Analysis of 5 Data & Analytics M&A and Fundraising Deals - Aug 13-19, 2024

TL;DR - Data & Analytics deals in Real Estate, Automotive and Financial Data sub-sectors

If you haven’t already subscribed, join 642 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

Aug 16 - PropertyGuru enters into definitive merger agreement to be acquired by EQT Private Capital Asia for $1.1bn.

EQT are taking private one of South-East Asia’s leading property marketplaces, currently listed on NYSE.

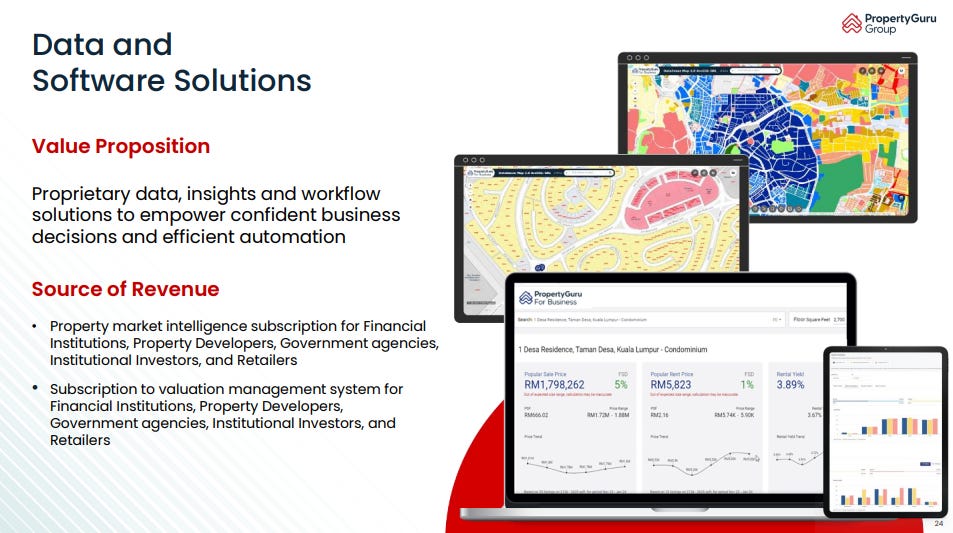

The data PropertyGuru ingests from its clients and users creates a valuable Data & Analytics business:

(Source: PropertyGuru Investor Presentation, August 2024.)

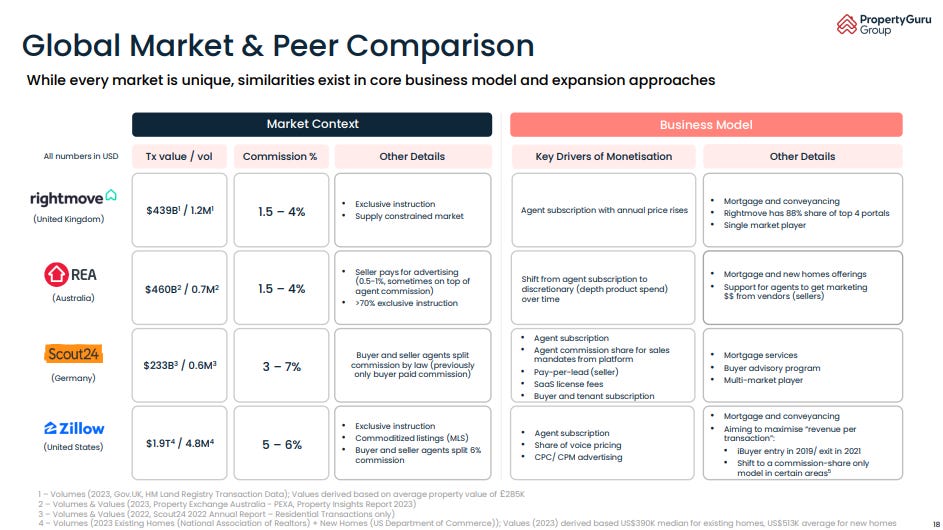

Asymmetrix assumes that EQT see the opportunity to grow the business regionally and perhaps globally through consolidation. As such, PropertyGuru should be analysed against its global peers.

PropertyGuru is advised by Moelis & Co and Freshfields Bruckhaus Deringer. EQT is advised by Morgan Stanley and Ropes & Gray. TPG and KKR is advised by JP Morgan and Latham & Watkins.

Aug 15 - AutoScout24, the pan-European online automotive marketplace, has signed an agreement to acquire TRADER Corporation from Thoma Bravo.

Much like PropertyGuru above, on the surface, this looks like a Consumer Internet deal, but look a little deeper and you find two Data & Analytics businesses, sitting on vast amounts of data on automotive valuations.

Hellman & Friedman invested in AutoScout in 2024, and have made a “meaningful incremental equity investment in AutoScout24” as part of this transaction. They have been instrumental in driving growth in the business, backing the acquisitions of LeasingMarkt.de in 2020 and the B2B auction platform AUTOproff in 2022.

As you’d expect for a deal of this size, there were a lot of advisors involved:

RBC Capital Markets and Deutsche Bank are acting as M&A advisors to AutoScout24 and Simpson Thacher & Bartlett LLP, Davies Ward Philipps & Vineberg LLP and Freshfields Bruckhaus Deringer LLP are acting as legal counsel. Goldman Sachs & Co. LLC is acting as lead financial advisor; BofA Securities and HSBC Securities (USA) Inc. are also acting as financial advisors to TRADER Canada and Kirkland & Ellis LLP, McMillan LLP and Goodmans LLP are acting as legal counsel.

Aug 15 - S&P Global announced that it has completed the sale of its Fincentric business to Stellex Capital Management, a private equity firm. Financial terms of the transaction were not disclosed.

Serial fintech entrepreneur John Wise has bolted Fincentric to his new Communify platform, providing instant scale to the provider of Market and Client Data apps. Wise most recently co-founded and ran InvestCloud, which reached a $1bn valuation in 2021.

Fincentric - formerly known as Markit Digital/Markit on Demand, and Wall Street on Demand prior to that - had been looking somewhat orphaned ever since S&P acquired Markit.

S&P had previously indicated their inclination to divest the business, and Stellex-backed Communify seems a good home. Wise gave an interesting interview to Finextra, which is worth watching if you want to dig in.

Jefferies LLC acted as financial advisor and Davis Polk acted as its legal advisor for S&P Global for the transaction.

Aug 15 - Prytek acquires TipRanks at $200 million valuation.

First up, hat-tip to Matt Ober for pointing this one out.

TipRanks plays into both the growing retail investor market and the demand from traditional investors for better Data & Analytics.

According to Israeli tech source CTech:

TipRanks provides services to financial institutions such as banks, hedge funds, brokers, and stock exchanges, including Nasdaq, Robinhood, CIBC, Morgan Stanley, and the Israeli eToro. Nearly all banks and investment houses in Israel have implemented TipRanks systems.

Prytek has essentially upped its stake in TipRanks from 40% to 80%, paying $80m for the privilege.

The article goes on to state that TipRanks is looking for acquisition opportunities. Might it be a good fit with Toggle AI, which we profiled a couple of months ago?

Aug 15 - Envestnet received two second round bids for its Data & Analytics business, valuing it at just $100m-220m

We looked at the $4.5bn take private of Envestnet a month ago:

Envestnet released a filing to the SEC on August 12 which has some wonderful detail about the background to and goings on in the Envestnet M&A process over the past few years.

Asymmetrix recommends getting a bowl of popcorn and giving it a read yourself. It’s rare to read this much detail on an M&A transaction - at times reading it feels like being in the board room with the directors and their advisors.

If we focus on the Data & Analytics part of Envestnet, the document makes clear that Bain Capital have been unwilling to acquire the Data & Analytics business formerly known as Yodlee from the get go.

Since conversations with Bain began in 2020, the valuation of the Data & Analytics business has dropped continually:

May 2020 - $1.7-2bn range;

Dec 2023 - $600-900m range;

May 2024 - $250-325m range (round one bids);

Jun 2024 - $100-220m range (round two bids).

And finally:

On June 19, 2024, Bain and its advisors submitted a “final” proposal letter to acquire the Company for (i) $62.75 per share, in cash, plus (ii) an additional amount, in cash, equal to any consideration received by the Company in respect of the sale of the D&A Business prior to the closing of a transaction with the Company and Bain provided that net proceeds from the sale of the D&A Business exceeded $50 million and that any such transaction was consummated on such terms reasonably acceptable to Bain (the “June Bain Proposal”). The June Bain Proposal was not contingent on the sale of the D&A Business and, assuming no additional consideration was paid in respect of the sale of the D&A Business, the June Bain Proposal represented a premium of eleven percent (11%) to the Company’s Unaffected Share Price.

Which effectively sets a floor for the Data & Analytics business at $50m, and suggests that Bain and their fellow investors would very much like to be rid of Yodlee, and its associated lawsuit.

Why is this?

Envestnet's data business is also bleeding customers; 157 firms dumped the service between June 30, last year and June 30 this year, according to company filings.*

That leaves the number of firms using Envestnet Data & Analytics (formerly Yodlee) at 1,182, down from 1,339.

Yodlee were first to market with consumer purchasing data from credit cards, but it’s a crowded space now, and no-one likes to catch a falling knife.