🚗 Driving Data & Analytics Growth - Asymmetrix Newsletter #42

Follow the global trends to find the growth in Automotive Data & Analytics.

The Asymmetrix newsletter has a new format. 🎉

As the newsletter has grown alongside Asymmetrix’s burgeoning dataset, it has become harder for readers to absorb the content shared here.

So we’ve changed things to make life a little easier. Please let us know your thoughts on the new format.

We would like to acknowledge our debt to Environmental Investment Data & Analytics provider Sightline Climate. 🙏

Their brilliant CTVC newsletter covering the new climate economy provided us with a great deal of inspiration for the new format. If you are investor in that space and you don’t subscribe to CTVC then you are missing out!

We’re digging into Automotive Data & Analytics this week in our main feature, driven by a couple of interesting M&A transactions in the space.

And in public markets, Bloomberg reports a potential IPO for provider of market research and consumer insights NIQ, Boeing are considering divesting their navigation unit, Jeppesen, and final bids are in for EHR and real-world evidence provider Veradigm.

In fundraising, there’s £28m in funding at a £100m valuation for UK GRC player Ripjar, plus a range of smaller deals.

And an appeal for any Data & Analytics professionals out there looking for an opportunity to help consulting and market research businesses to make the transition into Data & Analytics.

Thanks for reading!

Not a subscriber yet?

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

📧 If we missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.

The lights are turning green for Automotive Data & Analytics

This week saw two Automotive Data & Analytics transactions, and Asymmetrix was inspired to think more deeply about the trends and drivers in the space.

What happened?

Two software providers, Vitec Software Group and Kerridge Commercial Systems each bought an Automotive Data & Analytics business: Olyslager for Vitec and Silkmoth for Kerridge. (See Announced M&A below for detail on the transactions.)

Both listed Vitec and PE-backed Kerridge are similar in that they operate a “string of pearls” acquisition strategy. That’s to say that they tend not to fully integrate the businesses that they acquire. Kerridge does some integration, but Vitec most definitely keeps the businesses separate. In this respect, Vitec closely resembles Roper Technologies or Constellation Software.

Why it matters

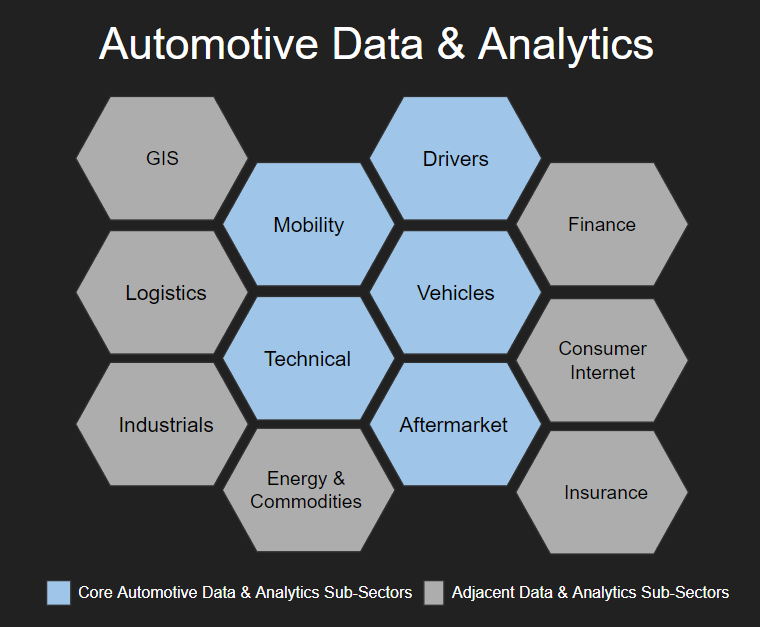

The Automotive Data & Analytics space is a large and fairly mature sub-sector within Data & Analytics, dominated by a handful of large providers.

Growth in Automotive Data & Analytics is driven by macrotrends shaping the global economy, such as vehicle electrification, autonomous vehicles, increased EHS regulation, and global growth of the middle classes.

New Data & Analytics providers are arising driven by these trends, as manufacturers, dealers, aftermarket servicers, financial services providers and consumers themselves look to make informed decisions.

Both Olyslager and Silkworm provide decision-making data for the automotive aftermarket to enable market participants to understand, respectively, what lubricants and what tyres to supply.

It’s interesting to note that neither business was acquired by one of the large Data & Analytics players: Cox Automotive, JD Power, Solera or S&P Global. Nor were they acquired by a business from the next tier down in terms of size, such as JATO or Infopro.

Was this because Olyslager and Silkworm are focused on more traditional parts of the Automotive market, and not, for example, electric vehicles?

What happens next?

From the perspective of other market participants, both strategics and investors, Kerridge and Vitec’s policy of not integrating the businesses they acquire means that, theoretically, both Silkworm and Olyslager could be acquired by another business in future.

In the meantime, we can expect to see continued activity in the Automotive Data & Analytics sector, particularly in the growth areas outlined above.

For example, S&P Global, who divested JD Power in 2016, have a strategy that clearly prioritises electric and mobility solutions in Automotive, although they did also acquire Market Scan, a provider of automotive pricing and incentive intelligence in February 2023.

Pricing is a great driver for Data & Analytics in all sectors, and Automotive is no different. Insight Partners knew this when they backed MARKT-PILOT in a $43m Series A funding round in April this year.

And Vista Equity Partners-backed automotive data and software services provider Solera filed for an IPO in May this year, and are rumoured to be seeking a valuation of $10-13bn for the business, which Vista took private for $6.5bn back in September 2015.

M&A and Fundraising, November 4-10

Deal chatter

⚕️McKesson, Oracle and Thoma Bravo have all submitted bids in the Veradigm M&A process final round.

Veradigm, formerly known as Allscripts, is a Chicago, Illinois, US-based provider of EHR software and real-world evidence, listed on NASDAQ.

Veradigm announced in May this year that they would “explore strategic alternatives”, advised by JP Morgan.

According to Seeking Alpha, McKesson, Oracle and Thoma Bravo have all submitted bids, but CVS Health has dropped out.

A deal is expected to be agreed by Thanksgiving, valuing Veradigm above their current $1bn market cap.

Asymmetrix Sector: Healthcare.

✈️ Boeing is exploring the sale of Jeppesen.

Jeppesen is a Denver, Colorado, US-based provider of intelligent information solutions across the aviation ecosystem.

According to Reuters, Boeing is working with an adviser on the potential sale of the unit.

There is significant private equity interest in Jeppesen.

The business could be worth approximately $6bn.

Asymmetrix Sector: Aviation.

🛍️ NIQ is exploring an IPO.

NIQ (AKA NielsenIQ) is a Chicago, Illinois, US-based provider of market research and consumer insights, backed by Advent International and KKR.

According to Bloomberg, NIQ has begun talking to potential advisers about a listing in 2025.

The IPO could value the consumer intelligence firm at about $10bn.

Asymmetrix Sector: Marketing.

Announced M&A

🚗 Kerridge Commercial Systems acquired Silkmoth.

Kerridge Commercial Systems, a Hungerford, Berkshire, UK-based provider of specialist ERP, Business and Retail Management Software, Services and Support to Distributors, Wholesalers, Retailers and the Hiring industry, backed by CapVest, announced the acquisition of Silkmoth, a Macclesfield, Cheshire, UK-based provider of automotive and tyre management software solutions.

Financial terms were undisclosed.

Asymmetrix Sector: Automotive.

🛢️ Vitec acquired Olyslager Group B.V.

Vitec Software Group, an Umeå, Sweden-based public vertical software provider that develops and delivers standardized software, announced the acquisition of Olyslager Group B.V., a Bunschoten, Netherlands-based provider of software and data for lubricant and fluid suppliers, backed by Bencis.

Financial terms were undisclosed.

Bencis and Olyslager were advised by Lincoln International.

Asymmetrix Sector: Automotive.

Normative, a Stockholm, Sweden-based provider of enterprise carbon accounting software and data, backed by Horizons Ventures, Blume Equity, Future Five, ETF Partners and 2150, announced the acquisition of Eivee, a Copenhagen, Denmark-based provider of enterprise carbon accounting software and data, backed by Seed Capital.

Financial terms were undisclosed.

Asymmetrix Sector: ESG.

Later-Stage / Growth funding

🦹 Ripjar.

Cheltenham Spa, Gloucestershire, UK-based data intelligence platform whose mission is to help organisations and governments automate the detection, investigation, and monitoring of threats from criminal activity.

Raised £28m in funding at c.£100m valuation, led by Long Ridge Equity Partners, with previous investors Winton Capital Ltd. and Accenture plc also participating.

Asymmetrix Sector: GRC.

Early-Stage funding

📈 Predikt

Leuven, Belgium-based AI-driven platform that helps CFOs and finance teams of large companies and multinationals improve their financial forecasts.

Raised EUR750k in funding at an unknown valuation from angel investors and global consulting agency Keyrus.

Asymmetrix Sector: Accounting

🪙 Warburg AI (formerly known as Thomas AI)

Dubai, UAE-based artificial intelligence company working across forex and cryptocurrency markets.

Raised $250k in funding at an unknown valuation from undisclosed backers.

Asymmetrix Sector: Financial

Dallas, Texas, US-based provider of a risk engine to combine external datasets and internal information to promote trust and transparency in decision making at large organizations.

Raised $4.2m in seed funding at an unknown valuation co-led by Lerer Hippeau and Origin Ventures, with additional investment from mark vc, Springtime Ventures, and continued support from early investor Crētiv Capital.

Asymmetrix Sector: GRC

Asymmetrix is regularly contacted by Consulting and Market Research businesses with proprietary datasets that are looking to make the transition into Data & Analytics.

If you are a seasoned Data & Analytics professional and interested in working with one of these companies, please contact Asymmetrix and we will put you in touch where appropriate.

📧 If we have missed your deal, or you would like to talk, please email us at a.boden@asymmetrix.info.