📈 Going Global - Asymmetrix Newsletter #49

Analysis of GlobalData plc, in a busy week for Data & Analytics M&A

We start this week by taking a brief look at GlobalData plc, who have been active in Data & Analytics M&A in recent months.

And we learn that, according to Business Insider, Healthcare Data & Analytics platform Datavant is planning at least "one or two" more acquisitions in early 2025.

We list 13 Data & Analytics acquisitions from last week, including deals in the Credit space for TransUnion and Clearscore, and S&P Global’s acquisition of AI-driven investment research platform ProntoNLP.

And we list six investment rounds, including monster fundraisings for XOCEAN and Hippocratic AI.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

📧 If we missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.

🌎 GlobalData - a coming force

GlobalData plc has received a lot of attention in the past few months for a number of reasons:

They have made three acquisitions since November;

One of these acquisitions was a US company, LinkUp, with a relatively high profile due to its focus on global job market data;

In January GlobalData announced that they had put in place a new £340m debt facility for M&A.

The existence of GlobalData appears to have come as somewhat of a surprise in America. But in the UK, both GlobalData and its founder Mike Danson are well known.

Why? To understand this, it’s worth delving into the history books.

GlobalData’s origin story

In 1989 Mike Danson and Doug Wilson created Datamonitor, a provider of reports on different markets and industries. The business went public on the LSE in 2000.

In 2007, at the top of the market, Danson sold Datamonitor to Informa for £513m in cash, a multiple of 7x revenues.

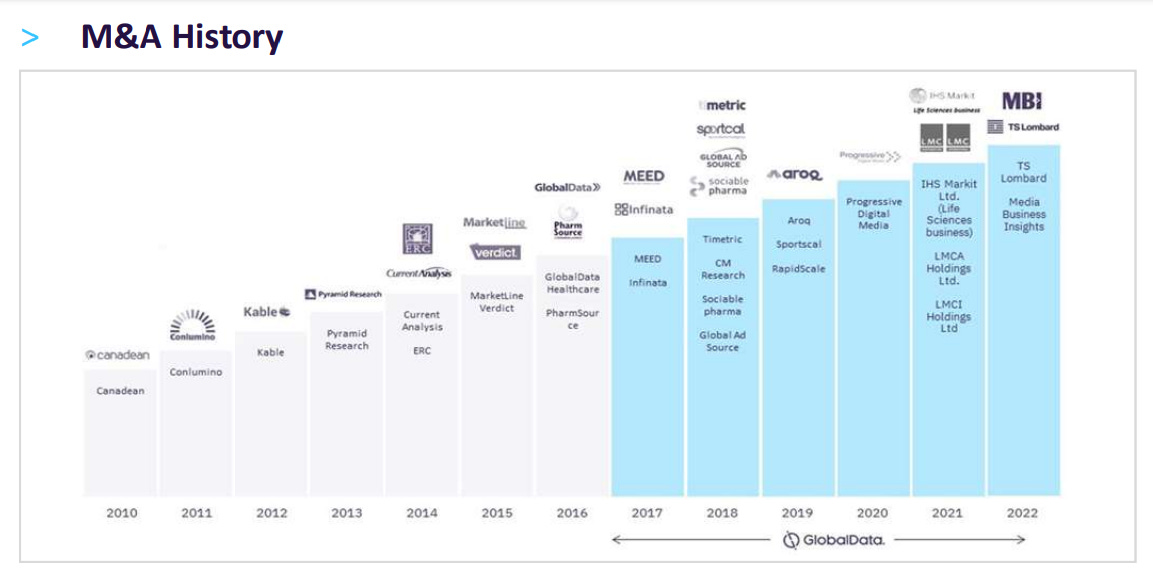

Danson did not stick around at the acquirer, but instead began to rebuild a data empire through his involvement with Progressive Digital Media.

In 2007 Progressive Digital Media acquired a set of assets from Wilmington plc. In July 2008 it bought Datamonitor’s Business Review from Informa. A series of acquisitions followed, including TMN, Kable, Pyramid Research and Current Analysis.

Meanwhile, by 2015, Informa had written down Datamonitor’s value by almost 40%. And in 2015 Progressive Digital Media acquired a large number of former Datamonitor assets from Informa for just £25m.

(Informa did not sell the Datamonitor Healthcare and Energy businesses at that point. They later sold the Pharma Intelligence division which included Datamonitor Healthcare to Warburg Pincus, who renamed it Citeline, and which was later subsumed into Norstella.)

And finally, in 2016, Progressive Digital Media bought GlobalData (also owned by Mike Danson) and rebranded as GlobalData plc.

Why it matters

GlobalData has now reached a scale where both the volume and the value of its operations and its M&A activity is having a meaningful impact on the market. The business has a market cap of £1.7bn, revenues of £273.1m, and adjusted EBITDA of £110.8m in 2023.

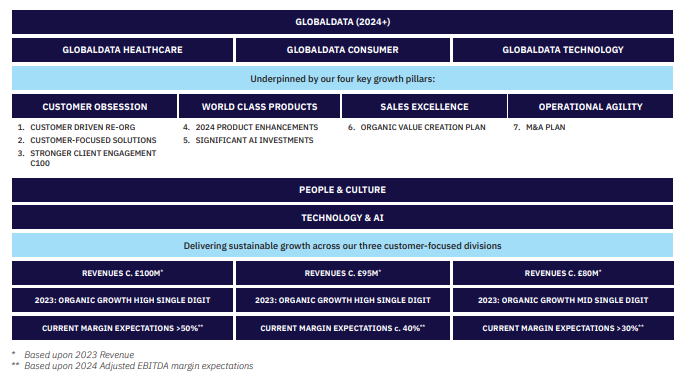

GlobalData’s 2023 annual report, published in March last year, is a good place to start if you want to understand the business, as it provides a snapshot of the business after two important changes made in December 2023:

Reorganising the business into three customer focused divisions: Healthcare, Consumer, and Technology;

Sale of a 40% minority shareholding in the Healthcare division for £434m, at a £1.15bn valuation, representing an EV/EBITDA multiple of 22x, to Inflexion.

As the origin story above demonstrates, GlobalData has always been a business driven by inorganic growth. The below slide from its 2023 Capital Markets Day shows more recent deal activity.

What happens next?

Inflexion’s investment in the Healthcare division, coupled with the debt facility, promises to unlock a new era of M&A activity.

GlobalData’s three most recent deals, LinkUp, Celent and, last week, Life Sciences-focused Deallus, were not material enough for valuations to be disclosed. Throughout the various incarnations of Mike Danson’s businesses, they have not overpaid for acquisitions. It is probable that GlobalData will continue to pursue such reasonably priced tuck-ins acquisitions.

But they also seem likely to seek out more transformative deals, particularly for the Healthcare division, where their private equity investors, Inflexion, will be looking for a relatively rapid return on investment, potentially through a full spin-off or sale of the division.

The larger the profile of any target company, however, the less likely it is to be available off market, and therefore at a multiple which GlobalData would historically have found attractive.

Finding acquisition targets in the goldilocks zone (big enough but not too expensive) will be an interesting challenge for the business in the near term.

M&A and Fundraising

Deal chatter

🩺 Datavant is on the M&A hunt as the $7bn health data company bulks up before a potential IPO.

Datavant is a Phoenix, AZ, USA-based data platform company for healthcare, backed by New Mountain Capital.

According to Business Insider, Datavant is planning at least "one or two" more acquisitions in early 2025.

When Datavant merged with Ciox Health in 2021 the combined entity was valued at $7bn.

Datavant has revenues in excess of $1bn.

Asymmetrix Sector: Healthcare.

🚗 CarDekho to launch USD500m IPO.

CarDekho is a Gurugram, Haryana, India-based digital car-retailing platform, backed by Harbor Spring Capital, Franklin Templeton, Mirae Asset, Canyon Partners, Sunley House, Peak XV, Google Capital, Hillhouse, Tybourne Capital, Times Internet and HDFC Bank.

According to Mergermarket, CarDekho intends to raise USD300-500m from a primary share sale and an offer of sale by existing investors.

CarDekho has appointed IIFL, Axis Capital, Goldman Sachs and Nomura as bookrunning managers for its initial public offering.

Asymmetrix Sector: Automotive.

Announced M&A

🩺 H1 acquired Ribbon Health.

H1, a New York, NY, USA-based provider of expertise, HCP information, claims data, research and insights, backed by Altimeter Capital, Goldman Sachs Asset Management, Flex Capital, IVP, Menlo Ventures, Transformation Capital, Lux Capital and LeadEdge, announced the acquisition of Ribbon Health, a New York, NY, USA-based predictive analytics and data platform for the healthcare industry, backed by General Catalyst, Andreesen Horowitz, BoxGroup, Core Innovation Capital, Rock Health Group and others.

Financial terms were not disclosed.

Asymmetrix Sector: Healthcare.

Mapp, a London, UK-based customer engagement software provider, backed by Marlin Equity Partners, announced the acquisition of Dressipi, a London, UK-based provider of software for personalization for fashion ecommerce, backed by Angel Academe.

Financial terms were not disclosed.

Asymmetrix Sector: Ecommerce.

💳 ClearScore Group acquired Aro Finance.

ClearScore, a London, UK-based consumer credit data business, backed by QED Investors and Lead Edge Capital, announced the acquisition of Aro Finance, a Manchester, UK-based credit marketplace.

Financial terms were not disclosed.

Asymmetrix Sector: Credit.

💊 GlobalData Plc acquired Deallus.

GlobalData Plc, an LSE-listed, London, UK-based data and analytics company, announced the acquisition of Deallus, a London, UK-based competitive intelligence solutions provider focused on the global life sciences sector, backed by Archimed.

Financial terms were not disclosed.

Asymmetrix Sector: Life Sciences.

🔍 Getty Images Holdings, Inc. acquired Shutterstock.

Getty Images Holdings, Inc., a NYSE-listed, Seattle, WA, USA-based visual content creator and marketplace, announced the acquisition of NYSE-listed, New York, NY, USA-based platform for licensing from a collection of 3D models, videos, music, photographs, vectors and illustrations.

The combined company will have an enterprise value of approximately $3.7bn.

Getty Images was advised by Berenson & Company and J.P. Morgan. Shutterstock was advised by Allen & Company.

Asymmetrix Sector: Intellectual Property.

💳 TransUnion acquired Monevo.

TransUnion, a NYSE-listed, Chicago, IL, USA-based global information and insights company, announced the acquisition of Monevo, an Alderley Park, Cheshire, UK-based credit technology business, backed by Quint Group.

Financial terms were not disclosed.

Asymmetrix Sector: Credit.

📈 S&P Global acquired ProntoNLP.

S&P Global, a NYSE-listed New York, NY, USA-based provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets, announced the acquisition of ProntoNLP, a provider of Generative Artificial Intelligence (GenAI) tooling.

Financial terms were not disclosed.

Asymmetrix Sector: Financial.

🔒 Tidal Cyber acquired Zero-Shot Security.

Tidal Cyber, a Washington D.C., USA-based threat-informed defense company, backed by USAA Today and Capital One Ventures, announced the acquisition of Zero-Shot Security, a private, Dallas, TX, USA-based threat intelligence platform.

Financial terms were not disclosed.

Asymmetrix Sector: Cyber Security.

👁 Muck Rack acquired Ruepoint.

Muck Rack, a Miami, FL, USA-based provider of PR software, backed by Susquehanna Growth Equity, announced the acquisition of Ruepoint, a private, Dublin, Ireland-based media intelligence company.

Financial terms were not disclosed.

Asymmetrix Sector: Media Monitoring.

Lusha, a Boston, MA, USA-based sales intelligence platform, backed by PSG Equity and ION Crossover Partners, announced the acquisition of Novacy, a Tel Aviv, Israel-based behavioral intelligence platform, backed by Fusion and 25madison.

Financial terms were not disclosed.

Asymmetrix Sector: Sales.

📈 Intercontinental Exchange, Inc. acquired American Financial Exchange.

Intercontinental Exchange, Inc., a NYSE-listed, Atlanta, GA, USA-based provider of technology and data, announced the acquisition of American Financial Exchange, a Chicago, IL, USA-based electronic exchange for direct lending and borrowing, backed by 7RIDGE.

Financial terms were not disclosed.

Asymmetrix Sector: Financial.

🥤 FoodBev Media acquired Zenith Global.

FoodBev Media, a private, Bath, UK-based provider of food and beverage industry journals and industry awards, announced the acquisition of Zenith Global, a private, Bath, UK-based provider of food and beverage industry insights and events.

Financial terms were not disclosed.

Asymmetrix Sector: Consumer, Food & Retail.

🛢️ Yellow Point Equity Partners acquired Rextag from Hart Energy.

Yellow Point Equity Partners, a Vancouver, BC, Canada-based private equity firm, acquired Rextag, mapping and data solutions related to energy infrastructure assets in the US market, from Hart Energy, a Houston, TX, USA-based provider of media, research and data for the global energy industry.

Financial terms were not disclosed.

Hart Energy was advised by JEGI CLARITY.

Asymmetrix Sector: Energy & Commodities.

Later-Stage / Growth funding

🩺 RAAPID

Louisville, KY, USA-based healthcare AI company.

Raised an undisclosed amount in funding from M12.

Asymmetrix Sector: Healthcare.

🌊 XOCEAN

Rathcor, County Louth, Ireland-based provider of turnkey ocean data Using Uncrewed Surface Vessels (USVs).

Raised $115m in funding from S2G Ventures, Climate Investment, Morgan Stanley's 1GT fund, and an affiliate of the Crown Family's CC Industries.

Asymmetrix Sector: Energy & Commodities.

Palo Alto, CA, USA-based healthcare LLM for patient-facing non-diagnostic clinical tasks.

Raised $141m in funding at $1.64bn valuation led by Kleiner Perkins, and joined by existing investors A16z, General Catalyst, Premji, NVIDIA, SV Angel, Universal Health Services (UHS) and WellSpan Health.

Asymmetrix Sector: Healthcare.

🔗 Zero100

London, UK-based membership-based intelligence platform for the supply chain.

Raised an undisclosed amount of funding from Levine Leichtman Capital Partners.

PWC advised Levine Leichtman Capital Partners. Management was advised by Raymond James and Eight Advisory.

Asymmetrix Sector: Supply Chain.

🌳 Tangible

San Francisco, CA, USA-based carbon emissions software for real estate.

Raised $3m in funding led by Prologis Ventures and Pi Labs, joined by Foundamental, Silence VC, and RE Angels.

Asymmetrix Sector: Environment.

Early-Stage

🛑 Abstract

New York, NY, USA-based artificial intelligence company developing a legislative and regulatory platform.

Raised $4.8m in funding co-led by Bonfire Ventures and Communitas Capital.

Asymmetrix Sector: GRC.

📧 If we have missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.