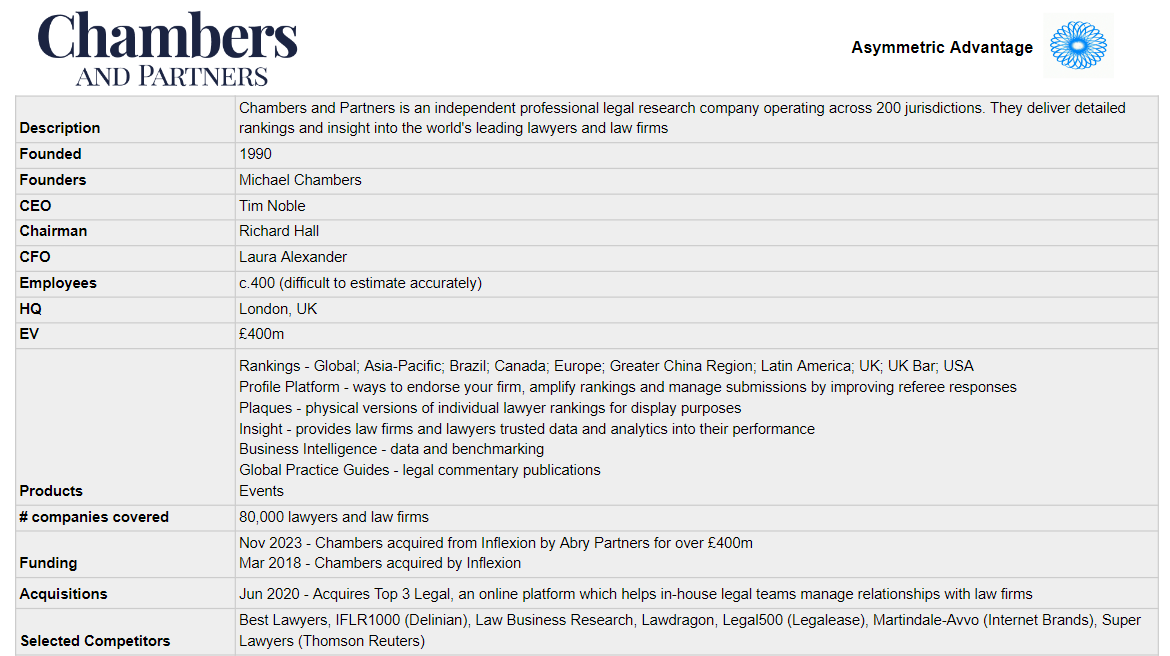

Chambers and Partners - $500m EV Legal Data & Analytics provider

TL;DR - Lawyer and Law Firm rankings provide value for both sides of the marketplace

If you haven’t already subscribed, join 399 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Introduction

I have taken many writing courses over the years, and the advice you are often given is “imagine your audience, and write for them.”

But I’ve also read a lot of books about writing by some of the best authors (George Saunders, Ray Bradbury, Stephen King and David Lodge spring to mind), and their advice is somewhat different: “write what you would want to read.”

This rings true to me. In this newsletter I’m ultimately writing what I wish someone else was writing for me to read. And my choice of topic reflects that.

However, I know that I have accrued a diverse audience in the past nearly four months, so I also beg your pardon for my self-indulgence. But I hope you will find something useful in my thinking.

I’ve been intrigued in recent weeks by the ways in which Data & Analytics businesses create ratings for different types of company.

We have looked at SecurityScorecard, provider of cyber risk ratings. We have looked at WiredScore, providers of digital infrastructure ratings.

Today I want to drill into Chambers and Partners, providers of ratings for lawyers.

I’d like to acknowledge a debt in writing this article to Lloyd Pearson of Pearson Communications, whose blog shines a clarifying light on the legal rankings market.

Origin Story

Orbach and Chambers Publishing Limited was founded 19 December 1969, in London, by friends Laurence Orbach, a university professor, and lawyer Michael Ernest David Chambers.

Chambers bought out Orbach in 1971 and launched a legal recruitment business, Chambers & Partners, alongside the publishing house. (Laurence Orbach went on to co-found The Quarto Group in 1976.)

Chambers shut down the recruitment division in 1990 and launched a legal directory ranking lawyers in the UK.

The directory was so successful that Chambers quickly launched a series covering international jurisdictions and eventually bought an office large enough to accommodate more than 300 staff.

The business was very lucrative for Michael Chambers. According to the 2012 Sunday Times Rich List, Chambers & Partners was making him several million pounds in dividends annually, and he had accrued a net worth of £37m.

In March 2018, Michael Chambers retired and sold the company to Inflexion, with former managing director Mark Wyatt re-joining Chambers and Partners as CEO.

Transition from Privately Owned to Private Equity-owned

Mark Wyatt was the legal publishing partner in Inflexion’s acquisition of Chambers - background at The Lawyer, Legal Week and European Lawyer.

He outlined his and Inflexion’s vision for Chambers in an interview with Lloyd Pearson:

We will be investing heavily in our digital footprint, and providing new tools, new products, new access. In terms of the team we have brought in an interim chief technology officer from Merger Market. One of the things that people have asked is, what is the plan in terms of research, and our plan is to grow it and add more analysis, more understanding of the marketplace. So we plan to invest in the research side, we want to make greater use of the information we have, add value to the law firms, and enhance our reputational analytics, which is what we do. To research a legal market and reach into people’s minds and find out what they think, machines are not as intuitive as humans at the moment.

Wyatt only stayed with the business for one year before being replaced by Tim Noble.

It’s difficult to divine from the outside what happened, but one thing that is clear is that not only has Tim Noble executed on the strategy to digitise and invest in research, but he has also invested in sales.

Chambers’ current emphasis on Sales is clear. By November 2023 Chambers had expanded the sales team from 11 to 65.

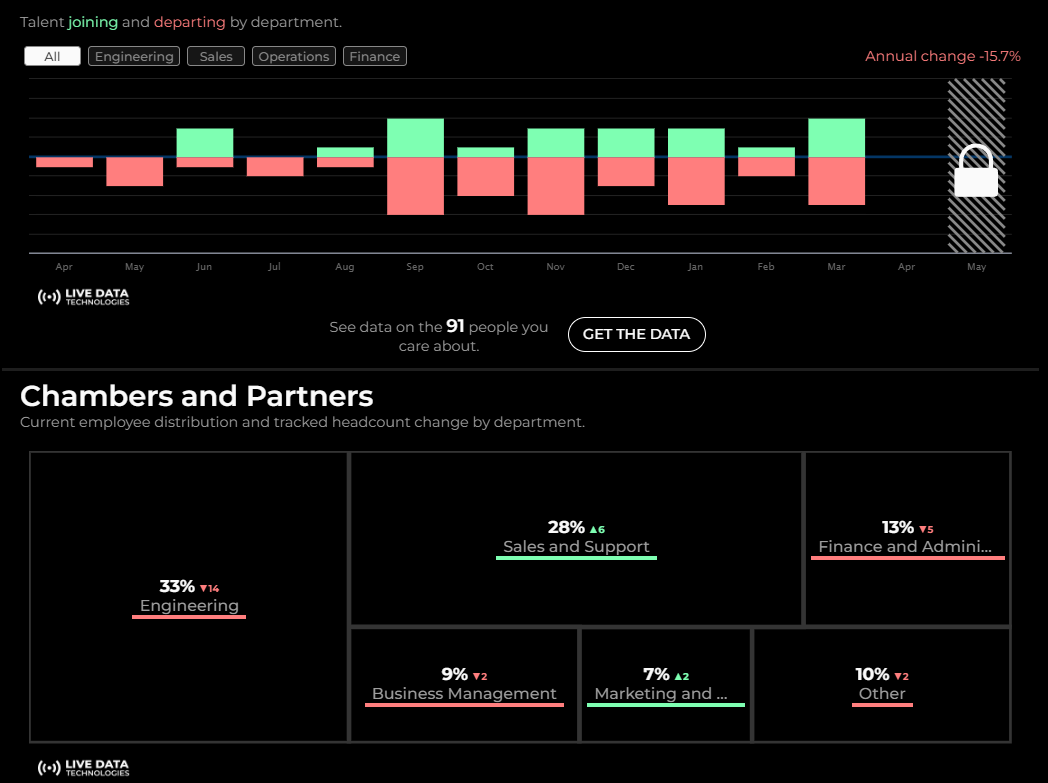

And here is Live Data Technologies’ headcount change for Chambers for the past 12 months:

[If you want to ask the Live Data Technologies team to answer any questions you have about employment trends, post a comment in their LinkedIn thread here.]

In addition to their organic growth, in June 2020 Chambers & Partners bought startup Top 3 Legal for about £5-10m. Top 3 Legal provided an online platform to enable in-house legal teams to use peer-to-peer referrals and feedback to evaluate law firms. It’s not clear from the Chambers’ website how they have integrated to solution into their product. It does not feature as a standalone product.

What does Chambers do?

Chambers & Partners’ bread and butter is its legal rankings business.

Their site lists 3,890 separate rankings in their content creation schedule - a mix of geography'/jurisdiction and practice area.

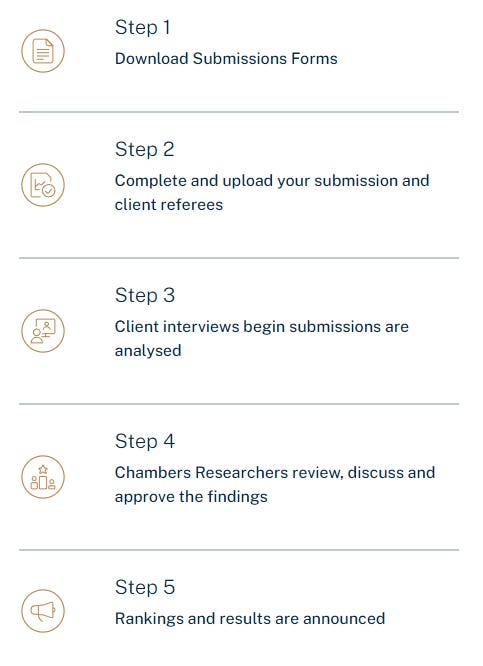

Chambers’ published methodology suggests that the process is somewhat time-consuming and that rankings take a good while to produce. In the region perhaps of 3-6 months?

In addition to their rankings service, Chambers also monetise the data they gather in number of other ways:

Profile Platform - enables lawyers and law firms to claim their profiles for marketing purposes;

Plaques - physical tombstones for use in offices to show off your ranking;

Insight - feedback on your ranking and how to enhance it;

Events - celebrating ranking success;

Business Intelligence - recently launched, this enables users to drill into the data Chambers has accrued on the legal sector to perform market research.

The latter is new and extremely interesting, driving value for the business and transitioning it into a full Data & Analytics company.

Sales to Abry Partners

In November 2023, Inflexion announced that:

Inflexion is pleased to announce it has agreed to sell its investment in Chambers and Partners, a leading B2B information services provider in the legal sector, to Abry Partners, a leading middle market private equity firm. The sale values Chambers at over £400 million and marks a highly successful exit for Buyout Funds IV and V, generating a 4.7x return.

The ROI speaks volumes for the transformational work Inflexion performed across product and sales.

What jumps right out at you about the acquirer is that Abry also owns Chambers’ main global competitor: Best Lawyers. Best Lawyers is slightly different in that it employs a peer-review model, but the end market and purpose of both companies is ultimately the same.

It looks like the two businesses are being kept at arms length, but it is certainly an unusual state of affairs.

What next for Chambers?

The employee data in the graphic above shows how Chambers are going for revenue growth. They clearly feel that their net promoter score and brand strength means that they can max out sales. And, according to Lloyd Pearson back in 2019:

Legal marketers have been hit with increases in the cost of their Chambers profiles recently – the effect of new ownership at the publisher starting to bite.

Understandably people are grumbling.

Who wouldn’t when they see significant increases?

Pearson goes on to emphasise the dangers of unrestricted price increases:

The directories have to be careful not to price gouge, and repeat the Martindale Hubbell mistakes.

For those who weren’t around in the 1990s and early 00s, law firms abandoned Martindale in droves after it jacked up its prices to unsustainable levels.

Martindale was a storied name in the legal publishing world and had dominated the directory market for decades, but law firms could no longer justify paying tens and hundreds of thousands of dollars a year in fees.

And the Martindale implosion happened quickly, because law firms have a herd mentality, and once firms started pulling out, others followed suit, and a trickle of departures soon turned into an avalanche.

Martindale still exists as part of Martindale-Avvo. It’s owned by Internet Brands, which also owns WebMD, and is controlled by KKR. And it still provides legal data and marketing services.

This is not a closed market. There are multiple other legal rankings providers. Customers do have a choice.

One imagines that in the marketing teams at large law firms there are individuals whose sole task is to manage submissions to rankings providers and ensure that ROI is maximised. When spend no longer providers adequate return, these folks will be the first to tell their CMOs to divert spend elsewhere.

But, in the meantime, business is booming at Chambers.

Perhaps the next step will be its acquisition by a larger player in the space, like venerable legal specialists Thomson Reuters, who own the Super Lawyers directory brand.

Or maybe Chambers will double down on its Data & Analytics strategy. Perhaps through a merger with a business like Law Business Research, formerly backed by Levine Leichtman, the former owners of Better Lawyers.

Legal Data & Analytics is a small world…