7 Data & Analytics M&A and Fundraising Deals - April 22-29, 2024

TL;DR - A busy week for Data & Analytics transactions across multiple sub-sectors

If you haven’t already subscribed, join 367 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

April 26 - Raptor Technologies (Raptor), the U.S. leader in school safety software, announced an agreement with Ontic, a software provider delivering Connected Intelligence that unifies how security professionals manage physical threats, mitigate risks and strengthen businesses, for the strategic acquisition of SIGMA Threat Management Associates (SIGMA), a leader in threat assessment and violence prevention services.

This deal brings Thoma Bravo-owned Raptor an interesting dataset on how to mitigate potentially deadly situations in schools. Given that there were an average of two mass shootings a day in the US in 2023, this is valuable information. (Another Data & Analytics provider, Beringea- and Mercia-backed Moonshot, does great threat analysis work in this space, and their report makes grim reading.) Ontic only owned SIGMA for 3 years before Raptor pounced.

April 26 - According to Colin Morrison, author of media industry newsletter Flashes & Flames: The Global Media Weekly, “UK-based Law Business Research (LBR) is being acquired for an enterprise value of £660mn (17x EBITDA for 2024). The buyer is thought to be Intermediate Capital Group”.

This deal has yet to be announced, so kudos to Colin for the scoop. The Mail on Sunday has more detail. Levine Leichtman bought LBR in 2017 from Bowmark. The merger with Globe Business Media in 2018 brought significant scale, and they have made a number of bolt-ons since, including MBL Seminars, Worldwide Legal Research and Docket Navigator. It will be interesting to watch what ICG do with the business next.

April 25 - Treefera, the AI-enabled data management platform focused on bringing transparency and accuracy to nature-based asset reporting - such as carbon credits and supply chain sustainability - announced a $12m Series A raise, led by AlbionVC. This raise comes just seven months after the announcement of the company’s $2.2m pre-seed.

Treefera is an exciting business in the ESG space that we’ve been tracking for some time, so it was unsurprising to see Albion make this significant investment. Albion Investment Director, Paul Lehair explains for himself on his Medium blog. See our previous post on Carbon Credit Rating agencies for more detail on the sector. Once again, this is a perfect example of how the explosion of data from LEO satellite constellations is driving innovation in Data & Analytics.

April 24 - ComplyAdvantage, a provider of financial crime intelligence, announced its acquisition of Golden (Golden Recursion Inc). Golden is a San Francisco-based innovator automating the construction of one of the world’s largest knowledge graphs, which shows interconnected data points and their relationships for the purpose of analyzing complex information.

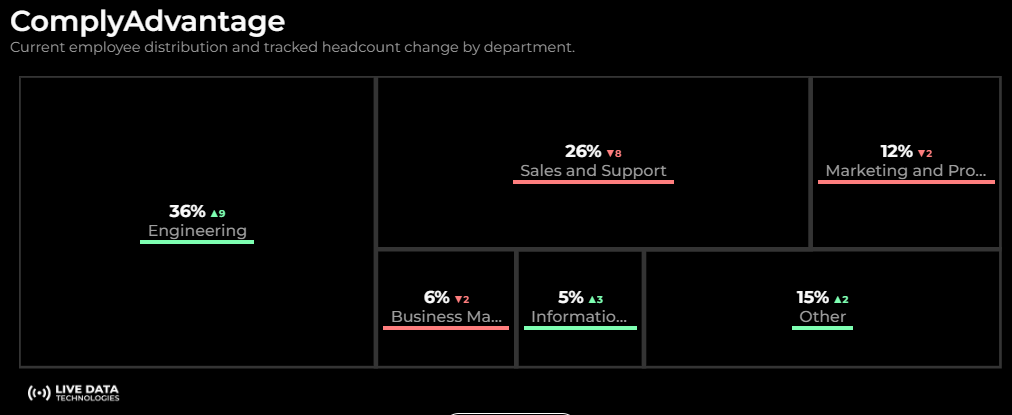

AML-focused ComplyAdvantage has been relatively careful with the $70m of investment it received back in May 2021 from Goldman Sachs. We believe that this is the only acquisition it has made since then. ComplyAdvantage has been using the cash to beef up their engineering team, as we can see from Live Data Technologies data:

The Golden acquisition dovetails nicely with that strategy.

April 23 - Clarivate announced that it acquired Global QMS, Inc., known as Global Q, a provider of cloud-based solutions that enable life sciences clients to automate regulatory reporting and compliance management.

A straightforward workflow solution tuck-in for Clarivate. As they say in their press release: “the workflow and reporting capabilities of Global Q complement the Clarivate Cortellis Generics Intelligence solution for Active Pharmaceutical Ingredient (API) tracking. The addition of these cloud-based solutions will serve to embed Clarivate into critical client workflows and enable the expansion of Clarivate services into new markets.”

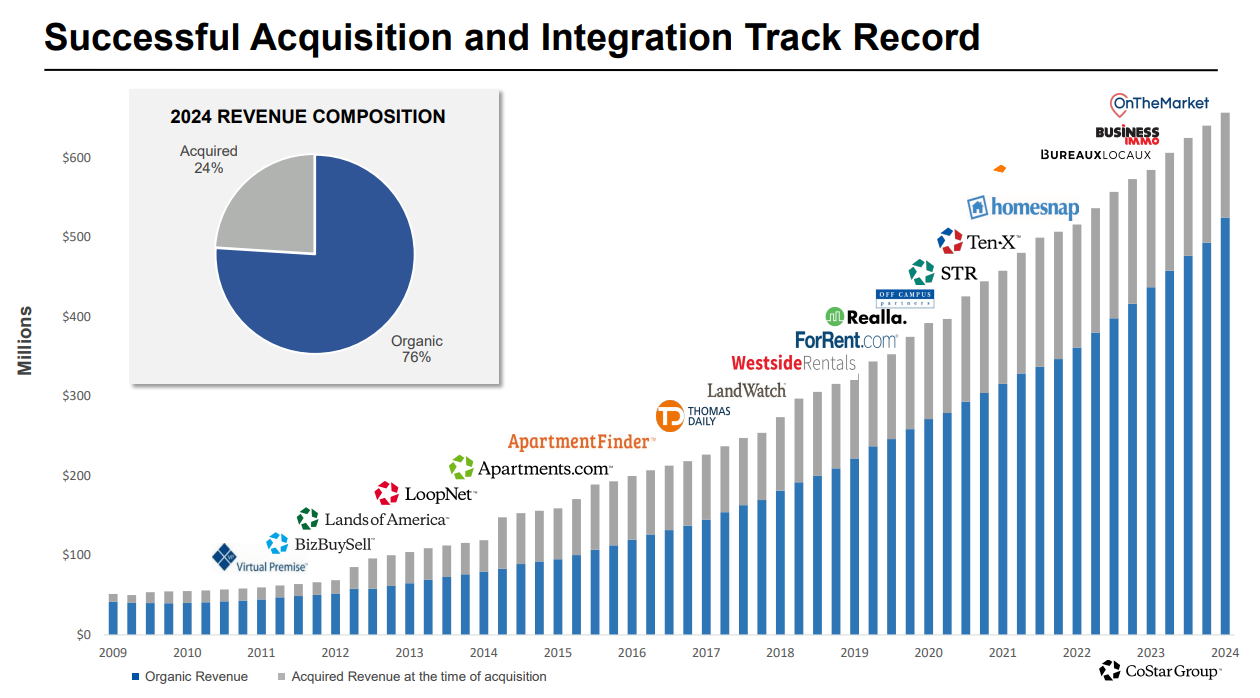

April 22 - CoStar Group, a provider of online real estate marketplaces, information and analytics in the property markets, announced that it has reached a definitive agreement to acquire all outstanding shares of Matterport in a cash and stock transaction reflecting an estimated $1.6 billion of enterprise value.

A very interesting acquisition - Matterport is a leader in capturing 3D information on the interiors of buildings, enabling 3D planning and virtual viewings. Matterport content was already integrated into CoStar’s consumer portals, and CoStar’s consumer division is a big growth driver. See their Q1 results presentation for more detail, including this analysis of the impact of their acquisitions over the years.

Motley Fool reports that “the terms of the deal were quite favorable for Matterport investors. CoStar values the company at $5.50 per share, half of which will be paid in cash and half paid in CoStar stock. This represents a massive 207% premium over Matterport's most recent closing price.”

However, the valuation is still down from Matterport’s massive $2.9bn valuation when it de-SPACed in 2021.

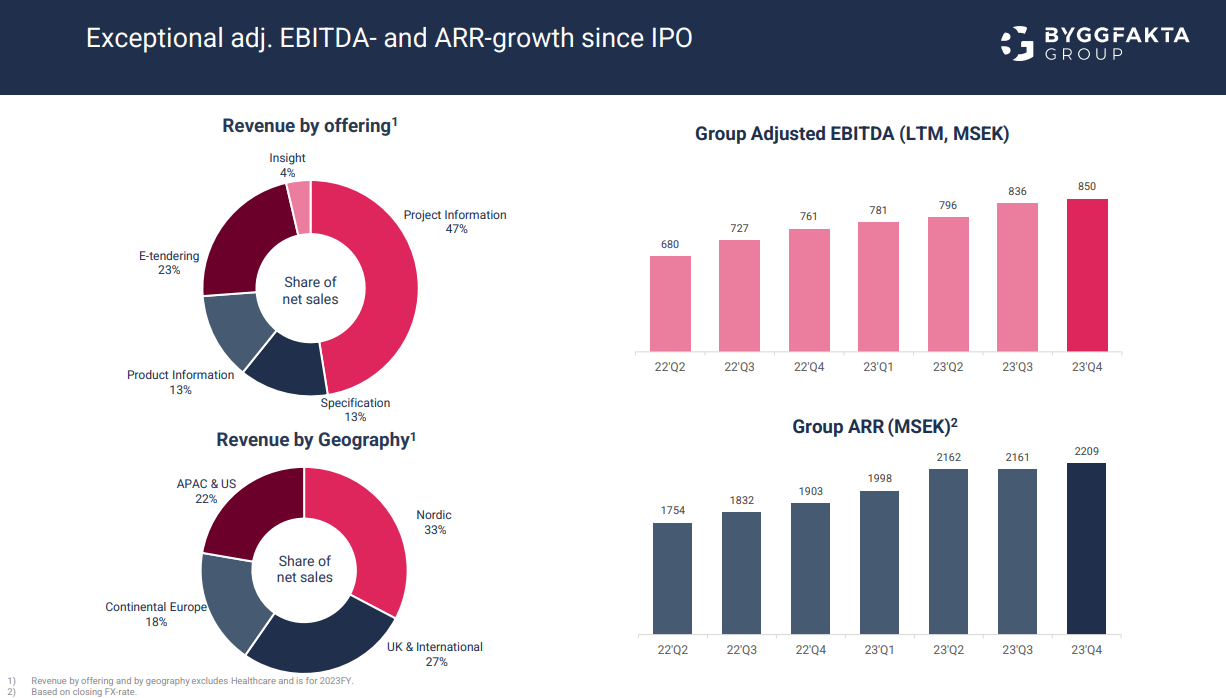

April 19 - Giant Sweden Bidco AB’s (“Giant BidCo”) public cash offer for BYGGFAKTA GROUP Nordic HoldCo AB (publ) (“Byggfakta” or the “Company”) was declared unconditional on 19 April 2024. Giant BidCo controls 99 per cent of the shares and votes in Byggfakta and has declared its intention to initiate compulsory redemption proceedings in respect of the remaining shares in the Company and has requested that Byggfakta applies for delisting of the Company’s shares from Nasdaq Stockholm.

This is the final stage of the take private of Construction Data & Analytics giant Byggfakta by Sterling Square and Macquarie Capital first announced in January.

Despite their history of steady growth, there is still more that could be done with Byggfakta - particularly in the US. Expect more acquisitions and organic investment.