$3bn EV SIX Group Financial Information is undergoing a strategic review - what might SIX decide to do?

TL;DR - SIX seems likely to spin off its Financial Information division, and make a transformative acquisition with PE backing in order to get scale.

If you haven’t already subscribed, join 684 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Late last week Reuters broke the news that Swiss financial infrastructure provider SIX Group is considering strategic options for their Financial Information division.

In the world of investment banking, this is usually code for “planning to the sell the business”.

But in this case, a spokesperson for SIX stated:

"There is no plan to sell the data business.”

Instead, Reuters’ sources suggest that the plan is to:

Create a new legal entity containing SIX Financial Information;

Acquire or merge it with another business, potentially with Private Equity backing;

Retain a majority stake in the new entity.

SIX Group CEO Jos Dijsselhof has long harboured ambitions to turn SIX into a Data & Analytics powerhouse.

In an interview with Financial News in 2022, Dijsselhof stated that there was “growing demand across the globe for stronger and better alternatives to Bloomberg and Refinitiv.”

And, in ruling SIX out of the acquisition process for Allfunds in March this year, Dijsselhof highlighted that more Data & Analytics deals were front of mind:

"Probably a data acquisition would actually have a higher priority than another exchange acquisition.”

In addition, the Reuters article notes that

Dijsselhof said SIX is in contact with private equity firms, including Allfunds' largest shareholder Hellman & Friedman, as it continuously scans the market for possible acquisitions.

The Reuters leak suggests that SIX are taking steps to get the scale required to compete with the larger Data & Analytics players.

Let’s take a look at SIX, and consider what the future might hold in store for the Financial Information division.

Who are SIX?

SIX is a mid-sized player in the world of financial plumbing, ranking behind players such as ICE ($9.9bn revenues in 2023), LSEG (£8.37bn revenues in 2023), Nasdaq ($6bn revenues in 2023), CME ($5.59bn revenues in 2023) and Deutsche Boerse (EUR4.34bn revenues in 2022).

SIX operates four divisions:

Exchanges - SIX operates the Swiss Stock Exchange and the BME Exchange - Bolsas y Mercados Españoles - in Spain;

Securities Services - provides post-trade settlement services, central securities depository services in Switzerland, Swiss land registry data services, and interbank clearing.

Financial Information - reference, pricing, corporate actions, and ESG data and regulatory services and indices;

Banking Services - processes mobile payment as well as credit card, debit card and prepaid card payments in Switzerland, Austria and Luxembourg as well as in many other European countries.

Although SIX makes its annual reports publicly available, it is not a public company - owned, somewhat like DTCC, by around 120 national and international financial institutions.

It may be that wresting ownership away from the likely conservative and lacking-in-inertia consortium of banks is at the heart of the rationale behind the current strategic review.

Moving the Financial Information division out of the rest of the business could enable management to a) remove some of the strictures imposed by the current governance structure; and b) bring in outside investment to finance a transformative acquisition.

The Artist Formerly Known As SIX Telekurs…

Until 2012, SIX Financial Information was known as SIX Telekurs, after the venerable Swiss stock market TV services, launched in 1961. SIX Financial Information is a lot easier for the international market to understand.

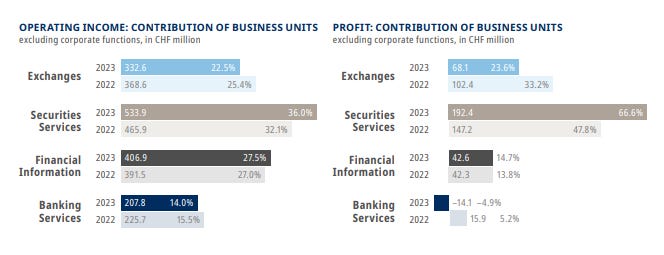

As the chart above shows, SIX Financial Information is the second largest division at SIX by revenue, but is lagging in terms of profit contribution. Presumably, this would be an area any PE investor would wish to address.

SIX Financial Information splits out as follows:

Reference data & pricing

Procurement, processing and distribution of reference data and pricing information. The business generates service revenues. Subscription fees are generally invoiced on an annual basis.

The main product, the Valordata Feed (VDF), is a source for reference and descriptive data plus corporate actions. VDF holds information on approximately 20 million financial instruments, drawing on over 1500 trading venues and contributors.

Market data & display

Procurement, processing and distribution of (real-time) market data and offers display products. The business generates service revenues. Subscription fees are generally invoiced on an annual basis. Royalties for financial data paid to stock exchanges are presented net in service income, as SIX does not control the service.

SIX Financial Information's market data products are real-time or delayed. The master database allows customers to link nearly 1,500 individual data elements across millions of active financial instruments. Services range from valuation pricing and real-time market data feeds to streamlined back-office products and all are used for improved straight-through processing.

Tax & regulatory services

Reference data required for local and cross-border regulatory and tax compliance. The business generates service revenues. Subscription fees are generally invoiced on an annual basis.

Indices

Financial Information provides index services by calculating indices and offering licenses for SIX indices. The business generates service revenues. Subscription fees for the index services are generally invoiced quarterly for variable fees and annually for fixed fees.

The division’s most recent acquisitions have doubled down on SIX Financial Information’s main areas of focus: fixed income reference data and indices.

In March 2024 SIX acquired FactEntry, a provider of fixed income reference data, analytics, and solutions;

In July 2021 SIX acquired ULTUMUS LTD, the international London-based index and ETF data specialist.

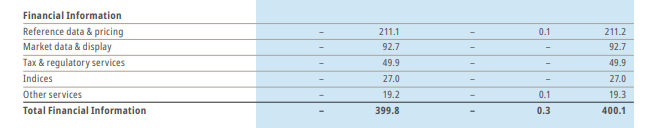

Revenues for SIX Financial Information break out as follows:

The indices segment jumps out as particularly underweight but, in truth, all segments (barring perhaps reference data) are smaller than they should be.

SIX Financial Information has recently begun providing ESG data, launching a new climate risk data offering, covering 33,000 companies, in late 2023.

If we assume that, given the low level of profitability of SIX Financial Information, it would trade on a lower multiple than the recent 13x revenues paid by BlackRock for Preqin - say, perhaps, 6-8x revenues - then the business would be worth roughly CHF2.4-3.2bn / USD2.8-3.8bn.

What companies might SIX Financial Information be combined with?

One imagines that CEO Jos Dijsselhof is looking at the transformation that has taken place at LSEG as a playbook for what to do next.

LSEG bought data company Refinitiv in 2019 for $27bn, bringing Blackstone and Thomson Reuters (who have now sold down their stake) onto the cap table.

Blackstone is a good analogy for the size of investor that it would make sense for SIX Financial to team up with - a competitor like KKR, Carlyle or Apollo would be a good fit.

And what might a PE-backed SIX Financial Information acquire?

It would not make sense, having removed SIX Financial Information from the exchanges, clearing and payments businesses, to then recombine it with another provider in those areas, like ICE, LSEG, Nasdaq, CME, Deutsche Boerse or Euronext.

A pure-play Data & Analytics or Data Management business, then, particularly with a focus Market Data / Reference Data, Indices or ESG.

Of course further bolt-on acquisitions are possible but, to really move the needle, any M&A targets would have to be several billion dollars in enterprise value.

That takes interesting potential acquisitions such as Five Arrows-owned Rimes Technologies out of the equation. Rimes was valued at approximately €800-900m, including debt, when Five Arrows acquired the business from EQT earlier this year.

Ditto Macrobond, for which Francisco Partners paid roughly EUR700m for in July 2023.

At the other end of the scale, MSCI, which is a perfect fit in terms of focus - covering roughly the same areas - is too large at $44bn market cap.

So what is in the goldilocks zone of $4bn-20bn? Here are a few ideas:

Fitch Group - would be an excellent fit, particularly with the Fitch Solutions subsidiary, which covers credit markets, credit risk and ESG. Hearst acquired the final 20% stake in Fitch Group from Fimalac in April 2018 for $2.8bn, valuing the whole entity at $14bn.

Morningstar - valued at roughly $13bn by the public markets, Morningstar owns a large amount of Market Data, plus Pitchbook and the Sustainalytics ESG ratings business.

AlphaSense - which recently reached a $4bn valuation and is making noises about an IPO, would be the right size. But is the more equity analyst-style research platform the right fit?

Factset - the same is true for this $16bn mkt cap listed business. Interesting, but not quite perfect.

Asymmetrix will keep a close eye on what happens over the months and years to come, and keep you abreast of developments as they happen.