Anaqua sale process update, and analysis of 6 other Data & Analytics M&A and Fundraising Deals - October 14-16, 2024

TL;DR - M&A for Law Insider, CoinDesk, Nearmap; Fundraising for OroraTech, OneClickData, Signify Research.

If you haven’t already subscribed, join 832 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

October 16 - Banks, private lenders prep $800m package for Anaqua sale - Bloomberg.

News leaked back in March that European private equity firm Astorg were preparing Intellectual Property Data & Analytics, Software and Services provider Anaqua for sale.

According to Reuters at the time, “the company could be worth as much as $3bn.”

Now, according to Bloomberg,

Banks and direct lenders are competing to provide a total debt package of around $800m to back a potential buyout… Lenders are working off an earnings before interest, taxes, depreciation, and amortization figure of between $80-90m... On the private credit side, the structure would likely include a unitranche loan of about $600 million, with the option of a delayed-draw term loan and junior financing — a form of riskier debt — on top of that.

The process is being run by Jefferies and Arma Partners according to 9fin.

Astorg acquired Anaqua from Insight Venture Partners and Bessemer Venture Partners in February 2019. Since Astorg’s investment, Anaqua has made multiple acquisitions, including:

June 2022 - Practice Insight Pty Ltd, and its intelligent time capture software WiseTime;

May 2021 - Actio IP - tech-enabled IP services;

May 2021 - SeeUnity - API-based content integration and migration software;

February 2021 - Quantify IP - IP cost estimating software;

June 2020 - O P Solutions - IP Management Software and Practice Automation.

Anaqua was founded in 2004 to commercialize software developed by corporate IP practitioners from Ford and British American Tobacco, addressing a market need for IP enterprise software. The Company later acquired SGA2 to complement its core IP management software with patent annuity and trademark renewal payment services. Since late 2015, Anaqua has accelerated the execution of its global growth strategy by acquiring and integrating talent, expertise, technology, and data through a number of acquisitions, including ideaPoint, AcclaimIP, and Lecorpio.

Back in March, Reuters flagged that “Anaqua's competitors include French software firm Questel, backed by IK Partners and Eurazeo, and British-American business Clarivate, formerly the intellectual property and science division of Thomson Reuters.”

Reuters’ sources indicated that Questel’s owners were considering bidding to merge the two businesses.

Asymmetrix notes that Anaqua have a partnership with SoftBank/CITIC/Sequoia/Tencent-backed Patsnap to deliver an IP management solution for Anaqua’s pharmaceutical clients. Putting these two businesses together would be another logical outcome.

October 16 - Law Insider acquires oneNDA.

LawSites provides some great colour around this transaction, so we’re going to quote it verbatim rather than reinvent the wheel:

Law Insider, a company that provides what it says is the world’s largest public contracts database, has acquired oneNDA, developer of an open source contract standard for non-disclosure agreements that has been downloaded by thousands of organizations throughout the world.

Through the acquisition, the oneNDA.org standards library — which includes oneNDA, oneNDA Playbook, oneNDA M&A, and oneDPA, and their corresponding translations — will be made available for free to Law Insider’s over 3 million registered users, and more than 10,000 paying subscribers.

In December, further building on the acquisition, Law Insider will launch Law Insider Standards, which it says will be an expansive contract standards and playbook library that will be offered for free to its users, and that will include the oneNDA standards and playbooks.

Asymmetrix imagines that the combined entity will be of interest to larger Legal Data & Analytics providers such as LBR, Lexis Nexis (RELX) or Wolters Kluwer. Watch this space.

October 16 - CoinDesk, a provider of media, events, indices, and data for the global crypto economy, announced that it acquired CCData, a UK FCA-regulated benchmark administrator and provider of digital asset data and index solutions.

Lots to unpick here.

Coindesk was acquired in November 2023 for c.$70-80m by crypto exchange Bullish (backed by, amongst others, Peter Thiel’s Founders Fund) from Digital Currency Group, who had paid just $500k for the business in 2016. Bullish had hoped to raise $300m from the sale.

Coindesk already supplied a number of crypto indexes, but CCData is laser focused on this area, and the acquisition will add significant indexing scale to a business which has historically been media heavy.

Asymmetrix notes that competitor The Block, which traded hands at around the same time as Coindesk for a similar valuation, has an investment in Dutch crypto indexing startup GMCI.

October 15 - OroraTech, a provider of wildfire intelligence, announced a €25m Series B funding round led by Korys, the European Circular Bioeconomy Fund (ECBF), and long-standing investor Bayern Kapital, with participation from Edaphon Private Impact Fund, Ananda Impact Ventures, ConActivity KG, and Findus Venture.

OroraTech is another Data & Analytics business made possible by the proliferation of Low Earth Orbit (LEO) satellites, and the reduction in cost of access to near real-time earth imagery.

Founded in 2018, OroraTech has partnered with Spire Global to create its satellite constellation - they will have five in 2025, and are aiming for 100 by 2026 - but are planning to launch their own soon.

The satellites provide a real-time wildfire detection service down to the level of a single tree. They sell their Data & Analytics into the government, insurance, financial services, agriculture, energy and infrastructure sectors.

Combining OroraTech with other providers of catastrophe or climate Data & Analytics, such as TA Associates’ KatRisk, would seem likely in future, as consolidation occurs in what is a fragmented market.

October 15 - OneClick Data completes $7.2m Series A financing led by State Farm Ventures.

OneClick founder Garrett Kurtt created the business to solve a problem he saw as a roofing contractor:

After working on so many roofs from both sides, I was frustrated with manually tracking down jurisdiction and building codes, compiling reports, and trying to defend my estimates. I was losing money and wasting massive amounts of time. So, I built an app called OneClick Code to give contractors and adjusters the ability to have accurate jurisdiction and building code data, instantly.

OneClick Data, Inc., provides data, analytics, and tools serving the intersecting needs of property and casualty insurance providers and construction professionals. It serves more than 1,300 customers including over 40 insurance carriers and suppliers.

Insurers are getting wiser to roofing risk. According to Verisk, U.S. roof claims exceeded $19bn in 2021, making up about 30% of all property loss dollars. According to Roofing Contractor insurers are looking for ways to wriggle off the hook when it comes to paying out for damage claims:

Experts say the parable of a new car’s value plummeting the moment it drives off the lot has leeched into how carriers treat many claims. Due to increased extreme weather, some insurance companies now pay the depreciated or actual cost of older roofs instead of the full replacement cost. They may also require higher deductibles and offer discounts for hail-resistant roofs or impose surcharges for non-hail-resistant ones to encourage homeowners to upgrade.

In addition, the FBI estimates insurance carriers pay at least $1bn annually on fraudulent roof claims.

OneClick helps contractors ensure their work is compliant with local construction codes, and create relevant documentation, which helps to prevent issues for insurance claims down the line.

Asymmetrix expects to see OneClick grow as premiums increase and insurance becomes harder to obtain in the wake of catastrophic weather events.

October 14 - Nearmap, a provider of location intelligence solutions, has completed an asset purchase agreement with Tensorflight, an AI-powered platform that uses artificial intelligence and machine learning to help P&C insurers predict potential risks and reduce overall costs.

Asymmetrix profiled Thoma Bravo-owned Nearmap (another business benefiting from the tightening roofing/P&C insurance market) back in April this year:

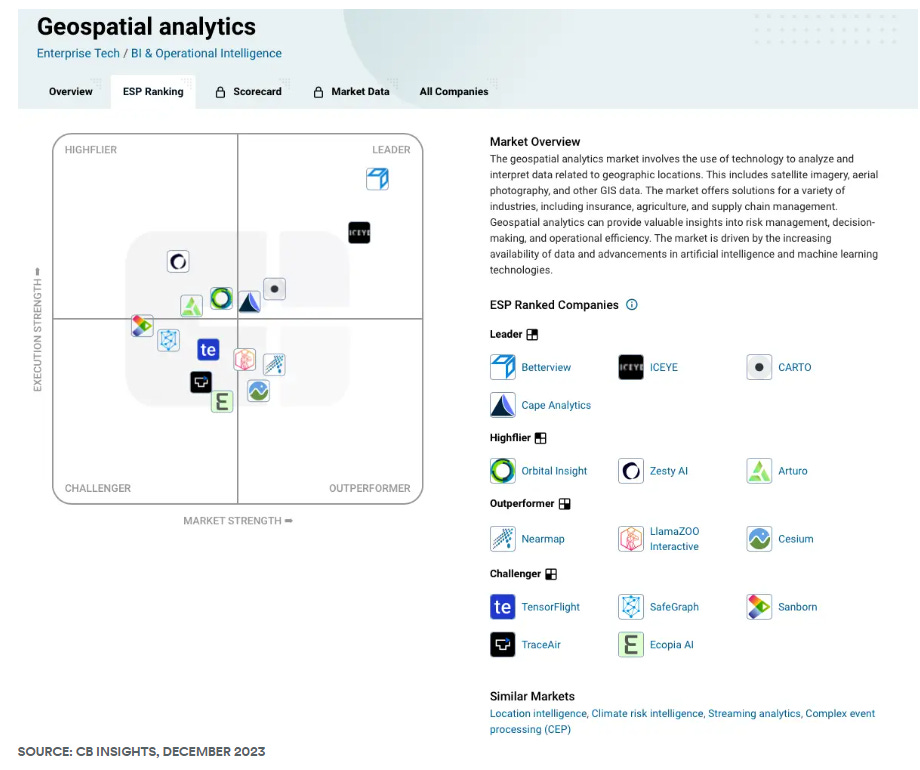

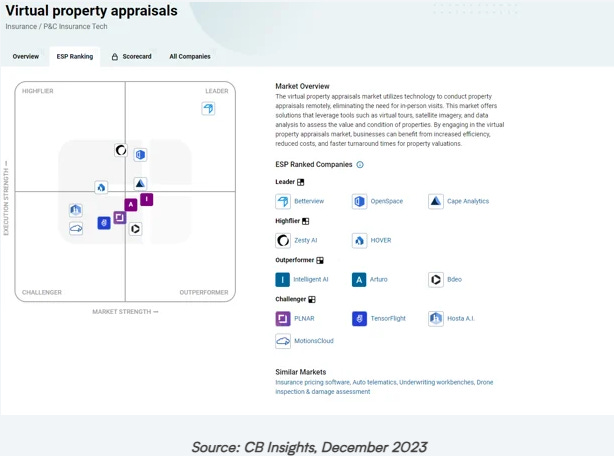

Tensorflight showed up in both the CB Insights Geospatial Analytics and Virtual Property Appraisals market maps that we shared in the above profile.

Although this is not confirmed anywhere, the wording of the press release implies that this might have been a distressed deal:

Nearmap has agreed to acquire the assets of the Tensorflight business and work with existing customers to understand how best to serve their needs now and in the future.

Asymmetrix looks forward to learning more about the drivers behind this transaction as the dust settles.

October 14 – BGF has completed a £6m investment into Signify Research, a specialist HealthTech market intelligence provider.

A straightforward growth investment.

BGF has a solid track record in investing in Data & Analytics businesses, with KYND, Gaist and now Signify Research currently on the books, and having sold power generation-focused Cornwall Insight to Bowmark in 2022. Interestingly, former Cornwall Insight CEO Gareth Miller has now become Non-Executive Chair of Signify.

Corporate Finance support for Signify Research was provided by Mike Tillson, Nigel Le Bas, Andre Lamego and Zach Rose at Grant Thornton.

Bonus Reading

Founder Anne Wojcicki races to rescue 23andMe - FT.com.

In-depth analysis of the twists and turns that have brought the genetic testing and Data & Analytics business to its current predicament.

Inside the Companies That Set Sports Gambling Odds - Bloomberg.

Analysis of the Sports Data & Analytics businesses that have taken over much of the responsibility for odds setting in sports gambling.