Investor Analysis: EQT - Motherbrain

TL;DR - To misquote William Gibson: the future of Financial Services data management is already here - it’s just not very evenly distributed

Welcome to the 19 new subscribers who have joined us in the three days since our last post! If you haven’t subscribed, join 216 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues you think may be interested. Thank you!

I recently watched the Tom Cruise “Groundhog Day with guns and aliens” vehicle, Edge of Tomorrow. In it, [SPOILER ALERT] the enemy are controlled by a giant central brain called the Omega.

Naturally, while watching the film, I thought of Motherbrain, investment behemoth EQT’s data project.

EQT has been in the news recently. Bucking the conventional wisdom that it’s tough for funds to raise money right now, EQT raised EUR22bn for their private equity group’s Fund X.

In what is EQT’s largest ever fundraise, its flagship private equity fund raise[d] EUR 22 billion (USD 24 billion) in total commitments, of which EUR 21.7 billion (USD 23.5 billion) are fee-generating assets under management, exceeding the EUR 20 billion (USD 21.6 billion) target.

EQT is a massive firm. The numbers here are big. And that includes the size of EQT PE investment team:

As one of EQT’s eleven business lines, the EQT Private Equity team consists of more than 130 investment professionals spread across 15 offices in Europe and North America…

The teams draw upon the expertise of EQT’s network of over 600 Industrial Advisors, who each bring experience leading companies in EQT Private Equity’s core sectors. EQT Private Equity works closely with EQT’s other private capital business lines, which include EQT Private Capital Asia, EQT Future, EQT Healthcare Growth, EQT Life Sciences, EQT Growth, and EQT Ventures.

That’s a lot of deal sourcing activity. And portfolio company management. And a lot of information required and gathered along the way.

Which is where Motherbrain comes in.

The Motherbrain Origin Story

According to Daniel Wroblewski, one of the Chief Architects of Motherbrain (now at CPP) in a podcast interview

Motherbrain came about precisely because the founders of EQT Ventures in 2016 were not investment professionals. They were techies. And they looked at the traditional way that VC and PE worked - analogue introductions to businesses - and thought that there had to be a better way. According to the EQT website:

Motherbrain started in 2016 as a platform for EQT Ventures to be truly data-driven in finding the best tech start-ups to invest in. As thousands of new start-ups are founded every day, no human can rate them all.

Today, a number of potential investments, identified with Motherbrain and assessed by EQT Ventures, have grown into potential investments for EQT Growth, creating an extension to the rest of the EQT platform.

Motherbrain supports the tracking of company life-cycles rather than deal life-cycles, ending at a fund’s exit. By visualizing and making the data accessible, building on a common corporate memory and collectively trained algorithms, Motherbrain creates structural competitive advantages enabling EQT to make faster and more substantiated decisions.

Daniel Wroblewski explains in the podcast that the EQT Ventures founders decided to look at the *whole dataset* and look for implicit signals of “outliers” that indicated prime candidates for investment.

According to Wroblewski, the signal that they picked up on for their first investment was web traffic - they spotted a company’s traffic spiking, and knew it was a hot property.

EQT Ventures’ investment thesis is proven with nine investments fully sourced by Motherbrain. These include Peakon, AnyDesk, CodeSandbox, Griffin, Handshake, WarDucks, Standard Cognition, Netlify and Anyfin. All of these are companies that would not have been identified without Motherbrain. For many of the investments, it is still early days, but for the earliest ones, there is proven successful growth and value creation.

According to Business Insider:

Two of [their investments] have become unicorns valued at more than $1 billion.

Both of these were 2021 top-of-the-market deals. Handshake, a diversity-focused recruitment network, raised money at a $1.5bn valuation in May 2021. And Standard Cognition, an autonomous retail checkout provider, was valued at $1bn in a fundraising in January 2021.

And one investment has already returned funds to the investor - employee engagement platform Peakon was acquired by Workday for $700m in 2021.

However, Warducks, an Irish gaming developer, went under in January this year.

You can’t win ’em all in VC investing.

What happened next?

Once Motherbrain started to generate alpha for EQT Ventures, it didn’t take long before it was adopted by the rest of the organisation.

And, according to Wroblewski, the biggest benefits came when external data was augmented with internal data from the investors themselves.

One imagines that the race to ingest as much internal data as possible was on. Back to the website:

Motherbrain combines external data points with company data and 140,000 unique connections uploaded by EQT employees.

Motherbrain’s most successful effort to capture metrics is the automated note parser. Through this functionality, EQT captures crucial metrics without changing users’ behavior.

With Ventures and Growth as trailblazers, all EQT Private Equity Advisory Professionals were onboarded to Motherbrain in 2020 and have commenced replacing their traditional tools with capabilities in Motherbrain to handle continuous deal flow work in EQT’s proprietary platform.

So:

Motherbrain can parse meetings notes and other internal data, and combine this with external company data;

Motherbrain has progressed through the EQT VC and PE organisation: EQT Ventures → Growth → PE;

EQT has now told all its professionals that they have to store their data in Motherbrain. And begun the process of removing the old note-taking tools.

Motherbrain has therefore effectively become EQT’s augmented CRM system.

I’ve said this before here, (and know this to be the truth from first-hand experience working on exactly this problem at the world’s largest Corporate Finance business: Houlihan Lokey) but this kind of data-first structure is the future for all financial services firms. Siloed information, manual research, ad-hoc business development - their days are numbered. The winners in investment and advisory firms will use systems that look like Motherbrain.

So how does a company go about building this?

Motherbrain lay out their development team structure in a post on their Medium pages about their use of AI:

Our team is divided into three primary units:

Motherbrain Platform: This team is focused on the development of long-term, scalable AI solutions. The intent is not merely to solve immediate challenges but to build a robust system of tools capable of supporting our different investment teams.

Motherbrain Labs: This group addresses specific, immediate needs through the development of quick, bespoke projects. Although less constrained by existing infrastructure, Motherbrain Labs serves as a proving ground for concepts that may eventually be formalized and maintained by the Platform Team.

Motherbrain ML Research: With an eye on the horizon, this team is responsible for assessing emerging technologies and methodologies in machine learning. They engage in testing new models and possibilities with a longer-term perspective. Their insights can support and inform the engines of both the Platform and Labs teams.

And if you want to get really geeky and understand their tech stack, you can dig into it here.

And how do they go about solving one of the hardest challenges: mapping companies to industry sectors? In this article, a PhD student who has been working on the problem at EQT lays out how they found that an LLM technique called Prompt-Tuned Embedding Classification (PTEC) performed best. In the course of which he reveals that:

EQT has created its own industry sector taxonomy, distinguishing between more than 300 different sectors organized in a four-level hierarchy.

Personally, I have my doubts that 300 sectors is deep enough to provide truly granular sector analysis, but it is a start!

EQT are clearly experimenting with multiple data mapping models. Some of their team members have authored an academic paper outlining their preferred technical solution:

To solve this problem, the Motherbrain team proposed a novel method - PAUSE: Positive and Annealed Unlabeled Sentence Embedding, which generates numerical representations from company descriptions enabling a measurement of closeness between any two companies. The model turns out to be best-in-class at defining similarity without relying heavily on pre-existing annotations by investment professionals, as other high performing models do.

And what can they build using this structure, systems and data?

They can use it to create predictive scoring for startups.

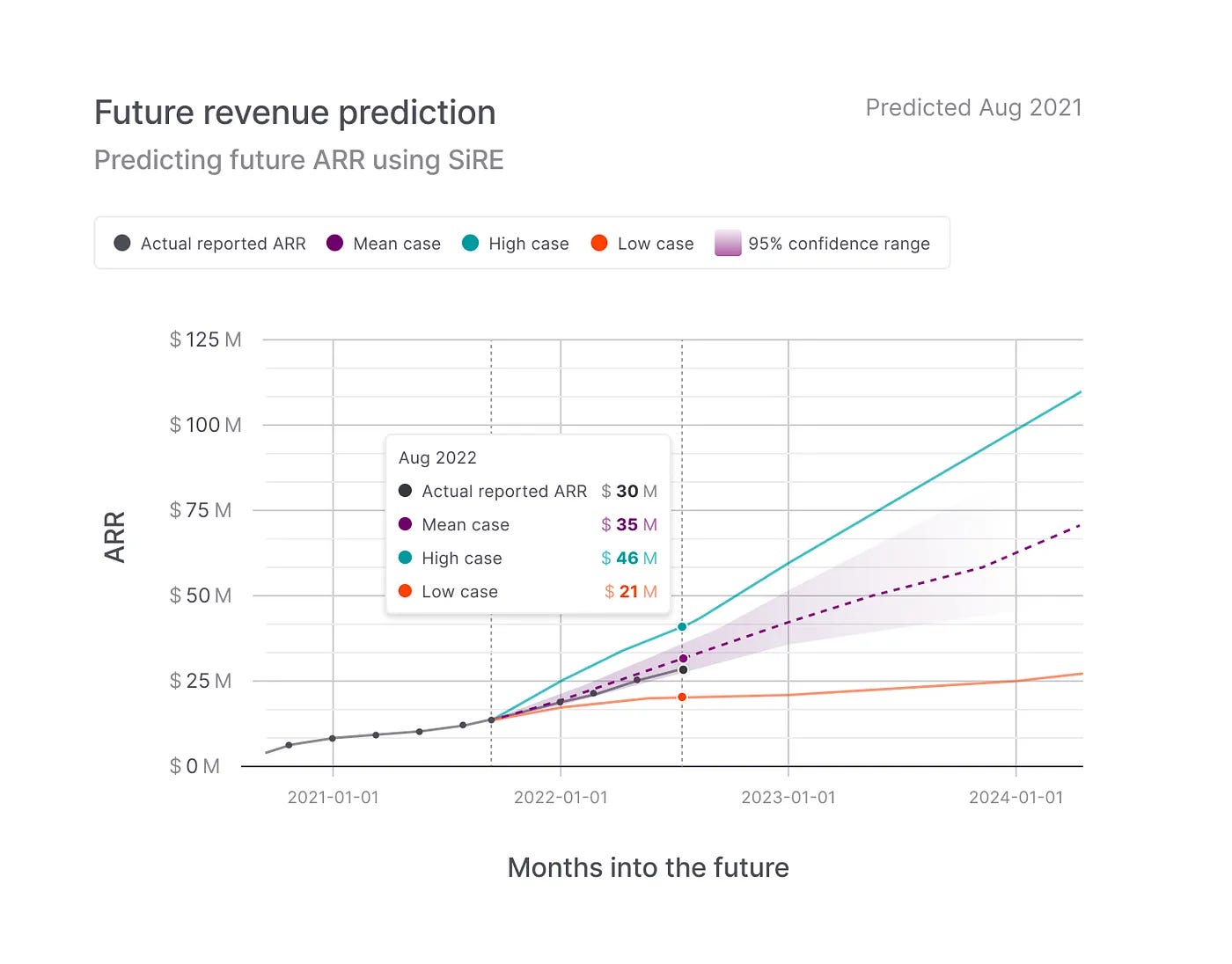

And they can predict future revenue growth for scale-ups.

For example, in August 2021, we received data from a company that had approximately USD 10 million in revenue, growing 150% year-over-year. Our revenue prediction model predicted with 95% confidence that the company would end up with revenue between USD 29 million and USD 40 million 12 months later. When receiving the actual data, we were delighted to find out that the company ended up with USD 30 million.

This article outlines three products they have built to help EQT teams and portfolio companies to source opportunities:

Spaces

The goal with Spaces was to train an artificial intelligence. It functioned much like the popular dating app Tinder. Companies would appear and investment professionals would swipe left or right depending on the company interests. Behind the scenes, the platform used machine learning to identify similar companies based on the user’s description and feedback. Once the AI had collected enough swipes, it produced a final list of potential acquisition targets for the human to review

List Expansion

Labs evolved from using Spaces to a more practical approach called List Expansion. List Expansion is a versatile solution that works by analyzing a set of interesting companies and their key characteristics. You select the criteria that are most important to you and it will identify similar companies from our extensive datasets.

AI-powered chatbot

You can ask questions like “provide me companies using computer vision and machine learning for tracking X in Y industry.” The bot will answer by providing companies that match the query. As the model is tuned to understand the provided set of companies rather than the whole web corpus, it has enabled a more specialized performance resulting in a leap ahead of Chat GPT. This approach furthermore solves the previous difficulties of backtesting, user control and simultaneously gains the efficiency of AI.

So far, this solution is live for one of our portfolio companies, where it has been highly effective. They have found and reached out to several new targets and are using our software platform as their primary way of working with M&A.

What next?

In their most recent Capital Markets Day presentation (yesterday, 6th March), EQT’s Motherbrain team leaders, Sven Törnkvist & Alexandra Lutz, stated the company’s ambition to:

Build the most AI literate investment organisation in the world, accelerating every part of the EQT platform with strategic data and AI.

And reminded their audience that EQT is the first private equity company to hold an AI patent.

In the supporting deck from the presentation they give a glimpse of the tools that Motherbrain is providing:

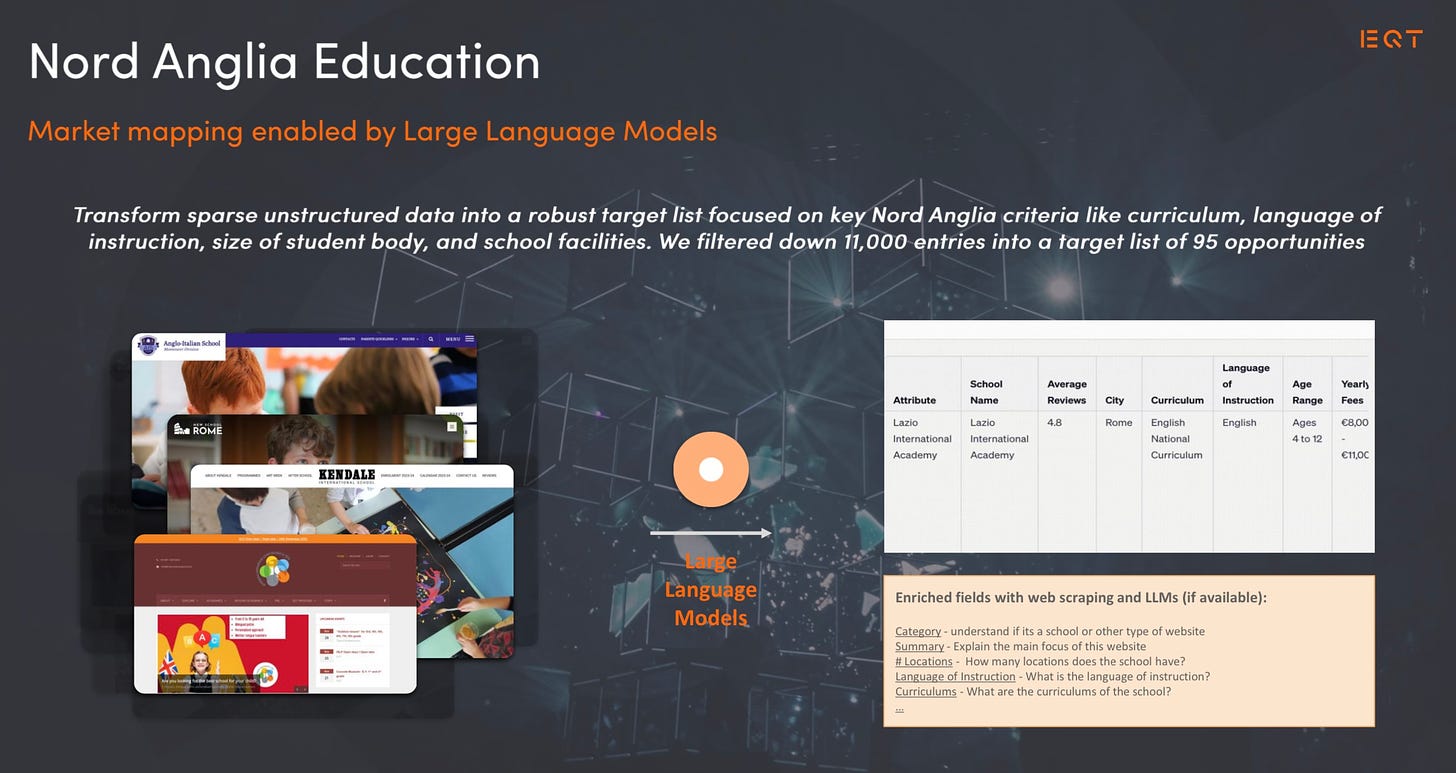

And, according to the deck, 32 portfolio companies now have access to “validated science based targets.” They show a real-life example for the market-mapping and bolt-on acquisition-sourcing work Motherbrain’s LLM tools have provided for Nord Anglia Education, a portfolio company.

How will they expand from here?

If I had to guess, I would say they will most likely be thinking about:

Providing access to the market-mapping tools to all PE and VC portcos;

Expanding their data ingestion efforts and tool provision to all other parts of EQT;

Continuing to add Alternative Data to the mix, particularly unsructured data;

Working on products to support:

Commercial due diligence;

Operational improvement of portcos.

And I expect to see many more investment firms following suit. Keep a close eye on this space!

Other things I have found interesting since the last post:

Apple Podcasts is getting auto-generated transcripts with iOS 17.4.

I’m somewhat late to the party here (again), but I was transfixed by the Rabbit r1 mobile device when I watched the launch video from CES in January. At $200 it is a bargain - if it can deliver on its promise of an AI-driven, app-free experience.

My internal speed read algo told me this was incoming data I should prioritise and consume in full. Great piece Alex