Analysis of 11 Data & Analytics M&A and Fundraising Deals - Sept 23-27, 2024

TL;DR - M&A for REA, Visa, Bain Capital, KKR, ZEMA Global Data Corporation; fundraising for Infact, Qure.ai, GEOX, Xceedance, Integrum ESG.

If you haven’t already subscribed, join 786 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

September 27 - REA Group made a fourth offer for Rightmove, valuing the company at £6.2bn.

Another public company takeover saga. See previous newsletters for more detail.

REA said its latest offer represented a 41% premium to Rightmove’s 556p share price on August 30, before news of REA’s interest emerged.

REA are pursuing a charm offensive towards Rightmove’s institutional shareholders. The latest press release contained the following text:

REA has a longstanding track-record of creating value for shareholders. Over the last 10 years, REA has tripled its revenue and EBITDA. REA’s share price has increased by more than 300 per cent. over the last 10 years and by over 75 per cent. in the last two years, testament to its continued strategic and financial delivery and execution track-record. In contrast, Rightmove’s share price has lacked any sustained upward momentum for two years, despite being supported by its ongoing share buyback programme and revised strategy announced at last year’s Capital Markets Day.

Oof!

September 26 - Visa to acquire Featurespace.

A month after the news leaked via Sky News, the deal has completed.

Although deal terms were not announced, last week Sky News speculated that the valuation to be somewhere around £730m.

Featurespace’s fraud detection product sits on a vast database of consumer transaction history, which it uses to flag potentially fraudulent activity in real time.

This deal brings to mind Mastercard’s acquisition of Ethoca in 2019, which also provided real-time identification of fraudulent transactions.

As Sky News pointed out last week:

IP Group, which owns a stake in Featurespace of just over 20%, and Chrysalis Investments, which is understood to own about 12%, ultimately stand to reap more than £220m from the sale of another leading UK-based technology company.

But Asymmetrix would also note that this is yet more Data & Analytics activity for Insight Partners, who sold Recorded Future to Mastercard on September 12 for $2.65bn. Selling assets to both Mastercard and Visa in the same month takes some beating!

September 25 - Infact secures £4m funding and FCA authorisation as a Credit Reference Agency.

We love a Credit Data & Analytics business at Asymmetrix. This is one of two fundraisings we’ve seen in the space this week. (As mentioned previously, we don’t comment on every fundraising we see, otherwise this newsletter would be too long, but we do add them to our database.)

What caught our eye about Infact is the real-time nature of their data:

Our API-first approach enables lenders to report and receive consumer credit risk insights in real-time, empowering credit risk teams to improve lending performance and increase profitable lending. More importantly, it allows consumers to build and rehabilitate their credit profiles faster and more safely, promoting financial inclusion and visibility.

This is potentially disruptive. We expect the big 3 incumbents (Experian, Equifax and TransUnion) will be interested to know what their secret sauce is.

The investment was led by AlbionVC with participation from 13books Capital, Outward VC, Form Ventures, and Portfolio Ventures, along with support from prominent angels in the credit referencing, lending, and fintech sectors.

September 25 - Global healthcare imaging provider Qure.ai completes $65m Series D funding round led by Lightspeed and 360 One Asset, with participation from existing investors including HealthQuad, Novo Holdings, Merck Global Innovation Fund, Kae Capital, and others.

DC Advisory advised Qure.ai on the fundraising, and their deal announcement is enlightening. Some nuggets:

Qure.ai is a Healthcare imaging AI platform, assisting clinicians in diagnosis and patient management for those impacted by tuberculosis, lung cancer and stroke.

DC spread the CIM very widely - “DC Advisory reached out to 170+ global Technology & Healthcare focused investors and received multiple indications of interest”;

The business has 27 patents, 50+ research publications in tier-1 journals, and a data repository of 1.4B+ radiology images.

Medical imaging was one of the earliest sub-sectors of Data & Analytics to adopt AI. Asymmetrix is tracking tens of businesses operating in this area. More to come.

September 25 - GEOX secured $19m Series A to analyze real estate risk from climate-related disasters.

Asymmetrix has reported on multiple natural disaster Insurance Data & Analytics providers in the past. Most recently, for example, we covered Moody’s Corporation’s acquisition of Praedicat, a provider of casualty insurance analytics.

GEOX’s technology uses artificial intelligence to conduct 3D analysis of aerial imagery, enabling automated and highly accurate assessments of real estate properties. This system helps to predict potential damage caused by natural disasters such as hurricanes, floods, and wildfires. The platform produces comprehensive, data-rich, 3D insights that include critical property details such as precise location, roof size, type, condition, slope, and more.

It’s unclear how this distinguishes them from, say, Eagleview or Nearmap. But it is a big market and there is plenty of room for competition.

We wrote a profile of Nearmap back in April if you want to read more on the sector:

The round was led by Flashpoint Venture Capital, with participation from Suretech Partnership, as well as investors Ariel Maislos and Noam Lanir. This funding brings the total investment in the company to $23m since its founding.

September 24 - Bain Capital launches sale of Kantar Media, lender education next week – according to Mergermarket.

Kantar Media provides data and audience measurement, targeting, analytics and advertising intelligence services. Nielsen is, of course, the largest player in this space.

Over the past few years the parent company, Kantar, which is jointly owned by Bain Capital and KKR, has been gradually separating Kantar Media’s operations in preparation for this transaction.

Last year Sky’s former chief business officer Patrick Béhar was brought in, in large part to sell the business.

The Mergermarket article is worth reading in full, as it has plenty of detail:

Bain Capital has formally launched the sale of Kantar Media, a division of market research firm Kantar Group, according to three sources familiar with the matter.

Sellside advisers JP Morgan and Jefferies distributed information memoranda to prospective bidders at the beginning of last week (16 September), one of the sources said.

The sponsor is expected to value Kantar Media at around GBP 1bn (USD 1.34bn), one of the sources added. The business is being marketed off USD 120m in EBITDA, as previously reported.

Vista Equity Partners are among the list of buyers that have been invited to participate in the auction, one of the sources said. CVC Capital Partners and Cinven were also among the financial sponsors that had signalled early interest in the business, this news service reported in July.

Undoubtedly there will be more news leaks as the deal progresses - this story was first reported by Sky News back in January this year. We’ll alert you as soon as there is more information.

September 24 - Envestnet, Inc., a provider of integrated technology, data intelligence, and wealth solutions announced that the Company's stockholders approved the pending acquisition of the Company by affiliates of vehicles managed or advised by Bain Capital.

One in one out for Bain.

We covered this $4.5bn transaction in detail in July when the deal was first announced. Please take a read for detail on who the investors are, the investment banks involved, and how the deal is being financed.

It’s not yet clear what the impact is for Envestnet’s Data & Analytics business, formerly known as Yodlee. For coverage of how that part of Envestnet, take a look here:

We’ll update you as soon as the dust settles and information is available.

September 24 - KKR completes acquisition of geospatial software business IQGeo for £333m.

Another concluded public markets transaction.

Back in May we wrote (and we still stand by this):

The artist formerly known as Ubisense has focused on building a Software, Data & Analytics platform for digital infrastructure providers since shedding its services platform. It will be interesting to see how many acquisitions KKR back to turn what is still a small business (£21m of ARR in 2023) into something of the scale one normally associates with KKR.

One to watch.

September 24 - Xceedance acquires Millennium Information Services, a North American insurance inspection and Data & Analytics company.

Both acquirer and target are hybrid insurance inspection services and Data & Analytics providers.

Millennium’s Data & Analytics product suite includes:

According to the press release:

Millennium conducts more than 1 million residential, commercial, and farm inspections annually and works with 80+ insurance carriers and MGAs. The firm has captured hundreds of millions of data points on specific risk hazards and property conditions that will fuel the next phase of innovation on its MAPS software platform, which aids in decision-making, workflow management, and data analytics.

Bermuda-based Xceedance will add roughly 200 employees to its existing 3,400 strong team from the transaction.

Morgan Partners served as the exclusive financial advisor to Millennium Information Services.

September 23 - YFM Equity Partners invested £3m in growth capital in Integrum ESG.

Integrum gathers and cleanses company-disclosed ESG data and provides analytics tools to enable asset managers and advisors to perform ESG benchmarking on potential and existing investments.

Asymmetrix will keep an eye on the business to see how YFM drives growth ahead of an inevitable exit in the fulness of time. This sector is highly fragmented, so we imagine inorganic growth is likely, as well as the potential acquisition of Integrum ESG by another business in turn.

September 23 - ZEMA Global Data Corporation (formerly ZE PowerGroup), a provider of enterprise data management and analytics for the commodity and energy sectors, announced its plans to acquire Morningstar Commodity Data, a provider of commodities and energy data and insights. The transaction is expected to close later this month. Financial terms were not disclosed.

We wouldn’t normally include an enterprise data management deal, but we have seen posts on LinkedIn from people seeking to understand what this deal was about. So here you go!

ZEMA is an enterprise data management business, focused on the Energy & Commodities space. It’s been around since 1995, but for the majority of that time it traded as ZE PowerGroup, named after its founder, Dr. Zak El-Ramly.

In July this year ZEMA sold a stake in the business to FTV Capital and brought in Energy & Commodities Data & Analytics veteran Andrea Remyn Stone to run the business.

Both ZEMA and the Morningstar Commodity Data businesses do the same thing: integrate data from multiple different Energy & Commodities Data & Analytics providers in one place enabling clients to perform their own analysis across the pool of data. However while ZEMA have historically focused on selling into the energy sector, Morningstar have covered financial services. So this acquisition enables ZEMA to access clients in an adjacent market.

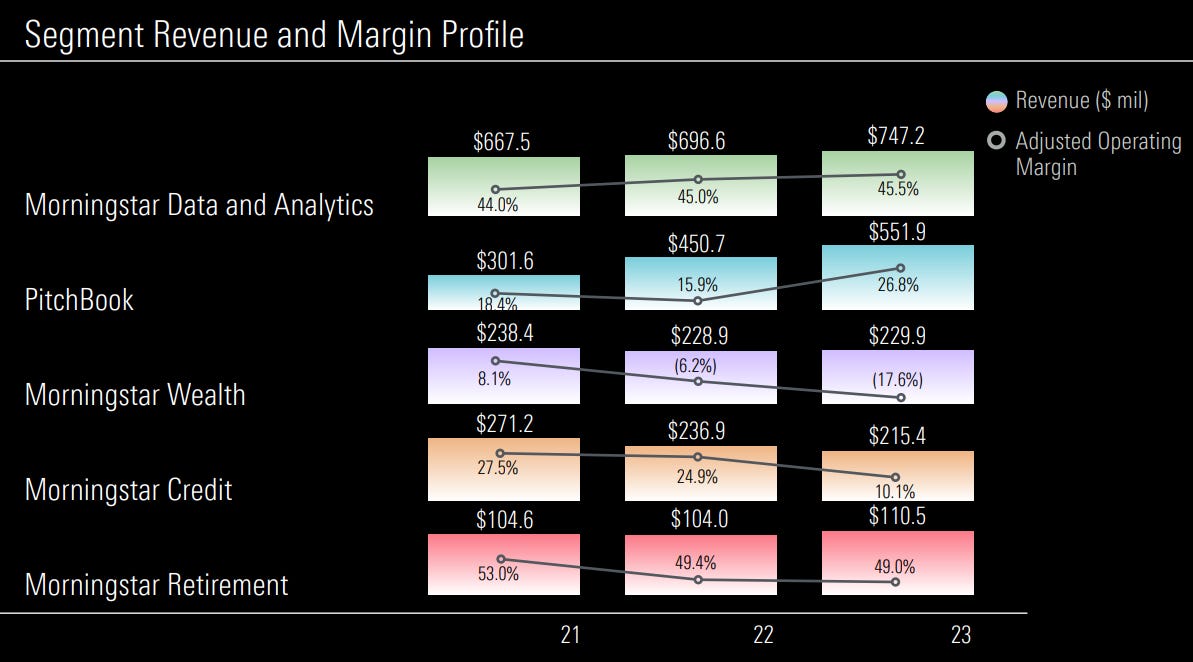

From Morningstar’s perspective, this divestment enables them to focus on their core Data & Analytics business, including their high-growth Pitchbook Company Data & Analytics business, which now makes up a significant percentage of Morningstar’s overall revenues.

(Source: Morningstar Annual Shareholders’ Meeting 2024 presentation.)

Morningstar Commodity Data clients formerly had access to Morningstar’s proprietary energy Data & Analytics. It is not clear what happens here going forwards.

Kirkland & Ellis, KPMG, Oliver Wyman and D.A. Davidson served as advisers to FTV Capital and ZEMA on the transaction. Financial terms were not disclosed.

Bonus Reading

Substack newcomer has written an insightful analysis of Bloomberg’s market position, which is well worth a read: