When S&P Global’s CEO Doug Peterson talks, it’s worth listening

TL;DR - the straight-shooting CEO of S&P Global provides useful insights into their M&A strategy

Welcome to the 18 new subscribers who have joined us in the two working days since our last post! If you haven’t subscribed, join 234 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues you think may be interested. Thank you!

Doug Peterson, the CEO of S&P Global, was interviewed at the Raymond James Institutional Investors Conference 2024 last week. The video is only available to financial analysts but transcripts of the conversation are available.

Mostly you have to pay to access transcripts like this, but EdmundSEC is an invaluable tool that is currently making transcripts like this available at no cost.

Doug Peterson is worth listening to because:

Peterson is an unusually open CEO in his pronouncements;

He’s an astute veteran of the data industry;

S&P Global is a Data & Analytics behemoth:

You can learn a lot about the dynamics in Data & Analytics by studying their strategy;

They make a lot of acquisitions - if you own a business in one of their focus areas you may end up being owned by them;

S&P Global are active in multiple sub-sectors of Data & Analytics - if you own a business in one of their focus areas you will likely compete with them.

When I reviewed the transcript of the conversation five M&A related topics jumped out at me:

Detail on the Visible Alpha acquisition;

S&P Global’s divestment strategy (including the upcoming divestment of Fincentric);

S&P Global’s acquisition strategy;

The status of the IHS Markit integration;

What has happened to the Kensho acquisition?

So I thought I’d take the opportunity to dig into them for your edification.

Skip this section if you know all about S&P Global and Doug Peterson

I don’t want to hijack this piece with an in-depth analysis of S&P. If you really want to dig into the business, I recommend reading the S&P Global Investor Fact Book, published September 29, 2023. But I’ll provide a quick summary as background.

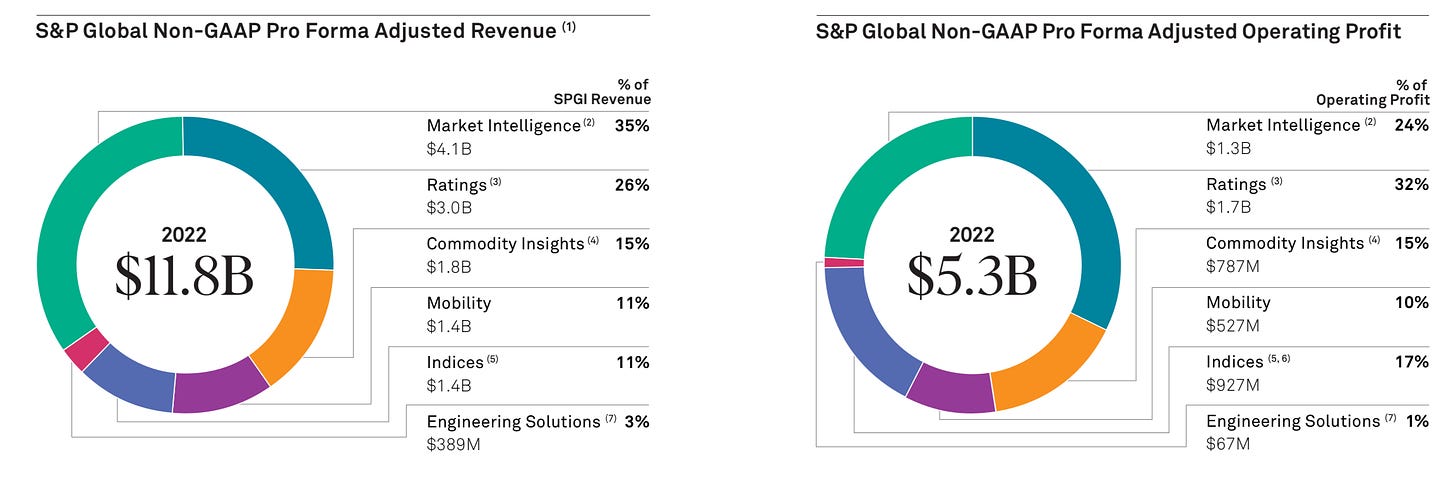

S&P Global is a $134bn market cap information giant, split into 5 divisions:

Market Intelligence - provider of financial and industry data, research, news, and analytics to investment professionals, government agencies, corporations, and universities. S&P Global Market Intelligence was born from the integration of S&P Capital IQ and SNL Financial in 2016;

Ratings - provides independent investment research including ratings on various investment instruments;

Commodity Insights - provider of information and a source of benchmark price assessments for the commodities, energy, petrochemicals, metals, and agriculture markets;

Mobility - provider of automotive data, analysis and insights;

Dow Jones Indices - world's largest global resource for index-based concepts, data, and research. It produces the S&P 500 and the Dow Jones Industrial Average.

S&P Dow Jones Indices calculates over 830,000 indices.

[The Engineering Solutions business was sold to KKR in January 2023 for $975m and now known as Accuris.]

Doug Peterson’s bio on the S&P website reads as follows:

Doug Peterson has served as President, Chief Executive Officer and a member of the Board of Directors of S&P Global since 2013. He joined the company in 2011 as President of its credit ratings business.

Mr. Peterson has repositioned S&P Global to power the financial markets of the future with data, analytics and benchmarks. Under his leadership, the company has steadily made investments in people, international expansion, cutting-edge technology, innovation and environmental, social and governance, or ESG, solutions. In February, 2022, S&P Global completed a transformative merger with IHS Markit to create powerful new insights for customers.

Before joining S&P Global, Mr. Peterson was the Chief Operating Officer of Citibank, Citigroup’s principal banking entity. Over his 26 years at Citigroup, he served as Chief Auditor, CEO of Citigroup Japan and in leadership roles in Latin America.

[S&P Global experts - you can start reading again now!]

Detail on the Visible Alpha acquisition

S&P Global announced the acquisition of Visible Alpha in February this year.

According to the FT, Visible Alpha, a provider of consensus estimates formed by a consortium of 12 banks in 2015, was generating nearly $100m in revenues and valued at around $500m when S&P Global acquired it.

Peterson explained that the acquisition strengthens both their data and their relations with those 12 institutions:

Visible Alpha is a fantastic franchise. It's a strong business. And it's also -- was started by 12 banks. There's 178 organizations that contribute their estimates. And the estimates are detailed down to the division level and even deeper than that, sometimes at product level.And we knew that, that kind of must-have data was a great fit for S&P Global. And we have really strong relationships with all 12 of those banks, which means that we'll continue those relationships. It gives us a way to have a strong market network.

They identified the need to make the acquisition in 2023:

If I go back to June last year, we delivered for Cap IQ Pro an upgrade and an update, which was something that we've been waiting for, actually a couple of years, we've been planning for it. This was almost like an overhaul of Cap IQ Pro. It took what was already embedded in the workflow of so many analysts, but it added in new features, new datasets that came from IHS Markit, new datasets we've been building over the years. It also added new features for plug-ins, for downloads, graphics, visualization tools. And as we looked at that, we said, "Well, what are the other datasets? And what are some of the opportunities we have to continue to enhance Cap IQ Pro? " That doesn't mean that Visible Alpha is going to only be plugged in through Cap IQ Pro. But we looked across what are the datasets that people like you need to do your job. And we want you to stay within the ecosystem of S&P Global. And the estimates is something that people use. And I knew that a lot of people are using -- in fact, our own people inside of S&P Global were having to use -- need Cap IQ to go get estimates somewhere else. We said this is a really -- it's unfortunate that we don't have that capability.

Somewhere in S&P Global HQ there is a strategy document showing what other gaps need plugging. It would make fascinating reading!

S&P Global’s divestment strategy (including the upcoming divestment of Fincentric)

Buried in the press release for the Visible Alpha acquisition, and somewhat lost in the noise, was the announcement that S&P Global are planning to divest Fincentric. Fincentric is the old Markit Digital business, which S&P acquired when they purchased IHS Markit.

Fincentric is S&P Global’s digital solutions provider focused on developing mobile applications and websites for retail brokerages and other financial institutions. Fincentric specializes in designing cutting-edge financial data visualizations, interfaces and investor experiences.

Peterson reiterates that this divestment is upcoming, and obliquely explains the criteria they apply when considering what to sell:

So we also look at what could be cash that could be generated as well.

So we look at cash flow. I'm a cash guy, I love cash. It's something that we spend time on looking at.

We also look at things like, believe it or not, receivables and days in receivables. Are we having any pockets of weakness of generating cash or getting paid back? So cash flow is critical for us. We do have our treasury organization CFOs across all the divisions. They have metrics around cash conversion.

And so we have an approach to making sure we have strong cash conversion. It fits in with our budget and our planning. We measure it on a quarterly basis. And then it fits into our broader capital allocation program, the 85% to return in S&P Global is our target and 15% to redeploy in the business. If we don't have something to redeploy the 15%, we'll use that to also return to our shareholders.

It’s not a surprise that S&P Global are selling off a services business - it’s not a good fit with their overall business model, despite the fact that Fincentric serves the same customer base. It would be a good fit for IDX (formerly Investis) backed by Investcorp.

S&P Global’s acquisition strategy

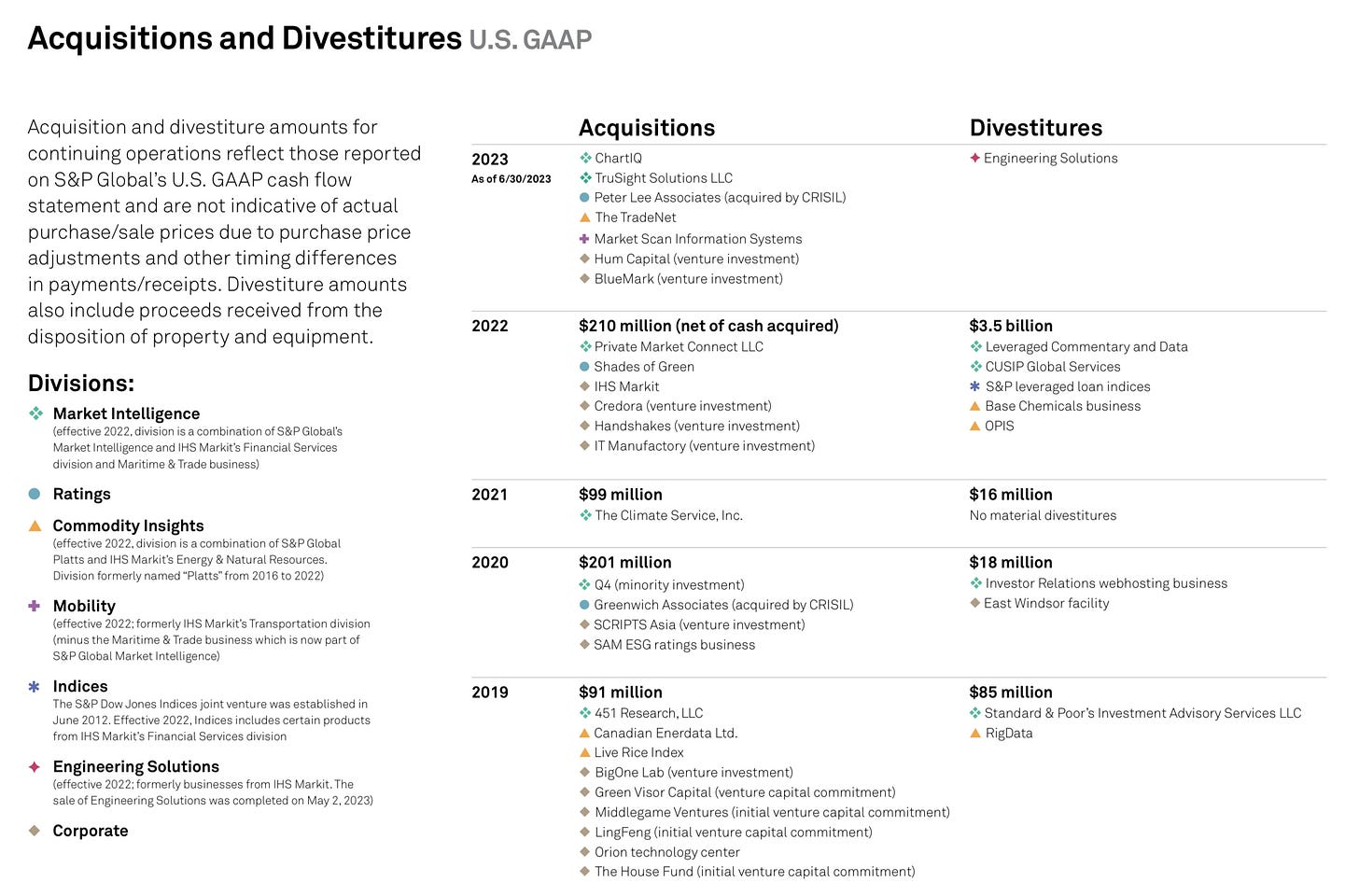

S&P are an acquisition machine. Take a look at this slide from their Investor Fact Book from last year to get an idea of how acquisitive they are across their business:

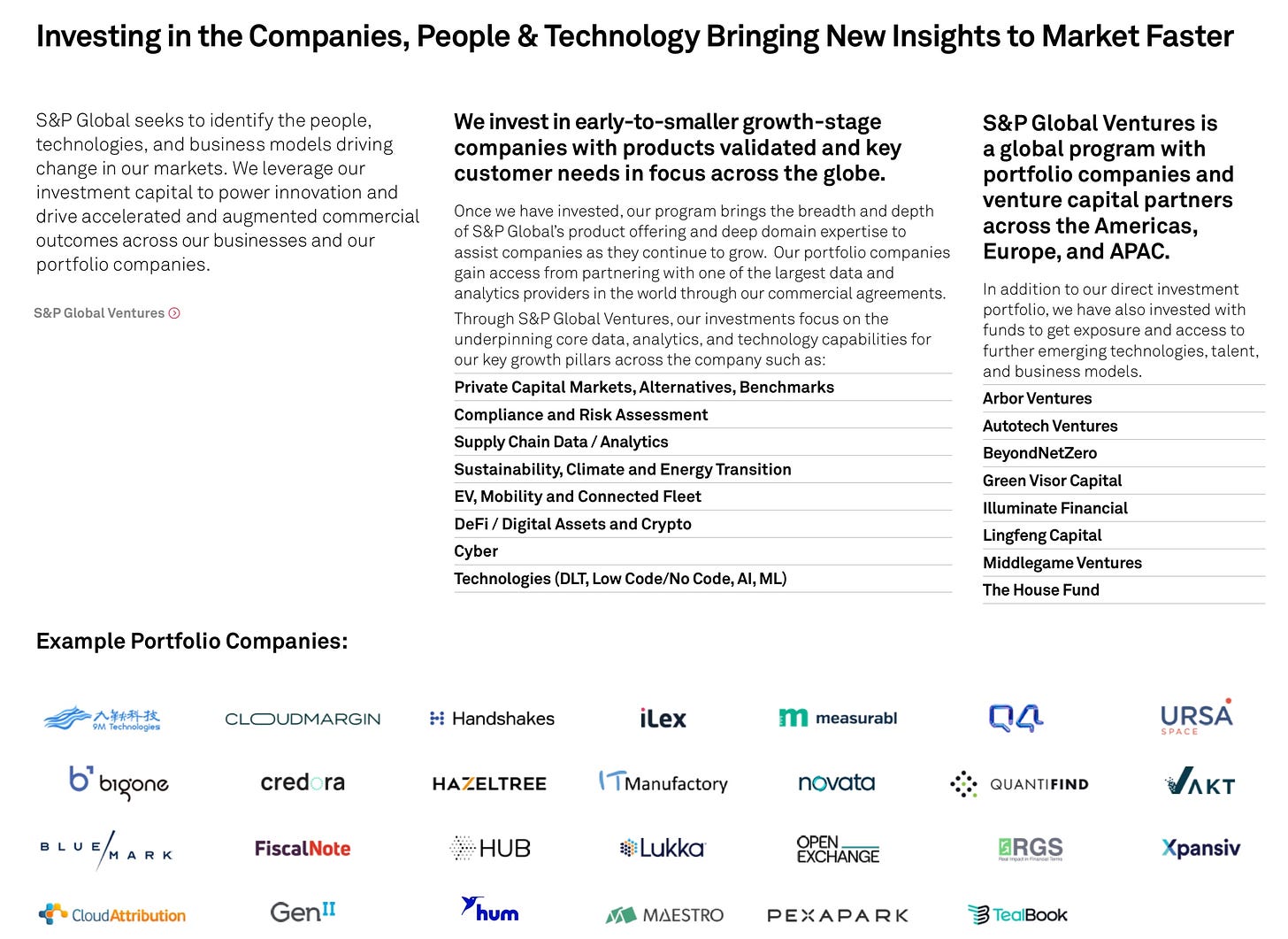

S&P Global are also making venture investments via S&P Global Ventures. As we’ll see later on from the Kensho analysis, this is a great way to learn more about businesses in advance of a potential acquisitions. The portfolio of investments makes fascinating reading:

At the conference last week, in response to the question:

So what makes a business a great fit for S&P? And what makes a business not a great fit?

Peterson replied:

We start with some of the elements I've already spoken about of S&P Global. And that has to do with taking advantage of the brand. It's about scale. It's about leadership position in your market, which means that you're in the top 1 or 2, 3. Remember, that all Jack Welch thing at GE days that if you wanted to have a great business at GE, you had to be at the top of your market, of your field. And we want to make sure it's global. And it needs to be in the data and the research analytics business.

Now that's a general framework for how it fits in S&P Global. But let's take one click down.And it has to do with customer and customer impact. Are we providing must-have information and must-have data for customers? Now does that data, does that flow, link with other parts of the business? Or sitting around the table with the management team, do we have things in common with what are applications we're going to be using for our customers, for the markets? Are we going to be able to leverage that expertise across the entire group?And then finally, we look at top line growth. We look at margins. And we want to make sure that we're a growth company, that we're delivering margins and that we can find ways as a company overall that this will be the philosophy that -- how we run it.

In summary:

Data & Analytics business!

Global;

Market-leading position - top-three business in its sector;

Must-have information;

Fit with S&P Global:

Customer fit;

Fit with existing product set;

Ability to leverage a business across the whole of S&P Global;

Revenue growth;

Positive impact on S&P Global margins.

This is not a bad checklist overall for analysing most businesses in the Data & Analytics sector. We’ve discussed this in previous posts when looking at what drives value. See this post on how to convert a Consultancy into a Data & Analytics business for detail.

And if you think your Data & Analytics business is likely to be a potential target for S&P you should definitely align your key performance metrics with Peterson’s acquisition criteria.

The status of the IHS Markit integration

As the above screenshot showed, while many firms would suffer from indigestion after an acquisition the size of IHS Markit, S&P Global barely missed a beat.

Peterson explains that they have been making progress on the integration (I’ll spare you his analysis of the back-office elements) and highlights the growth potential of the tie-up.

Now what's exciting is taking this revenue synergies, getting everybody to focus on revenue, on growth, tie up some of the loose ends on some of the operational aspects of the deal but keep everybody focused on what do we bring together that makes S&P Global stronger with IHS Markit as part of it. And this is where we see a couple of examples. Last year, we took within the Commodity Insights business, Platts Dimensions Pro, which is a platform for the Platts commodity business, along with IHS Markit's Connect platform. We put those together, and we now have an unparalleled -- there's nobody else in the market that has a commodities desktop like we do with everything from analytics, from benchmarks, from pricing to forecasting to news. This is something that is a new product. It's one of those promises of the merger.

Another one was capabilities we brought together called Power Evaluator between Market Intelligence and Commodity Insights for the power industry to bring together these tools that we couldn't have done before without having this merger.

So there's so much more of this to come. We're really excited about the opportunities. And this is now shifting our focus to clients, to the markets. Not to say that we weren't, but now the entire organization can get past this detailed integration that we're working on.

This emphasis on the Energy & Commodities businesses is interesting. Lost in the shuffle over the last few years is just what a beast the old IHS business was in this sector. Back in the 2010s at Quayle Munro we sold near double digits of Energy & Commodities businesses to IHS. Putting this together with Platts has created an industry giant. I would expect to see more acquisitions here as they expand its capabilities in what is an incredibly lucrative sector to be in.

What has happened to the Kensho acquisition?

Back in March 2018, S&P Global acquired Kensho for $550m in what was then “the largest price on an A.I. company to date.”

The whole Forbes piece, including an interview with founder and CEO Daniel Nadler is still thought-provoking reading in these days of AI fever. There’s a long interview with the CEO of Thomson Reuters, Steve Hasker, in today’s FT about their plans to spend their $8bn war chest on AI solutions in the Legal and Professional Services market.

As a close tracker of this space, I remember feeling back in 2018 that the Kensho acquisition was a seismic event. It felt like a lot of money to spend. There was a sense that either S&P had bought something totally transformative or that it was going to prove to have been expensive.

Peterson’s comments last week are inconclusive.

The AI that we bought with Kensho was more like traditional machine learning and artificial intelligence. And now we're moving into a world of generative AI. But because we have over 100 dedicated, really talented, high-quality people that work in Kensho, they even haven't been sitting still for the last 6 years. They themselves have become experts in gen AI. But let me go back to the original decision 7 years ago to put some A round and B round capital into Kensho, which was a startup that's focused on data and analytics using AI for financial markets. We weren't the seed investors. The seed investors were some banks and a couple of AI experts in Silicon Valley. We came in, in the B round and in the C round. And as we learned what they were doing, we developed two core thesis, and this was 6 years ago. One was that all of us, everybody in this room and everybody that we work with, would -- their roles would be enhanced by artificial intelligence tools.

Our hypothesis was that we weren't going to be replaced, but we would be enhanced, that what we did would be able to be automated, we'd be able to move faster, you can get more information synthesized, you could get better visualization tools, et cetera, through AI. And the second is that AI, in order for it to be successful, you had to have a really strong data platform. Data had to be clean. It had to be able to be linked.

And so over the last 6 years, we played that out. And Kensho brought to us a whole set of tools. And many of them, you can actually get on our Marketplace, like Scribe or Link or NERD. And these are tools that we built internally that now we monetize to the markets, which are used to manage data or to take what would be voice and turn it into digitized text, which then can be managed, it can be analyzed, it can be -- you can use it in ways to build completely new services around it. We came up with ways to extract data from PDFs that allow you to do new kinds of analytics.

Now the reason I gave you such a long answer is that we believe that AI to be successful, especially generative AI, you have to have data, which is clean, it's linked, that you can tokenize so that models can ingest it to use it for the large language models.

Now last thing I'm going to say is we put in place a governance structure, which starts with cleaning our data and protecting our data. We want our data to be used inside of S&P Global, inside of our firewalls, not out. And we have on top of that a layer of Kensho, Kensho oversight of data tools, of data linking tools.

We have a centralized approach to how we're looking at models. We're not linking up with one single provider. We're working with everybody that's building models. We're testing them.

We have an approach to understanding what are the best models. And then internally, as people want to start using models, they can go to this model garden and understand which one is going to give the best capabilities for what they're trying to get from that. And then we have an approach right now, I can't give you any numbers, but we believe over time, this is going to enhance our revenues, the ability to have higher retention rates, sticky -- more stickiness in our products, hopefully some pricing power and then some productivity, especially when it comes to things like generating code, generating language, et cetera.

So this is our vision. We're moving very fast. We're very pleased. And we believe that with Kensho as part of S&P Global that this gives us a base that we start from a very strong position.

In summary:

The Kensho AI technology they acquired in 2018 has now been surpassed by Generative AI;

But the smart people at Kensho have developed GenAI chops;

Internal tools developed by Kensho for S&P Global teams have been turned into products for S&P Global customers;

The Kensho acquisition has sped up their ability to handle unstructured data;

Better analytics and integrated AI has the potential to improve revenues and retention rates through stickier products and improved pricing power.

If you found this post useful please do consider sharing it with others. Thanks!

And please do sign up if you’re not already a subscriber.

I’ve found the following interesting reading and listening in the last week:

Must-read analysis by Robin Wigglesworth in the FT of the Norwegian oil fund’s petitioning of the government to allow them to invest in Private Equity;

Thought provoking podcast interview with Chris Dixon, a16z crypto founder and Managing Partner and author of the new book Read Write Own: Building the Next Era of the Internet. The two discuss their writing, the history of their shared interests, the emergent properties of decentralized networks, and how the internet has changed from its origins up to today;

UK Data & Analytics veteran Rory Brown brought Collingwood Capital’s presentation on “What is value and how can B2B media entrepreneurs unlock it?” to my attention on LinkedIn. Compulsory reading for Data & Analytics business owners;

Great Wired analysis of how advertising data can be used to track individuals on an incredibly granular basis;

New Statesman plea on a topic dear to my heart - sorting out WiFi on UK trains. I would argue that the bigger issue is that the mobile networks don’t seem to give two hoots that their service covering the UK transit infrastructure (both road and rail) is abysmal, but I agree with Daniel Susskind in spirit;

Lots of great insight into AltData in the latest instalment of

and ’s podcast: