10 Data & Analytics M&A Transactions and Fundraisings - October 21-25, 2024

TL;DR - Potential sales for Integral Ad Science, Dye & Durham; Acquisitions for TalentNeuron, Socure, Thomson Reuters, LegalSifter, DeepHealth, CoStar; Fundraising for Genie AI; Zelis stake sale.

If you haven’t already subscribed, join 845 smart, curious members of the Data & Analytics community by subscribing here:

Please do consider sharing this newsletter with friends or colleagues who you think may be interested. Thank you!

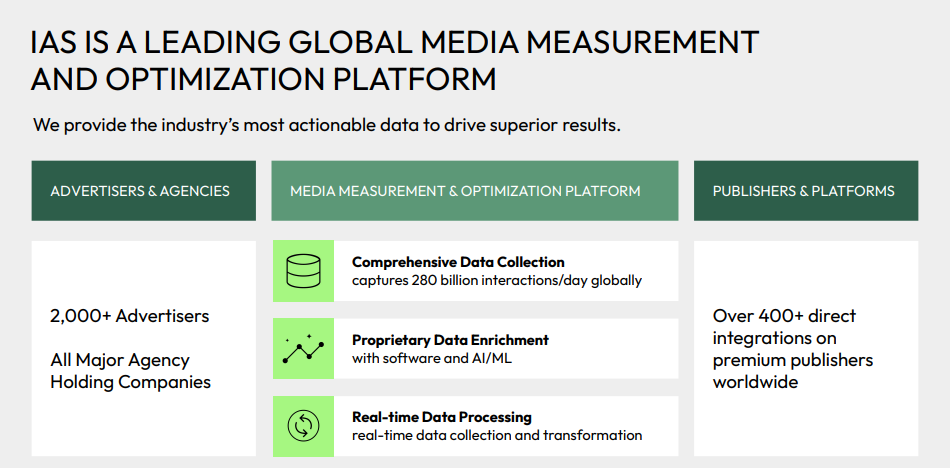

October 25 - Integral Ad Science Holding Corp. is exploring a potential sale after receiving takeover interest - Bloomberg.

Bloomberg reported on Friday that Jefferies is working with listed Advertising Data & Analytics provider Integral Ad Science.

(Source: Q2 2024 Investor Presentation.)

Vista Equity Partners acquired IAS in June 2018 and then IPOed the business in June 2021. They remain the company’s largest shareholder, holding around 40% of the equity.

Over the course of IAS’s partnership with Vista, the company has completed several acquisitions, including Amino Payments, Publica and Context.

IAS turned over $474m in 2023, with $159m of EBITDA. At the time of Bloomberg’s report, the business was valued at $1.9bn.

It seems likely that any potential approach will be coming from private equity, but a strategic such as Nielsen might be interested in acquiring the company.

October 24 - TalentNeuron, a Leeds Equity portfolio company, announced the acquisition of HRForecast, a Munich-based provider of strategic workforce planning and skills management software.

Provider of Labor Market Data & Analytics TalentNeuron claims to have “3 trillion data points, 2.2 billion profiles, and more than 28,000 skills” in its dataset.

HRForecast provides similar datasets but also some nifty workflow solutions.

TalentNeuron has a long and complicated past. Founded in Bangalore in 2011, it was acquired by CEB in 2014. CEB bolted on Canadian data provider Talent Neuron in 2014 before CEB itself was sold to Gartner in 2017.

Finally, in Leeds Equity acquired TalentNeuron from Gartner in 2023 for an undisclosed amount.

This is TalentNeuron’s first acquisition since Leeds’ investment.

October 24 – Socure, a provider of artificial intelligence for digital identity verification, fraud prevention and sanction screening, signed an agreement to acquire Effectiv, a real-time risk decisioning company, for $136m.

Founded in 2012, Socure provides vertically-integrated identity verification and fraud prevention solutions, using trusted online/offline data intelligence from physical government-issued documents as well as email, phone, address, IP, device, velocity, date of birth, SSN, and the broader internet to verify identities in real-time.

According to the press release for this deal, Socure serves more than 2,700 customers and has verified more than 2.26 billion identities over the past 12 months.

Socure raised a $100m Series D round in March 2021 led by Accel, with participation from existing investors Commerce Ventures, Scale Venture Partners, Flint Capital, Citi Ventures, Wells Fargo Strategic Capital, Synchrony, Sorenson, Two Sigma Ventures.

Socure made its first acquisition in June 2023, when it bought document verification startup Berbix for $70m.

Effectiv, founded in 2021, employs fewer than 30 people and completed a $9m seed funding round in July 2023 led by Better Tomorrow Ventures.

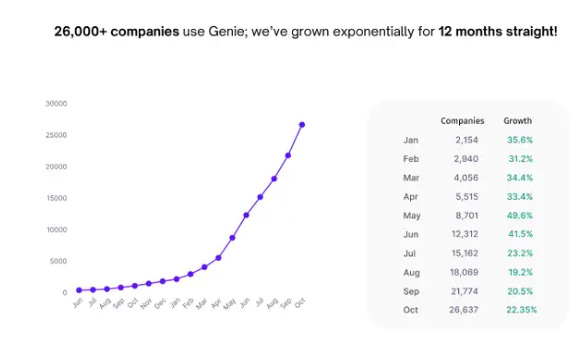

October 23 - Legal tech startup Genie AI secured $17.8m Series A funding from Google Ventures and Khosla Ventures.

Legal contract Data & Analytics is a hot space (see LegalSifter below for another deal last week in this area).

In July Harvey raised $100m in Series C funding from Google Ventures, OpenAI, Kleiner Perkins, Sequoia Capital, Elad Gil, and SV Angel, valuing the business at $1.5bn.

When we looked at the thoughts of listed Data & Analytics company CEOs back in July, Thomson Reuters and RELX, the largest players in Legal Data & Analytics, put AI right at the top of the agenda:

Two important market dynamics are providing what we expect to be long-term demand tailwinds for our business. The first is the rising complexity of regulatory compliance, and the second is generative AI. - Steve Hasker, President & CEO, Thomson Reuters - Earnings call Q1 2024 - May 2, 2024.

In the announcement for Genie AI’s fundraising round they highlight why AI is such a focus, and why financial sponsors and strategics alike are pouring money into the space:

Get 80% of your drafting or reviewing done in just 5 minutes, saving an average of 5 hours per week or up to $85,020 / £72,800 per year per attorney.

On average, users save 3.32 hours per document. The average total time saved per person per year is approximately 369.47 hours when using Genie AI.

Time- and cost-savings like this are a no-brainer for businesses and law firms alike.

The legal AI market is projected to be valued at USD 2.19 billion by the end of 2024, growing from its current valuation due to the increasing demand for automation in eDiscovery, contract review, case prediction, and compliance.

According to the pitch deck Genie used for the fundraise, Genie has seen dramatic growth in user numbers:

Interestingly, on Genie’s website, they have stub pages prepared comparing their product against Thomson Reuters’ Practical Law/Westlaw, RELX’s LexisNexis, Harvey and Robin, clearly demonstrating where they feel their competition lies.

Asymmetrix expects that Genie (and Harvey, and all the other AI contract drafting providers) won’t stay independent for long - a big beast like TR, RELX or Aderant will likely hoover them up, or they will combine to create a big competitor in their own right.

October 22 - Thomson Reuters Corporation acquired Materia, a US-based startup that specializes in the development of an agentic AI assistant for the tax, audit and accounting profession.

From one white-collar profession to another. Thomson Reuters has made a tuck-in acquisition for the other side of its business: Accounting.

New York-based provider of generative AI tools for public accounting firms Materia only came out of stealth in June this year. At its launch it announced a $6.3m funding round led by Spark Capital, with participation from Haystack Ventures, Exponential Founders Capital, the Allen Institute for AI, and… Thomson Reuters Ventures.

Thomson Reuters must have seen something they liked, as they have moved quickly to acquire the business for themselves.

Growth in adoption of accounting AI is in part being driven by a shortage of accountants in the U.S. It is expected that 75% of certified public accountants will retire within the next 15 years and the number of new members joining the workforce is down 33%, according to a report from The CPA Journal.

October 22 - LegalSifter, a provider of AI-powered contract operations solutions, has acquired Contract Logix, a provider of data-driven contract management solutions.

As mentioned above, here’s the second Legal AI contract management transaction of the week.

Carrick Capital Partners invested in Pittsburgh-based LegalSifter in March 2023. The business now has 53 employees.

This is LegalSifter’s third bolt-on acquisition since the investment. It had previously acquired Akorda and LawGeex, both in September 2023.

According to the press release, “the strategic acquisition expands LegalSifter’s client base, recurring revenues, and product capabilities while offering clients broader access to additional AI and contract operations solutions.”

As stated for Genie above - expect more consolidation…

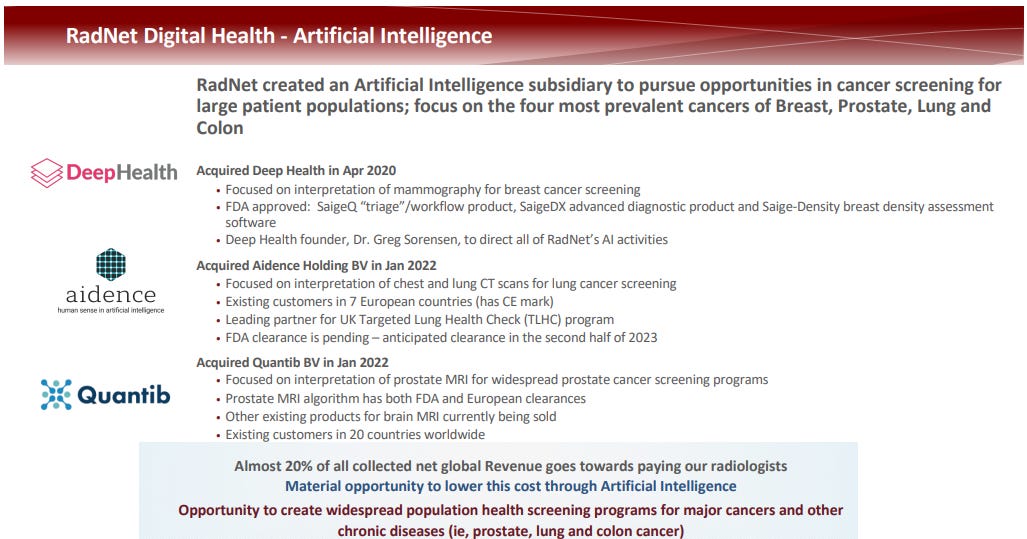

October 22 - DeepHealth has acquired Kheiron Medical Technologies Limited, a UK-based AI cancer diagnostic company focused on developing deep learning solutions to support radiologists improve breast cancer detection.

Medical Imaging has been one of the fastest areas of growth in AI usage, due in part to the vast quantity of data available from scans.

Kheiron’s focus on mammography enhances DeepHealth’s existing expertise in that area, and complements their focus on prostate, lung and brain scanning.

DeepHealth is a subsidiary of RadNet, a listed provider of outpatient diagnostic imaging services - it is the largest owner-operator of fixed-site imaging centers in the U.S - with a market cap of $4.9bn.

RadNet acquired DeepHealth in March 2024, and then subsequently bolted on Aidence Holding (focused on lung cancer screening interpretation) and Quantib (focused on prostate cancer screening interpretation).

DeepHealth would make an interesting corporate carve out for a Private Equity firm. Watch this space.

October 22 - CoStar Group, a provider of online real estate marketplaces, information, and analytics in the property markets, announced that it has reached a definitive agreement to acquire Visual Lease, a software platform for integrated lease management, accounting, and reporting, from Spectrum Equity and Growth Street, two private equity firms. Financial terms were not disclosed.

Visual Lease is more a SaaS platform than a Data & Analytics business, but any acquisition Real Estate Data & Analytics giant CoStar makes is worth paying attention to.

Founded in 1996, Visual Lease is a premier software platform for integrated lease management, accounting, and reporting, used by over 1,500 organizations across the business services, construction, healthcare, manufacturing, and retail sectors. Visual Lease offers support for each team involved in managing a company’s leased and owned assets through a seamless platform that encourages strategic financial and operational outcomes for organizations…

The strategic acquisition will enhance CoStar Group’s Real Estate Manager business line and provide additional lease management and lease accounting value to corporations of all sizes.

More of the same, in other words. More clients, buying more subscriptions, finding it harder to leave the CoStar ecosystem. And Visual Lease

Shea & Company served as the exclusive financial advisor to Visual Lease, Spectrum Equity and Growth Street Partners. CoStar Group was advised by Citigroup.

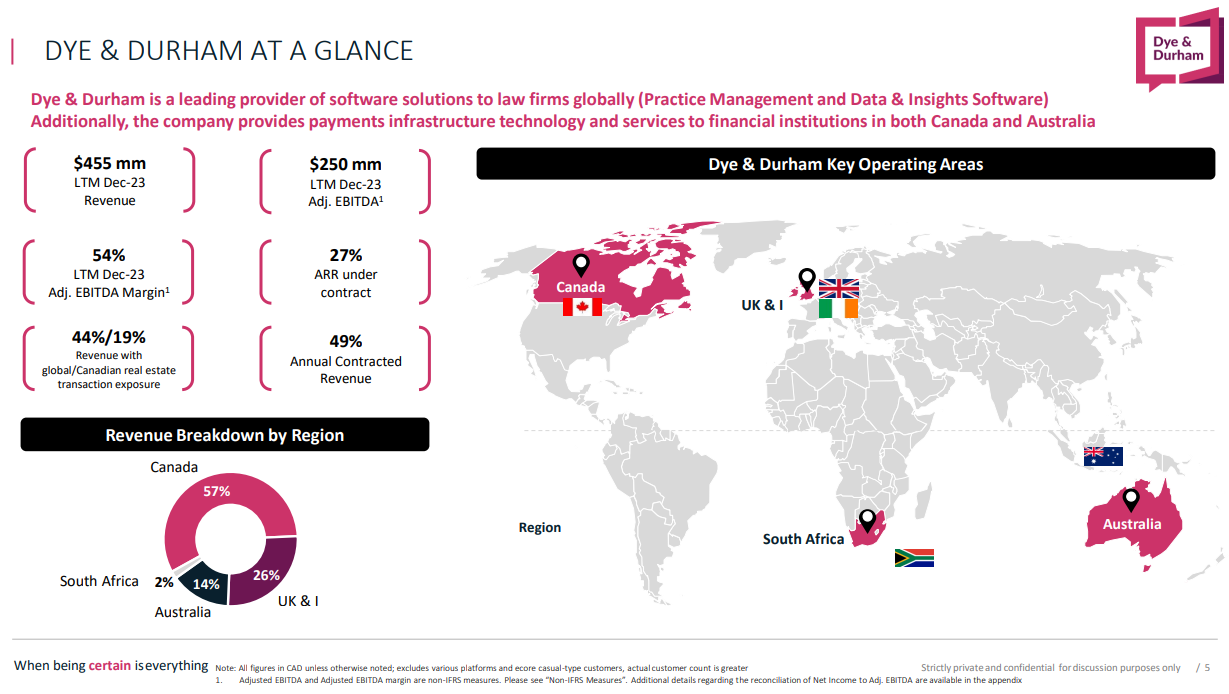

October 22 - Dye & Durham, a Canadian legal software company, is said to explore sale following takeover interest - Bloomberg.

Listed Canadian Legal Practice Management Software and Data & Analytics provider Dye & Durham has been fending off activist investors for some time now.

Last November the company hired Goldman Sachs and Canaccord Genuity to run “a strategic review of its non-core assets to significantly expedite its previously announced plan to reduce its leverage ratio.”

The strategic review will include the examination of a variety of options intended to generate additional capital to deliver on the Company’s stated goal of reducing its leverage to less than four times total net debt to adjusted EBITDA as soon as possible. These options include the potential partial or complete sale of non-core assets, such as the Company’s financial services business, among others.

This came after selling conveyancing platform TM Group to Aurelius for £91m in July 2023 (although they had purchased South African legal practice management provider GhostPractice and the UK’s Insight Legal Software in the months before.)

Now activist investor Engine Capital is attempting a hostile takeover. On October 22, Dye & Durham was forced to announce that:

it has expanded the scope of its previously commenced strategic review process to consider additional opportunities to enhance shareholder value that may include, but are not limited to, a sale of the company, merger, divestiture of assets, or other strategic transactions.

Goldman Sachs are advising Dye & Durham.

It seems likely now that there is blood in the water that a take private will happen. But have D&D done enough to fend off Engine and buy themselves time to find an acquirer who will pay a premium? We shall see.

(Source: Dye & Durham Q2 FY2024 Results Presentation.)

October 21 - Mubadala nears deal to buy stake in health tech firm Zelis - Bloomberg.

The journalists at Bloomberg were busy last week covering Data & Analytics businesses!

According to Bloomberg, the Abu Dhabi sovereign wealth fund Mubadala “is nearing a deal to acquire a minority stake in Zelis that values the health-care technology company at about $17bn.”

Bain Capital and Parthenon Capital have been co-investors in Zelis ever since Zelis was merged with RedCard Systems in October 2019.

Among a range of other healthcare cost management and payments software and services offerings, Zelis provides Data & Analytics to enable:

Price claims and compare provider rates across regions with a clear expectation of costs and deeper insights into claim pricing and processing and network performance.

I always enjoy your posts, it would be be good to jump on a call to discuss at some point?