Analysis of Four Data & Analytics M&A and Fundraising Deals - May 21 - June 3, 2024

TL;DR - Deals in Law Enforcement, Healthcare & Life Sciences, Cyber Security and Macroeconomic Data & Analytics during a quiet M&A period

If you haven’t already subscribed, join 431 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Before discussing the recent deals, here are the results of the survey we ran last Thursday to select the next companies to profile:

Amberdata - 7

Toggle AI - 5

Dataminr - 5

Arbolus - 5

Polymarket - 3

LeadGenius - 3

MNI - 3

Daloopa - 1

Genomenon - 1

FiscalNote - 1 (subscriber request)

People Data Labs - 1 (subscriber request)

Thank you for voting!

We will profile the most popular companies on Thursdays or Fridays over the coming weeks.

May 24 - LeadsOnline LLC, a provider of data, technology, and intelligence tools for law enforcement agencies, announced the acquisition of Nighthawk.Cloud, Inc., a provider of investigative data visualization and analysis. This strategic combination brings Nighthawk’s analysis capabilities into the LeadsOnline suite of investigative solutions to enhance law enforcement’s ability to expedite criminal investigations.

TA Associates invested in LeadsOnline in May 2022, shortly after LeadsOnline acquired Business Watch International. Nighthawk is the second acquisition LeadsOnline have made since TA’s investment, after Forensic Technology in September 2023. A classic buy-and-build strategy in a very defensive sector.

May 23 - Atropos Health, the pioneer in translating real-world clinical data into high-quality personalized real-world evidence for care, has announced the completion of a $33M Series B funding round. The Series B funding was led by Valtruis, with participation from new strategic investors including Cencora Ventures, McKesson Ventures, and Merck Global Health Innovation Fund, along with existing investors Breyer Capital, Emerson Collective, and Presidio Ventures.

Real World Evidence, clinical evidence on a medical product's safety and efficacy that is generated using real-world data resulting from routine healthcare delivery, is transformative for the pharmaceutical industry, reducing the time required to bring a drug to market, and improving prescribing and patient care decision-making for healthcare organisations. Atropos is definitely one to watch.

May 22 - SOCRadar, a provider of end-to-end threat intelligence and brand protection, announced the successful completion of its Series B funding round, raising $25.2 million. The round was led by PeakSpan Capital, with participation from Oxx.

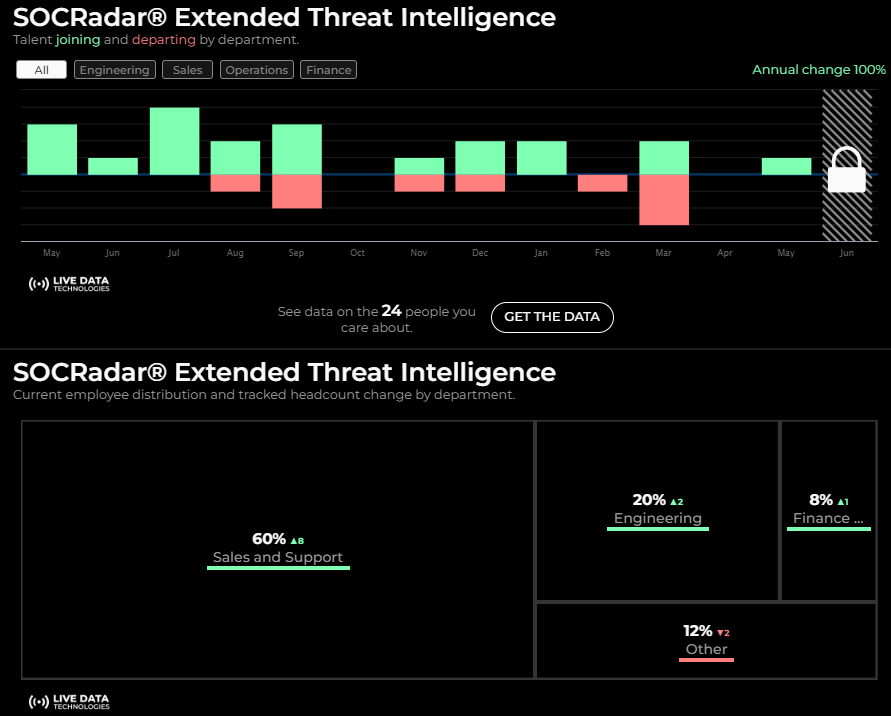

Having raised $5m in 2023, SOCRadar’s larger round last month is evidence that this is a high-growth business. Live Data Technologies’ data shows that SOCRadar has doubled its headcount in the last year:

We looked at the Cyber Security Data & Analytics sector in some detail a few weeks ago when we analysed Security Scorecard. We’ll also be keeping this business on our radar….

May 21 - Vanda Research, a provider of macroeconomic data, announced that the firm has been acquired by FPE Capital.

FPE Capital have a strong track record of growing Data & Analytics businesses, including drinks market analysis firm IWSR (now owned by Bowmark Capital) and financial product comparison provider Defaqto (now owned by SimplyBiz).

Vanda is small but interesting. No doubt FPE will be investing in the marketing and development of more data products like VandaXasset, their macro data set.