🌏 COP it like it's hot - Asymmetrix Newsletter #45

The environment and Europe dominated Thanksgiving week.

A quiet week for deals as the US shut down for Thanksgiving, with only a handful of transactions taking place, and the majority of the action was in Europe.

The acquisition of Irish classifieds business Distilled from Blackstone- and Permira-backed Adevinta by Black Sheep Management for EUR500m+ is the pick of the bunch.

And, as you’d expect from a European-dominated week, ESG is the dominant theme for fundraisings.

So it’s appropriate that, in this week’s guest-authored insight, Indre Kekyte gives her thoughts on the outcomes of the recently concluded COP29 United Nations Climate Change Conference, and the likely impact on the Data & Analytics sector.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

📧 If we missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.

🌏 COP29 - What happened and what does it mean for Data & Analytics?

What happened?

COP29 wrapped up on November 24 in classic climate summit fashion: two days late after two weeks of heated debates, hopeful promises, and existential anxiety.

Trump's election meant limited US involvement, but the summit did end in a deal.

In a nutshell:

$300bn pledged annually by 2035 to help developing nations;

Frameworks for a global carbon market under the Paris Agreement.

Why it matters

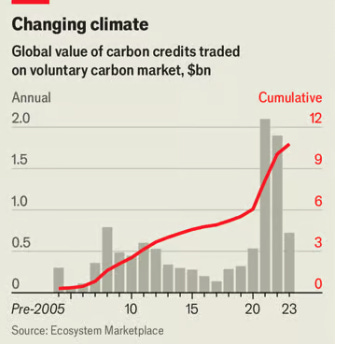

In 2023, the voluntary carbon market faced significant setbacks, with the trading volume dropping from $1.9bn to $723m, driven by accusations of greenwashing.

(Source: The Economist: Can the voluntary carbon market save the Amazon?)

The amendments to Article 6 of the Paris Agreement at COP29 confirmed the rules for carbon credit transactions and added safeguards to protect the environment and indigenous peoples.

How does this impact the Data & Analytics industry?

The policies agreed at the summit fundamentally depend on increased transparency and accountability by all participants in the carbon market. This requires increased use, and granularity of, Data & Analytics.

This means growth for those firms focused on analysing climate risk.

Carbon Credit Rating Agencies (CCRAs), like BeZero and Sylvera, that assess and certify projects, help separate credible credits from unreliable ones (see our previous analysis of the four main Carbon Credit Ratings players).

These initiatives aim to address the issues of transparency and accountability, ensuring that “a ton [one metric ton of carbon dioxide removed] is a ton”.

Additionally, Data & Analytics providers focused on specific sectors impacted by climate change are seeing high demand.

The world has witnessed multiple high profile wildfires in recent years, as global temperatures trend upwards. Data & Analytics providers serving the sector have grown correspondingly.

For example, Technosylva, a provider of wildfire risk analysis solutions, recently received a strategic boost from General Atlantic’s BeyondNetZero Fund, alongside TA Associates, an investor since 2022.

This follows a period of transformational growth for Technosylva. Since TA’s initial investment, Technosylva has focused on expanding and enhancing its capabilities through acquisition:

Dec 2023 – Heartland Software – wildfire science and technology;

Oct 2023 – Atmospheric Data Solutions (ADS) – weather and wildfires risk forecasting.

In October 2024, OroraTech, another player in the wildfire intelligence space, secured €25m in Series B funding to expand its satellite constellation for real-time wildfire detection (see here for our analysis of the deal).

And the world has seen not just an excess of fire, but of its elemental opposite: water.

The recent devastating floods in Spain highlight the urgent need for better resilience strategies, prompting demand for more sophisticated flood risk solutions.

Companies like Previsico and 7Analytics are advancing predictive technologies to address these challenges. Similarly, companies like ICEYE use satellite technology to offer timely insights into environmental changes, whether for wildfires, floods, or broader climate risks.

With a broad range of innovations in the market, there is no shortage of opportunities for consolidation and investment in Climate Data & Analytics.

What happens next? COP30: Belém and Beyond

COP30 is set to take place in Belém, Brazil's gateway to the Amazon, in November 2025.

Belém presents a chance to spotlight the region's pressing challenges and emerging opportunities.

According to Peter Fernandez, founder of Mombak, a company working on reforesting the Amazon,

Brazil can be to carbon removal what Saudi Arabia was to carbon production.

As the world digests the decisions of COP29, and innovations in climate risk technologies proliferate, from carbon markets to satellite-driven wildfire detection, it's clear that we will continue to see an emphasis on more, and more accurate and transparent, climate data.

Thanks to Indre Kekyte for writing this week’s insight. Indre was previously a Financial Analyst in the Data & Analytics team at investment bank Houlihan Lokey.

M&A and Fundraising

Deal chatter

📢 Ipsos weighs binding offer to buy Kantar Media.

Kantar Media is a London, UK-based provider of data and audience measurement, targeting, analytics and advertising intelligence services, backed by Bain Capital and WPP.

According to Reuters, Ipsos is working with debt advisers to finance a bid for Kantar Media ahead of a deadline next week.

The article estimates the business to be worth $2bn, however the valuation was previously estimated at $1.34bn.

Kantar has EBITDA of roughly USD120m.

Cinven, CVC, Triton Partners have also been rumoured to be participating in the auction process.

JP Morgan and Jefferies are advising the shareholders of Kantar Media.

Asymmetrix Sector: Advertising.

✈️ Jefferies Equities Research values Boeing’s Jeppesen at $7bn.

Jeppesen is a Denver, Colorado, US-based provider of intelligent information solutions across the aviation ecosystem.

According to AIN, Jefferies estimates that Jeppesen and ForeFlight generate the highest margin (30%) of all the Boeing Global Services entities. They value Jeppesen at $7bn and ForeFlight at $1bn.

According to Reuters, Boeing is working with an adviser on the potential sale of the unit.

There is significant private equity interest in Jeppesen.

Asymmetrix Sector: Aviation

Announced M&A

🏠 Blacksheep Fund Management acquired Distilled.ie.

Blacksheep Fund Management, a London, UK-based investment fund, acquired Distilled, a Dublin, Leinster, Ireland-based classified provider, co-owned by Adevinta, backed by Blackstone and Permira.

Financial terms were not disclosed, but the valuation is rumoured to be more than EUR500m.

Distilled was advised by Barclays, Blacksheep Fund Management was advised by Lazard

Asymmetrix Sector: Real Estate.

🚗 Vitu acquired Dealertrack Registration and Titling businesses from Cox Automotive.

Vitu, an Agoura Hills, CA, USA-based automotive title and registration platform, backed by Accel-KKR, announced the acquisition of Dealertrack Registration and Titling Businesses from Cox Automotive, an Atlanta, GA, USA-based vehicle transaction platform, a division of Cox Enterprises.

Financial terms were not disclosed.

Asymmetrix Sector: Automotive.

📢 Adwanted acquired MediaSpecs.

Adwanted, a New York, NY, USA-based advertising sector tech and information group, backed by Swen Capital Partners and Arbevel, announced the acquisition of MediaSpecs, a Hofstade, Brabant, Belgium-based advertising media search engine.

Financial terms were not disclosed.

Asymmetrix Sector: Advertising.

Later-Stage / Growth funding

🏢 Predium

Munich, Bavaria, Germany-based ESG real estate compliance platform.

Raised EUR13m in Series A funding led by impact investors Norrsken VC, with participation from UVC Partners, b2venture, and Mutschler Ventures.

Asymmetrix Sector: ESG.

🧬 Cradle

Amsterdam, Netherlands-based protein engineering platform.

Raised $73m in funding led by IVP, with continued backing from Index Ventures and Kindred Capital.

Asymmetrix Sector: Genomics.

Early-Stage

🌳 Darwin

Paris, France-based provider of biodiversity intelligence.

Raised EUR1.5m in pre-seed funding led by Astérion.

Asymmetrix Sector: ESG.

*NEW* - C-suite changes

Dye & Durham - CEO - 🆕 - TBC; 🗙 - Matthew Proud

📧 If we have missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.