💡Let there be light - Asymmetrix Newsletter #44

Shining a light on KKR's $370m investment into hospitality Data & Analytics provider Lighthouse, in another hectic week for Data & Analytics M&A and investment activity.

Another busy week in Data & Analytics as the market runs at full speed ahead of the impending holiday season.

There were some very interesting deals this week, and it was tough to choose which to spotlight.

Nordic Capital’s acquisition of Astorg’s stake in Intellectual Property Data & Analytics provider Anaqua for $2.5bn nearly triumphed but, in the end, we dug into KKR’s $370m investment in Hospitality Data & Analytics provider Lighthouse.

In M&A news, Adevinta-owned Distilled is nearing acquisition by Apax Partners, and Dye & Durham has paused its sale process. Prospector Portal is no longer going to merge with listed gold explorer Tarachi Gold. And TA Associates-backed wildfire D&A provider has a new investor in General Atlantic’s BeyondNetZero, and has acquired KatRisk. And many, many, many more transactions.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

📧 If we missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.

🦄 KKR checks in to Lighthouse

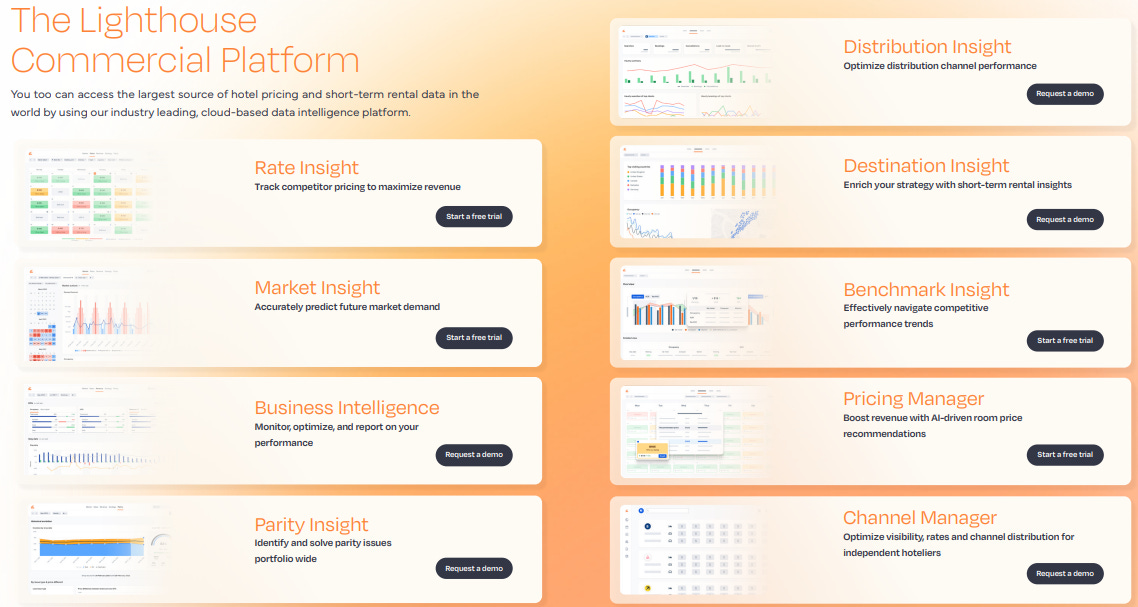

Lighthouse (which rebranded from OTA Insight in September 2023) provides market insights, business intelligence and pricing tools for the hospitality industry, with a focus on hotels and short-term rental markets.

Prior to this week’s news, Lighthouse had most recently raised $80m in funding in 2021 from backers including Spectrum Equity, who joined F-Prime Capital, Eight Roads Ventures, and Highgate Technology Ventures on the cap table.

The business has made four acquisitions since then:

June 2024 - HQ revenue - added more hotels and European coverage;

January 2024 - Stardekk - added channel management and distribution software;

April 2022 - Kriya RevGen - hotel revenue intelligence software;

March 2022 - Transparent - short-term rental data.

What happened?

KKR invested $370m in Lighthouse last week, valuing the business at over $1bn.

The hospitality Data & Analytics sector has been active in 2024. Accel-KKR and Haveli Investments-backed Cendyn acquired Knowland in October. In June GrowthCurve Capital acquired Duetto from Warburg Pincus. And (there was no announcement, so no date is available) Pamlico Capital invested in short-term rentals Data & Analytics provider Key Data.

Why it matters

This is a significant investment from a PE firm traditionally focused on the top-end of the market. And it tells us that KKR sees an opportunity to turn Lighthouse into the category leader in an end market still recovering from the COVID pandemic, and transform it into a business with real scale.

Although there are other hospitality Data & Analytics providers, Lighthouse is among the largest, but still only has revenues of roughly £80m. We can expect to see KKR money’s reinvested in an attempt to increase that advantage further.

What happens next?

Asymmetrix expects to see Lighthouse to prioritise expansion across the hospitality revenue Data & Analytics and Software stack. Lighthouse’s greatest strength is in pricing data and business intelligence, but it is weaker in revenue management and channel management, despite its StarDekk acquisition.

Combining Lighthouse with players such as listed RateGain (INR81bn/$959m market cap), or the aforementioned Warburg Pincus-backed Duetto, would add expertise in revenue management and channel management, and increase scale.

Beyond hospitality revenue, Lighthouse might also consider expanding into hospitality management sub-verticals such as Reservation Systems (Cendyn would be an obvious target here) or Property Management, which is a core focus area for short-term rentals (although ultimately lower margin, so less appealing). Customer Experience and Distribution are also adjacencies which could make sense.

M&A and Fundraising

Deal chatter

🏠 Distilled on brink of €300m sale to Apax Partners - Times

Distilled is a Dublin, Leinster, Ireland-based classified provider, co-owned by Adevinta, backed by Blackstone and Permira.

According to The Times, the business will shortly be acquired by Apax.

The valuation is rumoured to be €300m.

Distilled has EBITDA of €26m.

Cinven had previously been rumoured to be in the process.

Distilled is advised by Barclays.

Asymmetrix Sector: Automotive, Real Estate, Circular Economy.

[UPDATE - Sky News reports that Blacksheep Fund Management are now likely to acquire Distilled, at a valuation of EUR500m+.]

⚖️ Dye & Durham has paused its sale process.

Dye & Durham is a TSE-listed, Toronto, Ontario, Canada-based provider of legal software.

Dye & Durham announced that its Board of Directors has paused the consideration of additional opportunities to enhance shareholder value.

“Dye & Durham received significant inbound interest from multiple strategic and financial sponsor parties at attractive premiums to the market price of its shares.”

According to The Australian Financial Review, one of the bidders was PEXA Group.

Goldman Sachs are advising Dye & Durham.

Additional information on the transaction paywalled at The Globe and Mail.

Asymmetrix Sector: Legal.

Announced M&A

🔥 Technosylva acquired KatRisk.

Technosylva, a La Jolla, CA, USA-based provider of wildfire simulation modeling, risk analysis and operational response software solutions, backed by TA Associates and BeyondNetZero, announced the acquisition of KatRisk, a Berkeley, CA, USA-based catastrophe modeling software company, backed by TA Associates.

Financial terms were not disclosed.

Asymmetrix Sector: Environment.

📑 RepTrak announced a majority recapitalization by Periscope Equity.

RepTrak, a Boston, MA, USA-based provider of reputation intelligence, backed by Catalyst Investors LLC., announced its a majority recapitalization by Periscope Equity, a Chicago, IL, USA-based private equity firm.

Financial terms were not disclosed.

RepTrak was advised by Sam Barthelme and Eric Winn at BrightTower.

Asymmetrix Sector: GRC.

⛏️ Tarachi Gold Corp. acquisition of Prospector Portal has been discontinued.

Tarachi Gold, a listed Vancouver, BC, Canada-based gold explorer, announced the discontinuation of a transaction with Prospector Portal, a Fort Lauderdale, Florida, USA-based mining data provider.

Asymmetrix Sector: Energy & Commodities.

🔍 Nordic Capital to acquire Astorg’s majority stake in Anaqua.

Nordic Capital, a Stockholm, Sweden-based private equity investor, announced the acquisition of Anaqua, a Boston, MA, USA-based provider of innovation and intellectual property (IP) management technology solutions and services, backed by Astorg.

Financial terms were not disclosed, but the valuation is rumoured to be c.$2.5bn.

Astorg and Anaqua were advised by Arma Partners and Jefferies. Nordic Capital was advised by William Blair.

Asymmetrix Sector: Intellectual Property.

🔒 Enzoic acquired VeriClouds.

Enzoic, a private Boulder, CO, USA-based credential-based threat platform, announced the acquisition of VeriClouds, a private Seattle, WA, USA-based threat intelligence provider.

Financial terms were not disclosed.

Asymmetrix Sector: Cyber Security.

Later-Stage / Growth funding

Woburn, MA, USA-based provider of risk and performance management software for financial institutions, backed by TechVenture Investors and Spectrum Equity.

Financial terms were not disclosed.

The Empyrean management team and current investors, TechVenture Investors and Spectrum Equity, will all remain shareholders in Empyrean. Spectrum Equity will also participate alongside Hg in the new transaction.

Piper Sandler advised Empyrean. Raymond James advised Hg.

Asymmetrix Sector: Office of the CFO.

La Jolla, CA, USA-based provider of wildfire simulation modeling, risk analysis and operational response software solutions, backed by TA Associates.

Raised a strategic growth investment from General Atlantic’s BeyondNetZero.

Lazard served as financial advisor to TA and Technosylva.

Asymmetrix Sector: Environment.

London, UK-based hospitality intelligence provider.

Raised $370m in funding from KKR.

Existing investors Spectrum Equity, F-Prime Capital, Eight Roads Ventures and Highgate Technology Ventures will continue their participation in the business.

William Blair advised Lighthouse.

Asymmetrix Sector: Hospitality.

New York, NY, USA-based provider of enterprise telecom management software.

Raised $31m in Series B funding led by Altos Ventures, with participation from existing investors Ridge Ventures, Amplo, Zigg Capital, and Susa Ventures.

Asymmetrix Sector: Telecommunications.

🎯 Zeotap

Berlin, Germany-based customer data platform.

Raised $25m in funding from existing and new investors, including SignalFire and Salica Investments.

Asymmetrix Sector: Marketing.

🔗 Keychain

New York, NY, USA-based CPG manufacturing procurement platform.

Raised $15m in funding led by BoxGroup, with support from General Mills and Schreiber, and existing investors including Lightspeed Venture Partners, and SV Angel.

Asymmetrix Sector: Supply Chain.

📈 IMPLAN

Huntersville, NJ, USA-based provider of economic modeling and analytics software, backed by Boathouse Capital.

Raised an undisclosed amount of funding from Charlesbank Capital Partners.

As part of the transaction, existing investor Boathouse Capital will fully exit the business.

Raymond James, led by Evan Schutz, served as financial advisor to IMPLAN and Boathouse Capital. Solomon Partners served as financial advisor to Charlesbank.

Asymmetrix Sector: Office of the CFO.

🔗 Portcast

Singapore-based provider of real-time transportation visibility and predictive analytics for global supply chains.

Raised $6.5m in funding, led by Susquehanna Asia VC, with participation from Hearst Ventures, Signal Ventures, and existing investors including Wavemaker Partners, TMV, and Innoport.

Asymmetrix Sector: Supply Chain.

💎 Nivoda

London, UK-based digital marketplace focused on the diamond industry.

Raised EUR48.4m in funding led by Northzone with participation from existing investors Avenir, Headline, Abstract Ventures and Canaan Partners.

Asymmetrix Sector: Energy & Commodities.

Early-Stage

⚖️ Theo AI

Palo Alto, California, USA-based AI prediction engine for legal disputes.

Raised $2.2m in funding co-led by NextView and nvp capital with participation from Ripple Ventures, Beat Ventures, and SCVC Fund.

Asymmetrix Sector: Legal.

🛒 Flywl

San Francisco, CA, USA-based cloud software marketplace.

Raised $7m in funding from Storm Ventures, Foster Ventures, BeeNex, FeBe, and Teknos Ventures.

Asymmetrix Sector: Procurement.

🚗 Revv

New York, NY, USA-based research platform for ADAS repairs.

Raised $20m in funding led by Left Lane Capital, with continued participation from Soma Capital, 1984, and Agalé Ventures.

Asymmetrix Sector: Automotive.

Israel-based generative AI platform for accelerated drug discovery and development.

Raised $5.5m in funding led by TLV Partners.

Asymmetrix Sector: Genomics.

💊 Revisto

San Antonio, TX, USA-based medical, legal, and regulatory (MLR) review platform.

Raised $4m in funding led by LiveOak Ventures, with participation from Eli Lilly and Company, Tau Ventures and Arkin Digital Health.

Asymmetrix Sector: Pharmaceuticals.

Noordwijk, South Holland, Netherlands-based soil health monitoring platform.

Raised EUR350k in funding from UNIIQ.

Asymmetrix Sector: Environment.

Interesting Content

Financial Times - What are banks doing with your financial data?

Bloomberg - Wall Street Banks Team With BlackRock to Provide Bond Price Data.

arg min - Going beyond the polls.

📧 If we have missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.