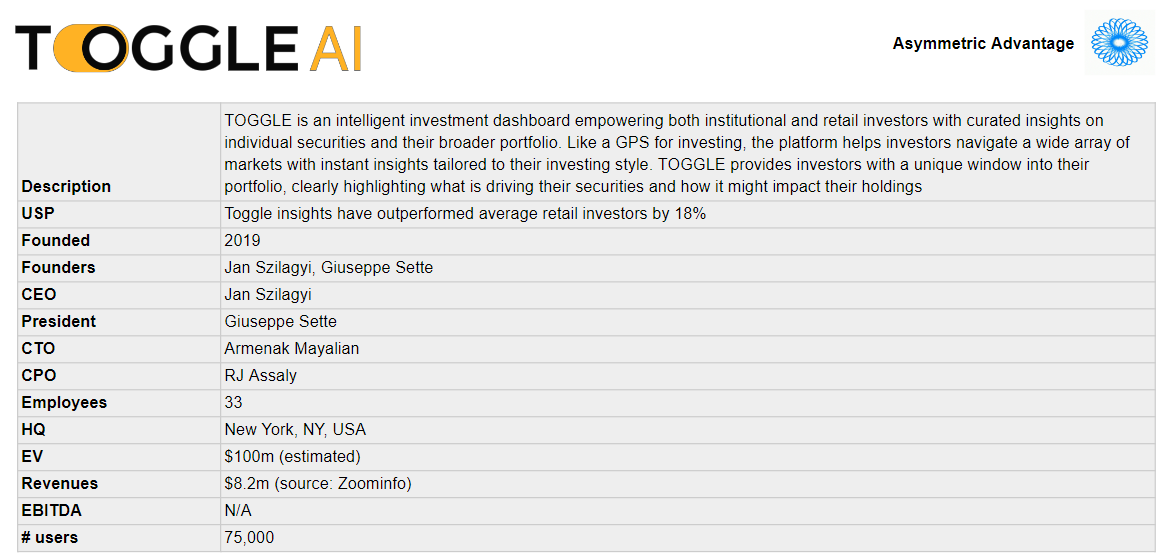

Toggle AI - an AI Copilot for Retail and Professional Investors

TL;DR - AI-driven Data & Analytics to help make sense of the "IKEA of financial information" available to investors

If you haven’t already subscribed, join 438 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Introduction

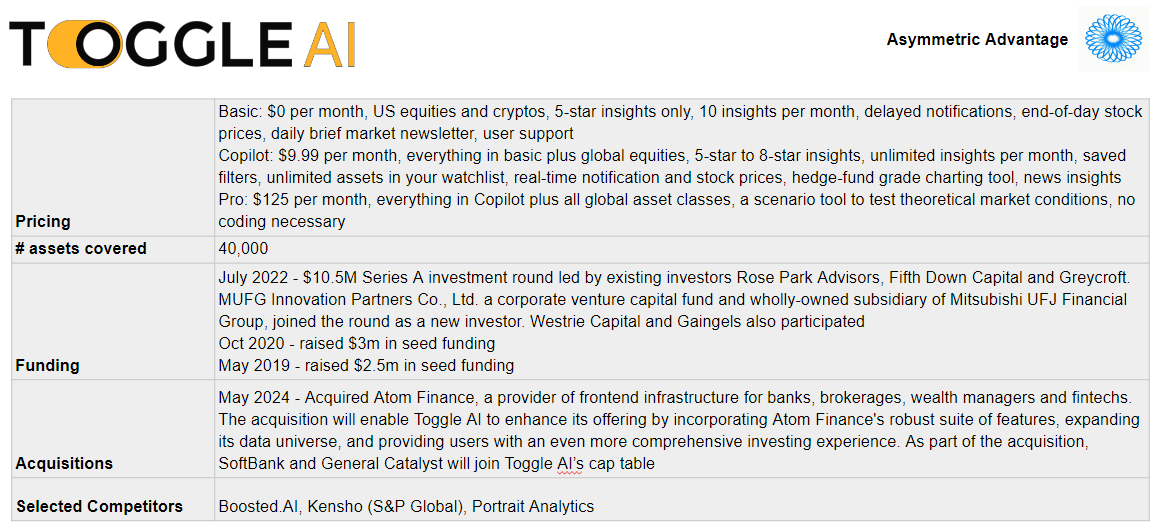

Toggle AI appeared on our radar last month when they acquired the assets of Atom Finance. We flagged the transaction in our weekly Data & Analytics M&A round up as follows:

May 15 - Toggle AI, a provider of artificial intelligence solutions for investing used by hedge funds, banks and brokerages, announced they are acquiring Atom Finance, a provider of frontend infrastructure for banks, brokerages, wealth managers and fintechs.

Toggle AI provides an AI tool for querying market data, enabling non-technical users to access financial information. Atom Finance provided data querying and visualisation tools for similar datasets. It’s hard to tell exactly from the outside but something about this deal says that Atom may have been in need of a home…

Perhaps most interesting feature of this acquisition is the fact that SoftBank and General Catalyst, both prominent players in the venture capital landscape, will join Toggle AI’s cap table.

Greycroft were already investors in Toggle AI.

We’ll keep a closer eye on Toggle AI going forwards.

Last week we asked you which of 10 companies you would like us to analyse next, and Toggle AI came out in second place (behind Amberdata, which is coming very soon).

So here we go.

Origin Story

“Data does seem to be available. It is just scattered all over the place.”

- Toggle AI CEO, Jan Szilagyi

With a BSc and an MSc from Yale in mathematics and economics, and a Harvard Economics Ph.D. in quantitative finance, earned in a record two and half years, Jan Szilagyi was never going to move slowly.

In his own words:

Right after I finished my Ph.D. in Economics, I went to work for Stanley Druckenmiller at Duquesne [Capital] before eventually becoming co-CIO of Global Macro at Lombard Odier. This is where I met my future co-founder Giuseppe Sette and together we dreamed up an AI-powered market analytics platform that we could chat with as we would a junior analyst, monitor the markets around the clock for us and answer standard investment questions. This idea was really born from our day-to-day work needs where we saw the struggle of keeping up with the ever-mounting piles of financial data.

In 2019, Szilagyi and Sette founded Toggle AI, with Druckenmiller the first investor, to do exactly that.

What problem does Toggle AI solve and how?

The internet, web and social media means that tradable information is everywhere. Everything is signal. Professional traders take advantage of this information asymmetry to gain an advantage over the rest of the market.

But what about the average investor? How can they compete?

This is the problem Toggle AI solves, for both retail and professional investors.

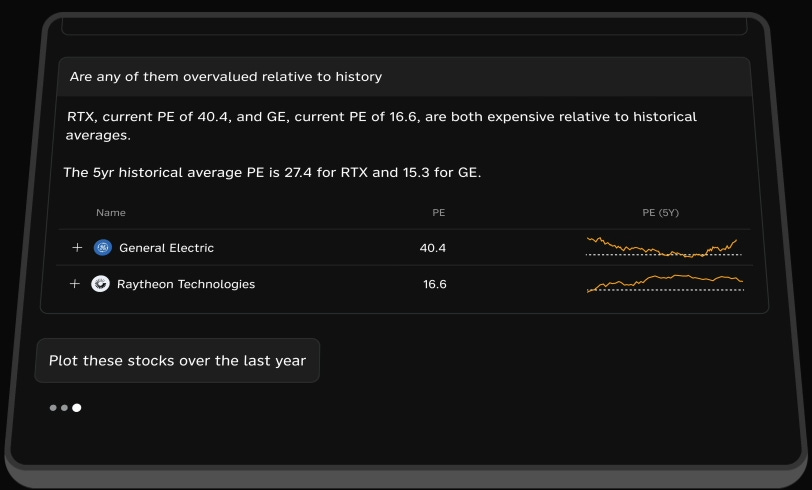

Toggle AI ingests data from a range of different sources, adds it their LLM/knowledge graph, and then presents the findings as tradable information via their ToggleChat interface.

The result, according to Toggle is

A personal laboratory, where you can put all your hypotheses to the test using natural, simple language. You can test 40,000 assets or even ask questions about groups of assets – without ever having to code or open a spreadsheet. Simply ask a question and put Toggle Terminal to work.

Toggle AI call the resulting datapoints “Toggle Insights”, and claim that by using this data, Toggle AI retail customers have outperformed the retail investor market by 18%.

Reading between the lines, it appears that Toggle can help the investor to:

Identify potential trades;

Anticipate timing and direction of trades;

Mitigate risk

Even in larger numbers and across different periods, TOGGLE insights demonstrated remarkable robustness: the drivers TOGGLE highlighted anticipated the timing and direction, if not always the magnitude, of the subsequent price move.

Across nearly 1,800 trades - the confidence intervals TOGGLE includes in its charts served as a guide for stop loss and take profit. That element of risk control created a very clear fat tail to the positive side: virtually no trade lost more than 16% during the period when the S&P 500 dropped 30%.

This is clearly valuable data. And the democratisation of access to tradable insights. through the user-friendly AI interface that Toggle enables, has the potential to increase the intelligence of trades made by a wider proportion of the market.

How does this work in practice? Szilagyi gave a practical example in January 2021 in an interview with the Interactive Brokers podcast:

So one of the things that the system will do for you is it doesn't just parse through financial data such as earnings or endless expectations and so on, but it also on your behalf reads and processes news, news articles.

And so recently there was an interesting example where you take a company like Disney, and a company like Disney will have literally hundreds of articles published about it on a regular basis because people will either talk about the movies that have come out or the streaming and this and that. And so the system picked up that there have been some articles that noted that actually, interestingly, Disney had started really aggressively discounting its streaming services.

Now, at the time, the stock was rising, doing really quite well. This was a few weeks back and it was coming up to their earnings announcement as well. Now, what happened in the end is on the earnings call, they reported a very disappointing number of new subscribers.

And so the stock in the aftermath tanked, it was down 20% to 25% in the aftermath. And so a user that would have been plugged into Toggle would have seen these articles highlighted as incrementally negative for the stock. It didn't take very much or a lot of experience for a trader to connect the dots and say, well, hold on a second, one of the things that is really riding on this earnings call is what the new number of subscribers will be. The fact that they seem to be doing all of these aggressive promotions suggests that they may be desperate and really trying to get that number up to a certain point not to disappoint.

And so maybe you would have reacted, maybe you would have scaled down your position and so on.

So those catalysts can be really buried in the mounds of news that are out there, but AI can bring out certain very critical, critical components to that news and make it rise to the surface. I know that Disney has been very, very focused on its streaming services as opposed to, I suppose, the pandemic having hindered a lot of its more physical types of activities like going to the theaters or even its theme parks, I suppose. So that's really incredible that AI is able to sift through so much information to bring out a kernel of it that could be most important to a trader's decision.

Toggle’s current position

It’s not clear what the split is, but Toggle has both institutional and retail investor customers. Here’s Szilagyi again:

Interestingly enough, we started as a product for institutional investors, but by the time we were ready to build out our office, we also found ourselves in the throes of a global pandemic as well as the retail investor boom. We built new areas of our business, including a retail version of our software while continuing to build out our suite of tools for professional investors.

At the end of the day, the pitch is the same. Toggle AI offers institutional-grade analytics to help you become more efficient. For institutions, it means empowering your analysts, advisors, or brokerage clients to make better, more-informed trading decisions.

It appears that, although they have data on a variety of asset classes, the focus is on enabling trading of equities and crypto (using Coin Metrics data). If we can get verification of this at a later date we will come back and update this post.

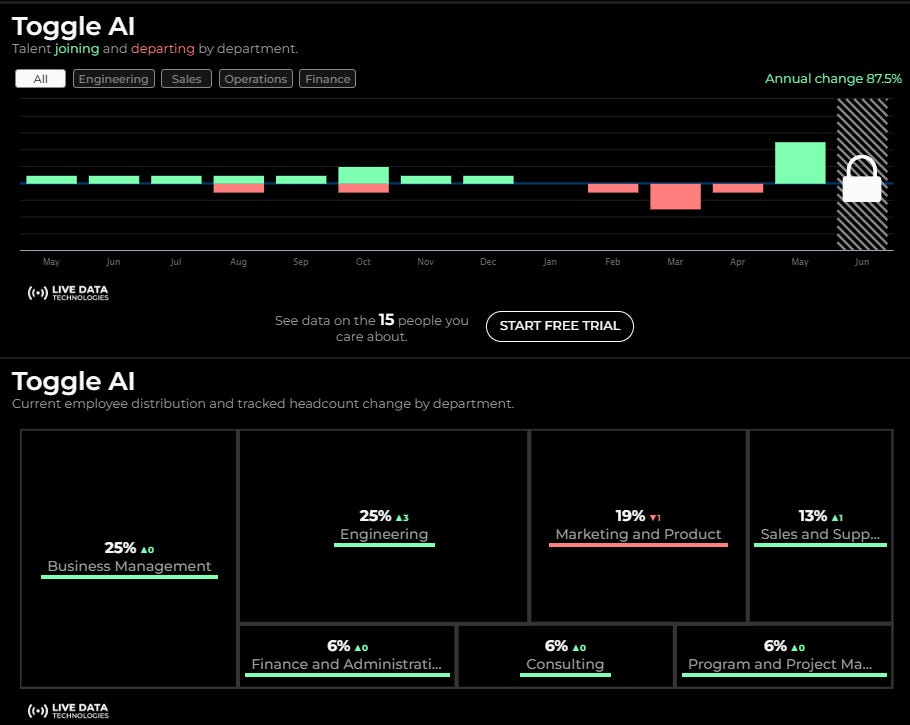

Toggle is clearly on the right track - according to Live Data Technologies they bucked the trend for Tech layoffs in the last year:

And they have added 63 Atom Finance team members on top of this through the May acquisition.

What next for Toggle?

There is plenty of scope for product development for Toggle.

In the aforementioned podcast, Szilagyi explained that they consider providing general tradable datapoints to be just phase one of the project.

Looking forward, our phase two will be much more around the entire portfolio. So once you've now put together these individual trade ideas into a collection that you call your portfolio, the system will be able to generate insights about whether or not your portfolio as a whole is vulnerable potentially to the rise in inflation that we're seeing and the subsequent rise in short-term rates. Is it vulnerable to a potential rerating in PE multiples across the entire market and other types of systematic risks?

The third phase in this journey to becoming really the kind of the intelligent dashboard that users can connect and use with their brokerage is analyzing your trading style. And I think this is going to be possibly the most challenging, but also really a very rewarding stage where you will be getting real time feedback on what parts of your trading style may actually be responsible for your wins and what other habits might be responsible for your losses.

To give you a concrete example, the system might say, look, you tend to really be quite good at picking stocks, but you're very bad at selling them. And what I mean by this is that the stocks that you pick generally outperform the overall market, but it turns out that you're very slow in selling your losses. In other words, by the time you panic and get out, the stocks have generally already bottomed and you end up offsetting a lot of your gains by driving these losses to numbers that just are unacceptable.

And so you might look back and be like, okay, so I'm somebody who panics too late. Maybe this is something that I can do. I can have tighter stop losses and so on. Or maybe the system says, you're really good at trading technology stocks, but you're rubbish at trading industrials.

And so again, it's just something where you get an objective picture, a little bit like people like Fitbit or any of the others, any of these other wearables that have become very popular. And you are getting a real time feedback on your habits that you can say, oh, you know what, I'm going to make a tweak here. Maybe I should walk a little bit more every day and so on. So that would be the kind of the final phase.”

In addition, there is the possibility that Toggle could be adapted or optimised to enable users to trade other asset classes.

And Toggle will only become useful as the LLM and knowledge graph grows through the addition of more data.

More acquisitions seem unlikely. The acquisition of Atom Finance in May seemed opportunistic (the business had seen 55% of its team leave in the prior 12-month period, so something was awry) and potentially more of a convenient acquihire of management, engineers and high value investors than an expensive bolt on.

In addition Toggle does not need to buy data assets - its model is to license them - which removes one area for deals that many Data & Analytics providers pursue.

And where is the likely exit?

We imagine that all the major financial data providers and trading venues will be looking at Toggle and licking their lips.

Their current data partners, Refinitiv (owned by Microsoft-backed LSEG), Nasdaq and Interactive Brokers are indicative of the type of strategic interest they are likely to attract. We would also expect Bloomberg (could Toggle spell the end of HELP HELP?), soon-to-IPO AlphaSense, and S&P Global also to be in the mix.