earth Observation data unleashed by the large number of satellite constellations launched in the last 15 years.

Aerial data has been available for longer than that, of course. As a kid I was fascinated by the businesses who made their money taking aerial photos of your home from light aircraft.

And I’ve been following the progress of aerial photography-based businesses in the GIS space since I started working in Corporate Finance back in 2008.

My recent posts on Earth Observation-driven Data & Analytics businesses made me ask myself:

“How are ‘old-fashioned’ aerial photography businesses faring?”

So I thought I’d take a look, using Thoma Bravo-owned Nearmap as a proxy.

Nearmap - the origin story

Founder Stuart Dixon created Nearmap in Perth, Australia, back in 2007 to disrupt the aerial surveying industry.

Historically, aerial imagery was available mainly to government and large enterprises, as it was quite an expensive and long process. First, a surveying company had to be engaged to take photos of a certain area of interest. Then, the data would be manually processed and stitched together digitally to create aerial maps. Imagery was then delivered on a hard disk. The entire process could take months and was repeated once every few years at best.

Nearmap disrupted this model by creating a patented camera system and software pipeline that enabled the company to capture aerial photos, stitch them together into seamless digital maps, and publish the content online within days of capture.

The potential of the business was spotted by Sydney-based Venture Capitalist Rob Newman, who acquired it with his listed vehicle Ipernica (at that time doing business as a patent troll!) in 2012 for AUD16m.

In 2014, the company expanded into the United States market.

In 2017, Nearmap expanded into New Zealand and started providing 3D models of Australia's major capital cities.

The business then went through a period of rapid growth, culminating in the sale of Nearmap to Thoma Bravo in August 2022 for AUD1.055bn (c.USD700m).

Not a bad growth story!

How does Nearmap create value?

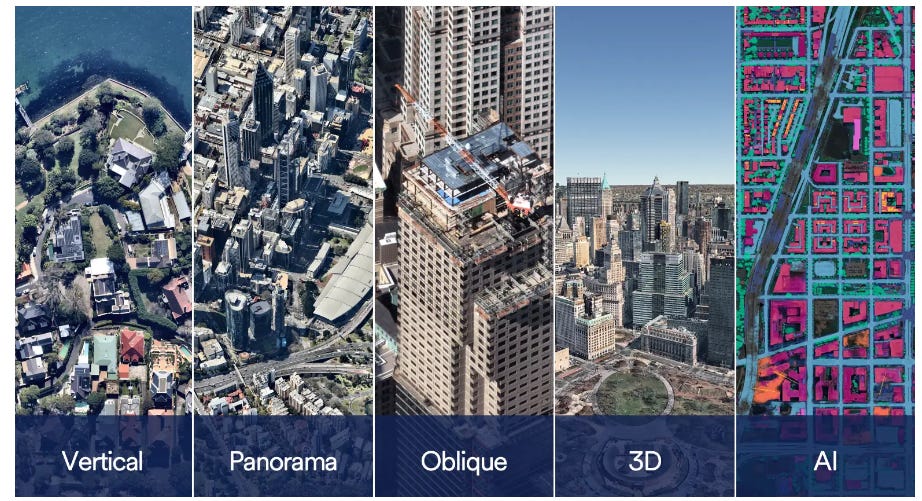

Nearmap builds cameras in-house specifically for complex aerial captures, grabbing multiple angles at once—vertical, oblique, panoramic, orthographic, and even 3D. They systematically fly multiple times a year to provide the most consistent and recent imagery across multiple seasons for the best views of structures with foliage and without. It has the highest quality processing and speed to market, with imagery available days or even hours after a flight.

Nearmap’s data has uses in a variety of fields including construction, planning and environmental services.

But the industry where it appears to have struck gold is insurance, with a focus on loss adjusting and claims management for Property & Casualty.

It appears (without access to their internal client data but making inferences from their marketing material) that the two most lucrative revenue streams are 1) roofing, and 2) catastrophic weather events.

Roofing is the most straightforward.

According to the Nearmap website:

36% of all property claims in the US come from roof-related claims. It is a huge problem for insurers as they try to accurately price, underwrite and respond to claims.

That’s a big market. And a nice renewable source of revenue too - roof tiles have a finite lifespan, particularly in the US, where short-lifespan asphalt shingles are popular.

Catastrophic weather events is more interesting. Large insurance events that need rapid response and where loss adjusting costs are high means potentially high margins.

Nearmap flies severe weather events and catastrophic storms (CAT) as soon as it is safe to get in the air. Post-event imagery is available within days after an event.

This data is high value for their insurance company clients:

In Sept. 2022, Nearmap captured images of the billions of dollars of insured damages caused by Hurricane Ian. Many of the impacted properties were inaccessible due to washed-away roads and dangerous conditions — making aerial captures invaluable data sources for knowing who needs help.

Kin Insurance, a licensed Florida provider, used aerial intelligence to process claims for 50% of their claimants, without setting foot on the ground.

Nearmap post Thoma-Bravo investment

There have been four obvious impacts of the August 2022 Thoma Bravo investment:

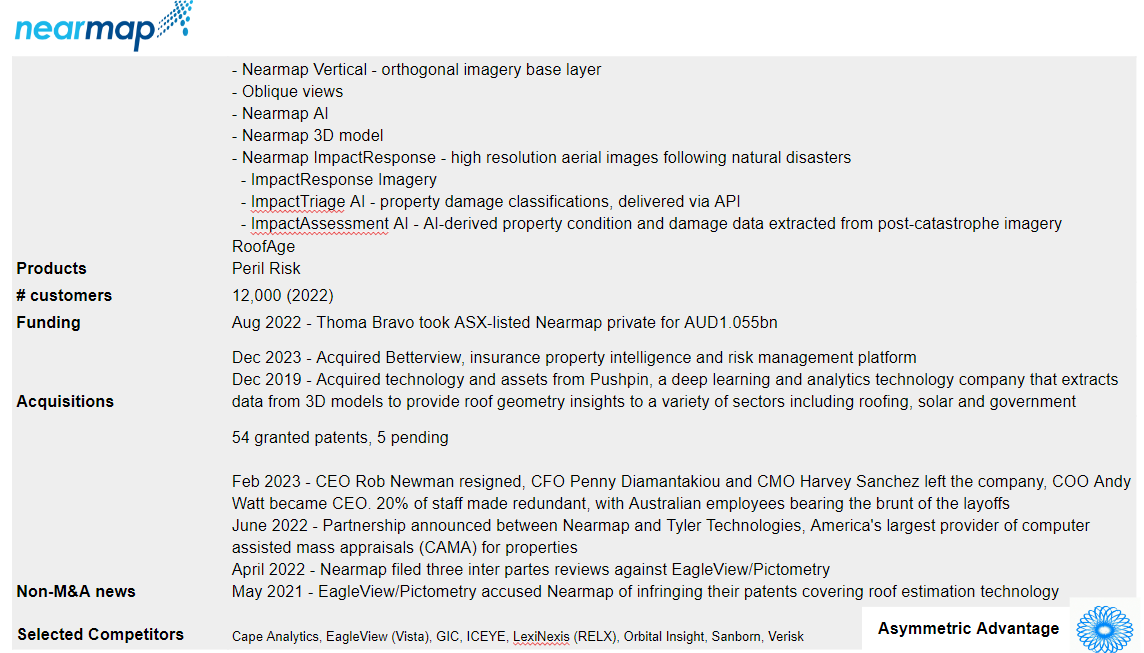

Management changes - in February 2023 CEO Rob Newman resigned, CFO Penny Diamantakiou and CMO Harvey Sanchez left the company, and COO Andy Watt became CEO;

Reduction in employee numbers - according to Australian Finance Review, 20% of the workforce were let go at that time;

Shift from Australia to the US - the majority of those cuts were made in Australia. The company now places more emphasis on its Utah base, and has senior hires in the US;

Increased focus on Insurance, driven by the acquisition of Betterview.

The acquisition of Betterview is transformational for Nearmap.

Betterview applies computer vision and machine learning to imagery, creating a system that detects and scores property condition, models risk, and predicts loss.

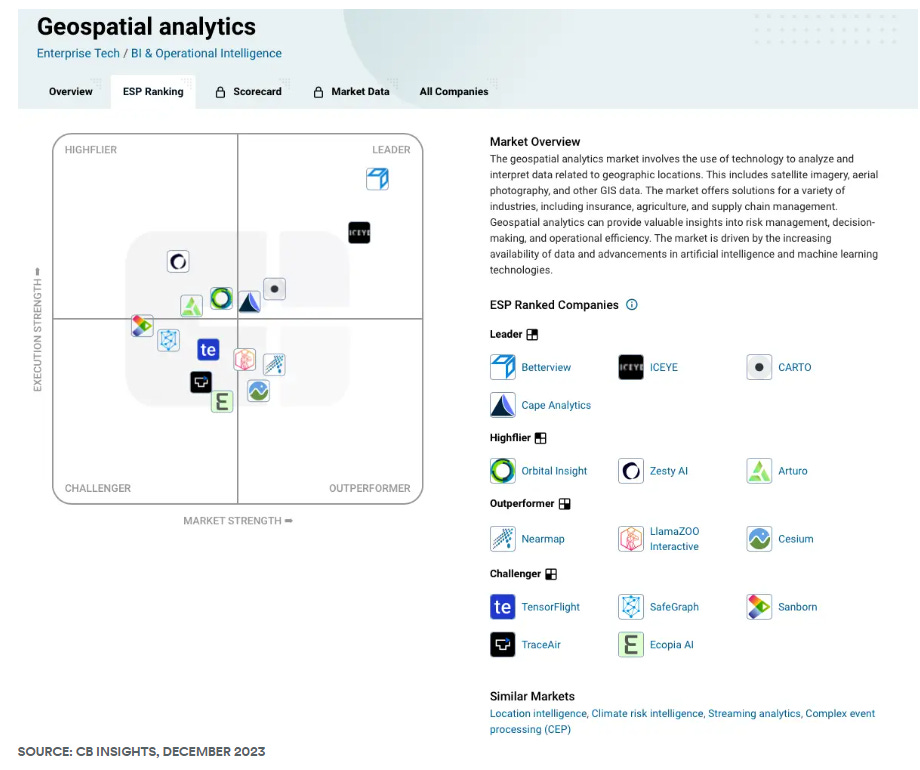

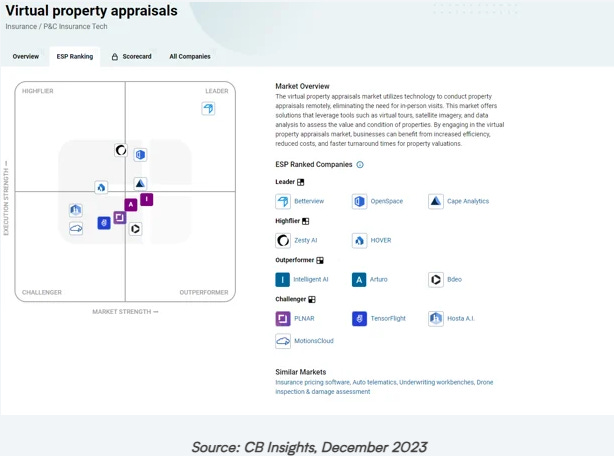

It catapults Nearmap’s Analytics capabilities forward. The below maps of Geospatial Analytics and Virtual Property Appraisals landscapes from CB Insights show how Betterview provides Nearmap with a competitive advantage.

How does Satellite-originated Data change the landscape?

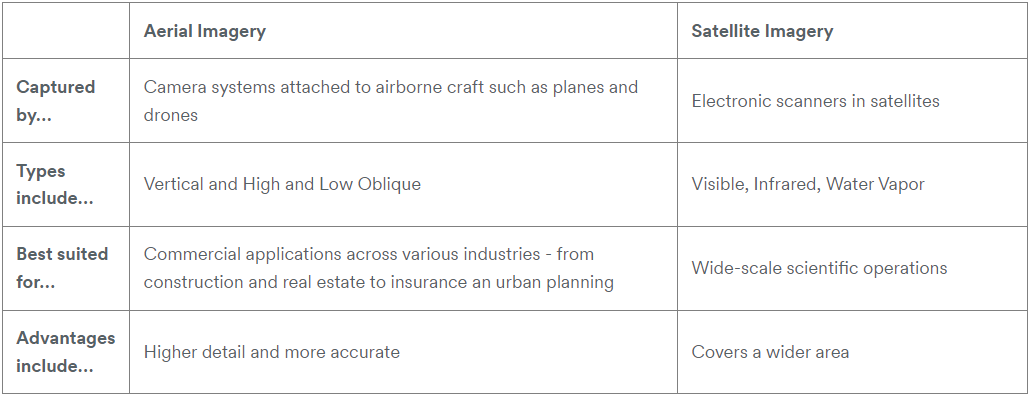

The Nearmap blog tries hard to show the distinction between aerial and satellite imagery:

But (IMO) the reality here is that satellite data is going to level the playing field, and in many cases make flown imaging redundant. Particularly as the cost of satellite data continues to fall as more and more satellites are launched.

I would imagine we will see Nearmap add more satellite data and reduce their reliance on aerial imaging.

What next for Nearmap?

Nearmap are already harnessing Artificial Intelligence in their product set. Their ImpactTriage AI and ImpactAssessment AI products do a lot of the boring leg work of extracting data from images. And they can do this for non-catastrophic datasets too - assessing health of roofs for example. Expect to see more advances here.

There is an opportunity for Nearmap to produce Digital Twins of environments to enable forecasting of catastrophic events.

It is conceptually intriguing to consider what they might achieve if they combined predictive weather data with their data sets. What data products could be created?

Beyond product development, we should expect to see Nearmap to continue to be acquisitive under Thoma Bravo. A combination of buying competitors to get scale, innovators to acquire technology, and businesses in adjacencies (environmental data?) seems likely. Nearmap could also be put together with a Satellite data business (e.g. currently depressed valuation Spire Global) to create a vertically integrated business, if they want to make a leap forward in the Satellite data space.

Thoma Bravo will not sit on their hands. They will want to outmanoeuvre their rivals Vista, with their Eagleview platform, and generate a lucrative exit in the next few years. Their track record tells us that they will achieve this.

Here’s what I’ve found most interesting reading and listening in the last few days:

Agribriefing founder Rory Brown on lessons learned from his career in Data & Analytics;

How satellite data is being used for investigative journalism;

Hedgineer podcast interview with Kirk McKeown, founder of Carbon Arc, ostensibly on the integration of AI to augment data analysis and fundamental research. But really a wide-ranging discussion of the use of AltData to make trading decisions, and the opportunities still out there;