Analysis of 10 Data & Analytics M&A and Fundraising Deals - July 5-22, 2024

TL;DR - Clarivate, Inflexion, Xapien, GardaWorld, Defaqto/Fintel, Quantum Commodity Intelligence, Envestnet, OpenBrand, Parthenon Capital and Dow Jones have all been all active

If you haven’t already subscribed, join 580 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

After a two-week break, we returned to find that there had been so many transactions during this period that (once again) this post will not fit in the email!

If you find that your email client has cut off the post, please click through and read the full post online:

If you were the banker or investor on any of these deals, and would like to discuss the sector, drop us a line!

July 22 - Clarivate acquired Rowan TELS to enhance support for patent practitioners. Rowan TELS Corp. is the provider of Rowan Patents – an integrated patent drafting and prosecution solution specially designed for patent practitioners to establish and protect patents more effectively.

Listed Data & Analytics provider Clarivate (the old Intellectual Property and Science division of Thomson Reuters) focuses on Academic, Government, Life Sciences, Healthcare and Intellectual Property.

Rowan is their second small tuck-in acquisition in recent months after Global Q (we discussed this deal briefly back in April).

Clarivate’s stock is roughly one-sixth of what it was at its peak in 2021, shortly before Clarivate acquired ProQuest (and Andy Snyder) for $5.3bn.

Clearly, Clarivate’s indigestion from the acquisition of ProQuest, and CPA Global and Decision Resources before that, still means that only small deals are on the menu.

July 18 - Inflexion announced that it has invested in FDM, a provider of telecoms market share, pricing and proposition data across Europe, to accelerate its global ambitions.

This is a relatively small investment for Inflexion, who normally operate further up the size range. One can only assume that Malcolm Coffin and Sarah Gestetner have seen an opportunity to turn this into something much larger. Certainly, FDM’s focus on providing pricing data for telecoms providers is attractive.

One suspects that geographic growth in Europe and beyond, plus a focus on sales and price increases, will be key parts of the growth strategy.

July 17 - Xapien announced the completion of a $10M Series A funding round led by YFM Equity Partners, bringing their total funding to $17.8M.

We’ve highlighted many deals in Governance, Risk and Compliance Data & Analytics before.

For example, take a look at recent transactions involving Cube, Corlytics and ComplyAdvantage in these posts:

Chaired by Complinet-founder Chris Pilling (who is also a NED at Data & Analytics businesses ComplyAdvantage and Elliptic), it’s no surprise to see Xapien raise money. YFM operate at the lower end of the investment size range in the UK.

July 17 - GardaWorld enters into a binding agreement to acquire OnSolve, a provider of Critical Event Management software and Data & Analytics.

We wrote about Critical Event Management Data & Analytics last month when we looked at Dataminr:

and we looked at Thoma Bravo’s take private of Everbridge a couple of weeks ago:

This sector was front of mind once again last week when the Crowdstrike outage happened. Providers like OnSolve and GardaWorld’s Crisis24 enable customers to detect and respond to business-critical threats. The Crowdstrike debacle will likely be great marketing for Critical Event Management Software and Data & Analytics providers.

This deal brings together two of the largest players in the sector, augmenting Crisis24’s more service-driven approach with software and data.

July 16 - Defaqto, a UK source of financial product and market intelligence, has announced that it has conditionally acquired RSMR (subject to regulatory approval) to further extend its Fund Research and Ratings capabilities for financial services and investment professionals.

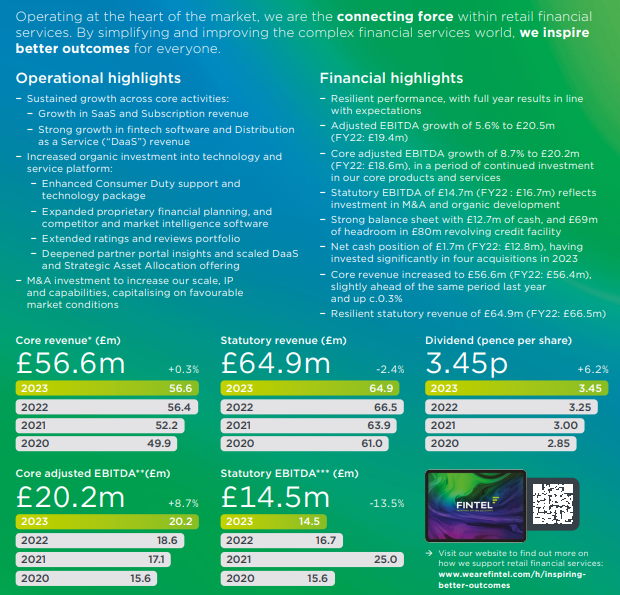

Listed entity Fintel has been actively pursuing a roll-up strategy in the UK fund intermediary Data & Analytics and Consumer Internet space. Formed initially through the combination of Defaqto and SimplyBiz, Fintel has made three acquisitions in 2024 alone.

Financial performance has not been linear in the past few years, but the strategy is sound.

You can read Fintel’s Annual Report here.

July 12 - Quantum Commodity Intelligence, a price reporting agency for international oil, carbon, biofuels and ammonia markets, has raised £12.5m in growth capital. The investment from US-based VC firm Elephant represents a minority stake in the business.

This deal, like Quantum itself, has flown under the radar.

Launched in 2021 by Price Reporting Agency veterans Andy Allan and Andrew Goodwin, Quantum has grown its offering to cover carbon offsets, crude and oil products, biofuels and environmental certificates as well as ammonia.

This is Elephant’s second investment in the Energy & Commodity Data & Analytics sector this year, having already backed Welligence in its $41m fundraising in January. Elephant also back Ben Zweig’s Revelio Labs, which we profiled back in March.

Andy and Andrew know what they are doing - they were part of the Steel Business Briefing success story (sold to Platts by Quayle Munro) and then started, grew and sold Census Commodity Data to Fastmarkets between 2017 and 2020.

Quantum are one to watch.

July 11 - Envestnet, a provider of integrated technology, intelligent data and wealth solutions, announces $4.5bn take-private transaction with Bain Capital. Reverence Capital also agreed to participate in the transaction. Strategic partners BlackRock, Fidelity Investments, Franklin Templeton, and State Street Global Advisors have committed to invest in the proposed transaction, and upon its completion they will hold minority positions in the private company.

This one is a whopper!

Hot on the heels of the Preqin deal, Blackrock find themselves involved in another transaction, albeit this time as a minority partner.

According to the Financial Times “each stake is just below 5 per cent, people familiar with the terms said.” It’s not clear whether this also includes Bain, or whether they are taking a larger stake, which seems likely.

This deal provided a fee bonanza for investment bankers and lawyers:

Morgan Stanley & Co. LLC is acting as exclusive financial advisor, and Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as legal counsel to Envestnet.

J.P. Morgan Securities LLC is acting as lead financial advisor, and Ropes & Gray LLP is acting as legal counsel to Bain Capital.

RBC Capital Markets, BMO Capital Markets, Barclays, and Goldman, Sachs & Co. LLC provided committed debt financing for the transaction and financial advisory services to Bain Capital. Funds managed by Ares Management, funds managed by Blue Owl Capital and Benefit Street Partners also provided committed debt financing for the transaction.

The debt providers are stumping up around $2bn of debt.

The deal is not quite done yet. According to the Wall Street Journal

Envestnet said its agreement with Bain contains “no-shop” restrictions on its ability to seek a better deal, but it can hold talks if approached by another buyer with a superior proposal, with Bain holding matching rights.

Unlike the Preqin deal, the troika of acquirers are not paying a premium valuation for Envestnet, which had been struggling in recent years, and had been subject to activist investor activity. It seems likely that they saw an opportunity to swoop in on an unloved asset and turn it around. We may well also see the business split up and sold as separate asset management, software and Data & Analytics businesses.

July 9 - OpenBrand, a leading market intelligence platform powered by AI-driven insights, announced the acquisition of TraQline, marking the company's expansion into the market measurement space.

ParkerGale-backed OpenBrand enables retailers to measure the impact of both online and offline marketing and advertising spend.

OpenBrand has been very active in the M&A market recently:

This acquisition is the third by OpenBrand, following the combination with Gap Intelligence and Deep.ad in October 2023, and the acquisition of Competitive Promotion Report (CPR) in March 2024.

Expect more deals to come.

July 8 - Parthenon Capital Group invested in medical review company Medical Review Institute of America LLC.

MRIoA inhabits a high-value niche in the nexus of healthcare, insurance and life sciences, providing data which helps all parties agree on what expenditure is appropriate for patients.

The business had been established for nearly 30 years before Summit Partners invested in 2017.

Mizuho and Greenhill & Co. were financial advisers to Medical Review Institute. Kirkland & Ellis LLP was legal adviser to Parthenon.

July 8 - Dow Jones announced that it has acquired A2i Systems, a provider of AI-powered fuel pricing solutions.

A straightforward tuck-in acquisition for Dow Jones’ OPIS unit, which they acquired back in 2021.

A2i’s best-in-class AI engine applies advanced predictive technologies and real-time pricing data to forecast consumer buying behaviors in dynamic market conditions. Its PriceCast platform is in operation at over 12,500 fuel sites, electric vehicle (EV) charging stations and convenience stores across 20+ countries globally.

Much like FDM above, A2i is driving value through its focus on pricing and, even better, forecasting buying activity and pricing.