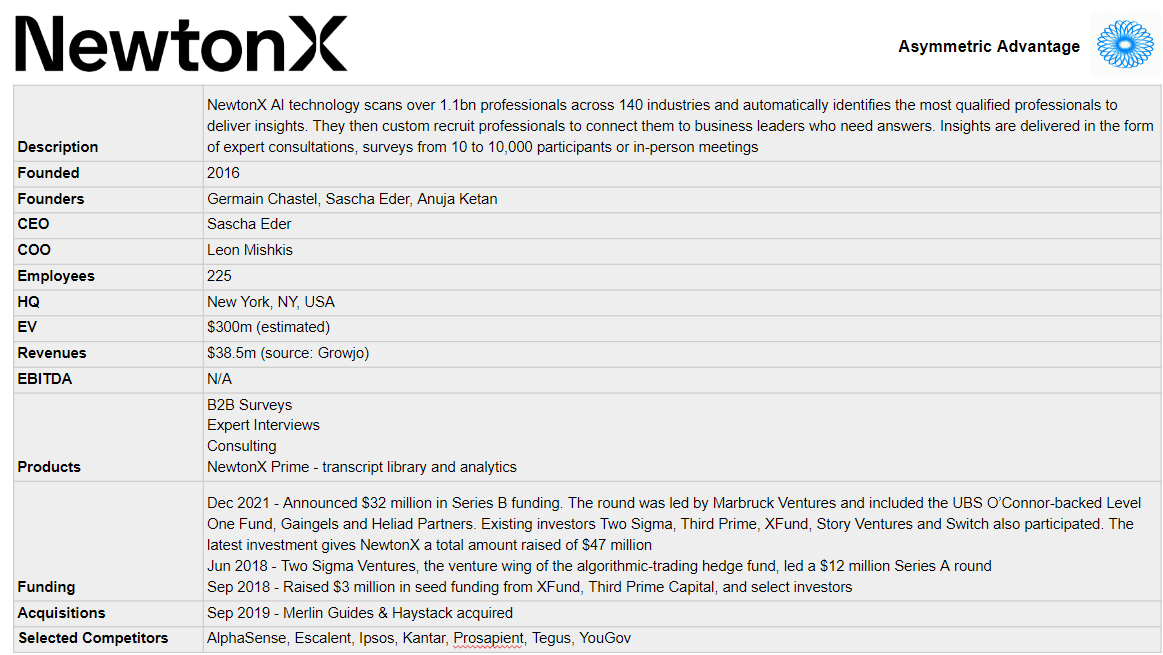

NewtonX - $300m AI-Driven Hybrid Market Research / Expert Network / Data & Analytics Provider

TL;DR - The future of Expert Networks and Market Research lies in AI-driven participant selection and Data & Analytics

If you haven’t already subscribed, join 351 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

One final ask. After three months and 18 posts about Data & Analytics, I’d love to know more about you and your reading habits to help inform what I write about next. Please complete the following one-minute survey. Thanks!

Is it a market research business? Is it an expert network? Is it a Data & Analytics business?

No! It’s NewtonX.

Hybrid businesses, sitting at the intersection of a number of different areas, are intriguing.

You can tell when you’ve found one because if you show it to experts in each separate field they all see their own specialisms in it.

If executed correctly they can have a disruptive impact on a number of industries, and are attractive investment propositions.

NewtonX jumped out at me for these reasons. Worthy of further investigation…

Origin Story

Two of the three cofounders of NewtonX were McKinsey consultants. Consultants are heavy users of both expert networks and market research panels.

Sascha Eder, now CEO, says that:

While at McKinsey, we were systematically frustrated by the lack of quality, overall speed, and cost from third-party vendors for sourcing insights for our clients. After conducting hundreds of consultations and surveys for Fortune 100 companies without finding the right solution, we decided to create NewtonX to tackle the pain point of B2B market research.

At NewtonX we innovated on an outdated process with an “open-network” approach. Our AI-technology scans over 1.1 billion professionals across 140 industries and automatically identifies the most qualified professionals to deliver insights. We can then custom recruit hundreds of thousands of professionals daily to connect them to business leaders who need answers. Insights are delivered in the form of expert consultations, surveys from 10 to 10,000 participants or in-person meetings

How are they disrupting Market Research?

NewtonX sees their giant dataset of experts as the key to gaining market share in the B2B market research industry:

The future of B2B market research is not a better B2B panel, but a vast network of professionals that expands and evolves to meet the demands of a business world marked by radical change and innovation.

But what, exactly, is B2B market research? Put simply, B2B market research is conducted to inform decisions about transactions between businesses. The customers are other companies. When a company performs B2B research, they’re usually looking to accomplish one or more of the following:

Learn about the experiences of their customers.

Understand what their competitors are doing and how they’re doing it.

Gain informed feedback on a given product or service.

Ultimately, the most important difference between B2C research and B2B research is that while B2C research focuses primarily on the tastes or preferences of consumers, B2B research focuses on the knowledge and experiences of professionals.

NewtonX claim this enables them to generate higher quality participants, and faster, than traditional providers. My contacts in the market research industry are sceptical, but NewtonX’s case studies document some seemingly effective work. The truth? Most likely it lies somewhere in between.

How is NewtonX using AI?

I used to be on the client side of expert networks when I worked at McKinsey, and saw a missed opportunity for automation. The industry is a perfect use case for AI today. - NewtonX CEO Sascha Eder.

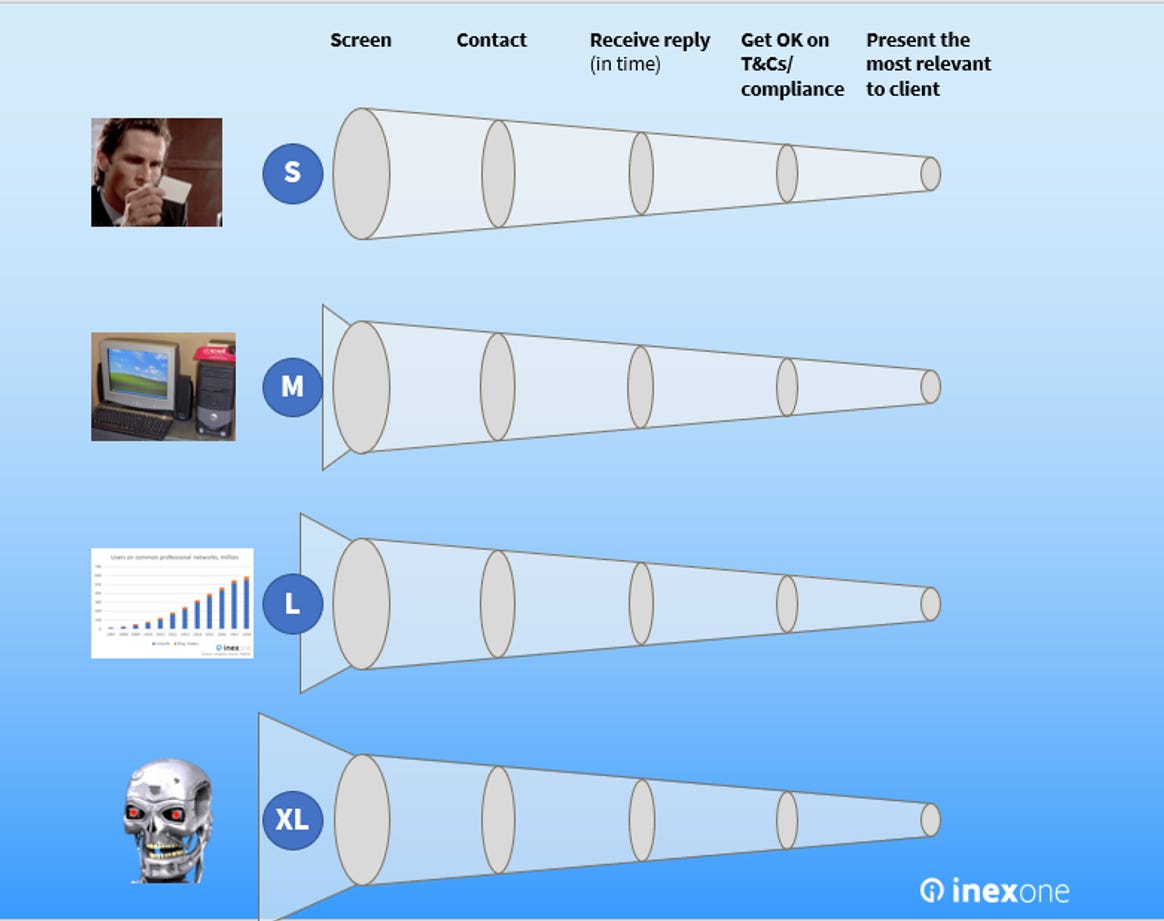

Max Friberg of InexOne provides great research into NewtonX, and the AI and Survey sub-domains of Expert Networks. If you are interested in the space, InexOne’s content is required reading.

In a 2019 article on the use of AI in Expert Networks, Max says:

Now, what is interesting about the machine-driven expert networks is the potential to run queries in multiple databases in parallel (XL). Instead of having an analyst manually search for it, an “AI” could theoretically compile a gross list of the most relevant experts, according to certain criteria. The analyst would then apply her human intelligence to this list, selecting which experts to proceed with. If this machine-generated gross list is any better than random, the expected value and relevance of presented experts is higher. It’s beautiful in theory.

The below image (read the full article for more detail - it’s amusing :-)) shows how although the methods for gathering and storing information about experts has evolved over time, the process for running a project has changed very little:

(Any excuse to include an image from T2…)

In a separate article on Newton X, InexOne state that:

NewtonX is one of the handful of firms outright stating they use AI and machine learning in their work. Much of this technology is common across all larger expert networks. That said, various networks emphasize it more than others in their marketing. These include Xperiti, ENG llc, CleverX, Prosapient, Techspert.io and Atheneum (after its acquisition of Chime Advisors).

Surveys as a differentiator

According to InexOne, when NewtonX launched in 2016:

NewtonX initially focused on automating regular expert network services. However, it soon pivoted to survey data collection from professionals and consumers.

These days, NewtonX does both. But its focus on surveys, alongside its use of AI is a differentiator that enables it to keep employee numbers (and costs) down.

(For more information on how the $119bn survey industry works, InexOne is once again your friend…)

Surveys are significantly cheaper to run than full-blown expert network projects.

According to Expert Network insider blog ExpertOpportunities.com

Reviews of NewtonX’s surveys reveal compensation rates to range between $20 – $200; $40 – $75 for a 10 – 15 minute survey is typical.

If you have been contacted for participation in a 1-hour 1:1 phone or video consult, you can expect to be offered $100 – $200 if you are a Director level or below, or $200 – $350 for above a Director level. While you can absolutely negotiate your rate, if you ask for anything above $500, you risk your profile not being seen by the client, or a client balking at your rate and going with a cheaper expert.

Surveys are a real growth story in Expert Networks right now. Last week, Nalka and Kirk Kapital acquired survey provider Norstat from Triton, in a deal advised by William Blair and rumoured to be worth SEK3bn ($280m).

Triton was rumored to be doing 7x MOIC and 54% IRR on the investment, after growing the topline 128% and EBITA by 227% (mainly driven by EBITA margin growth from 15% to 20%) over the holding period, in a shift to online sampling.

And they are attractive to traditional Market Research providers. In February 2023, Ipsos acquired Xperiti to harness its technology-driven survey capabilities:

Xperiti's online platform leverages AI technology to recruit professionals across 130 countries and over 90 industries in real-time allowing users to quickly and efficiently surface industry expertise. This acquisition will directly improve Ipsos' efficiency, speed for experts’ recruitment, scale and optimize its B2B research capabilities globally, and grow into adjacent offerings by building a large-scale, global B2B Expert Insights Platform.

Sounds familiar, right?

Where are NewtonX going now?

In July last year, NewtonX finally launched a transcript library - NewtonX Prime - to layer on top of their survey and expert network businesses. They recruited some serious talent to manage this:

NewtonX Prime is led by seasoned executives from the financial services space, including Head of Content and Compliance Khang Nguyen (Tegus, Gamut, McKinsey), RVP Aarti Desai (AlphaSense, S&P Capital IQ, FactSet), and Hedge Fund Lead Thomas O’Connor (Lightkeeper, Charles River Development, Coleman Research).

So clearly they are invested in growing this part of their business.

It would be interesting to know how integrated the data from their survey business is with the library. Currently the dataset only includes “1000 public and private companies and 30k expert opinions”, so - not very - seems the likely conclusion. But further integration does seem the likely direction of travel.

NewtonX Prime brings them into the realms of AlphaSense, Tegus et al. It has the potential to catapult their valuation forward. AlphaSense and Tegus are both valued at around $3bn currently (and an AlphaSense IPO is not far away…)

One assumes that NewtonX’s VC investors at Two Sigma, Third Prime, XFund have been firm backers of this development.

If NewtonX can get the balance of the business right, the three legs should feed one another and drive a growth flywheel.

When they raised money in 2021:

Sascha Eder, co-founder and CEO of NewtonX told TechCrunch that the company was very close to the path of profitability, but decided to take on the new capital to prioritize growth.

Given that we are now in 2024, some kind of liquidity event in the not-too-distant future seems likely. At their current revenue point, and with profitability a possibility, private equity are likely waiting in the wings.

The large Market Research industry players such as Ipsos and Kantar are most likely paying attention too.

Such is the life of a hybrid business - attractive to many potential acquirers!

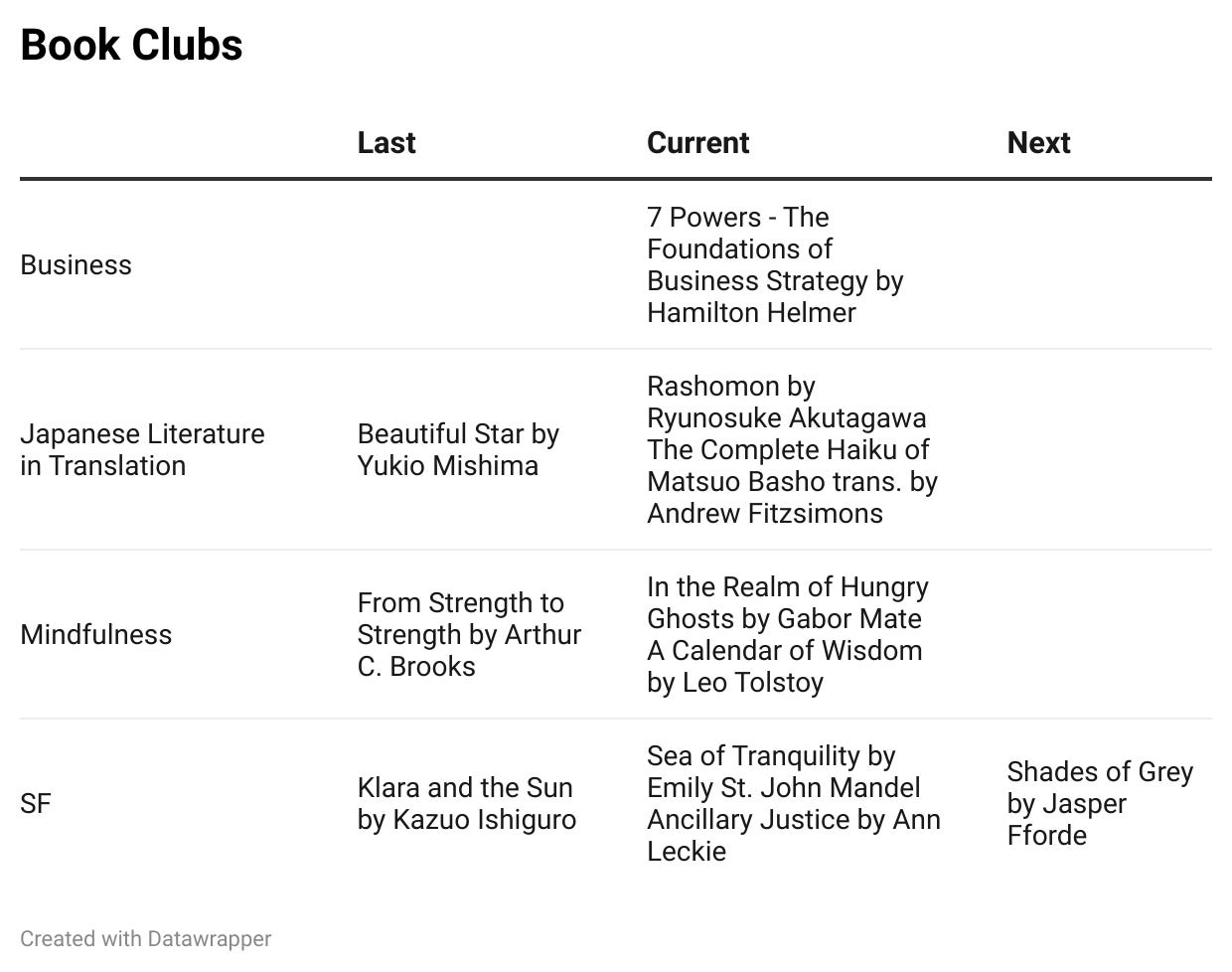

I’m pleased to say that I have had a number of people join my book clubs in the last few weeks.

If you would like to join me in reading any of the below books, please drop me a line.

The rules for all the clubs are the same:

One book every two months;

Choice rotates between book club members.

I really need to finish 7 Powers…